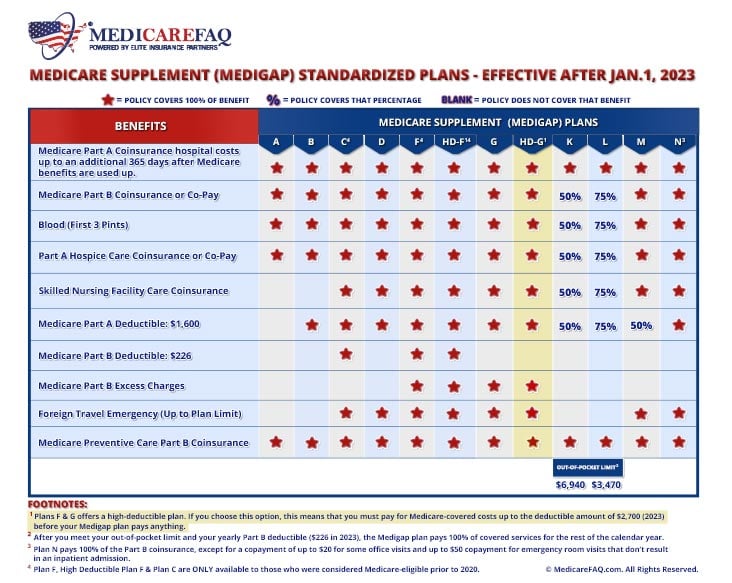

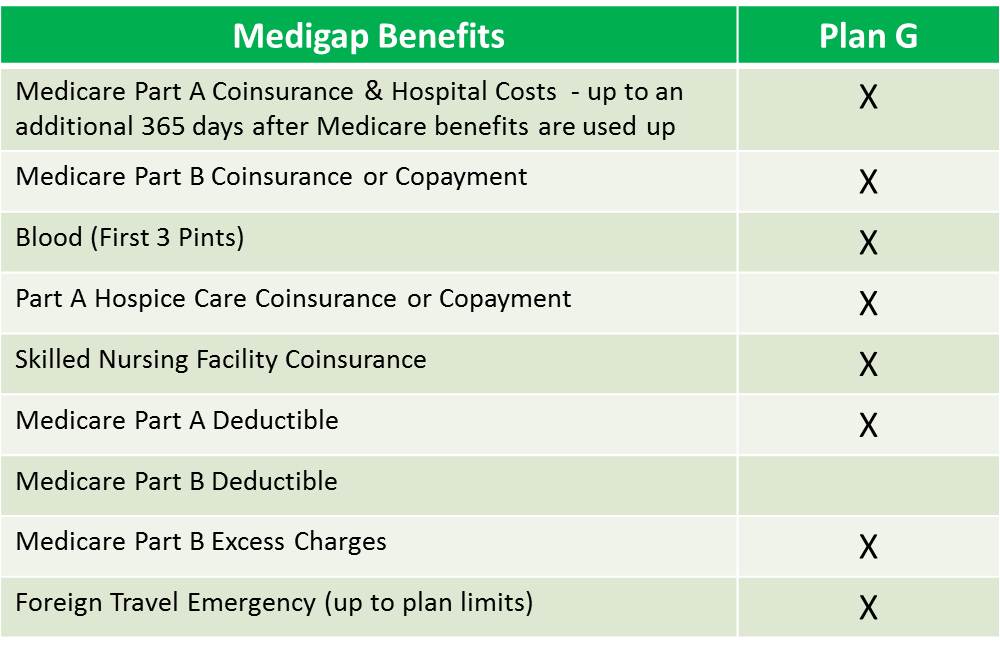

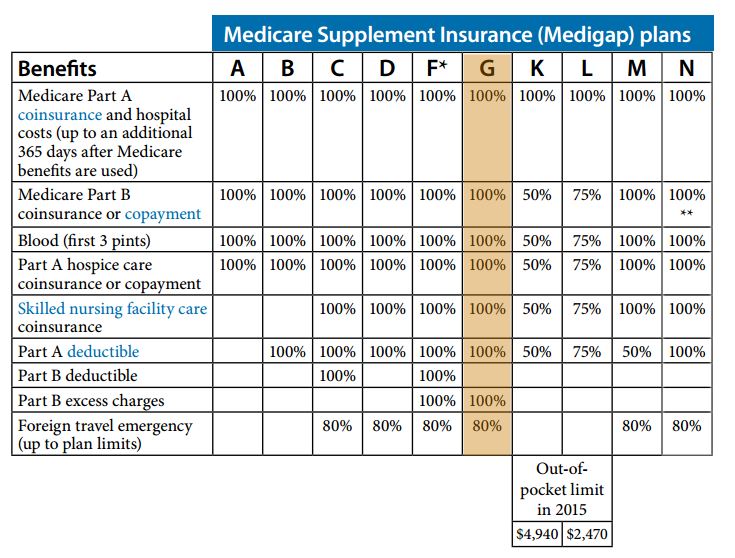

Of course it does not cover the Part B deductible for 185 a year but it does offer coverage for everything else. This deductible is currently 2021 203year.

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Medicare Supplement High Deductible Plan G For 2021 Medicarefaq

Plan G covers 80 after a 250 deductible to a lifetime maximum benefit of 50000.

Plan g high deductible cost. The 2020 deductible amount for high deductible Plan G is 2340. Heres what you need to know about the High Deductible Plan G. The deductible amount is 2370.

Heres what the Plan G deductible looks like in action. Theres also an additional yearly. Once your out-of-pocket expenses get to the deductible amount you pay 20 of Medicare-approved amount for Part B services and supplies.

Plan G is a similar type of plan. If you need to go to a Skilled Nursing Facility SNF after a hospital stay and stay in the SNF longer than 20 days this benefit begins. Once you reach that level of spending in a calendar year the plan kicks in and pays all remaining costs for the rest of the year.

High-deductible Plan G often has lower monthly premiums. High Deductible Plan G is a good alternative to High Deductible Medicare Supplement Plan F which wont be available to new beneficiaries in 2021. High-deductible Plan G is available but not all insurance companies offer it.

In 2021 the Plan G deductible is 203. High-deductible plans will pay your Medicare out-of-pocket costs after you pay an annual deductible which was set. High Deductible Plan G is a Medigap plan that works with Medicare A B.

It has a 2370 deductible in 2021 that has to be met before coverage begins. Once you spend a certain amount in qualified out-of-pocket Medicare expenses you will meet your deductible and your Plan G benefits will kick in. Plan G will offer a high deductible option starting on January 1 2020.

Medigap Plan G may be a good choice for beneficiaries who want broad coverage but dont want or need the Part B deductible benefit. Medicare pays for the first 20 days of a skilled nursing facility. The Plan G deductible is standardized by the federal government and will be consistent no matter where the policy is sold or by whom.

Medicare pays 80 of his Part A B hospital and medical expenses. If you would like a Medicare Supplement Plan and choose Plan G decide if you would like a Regular or a High-Deductible Plan G. Plan G in particular covers all the gaps in Medicare with the one exception of the Medicare Part B deductible.

Once the deductible is met you get the same coverage as a regular Plan G. The high-deductible plan can be found for as low as 60 per month but comes with the stipulation of first paying the deductible 2340. Ron buys High Deductible Plan G Medigap policy for 65 a month.

His HDG Plan will start paying the remaining 20 after he pays a 2300 deductible. He will have co-pays and co-insurance up to a maximum out of pocket of 2300 for the entire year. When you have a High Deductible Plan G policy Medicare pays its 80 share as usual but you pay the remaining 20 of all costs until your out-of-pocket costs reach 2340 2020 deductible.

It is high coverage as well and offers nearly full coverage for all supplementary expenses. Bob goes to the doctor for routine blood work on March 1. This applies to both the High Deductible Plan G and High Deductible Plan F.

The deductible is not very high either. Plan G 250 x 12 185. The plan deductible is 2370.

You can see why so many people choose this one. If you are saving more than 203 in premiums by purchasing Plan G then it makes sense to pick Plan G over F. This usually increases by a small amount every year.

The deductible amount for the high deductible version of plans G F and J represents the annual out-of-pocket expenses excluding premiums that a beneficiary must pay before these policies begin paying benefits. Once this deductible is met the plan pays 100 of covered services for the rest of the calendar year. In 2020 the deductible for High Deductible Medicare supplements is 2340.

Original Medicare will still pay its 80 portion You will pay the other 20 until you satisfy the 2370 deductible After the out-of-pocket deductible is met the plan will pay the same benefits as. High-deductible Plan G has the same benefits as original Plan G after you meet the plans annual deduction of 2370. Effective January 1 2021 the annual deductible amount for these three plans is 2370.

High Deductible Plan G is one of two high deductible Medicare Supplement plans available in 2021. However youll have to pay a deductible of 2370 before your policy begins paying for benefits. Youve been doing a lot of research regarding your Medicare coverage.

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

High Deductible Plan G Medicare Review Reviews Ratings

High Deductible Plan G Medicare Review Reviews Ratings

High Deductible Plan G Boomer Benefits

High Deductible Medigap Plan Makes Sense For Some

High Deductible Medigap Plan Makes Sense For Some

The New High Deductible Plan G Health Exchange Agency

The New High Deductible Plan G Health Exchange Agency

High Deductible Plan G What Are The Facts Gomedigap

High Deductible Plan G What Are The Facts Gomedigap

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

High Deductible Plan G Empower Medicare Supplements

High Deductible Plan G Empower Medicare Supplements

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Supplement Plan G Medigap Plan G

Medicare Supplement Plan G Medigap Plan G

Medicare Supplement Plan G High Deductible High Risk Coverage

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.