While those programs top out at 138 of the Federal Poverty Guidelines individuals earning up to 400 of the FPL may still qualify for subsidized health insurance coverage through the ACA. The premium tax credit helps lower your monthly premium.

Obamacare Subsidy Coverage Chart Rf Insurance Masters

Obamacare Subsidy Coverage Chart Rf Insurance Masters

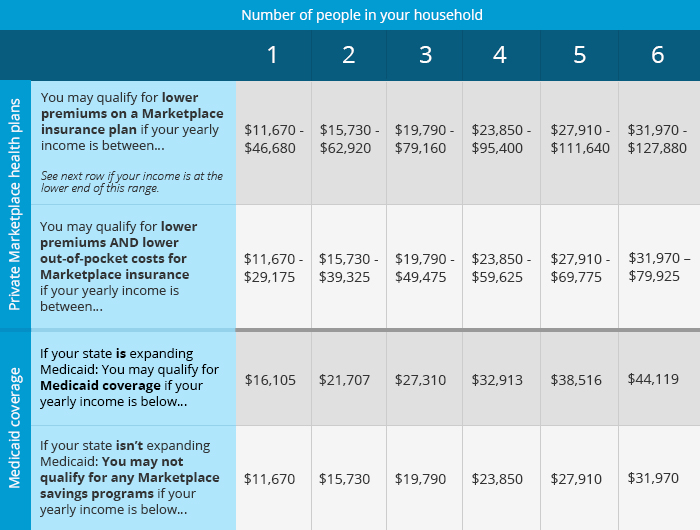

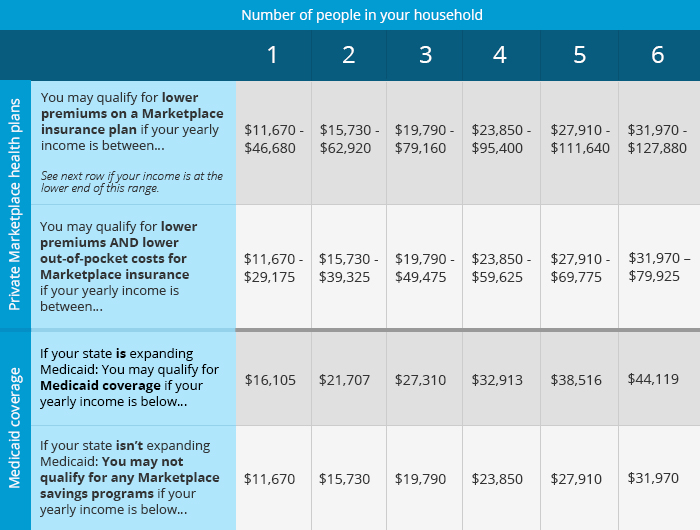

You may qualify for a premium subsidy AND a cost share reduction if your yearly income is between.

Health insurance subsidy chart. According to Connect for Health Colorados subsidy calculator you qualify for a subsidy of 688month and the lowest-priced plan is 211month after the subsidy is applied. Fortunately the HealthCaregov exchange figures it all out for you. This page features a 2021 ObamaCare eligibility chart the 2020 federal poverty level used for 2021 subsidies and a subsidy calculator.

For coverage in 2021 the subsidy. Click here to view the latest charts and information available on income or premium limits in the ACA. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of.

Toms premium tax credit subsidy will be 258210 per year or 29460 per month. The average subsidy amount in 2020 was 492month which covered the large majority of the average 576month premium note that both of these amounts are lower than they were in 2019. 3900 - 36480 353520.

978 of your income. With the new help more than half can. 983 and boosts subsidies to lower-income consumersthose with incomes between 100 and.

ACA Affordable Care Act Obamacare Government Subsidies for Health Insurance. With the recent passage of the ARPA there is now NO INCOME LIMIT for ACA tax credits. This page features a 2022 ObamaCare eligibility chart the 2021 federal poverty level used for 2022 subsidies and a subsidy calculator.

You may qualify for a 2020 premium subsidy if your yearly income is between. For a family of four the income limit is 97000. He cannot get a subsidy for his familys health insurance through the ACA because he makes just above the amount to qualify for the subsidy.

Your actual subsidy could be much greater or much smaller depending on your income the number of people in your family your age and whether you smoke or not. Learn more about who to include in your household. Again subsidies have increased for 2021 and will remain larger.

For 2015 that means an individual earning up to 47080 may qualify for an ACA subsidy. Subsidies are available to individuals and families with income between 100 to 400 of the FPL chart below. It also limits the maximum amount anyone must pay for marketplace health insurance to 85 of income vs.

Count yourself your spouse if youre married plus everyone youll claim as a tax dependent including those who dont need coverage. 9500 - 4890 4610. 2021 Key Subsidy Information.

Under the original ACA subsidies 14 of people using the marketplaces can buy a mid-level plan for 10 or less per month according to HHS. ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100. To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level.

This subsidy is available to people with family incomes between 100 1 times and 400 4 times the poverty level who buy coverage. But it varies widely by income with. The approved subsidy amount will provide a direct and immediate offset.

The premium tax credit helps lower your monthly expenses. The premium tax credit and the cost-sharing subsidy. There are two types of health insurance subsidies available through the Marketplace.

If your total income is below 100 percent of the FPL you should apply for Medicaid in your state. Cost of the benchmark plan expected contribution amount of the subsidy. Including the right people in your household.

If your income and assets are very low you may qualify for Medicaid health coverage immediately. He says that even going to his employers health insurance he has to pay a co-pay amount of 20000 every time either he or his wife sees a doctor in-network and this is on top of his monthly premium payment. Reducing the monthly cost of health insurance for the eligible individual.

The average savings for current enrollees will be 70 a month or 25 of what they pay now Kaiser found. 00978 50000 4890. The benchmark plan second-lowest-cost silver plan is about 430month which amounts to 98 percent of your income.

This tool provides a quick view of income levels that qualify for savings. Those with incomes over the set 400 FPL income limit may now qualify for lower premiums based on their location age and income. All but 16 states have chosen to allow people making up to 138 of the FPL to qualify for Medicaid.

If Tom chooses the benchmark plan or another 325 per month plan hell pay about 30 per month for his health insurance.