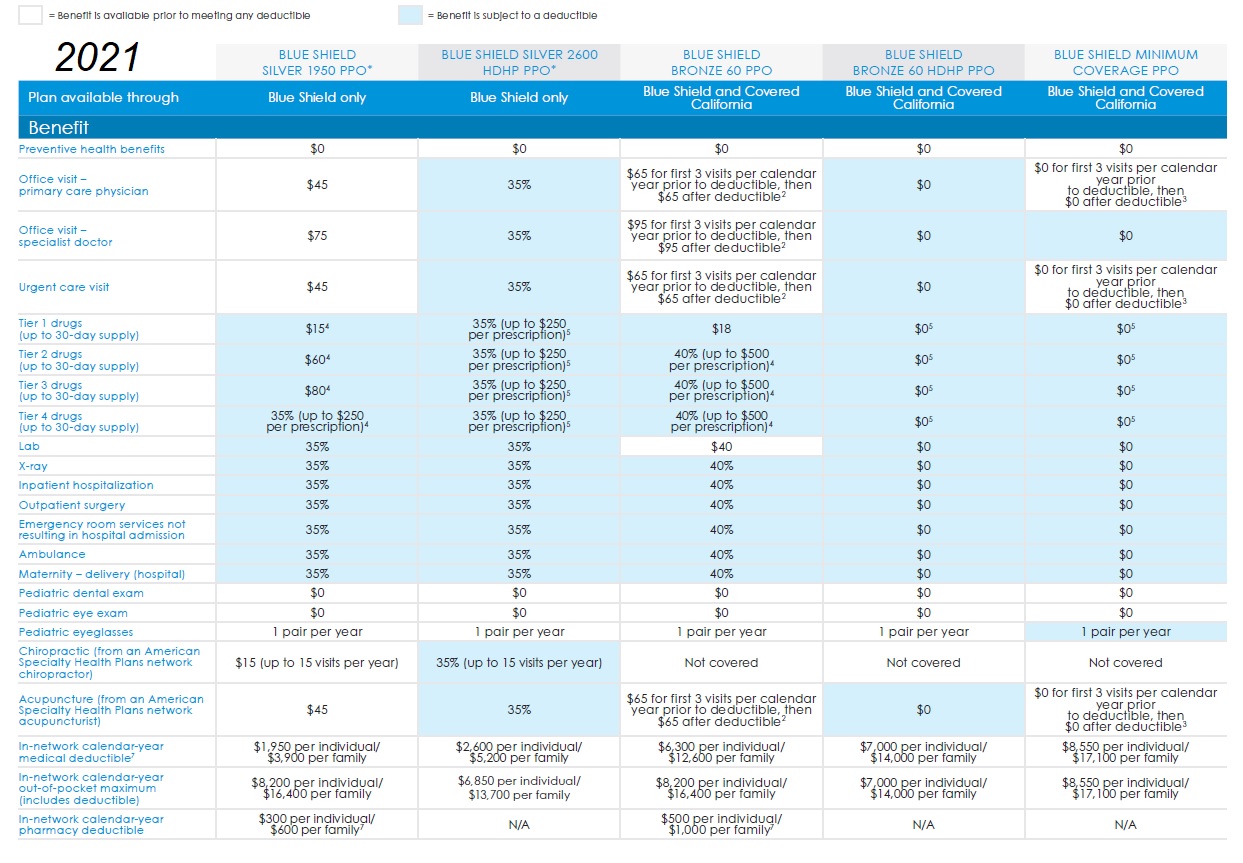

It is only a summary and it is included as part of the Evidence of Coverage EOC1 Please read both documents carefully for details. A46210-HDHP 118 1 Summary of Benefits Individual and Family Plan PPO Savings Benefit Plan Bronze 60 HDHP PPO This Summary of Benefits shows the amount you will pay for covered services under this Blue Shield of California benefit plan.

Https Www Blueshieldca Com Bsca Bsc Public Broker Portalcomponents Streamdocumentservlet Filename Bronze 60 Hdhp Ppo Ai An 1 18 Sob Pdf

This formulary corresponds with the following plans.

Blue shield bronze hdhp ppo. Due to plan changes from Covered California the following changes have been made to your 2021 benefits shown in the Summary of Benefits SOB. Blue Shield of California. Blue Shield Bronze 60 HDHP PPO.

The SBC shows you how you and the plan would. A46210-HDHP-NA Blue Shield Bronze 60 HDHP PPO AI-AN This plan is only available to eligible Native Americans 1 Uniform Health Plan Benefits and Coverage Matrix Blue Shield of California Effective January 1 2017 THIS MATRIX IS INTENDED TO BE USED TO HELP YOU COMPARE COVERAGE BENEFITS AND IS A SUMMARY ONLY. Blue Shield Silver 73 PPO.

Minimum Coverage PPO This plan is a great choice if you. English PDF 2M B Spanish PDF 2M B Blue Shield Minimum Coverage PPO. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

English PDF 2M B Spanish PDF 2MB We offer three Silver PPO cost-sharing reduction plans through Covered California for clients whose income is between 138 to 250 of the federal poverty level FPL. All changes and clarifications to your Bronze 60 HDHP PPO plan are effective January 1 2021. You can prepare for future medical costs by contributing tax-advantaged money to your own HSA.

For doctors that you see in your network Calendar-year medical deductible. Blue Shield Bronze 60 HDHP PPO. For incomes between 138 percent to 250 percent of the federal poverty level.

These plans are available only through Covered California. Account HSA the Blue Shield Bronze 60 HDHP PPO plan may be for you. Covered California is a registered trademark of the State of California.

A46210-HDHP Blue Shield Bronze 60 HDHP PPO Uniform Health Plan Benefits and Coverage Matrix Blue Shield of California Effective January 1 2017 THIS MATRIX IS INTENDED TO BE USED TO HELP YOU COMPARE COVERAGE BENEFITS AND IS A SUMMARY ONLY. Blue Shield Minimum Coverage PPO. Health insurance plan details for Blue Choice Preferred Bronze PPOв 201 offered by Blue Cross Blue Shield of Illinois.

Bronze 60 HDHP PPO Coverage for. It is only a summary and it is part of the contract for health care coverage called the Evidence of Coverage. The main downside of a PPO is that youll pay higher monthly premiums.

Blue Cross Blue Shield HSA-Advantage High Deductible Health Plan HDHP Coverage Period. PPO Group Number 007000285-0014 0015 5 of 8. Lower out-of-pocket maximum.

PSP 1 of 10 Blue Shield of California is an independent member of the Blue Shield Association. The Summary of Benefits and Coverage SBC document will help you choose a health plan. Individual Family Plan Type.

I am now debating between the Blue Shield Bronze PPO Mirrored plan and Health Nets Bronze 60 Enhanced Care PPO. PPO Savings Plan Bronze 60 HDHP PPO This Summary of Benefits shows the amount you will pay for Covered Services under this Blue Shield of California Plan. Blue Shield Platinum 90 PPO Blue Shield Gold 80 PPO Blue Shield Silver 70 PPO Blue Shield Silver 73 PPO Blue.

Shield Silver 87 PPO Blue Shield Silver 94 PPO Blue Shield Bronze 60 PPO Blue Shield Bronze 60 HDHP PPO Blue. IndividualFamily Plan Type. Get 2021 health insurance plan info on Bronze 60 HDHP PPO None from CA Physicians Service dba Blue Shield of CA of CA - premiums out-of.

Beginning on or after 07012020 Medical Prescription Plan Summary of Benefits and Coverage. What this Plan Covers What You Pay For Covered Services Coverage for. Blue Shield Bronze 60 HDHP PPO.

Bronze 60 HDHP PPO. The PPO typically has a lower maximum out-of-pocket cost than an HDHP. The big difference is the premium about 350 more per month for Blue Shield.

Get plan details on Bronze 60 HDHP PPO. Their benefits look identical and they have similar doctors on their preferred provider network I was able to locate drs directly on their website not through the quote website. THE EVIDENCE OF COVERAGE SHOULD BE CONSULTED FOR A DETAILED DESCRIPTION.

And you can receive preventive care services for no additional cost before meeting the deductible. Individual and family cost-sharing reduction PPO plans available on exchange through Covered CA only. Learn more about this California health insurance PPO plan from Blue Shield of California and apply online.

Health insurance plan details for Bronze 60 HDHP PPO offered by Blue Shield of California.