How much you have to pay if you see a provider who is out of network. The biggest difference in the HMO vs.

Hmo Vs Ppo Health Insurance Plans Selecting The Right Plan For Your Needs San Diego Financial Literacy Center

4 rows Is an HMO or a PPO plan better.

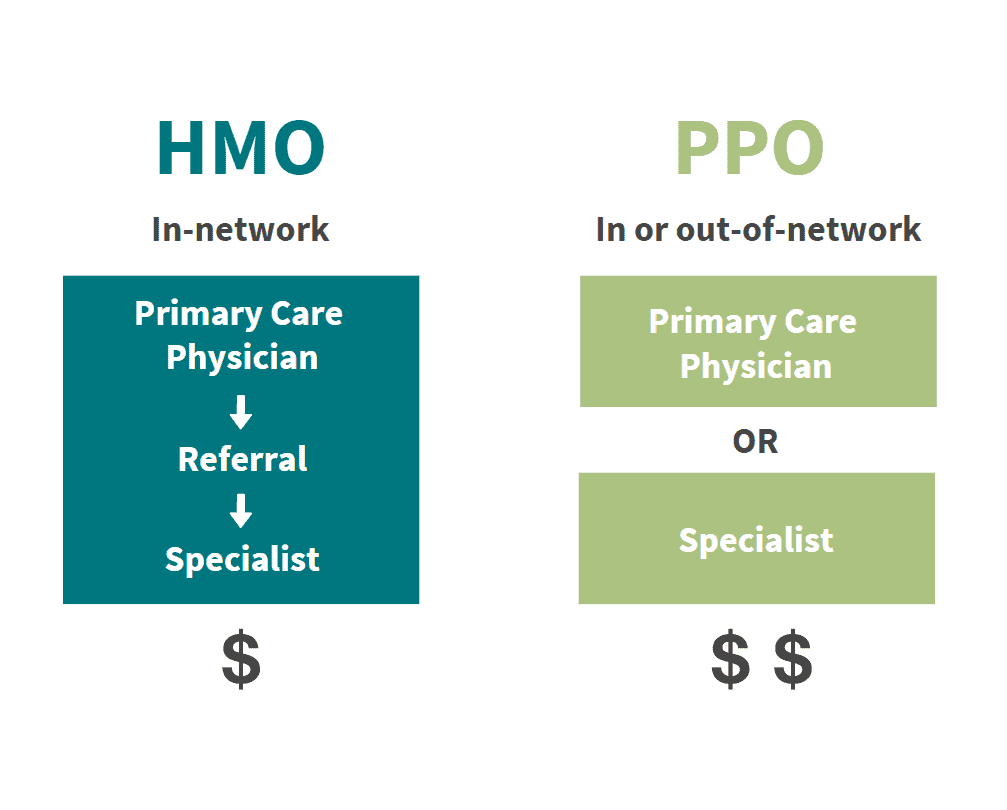

Different between ppo and hmo. Call Moseley Collins at 916 444-4444 for a free consultation. An HMO is a Health Maintenance Organization while PPO stands for Preferred Provider Organization. A PPO typically lets you see a specialist without a referral.

Moseley Collins is a personal injury attorney serving those badly hurt throughout California. The differences besides acronyms are distinct. The central differences in HMO vs PPO vs POS plans are.

Compared to PPOs HMOs cost less. Both HMO and PPO plans rely on using in-network providers. HMO acts as an acronym for Health Maintenance Organization while PPO serves as an acronym for Preferred Provider Organization The layout of an HMO insurance plan.

If you want to see a specialist an HMO generally requires you to get a referral. This plan type lets you see any provider you want and you dont have to get a referral from a primary care doctor to see a specialist like you would with other types of insurance plans like an HMO which well discuss later. A PPO may be better if you already have a doctor or medical team that you want to keep but who dont belong to your plan network.

A decision between an HMO and a PPO should be based on. Medicare also has both PPO and HMO options. The difference between them is the way you interact with those networks.

Plan Comparison As mentioned above Differences between HMO Health Maintenance Organization and PPO Preferred Provider Organization plans include network size ability to see specialists costs and out-of-network coverage. Co-payments under a PPO are generally higher when compared to an HMO. Medicare HMO PPO.

If you or a loved one have been injured by medical malpractice you will need a lawyer with experience. All these plans use a network of physicians hospitals and other health care professionals to give you the highest quality care. Generally speaking an HMO might make sense if lower costs are most important and if you dont mind using a PCP to manage your care.

However PPO plans offer flexibility by covering out-of-network providers at a higher cost. PPO plans are among the most common types of health insurance plans. But the major differences between.

These two types of plans have unique features benefits and limitations that are attractive to different people. Although Medicare Advantage PPO plans may offer more flexibility your costs such as the monthly premium are generally higher under a PPO. In order to understand the difference between DHMO and PPO dental insurance lets take a closer look at how each plan operates.

Preferred Provider Organization PPO While both Medicare HMO and PPO typically have more similarities than differences the main contrast comes down to premiums or higher costs in When choosing a Medicare plan that is best for you or your loved ones you may want to consult a plan representative to better understand the advantages of each plan. HMO stands for health maintenance organization. PPO dental insurance plans on the other hand offer a balance between low-cost care and dentist choice.

Whether or not you have to select a primary care physician who refers you to specialists. HMOs and POS plans require a primary care physician and referrals while PPO plans do not. HMO deductibles are usually smaller than PPO deductibles but either can still run thousands of dollars a year if you have serious medical issues.

HMOs offered by employers often have lower cost-sharing requirements ie lower deductibles copays and out-of-pocket maximums than PPO options offered by the same employer although HMOs sold in the individual insurance market often have out-of-pocket costs that are just as high as the available PPOs. PPO stands for preferred provider organization. PPO universe is how an enrollee in one of these plans.