8 Zeilen The only benefit Plan F offers that Plan G doesnt is coverage for the Medicare Part B. Plan F benefits include coverage for all copays deductibles and coinsurance.

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

What is the difference between medicare supplement f and g. If you select the high deductible plans you have to pay the first 2000 deductible in 2010 in MediGap-covered costs before the MediGap policy pays anything. If you first became eligible for Medicare on or after January 1 2020 you cannot enroll in Medicare Plan F. Plan G will offer a high deductible option beginning January 1 2020.

Medicare Supplement Plans F and J also have a high deductible option. In exchange for you paying the Part B deductible youre going to get a big difference in premium savings. The ONLY difference between Plan G and Plan F is under Medicare supplement Plan G the Medicare Part B deductible is not covered.

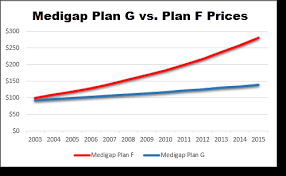

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. In other words Plan F will cost you 500 or more in annual premiums than Plan G. Both plans require you to first have Original Medicare but the enrollment guidelines for Plan F changed at the beginning of 2020.

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. See the chart below to get a visual of my explanation.

When you compare the lower premium benefit of Plan G you can save 500 or more. Lets Look at an Example. What is the difference between Medicare Supplement Plans F G.

Medigap or Medicare supplement insurance can help to pay for things that original Medicare doesnt. Plan G does not pay the Part B deductible like Plan F. Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges.

Plan F covers the Medicare Part B deductible and Plan G doesnt. Medicare supplement Plan G is very similar to Plan F. Another big difference between Medicare Plan F and Plan G is who is eligible to enroll.

There are two big differences between Medicare Plan F and Plan G. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Medigap has several different plans that you can choose from including Plan F and Plan G.

With a Plan G she would pay about 120. 8 Zeilen Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible. After the deductible is met Plan G benefits are exactly the same as Plan F.

The only difference between Plan F Plan G is the Part B deductible which will be 198 in 2020. In 2021 the Part B deductible is 203. For example a 70 year old woman in a big city pays 200 a month for her Medicare Supplement Plan F.

Medicare Supplement Plans F and G are identical with the exception of one thing. The difference between Plan F and Plan G is the annual Part B deductible. Jack has Plan G in addition to Medicare.

The better option depends on the monthly premium difference between Plan G and Plan F in your area. The trade is youre going to get a significantly lower premium with Plan G. First Plan G has lower premiums than Plan F.

Medicare Supplement Plan N. Example if the Plan F premium in your area is 140 but the Plan G premium is 100 you end up spending 480 more over a 12-month period in premiums with Plan F just to have the Part B. This means that you will have to pay 183 annually before Plan G begins to cover anything.

Otherwise they function just the same. Medicare Supplement Plan G. In Washington a Plan Fs premium is 2568 and the Plan G1896 a difference of 672.

There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans. Second you will pay a 203 Part B deductible in 2021. The Medicare Part B deductible is an annual deductible.

We dont recommend the high deductible plans. This means the most you can pay out of pocket under Plan G is 203 for the year. The annual premium on Plan G is usually lower which is typically a l ot less than what the cost of the part B deductible is.

What is the difference between Plan F and G. Most striking is one company in North Carolina that offers a Plan F with an annual premium of 3556. 9 Zeilen Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B.