Voluntary life insurance is a low-cost type of term life insurance offered through employers. People with less-than-perfect health or multiple.

Http Www Reliancestandard Com Sitedata Docs Rs2355 A2ec37581eaf1ac7 Rs 2355 Pdf

This type of insurance also provides the insured with the option to cover his or her spouse or children and the spouse would also be covered for his or her entire life.

What is voluntary term life insurance. A policy can often cover just you or your spouse but typically at least one parent needs to be covered in order for children to receive coverage. Rates for voluntary life insurance are determined at the group level and therefore may end up costing healthier. Employers can provide two types of voluntary life insurance to employees.

Voluntary Life Insurance vs. If you are in need of life insurance on someone you can always get it through a company like Life Quotes but your options will vary. This one is a bit like level premium except that the policy renews and the premium amount.

Disadvantages of Term Life Insurance. When looking to buy a term policy from an insurer outside of your groups plan you will. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity.

Added features such as dependent life insurance help you cover the death of a family member such as a spouse or child. Through this program an employee can buy life insurance coverage that would pay their heirs a death benefit if the employee died. Voluntary group term life insurance provides coverage on an annual basis meaning each year you can choose to renew or cancel your life insurance or for a specified period of time such as 10 years.

Voluntary accidental death and dismemberment insurance VADD is a financial protection plan that provides a beneficiary with cash in the event that the policyholder is accidentally killed or. Whether you choose term life or whole life voluntary insurance you guarantee coverage for yourself and your family. The takeaway Voluntary life insurance is an employer-sponsored policy thats offered to employees through a benefits package.

Most insurers will have a maximum on the amount of coverage that can be purchased based on an individuals annual income eg not to exceed five times the individuals annual income. Voluntary life insurance is a form of term life insurance that is offered through employers. The employee is able to purchase the additional coverage at group rates.

Basic life insurance is offered to some employees as part of their employment package. Voluntary Term Life Insurance is a provision of group life insurance where the employee may purchase additional coverage beyond what the employer provides. Voluntary Term Life Insurance Mar 2021.

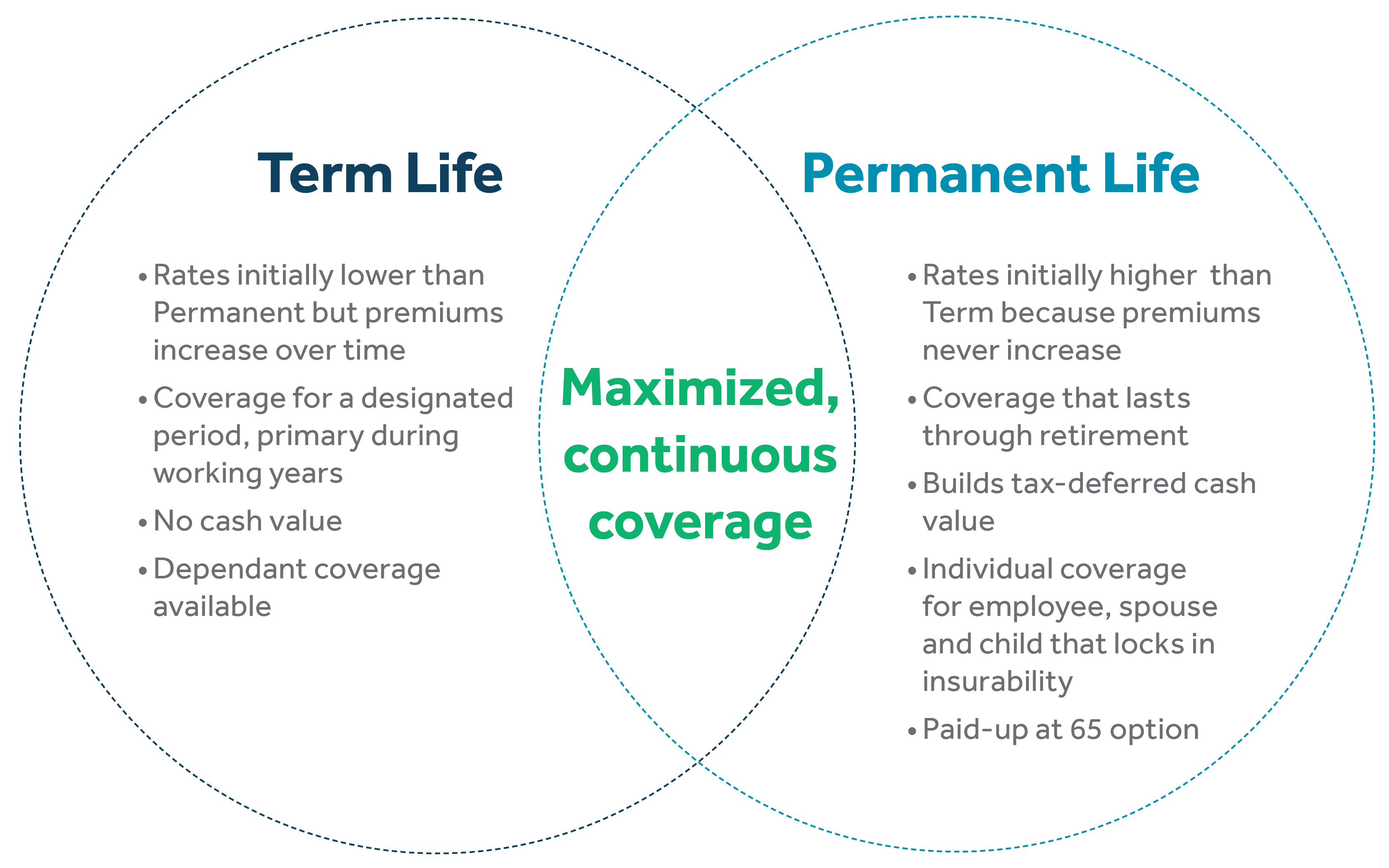

Voluntary term life also known as group term life insurance With voluntary whole life the insurance coverage is permanent. In other words the insured will be covered for the rest of their life. There are even companies that offer.

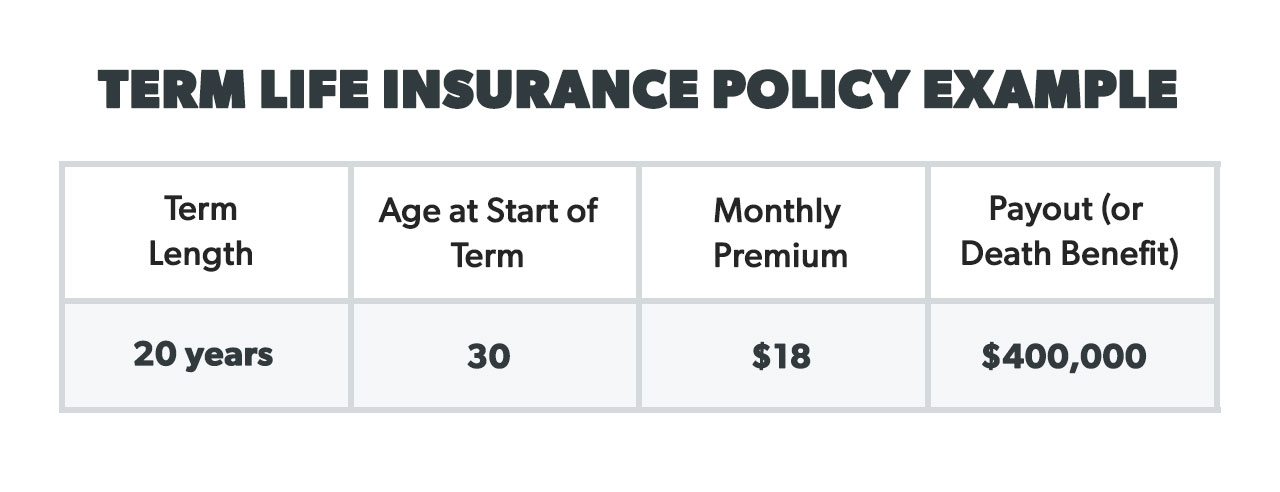

This type of insurance is offered at a low cost or free. Employers offer voluntary life insurance to ensure that employees have the opportunity to purchase the amount of insurance needed at a group rate. Employee and Spouse Voluntary Term Life Insurance Rates Age Monthly Rate per 1000 of Coverage Under 25 006 25-29 006 30-34 009 35-39 010 40-44 013 45-49.

Voluntary life insurance is a workplace benefit that employers can set up for their employees. You may only apply for voluntary life insurance through your companys specific open enrollment period so check with your employer shortly before or after. Voluntary life insurance also covers you or a loved one in case of critical illness or total disability.

Level premium term life insurance makes sure the costs stay level based on the length of term youre. What is voluntary term life insurance and is also called permanent life insurance The best thing that you can do is use a company that is reliable. The employer doesnt pay any of the.

The program is voluntary because employees choose whether they want coverage or not. Voluntary term life insurance Voluntary permanent life insurance. Voluntary Term Life Insurance coverages have a two-year suicide exclusion from the effective date of coverage or an increase in coverage.

Voluntary Term Life Insurance can also extend to the spouse or dependents of the employee. All groups that offer voluntary life insurance also offer basic term insurance that is normally paid for by. Purchasing a term policy or most other types of life insurance via an insurance company on your.

Size of the Death Benefit. What Are the Types of Term Life Insurance. Look for voluntary group term life insurance policies that also offer options for spouse and child coverage.

What are the disadvantages of term life insurance. Voluntary life insurance is a form of group life insurance in which an employer takes out a supplemental life insurance policy on behalf of their employees to provide them with additional coverage. Standard Term Life Insurance Medical Questionnaire.

Http Www Reliancestandard Com Sitedata Docs Employerrs Ff52e16ac92a97a3 Employer Rs 2355 Pdf

5 Voluntary Term Life Insurance Factors To Determine Coverage Costs

5 Voluntary Term Life Insurance Factors To Determine Coverage Costs

Voluntary Group Term Life Insurance Professional

Voluntary Group Term Life Insurance Professional

Voluntary Term Life Insurance Vs Voluntary Permanent Life Insurance Peterson Insurance Services Inc

Voluntary Term Life Insurance Vs Voluntary Permanent Life Insurance Peterson Insurance Services Inc

Voluntary Term Life Cowley College

Term Life Insurance Voluntary Term Life Insurance Insurance Information Center

Term Life Insurance Voluntary Term Life Insurance Insurance Information Center

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

How To Explain Term Life Insurance

How To Explain Term Life Insurance

Voluntary Term Life Cowley College

Voluntary Term Life Cowley College

What Is Term Life Insurance Ramseysolutions Com

What Is Term Life Insurance Ramseysolutions Com

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

What Is Voluntary Life Insurance And How Does It Work Thestreet

What Is Voluntary Life Insurance And How Does It Work Thestreet

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

What Is Voluntary Life Insurance Vs Basic Life Insurance Free Quotes Quickquote

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.