This short-term medical insurance policy. Under the Affordable Care Act this gap ins.

Short Term Health Plans In California Health For California

Short Term Health Plans In California Health For California

California law banned the sale or renewal of short-term health insurance as of 2019.

Short term health coverage california. Its not meant as a replacement for a comprehensive health insurance plan especially for those with chronic medical conditions. They both used to offer such a plan. An Alternative to Short-Term Health Insurance.

Pay a penalty when they file their state tax return. California banned short term health insurance plans effective 912018. Short term health insurance offers you just the kind of flexible fast coverage you need for those dynamic times of change in your life.

A short-term plan is meant to bridge the gap in health insurance coverage for those who temporarily lack major medical insurance. For now it is AlieraCare and you can quote them here. UnitedHealthCare has a large chosen supplier network of over 790000 participating doctors.

Despite the law on the books in California you dont currently have the option to enroll in a short-term health plan that lasts for six months. Similar exemptions apply depending upon the policy which is bought. Short-term medical insurance offers a solution to individuals in need of temporary medical coverage.

What is short-term medical insurance. Short-term health insurance coverage will vary based on the plan you choose. As we get more options well add their plans and rates into the rating engine.

Short-term health insurance plans offered health coverage to enrollees in need of urgent insurance while waiting to enroll in a standard health plan. Federal limits have restricted Californians enrollment options. Click the button below to get short term health insurance quotes.

In California get coverage for just one month or up to 6 months. Prior to the states ban on the sale of short-term plans regulators in California expressed concerns about the short-comings of short-term plans. Short term healthcare plans are a great way for California residents to cover their medical expenses in an affordable way while they wait to qualify for a major medical plan or while they go through a transitional period in their life.

In 2018 Senate Bill 910 was passed by California lawmakers which effectively banned the sale and renewal of all temporary health policies starting January 1 2019. Short-term health insurance plans are not available for purchase in California. A bill drafted by the California State Legislature and signed into law by Gov.

Have qualifying health insurance coverage. Personal Health Insurance Plans. Right now in California we basically have AlieraCare InterimCare health sharing plans.

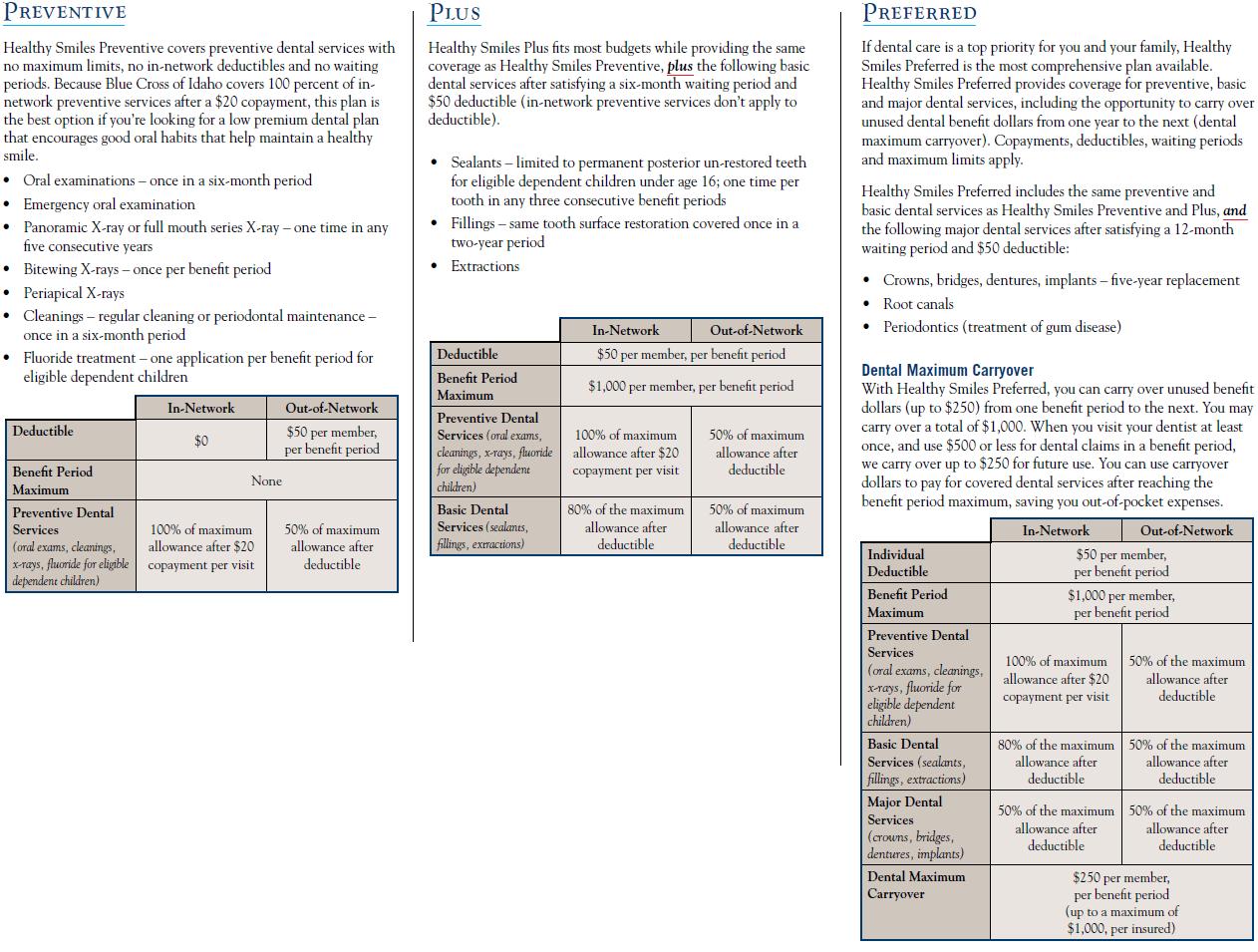

Health Care Sharing Ministries. Short-term limited-duration STLD health insurance also known as short-term medical STM is meant to cover hospital room and board emergency health situations inpatient doctor visits and. Short term health insurance will fill in a gap in coverage.

Short term health insurance is very popular now due to open enrollment restrictions. Explore health plans for you and your family including short-term gap coverage and more. If you live in California or another state where short-term health insurance isnt available you can try to apply for subsidies apply for medicaid or other government health insurance.

Get covered fast as soon as the day after application. Most short-term plans will cover emergency hospital visits certain prescription medications and some doctors appointments not related to pre-existing conditions. Unfortunately as of January 2019 short-term health insurance plans are no longer available to consumers in California.

Urance no longer counts as qualifying coverage. And they were very popular. Throughout the country the maximum duration of.

Blue Shield of California is now 2nd in market share for California coverage. Obtain an exemption from the requirement to have coverage. Jerry Brown now prohibits their sale within the state.

Beginning January 1 2020 California residents must either. Prior to 2019 state regulations limited short-term plans to a term of 185 days. Find California health insurance options at many price points.

How do we get short term health insurance through Blue Cross or Blue Shield of California. In a survey conducted by eHealth 61 of respondents reported that they chose short term as temporary coverage but there was also a group of respondents 27 who chose short term health insurance because they couldnt afford other coverage. Short-term health plans in California State law no longer allows the sale of short-term health insurance in California.

Get an online quote today. We are going to discuss with you all the important details to know about short term health insurance California plans and how they work how much. Immediate short term health coverage Carriers.

With short term medical plans 1 you can. Get Short Term Insurance. Short-term health insurance in California is available to individuals and families who can meet the underwriting guidelines set forth by insurers.

Short-term coverage in California. The benefits of short term health insurance. You cannot apply for short-term coverage through Health for California.

Anthem Blue Cross is 3rd. You will begin reporting your health care coverage on your 2020 tax return which you will file in the spring of 2021.

/cdn.vox-cdn.com/uploads/chorus_image/image/63037764/private_healthcare.0.jpg)

:max_bytes(150000):strip_icc()/dentist-5bfc37af46e0fb00511cee5c.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/9688285/erfees_cover_alt.jpg)