Members must receive services rendered by providers who are contracted for and participate in the Tufts Health Plan Spirit network. All of this makes it easier for you to manage your healthcare needs.

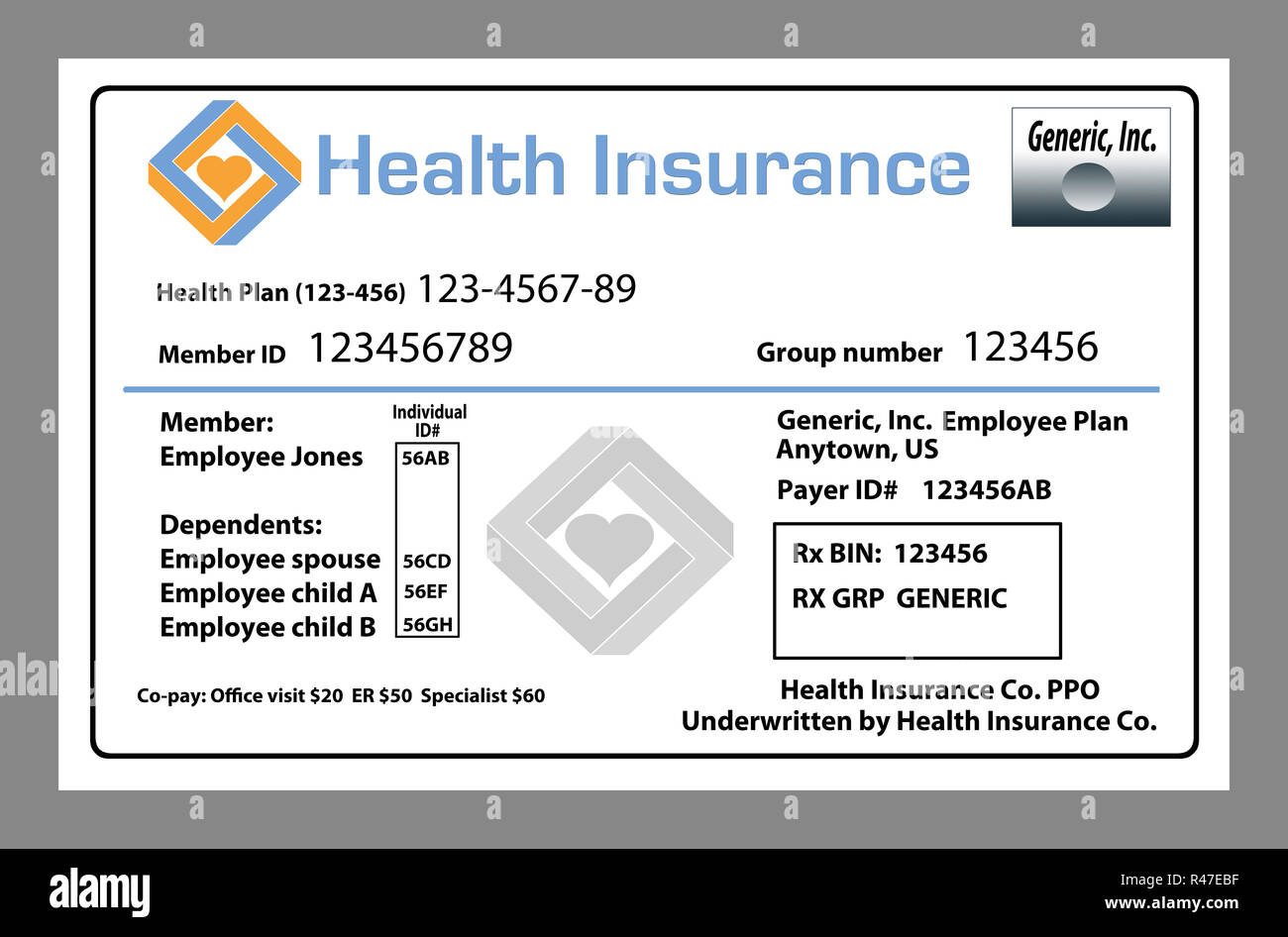

Here Is A Generic Medical Insurance Healthcare Insurance Member S Id Card Stock Photo Alamy

Here Is A Generic Medical Insurance Healthcare Insurance Member S Id Card Stock Photo Alamy

Representguarantee of payment.

Health plan member id. It will also allow you to obtain your prescription medication. It is important to create your account at myPRES where you can review claims view your Presbyterian Health Plan coverage order an ID card and more. Select the program you are enrolled with.

Complete your Health Needs Screening HNS View all dependents under one account. For registration or secure website questions call 1-877-647-4848. With a fresh redesign the new cards showcase a cleaner more organized look making it easier for you to find the information you need quickly.

If youre a Medicare Advantage plan member please contact Member Services to find your ID number. Program eligibility depends on your age income family size and any special health needs you may have. Track copays and deductibles.

Log in to access your myProvidence account. If you are not enrolled with Magnolia Health review Eligibility for more information. Your primary care site name has been removed from the new cards.

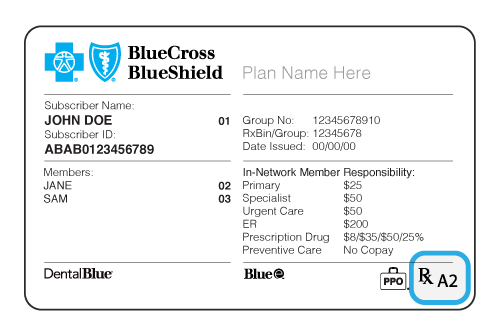

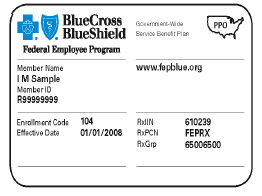

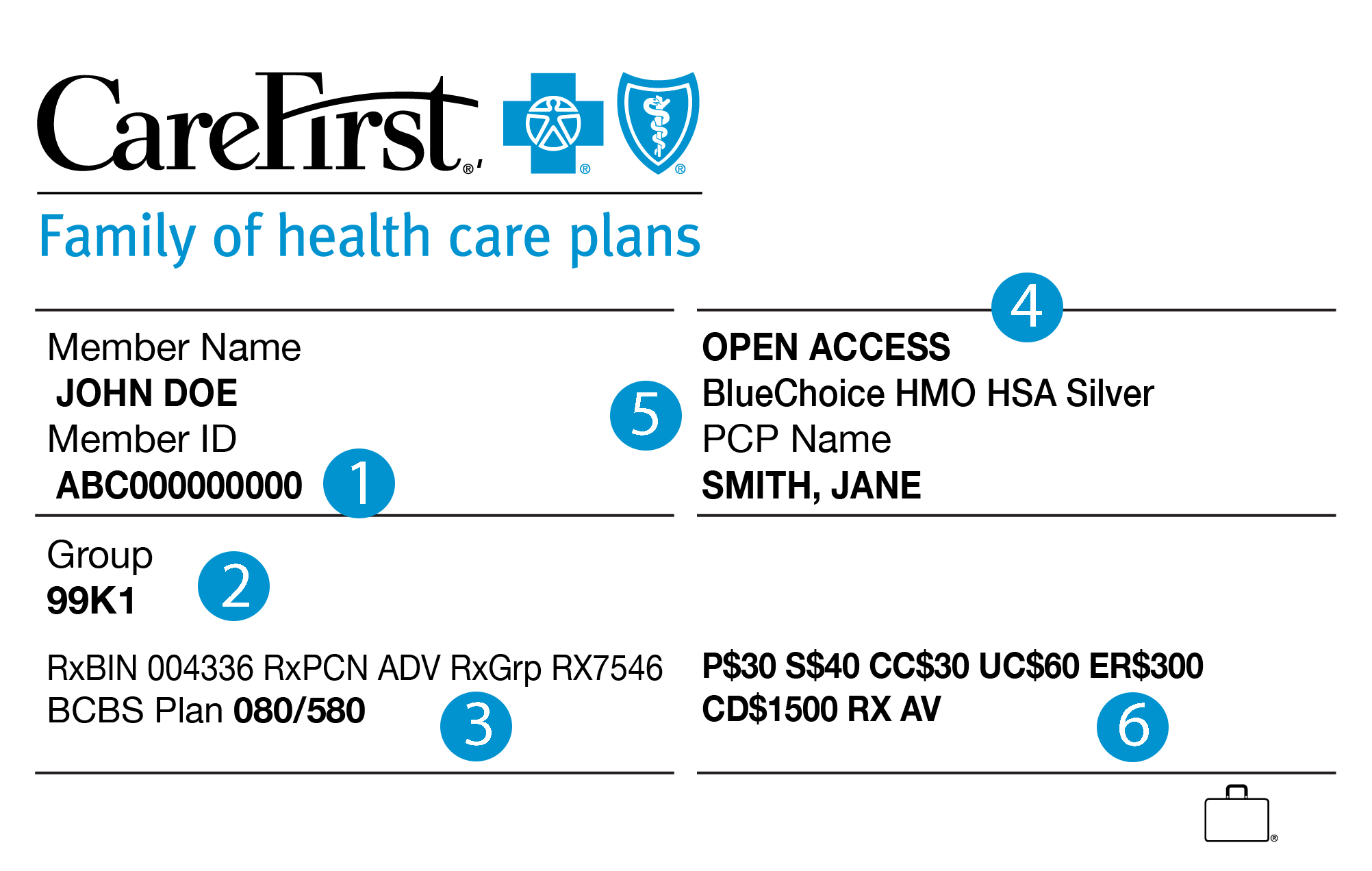

Whats on my card. The Member ID number allows you to register for Member Hub as well as access your digital ID card for you and your dependents. Additionally you can provide your name and date of birth to your Provider and they can contact CHP to verify eligibility and copayment information.

Reduce bad debt reduce paperwork for billing statements. This will take you to more information about that program. Manage your teams health benefits.

Show it when you fill a prescription and check-in for your medical appointments. Member ID and Group Number. MyPRES also has helpful features for Presbyterian patients such as emailing your care team and paying your medical bills.

Your secure account gives you access to. Information on your card will remain the same with one exception. View all of our health insurance plans available below.

These debit cards can help you simplify your administration process and can potentially help to. And contributing significantly to achieving a patient-centered health care system. Member ID Card.

Print a member ID Card. View your ID card find a doctor view claims and more. Access everything you need to sell our plans.

Covered by the health plan. Coverage Member Cost Share Tufts Health Plan Spirit Provider tier updates occur July 1. View or print your member ID card.

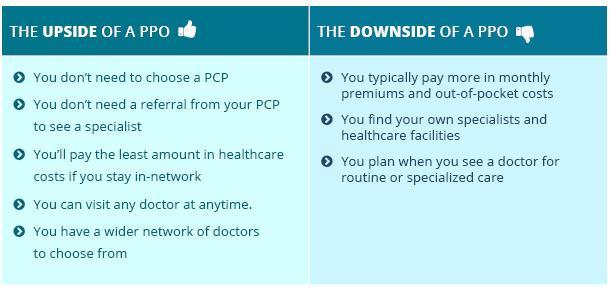

This is the type of plan you have. In-network hospitals are grouped into inpatient tiers. No Tufts Health Plan Spirit is a tiered limited-network PPO product.

Our Geisinger Health Plan member ID cards are sporting a new look. Care Health Plan Your Member ID Card has all the information you need to see your doctor call the Member Services Department or contact the Nurse Advice Line. You may print a temporary Member ID card on CHPConnect or contact CHP Member Services to request your Member ID number.

Creating an account is free and easy. Enter the plan subscribers information below. Affinity strives to be the health plan of choice for its Members and its providers -- known for assuring access to high quality cost-effective care.

Is a Harvard Pilgrim company Copyright 2021. Last Four of Social Security Number. Download the free MyPlan mobile app and access your account on your smartphone.

Your acceptance of this referral to provide servicesferenced memberpatient to the above-re constitutes yagreementour taccepto payment iaccordancen with HealthCare PartnersIPA reimbursement fee schedule whicmay h. Enter your information below to recover your user name. Some cards are stand-alone debit cards that cover eligible out-of-pocket costs while others also serve as a health plan member ID card.

Access your health information online 247. Delivering the best customer experience. The primary care site name will remain on Geisinger Gold member ID.

Your Member ID Card LA. Member IDYour plan subscribers SSN. Join our network of top doctors.

The MHS secure member portal has helpful tools to help manage your health. This does not include Geisinger Gold. Your date of birth.

Always carry your health plan ID card with you. Members Providence Health Plan.