Most nursing home care is custodial care. Physical speech or occupation therapy services Durable medical equipment DME.

Do I Need Long Term Care And Why Legacy Planning Law Group

Do I Need Long Term Care And Why Legacy Planning Law Group

What is custodial care.

Long term custodial care. Some insurance companies sell a type of policy called long-term care insurance. Medi-Cal Eligibility and Long-Term Custodial Care 1Google Jimmo v. It is important to remember that custodial care does not include medical.

Medicare typically doesnt cover custodial care benefits but it may for a short period 100 days or less if. Alzheimers patients who have a tendancy to wander usually have only custodial care needs. Wound Care Tube Feeding Diabetic Treatments and Monitoring.

If custodial care is the only type of care needed Medicare will not cover these expenses. Medicaid has a complex and ever-changing set of eligibility rules. It is appropriate for patients when they have reached their greatest potential after experiencing an acute illness.

3Give them the Fact Sheet. Some examples of custodial care would include help with dressing bathing help out of bed help to the bathroom incontinence and assistance for patients with wheelchairs andor dementia. Custodial care and skilled care.

Medicaid is the largest payor for long-term custodial care in the United States. What is Custodial Care. Long Term Care is typically thought of as custodial care.

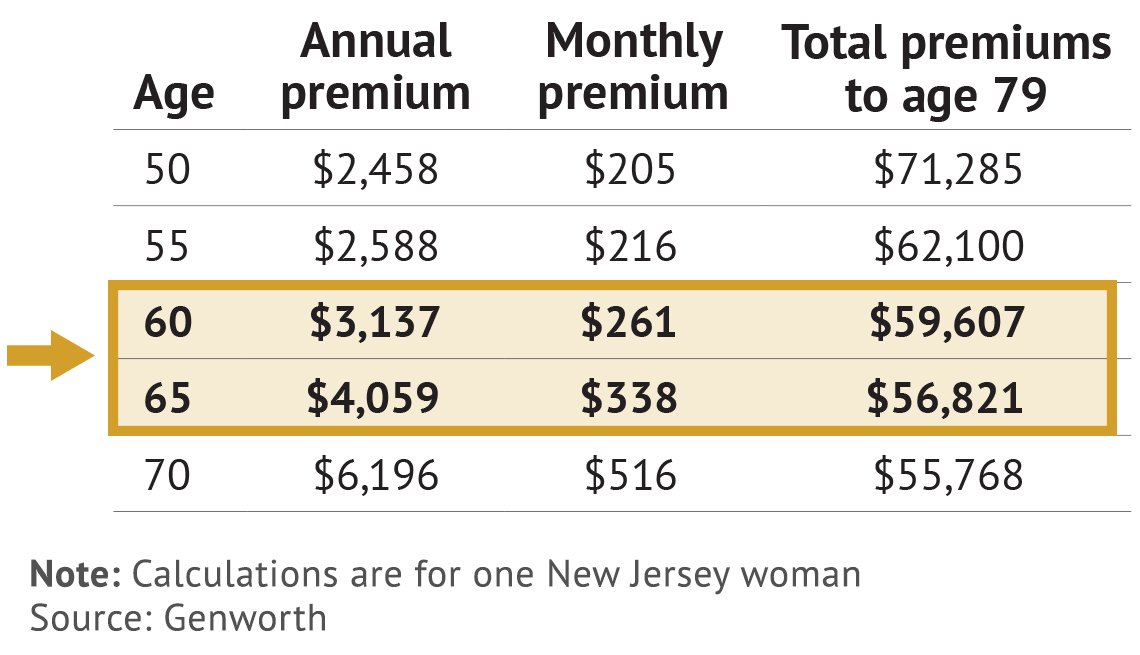

Long Term Care Insurance. This is where long-term. 2Take the copy of the Fact Sheet to the SNF administrator who told you your Medicare rehab services were about to end.

Patients receiving custodial care most often have a chronic condition where their recovery is not expected. If your countable assets are between 28000 and 4000000 and. Program of All-inclusive Care for the.

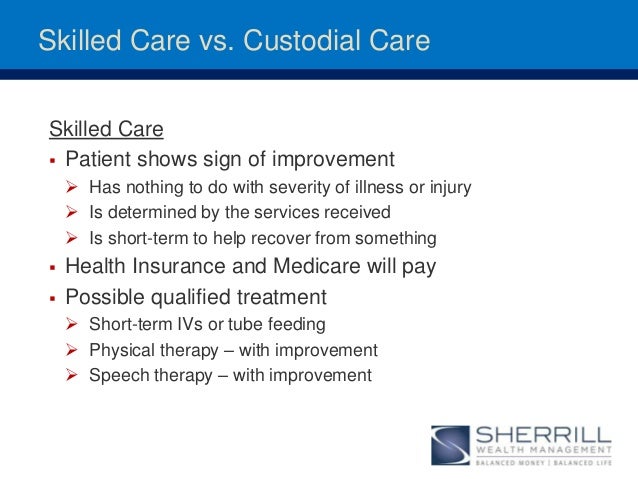

Long-term custodial services Short-term skilled nursing services Long-term care services that are not included in per diem or covered by any other insurance. Skilled Care Long-term care LTC is for a benef iciary who needs someone to help them with their physical or emotional needs for an extended period of time. When a patient no longer needs skilled care for instance he or she can be transferred to an intermediate or custodial section within the same facility.

Skilled care refers to skilled nursing or rehabilitation services provided by licensed. Many long-term care insurance policies determine benefit eligibility based on policy holders being unable to do two out of the six activities of daily living. Medicare doesnt cover long-term care also called Custodial care if thats the only care you need.

Private and semi-private rooms are available. In addition to home-based custodial care it is also available in long term care facilities retirement homes and assisted living communities. Another important differentiator between skilled care and custodial care is what Medicare will and will not cover.

Luckily with pre-planning we can help preserve your familys assets and help you prepare for the eventuality that you may require custodial care. What is skilled nursing care. The patient still requires assistance to perform self-care and Activities of Daily Living ADL even after attending intensive therapy.

Custodial care is available on a long term or short-term basis. One must meet strict financial requirements to qualify for state-administered Medicaid services to pay for. Your costs in Original Medicare You pay 100 for non-covered services including most long-term care.

This area is home to 74 residents. Long-term care insurance is meant to cover the costs of custodial and personal care in case of a long debilitating illness. There are two types of LTC.

These policies are meant to cover long-term care including custodial care. Find out if its right for you. This unit is designed to meet the needs of residents who are chronically ill or need very special nursing care services such as.

This includes help with eating dressing getting in or out of a bed or chair moving around and using the bathroom. Custodial care is paid out of pocket sometimes referred to as private pay through long-term care insurance or through public benefits such as Medicaid or Veterans benefits. Some long - term care takes place in nursing homes that provide custodial care primarily but many can provide skilled care intermediate care and custodial care.

Many families will hire a caregiver to supplement the care they provide for their loved ones in their own homes. Paying for Custodial Care Medicare. The other way to trigger benefits is due to a cognitive impairment such as dementia or Alzheimers.

Sebelius Summary access the Settlement Agreement Fact Sheet and make a copy of it. Long term care primarily involves assistance with daily living walking personal hygiene dressing etc or supervision of someone who is cognitively impaired. Long Term - Custodial Care services include 24 hour skilled nursing care.

Medicare along with private insurance may cover short-term skilled care needs when certain conditions are met. It is important for families to understand the differences in types of care and how costs are covered so they can make informed decisions about where their loved one will reside after skilled care ends. Those activities include bathing continence dressing eating toileting and transferring.

Also known as custodial care Non-skilled personal care for basic day-to-day tasks.