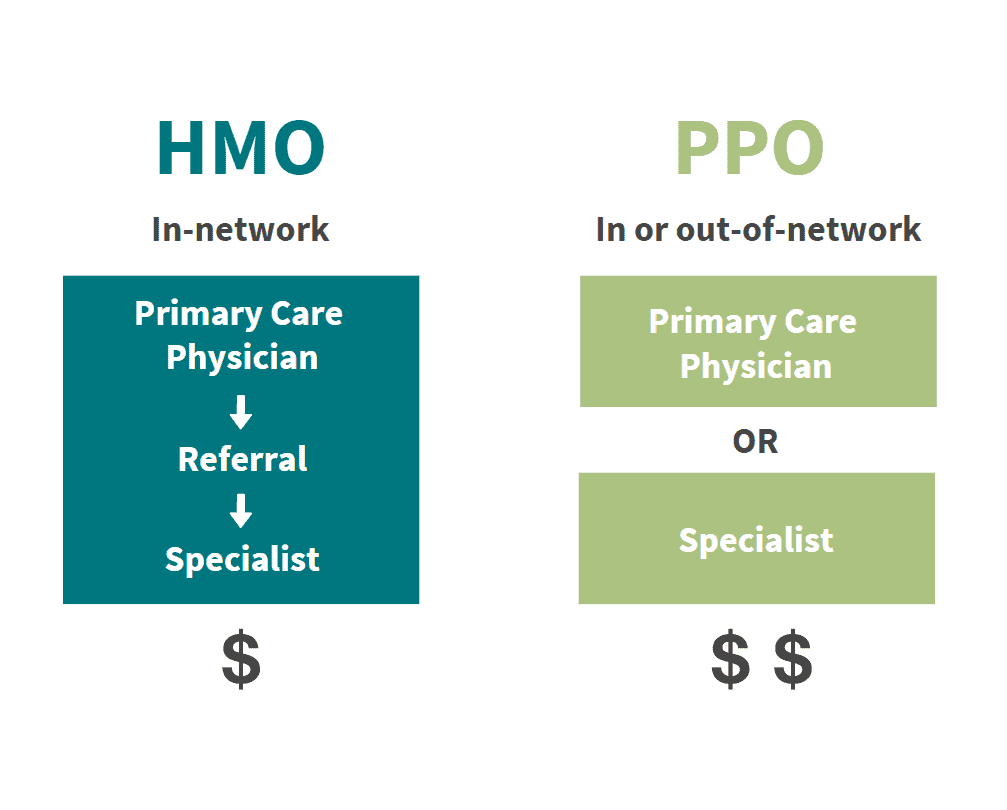

HMO insurance is often termed as an insured product meaning that the insurance company will pay the cost of the claim if it meets all coverage guidelines. Health Maintenance Organization HMO HMOs require primary care provider PCP referrals and wont pay for care received out-of-network except in emergencies.

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Other parts of an EPO plan are similar to an HMO such as having a limited network of doctors and hospitals.

Difference between hmo and epo. You cant get care outside the network unless its an emergency. If you are eligible or over the age of 65 you might want to check out Humanas Medicare PPO plan or Humanas Medicare HMO plan. 3 rows An Exclusive Provider Organization EPO is a lesser-known plan type.

The Difference Between EPO HMO and PPO Plans Of the three plan types HMO PPO and EPO you have HMO and PPO at two opposite ends of the spectrum with EPO plans somewhere in the middle. The insurance company pays out based only on the services rendered for EPO plans as opposed to a monthly payment schedule for those on an HMO plan. The member doesnt need a primary care physician for most visits to a specialist.

Humana Dental Vision. Hows A Consumer To Know What Health Plan Is Best. But as with PPOs youll be able to make your own appointments with specialists.

Like a PPO you do not need a referral to get care from a specialist. Medicare HMO PPO. EPOS exclusive provider organizations combine features of HMOs and PPOs.

But like an HMO you are responsible for paying out-of-pocket if you seek care from a. Medicare also has both PPO and HMO options. HMO is right for you read this guide on the differences between these health insurance plans.

Similar to a PPO a member can make an appointment with any doctor in the network. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO. Exclusive provider organization plans EPO PPOs are the most common type of health plan in the employer-sponsored health insurance market while HMOs lead the way in the individual insurance market.

Plans that are classified as preferred provider organization or. This year HMOs and PPOs dominated the plans offered. If youre not sure which plan EPO vs.

Then decide which one will work best depending on your specific circumstances. But they tend to have lower monthly premiums than plans that offer similar benefits but come with fewer network restrictions. Then you can see where the EPO fits in as a hybrid of the other two.

The Exclusive Provider Organization is more flexible than the Health Maintenance Organization. Like HMOs EPOs cover only. HMO PPO EPO.

If your health plan has the HMO or health maintenance organization designation then your insurer has enrolled you. There are a number of different types of networks with HMO PPO EPO and POS being some of the most common. Both types of plans typically have co-payments due at the time of the office visit as well as yearly deductibles.

You should recognize the difference between HMO and PPO plans first. You dont need to choose a PCP or need a referral so in that sense its similar to a PPO but you will only receive coverage for providers in your network. In comparison EPO insurance is often termed as a self-insured product in which the employer pays the costs.

They have exclusive networks like HMOs do which means they are usually less expensive than PPOs. On average EPO plans cost less than a comparable HMO plan. The EPO shares the HMO design of not recognizing any medical health care expense outside of.

Another major difference between the two relates to flexibility. 5 rows EPO Exclusive Provider Organization An EPO plan is less common than HMOs and PPOs but. In the case of Health Maintenance Organisation insurance a referral from the Primary Care Physician is required.

Dental and vision coverage is also available in both PPO and HMO plans. A provider network can be made up of doctors hospitals and other health care providers and facilities that have agreed to offer negotiated rates for services to insureds of certain medical insurance plans. What is the Difference Between HMO PPO and EPO Health Plans.

HDHPs make up about one-third of employer-sponsored plans and are seen as a lower-cost health insurance option for employers over the past decade. HMO can be termed as an insured product which means that the.