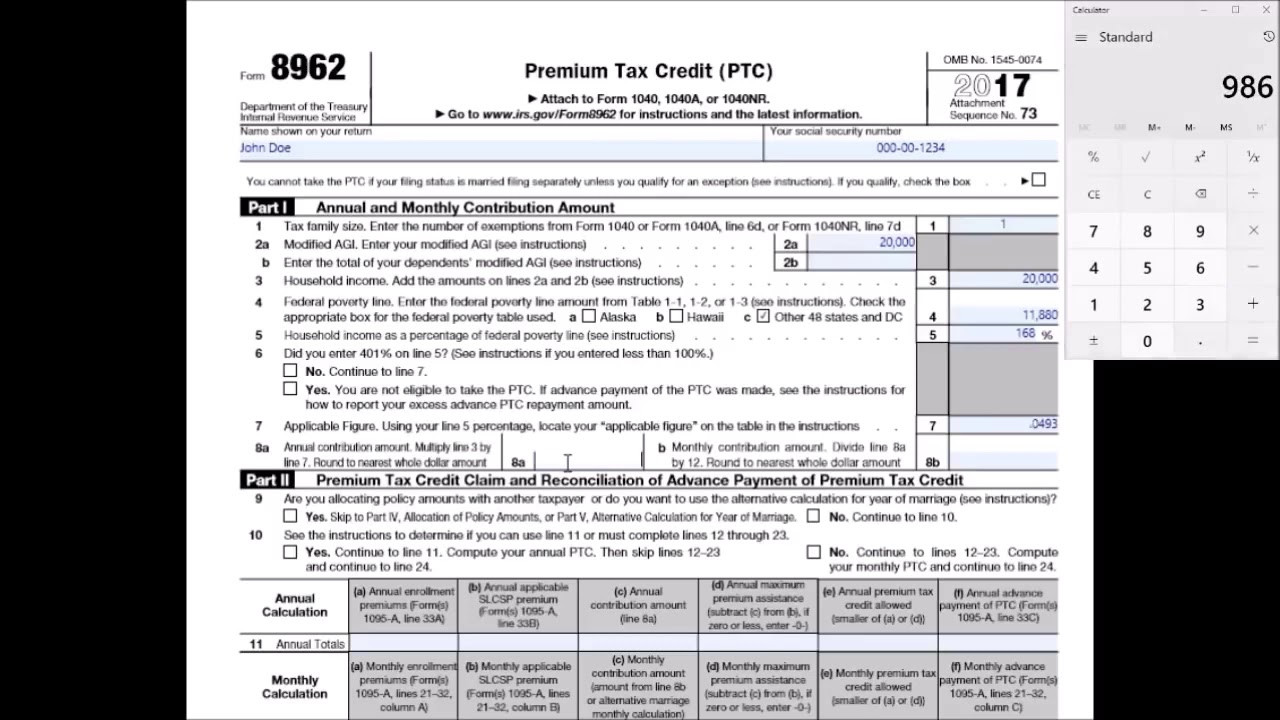

To calculate your clients Premium Tax Credit you will need to reconcile the amounts reported on their Form 1095-A and use those figures to complete Form8962 Premium Tax Credit. Download the form and open it using PDFelement and start filling it.

Aca Affordable Care Act Information Vita Resources For Volunteers

Aca Affordable Care Act Information Vita Resources For Volunteers

Start completing the fillable fields and carefully type in required information.

How to do form 8962. This is to aid the taxpayers afford and benefit from the health insurances purchased through the HealthCaregov. You can get the IRS Form 8962 from the website of Department of the Treasury Internal Revenue Service or you. If APTC was paid on your behalf or if APTC was not paid on your behalf but you wish to take the PTC you must file Form 8962 and attach it to your tax return Form 1040 1040-SR or 1040-NR.

Entering Multiple Forms 1095-A on One Form 8962 Make sure everyone on the Forms 1095-A is also on the tax return. The recipient for Form 1095-A should provide a copy to the other. Taxpayers use Form 8962 Premium Tax Credit to figure the amount of their PTC and reconcile it with their APTC.

While in your return click on Tax Tools Tools in the black bar at the side of your screen. Add the premiums together. How to Fill Out Form 8962.

As noted above you may also need to file additional 1040 forms like a Schedule 2 used for repaying excess tax credits due to the. Get Great Deals at Amazon Here. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

At enrollment the Marketplace may have referred to APTC as your subsidy or tax credit or advance payment. Use Get Form or simply click on the template preview to open it in the editor. Complete Form 8962 and attach it to your 1040.

Start completing the fillable fields and carefully type in required information. Before you dive in to Part I write your name and Social Security number at the top of the form. At the top of the form enter the name shown on the top of your return and your.

This includes your formal legal name and your Social Security number. If you need IRS 8962 form instructions here is the information you need to know. You fail to provide information of your form 1095A from the market place health insurance.

Youll enter the number of exemptions and the modified adjusted gross income MAGI from your 1040 or 1040NR. IRS Form 8962 Premium Tax Credit is automatically generated by the TurboTax software after you have entered the Form 1095-A you received for Marketplace Insurance in the Health Insurance section of the program. Part I is where you enter your annual and monthly contribution amounts.

Quick steps to complete and e-sign Form 8962 Instructions online. In this video I show how to fill out the 8962. Next you need to enter your basic information.

If the enrollees are in different states. Form 8962 is divided into five parts. You need to get IRS Form 8962 from the Department of the Treasury IRS or through various online portals where you can download it as a PDF.

Under certain circumstances the marketplace will provide Form 1095-A to one taxpayer but another taxpayer will also need the information from that form to complete Form 8962. Quick steps to complete and e-sign Form 8962 online. Use the Cross or Check marks in the top toolbar to select your answers in.

This computation lets taxpayers know whether they must increase their tax liability by all or a portion of their excess APTC called an excess advance Premium Tax Credit repayment or may claim a net PTC. You will need to to. If youre filling out a paper tax return and mailing your forms to the IRS you include Form 8962 with your Form 1040.

To complete Form 8962. If not this may be a Shared Policy Allocation. Use Get Form or simply click on the template preview to open it in the editor.

Try It Free Step 3. Reporting your Premium Tax Credits on your 1040. You then mail your forms to the.

Youll also enter your. If you want to delete an individual form please follow these instructions. If your client received anyAPTC in the prior year those payments will also need to be reconciled on Form8962 and submitted with their tax return.

Step 1. Form 8962 is to calculate and claim the Premium Tax Credit PTC. If everyone is in the same state the SLCSP should be the same on all Forms 1095-A for a given month.

The PTC is a refundable tax credit that you can claim by eligible tax payers and families earning and falling between the zero to moderate incomes. Youll need Form 1095-A Health Insurance Marketplace Statement to complete Form 8962. Httpamznto2FLu8NwHow to fill out Form 8962 Step by Step - Premium Tax Credit PTC - LLC - Sample Example Completed Expl.

You can delete Form 8962 and then it will repopulate from the information your entered from your 1095-A.