Up to 7500 per year with no monthly limit for TRIUMEQ. PREZCOBIX is a prescription medicine that is used with other HIV-1 medicines to treat HIV-1 infection in adults and in children who weigh at least 88 pounds 40 kg.

Gilead Advancing Access Medication Co Pay Coupon Card

Gilead Advancing Access Medication Co Pay Coupon Card

If you are hypersensitive to TRIUMEQ tablets you should return all of your unused TRIUMEQ tablets to your doctor or pharmacist for proper disposal.

Copay card for triumeq. Up to 6250 per year with no monthly limit for DOVATO. Triumeq comes with a Medication Guide and a Warning Card listing symptoms of an allergic reaction. If you have been diagnosed with HIV your doctor may prescribe Triumeq to strengthen your immune system.

To obtain a new card or for additional information contact the program at 844-588-3288. This medicine can lower but not fully prevent the risk of spreading HIV to others. Triumeq wordt niet aanbevolen bij patiënten met een matig tot ernstig verminderde leverfunctie zie rubrieken 42 en 52.

Triumeq should not be administered to adults or adolescents who weigh less than 40 kg because it is a fixed-dose tablet that cannot be dose reduced. PREZCOBIX contains prescription medicines darunavir and cobicistat. Deze combinatie is op recept verkrijgbaar in tabletten.

Contact Us 800 657-7613 Call us if youre a pharmacist or patient looking for support. It is a combination of three separate antiretroviral drugs in one pill taken once a day. Deze combinatie wordt gebruikt bij HIV en aids als deze virusremmende medicijnen precies in deze.

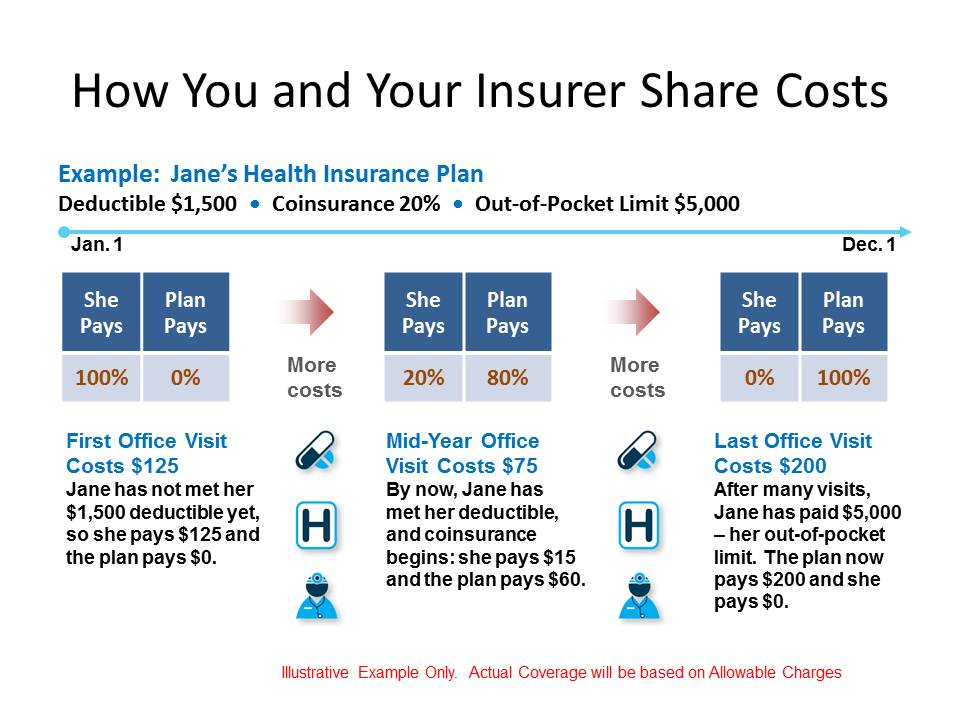

The recommended dose of Triumeq in adults and adolescents is one tablet once daily. This medicine is not a cure for HIV. In the Donut Hole also called the Coverage Gap stage youll pay more for your prescriptions.

I am 55 years old and am very healthy with high energy and never missed a day of work in over 15 years. Unfortunately this specialty medication can be very expensive without insurance a Triumeq copay card or another form of financial assistance. Keep the Wallet Card.

Triumeq is a fixed-dose tablet and should not be prescribed for patients requiring dose adjustments. Triumeq ViiVConnect Savings Card. Patiënten met een reeds bestaande gestoorde leverfunctie waaronder chronische actieve hepatitis.

With their copay assistance cards they basically pay nothing for their meds. Triumeq is a medication used to treat HIV. De veiligheid en werkzaamheid van Triumeq zijn niet vastgesteld bij patiënten met significante onderliggende leveraandoeningen.

Read this information and learn what symptoms to watch for. Detach this card and keep it with you at all times. Eligible commercially insured patients pay 0 per prescription with savings of up to 7500 per calendar year.

Abacavir is sinds 1998 internationaal op de markt dolutegravir sinds 2013 en lamivudine sinds 1995. The important part is striving to take it around the same time every day. In your Janssen CarePath account you can navigate to the Savings Program tab and click on Savings Program Request and follow the instructions to complete the process online.

And like many health plans theirs has a tucked-away not-loudly-advertised fiscal perk to patients. The TRIUMEQ pack includes an Alert Card to remind you and medical staff about abacavir hypersensitivity. It combines 50mg dolutegravir 600mg abacavir and 300mg lamivudine in an oval film-coated purple tablet.

Triumeq is normally taken by mouth once a day with no food or timing restrictions ie it can be taken any time of day. In the Post-Donut Hole also called Catastrophic Coverage stage. It is used to treat HIV.

Before you start to take it. In 2016 the Donut Hole begins once youve spent 3310 in one year. I never had any side effects since being on Triumeq.

The tablet has 572 Tri on one side. Up to 7500 per year with no monthly limit for RUKOBIA. HIV-1 is the virus that causes Acquired Immune Deficiency Syndrome AIDS.

The lowest GoodRx price for the most common version of Triumeq is around 310023 20 off the average retail price of 391746. If your pharmacy is unable to process your Savings Program card you have two options. Triumeq is definitely a HIV wonder drug that I would highly recommend to anyone living with this disease.

I have great insurance and with the patient savings card I pay nothing. De werkzame stoffen in Triumeq zijn abacavir dolutegravir en lamivudine.