Like a PPO you do not need a referral to get care from a specialist. Let us see the two plans closely.

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

Hmo Vs Epo Vs Ppo Which Is Better What S The Cheapest

It is difficult to predict when we will get sick and therefore know when we will need medical attention and therefore it is important to be insured.

Epo vs ppo which is better. 4 rijen You must stick to providers on that list or the EPO wont pay. By Amy De Vore. For some however an HMO health maintenance organization or.

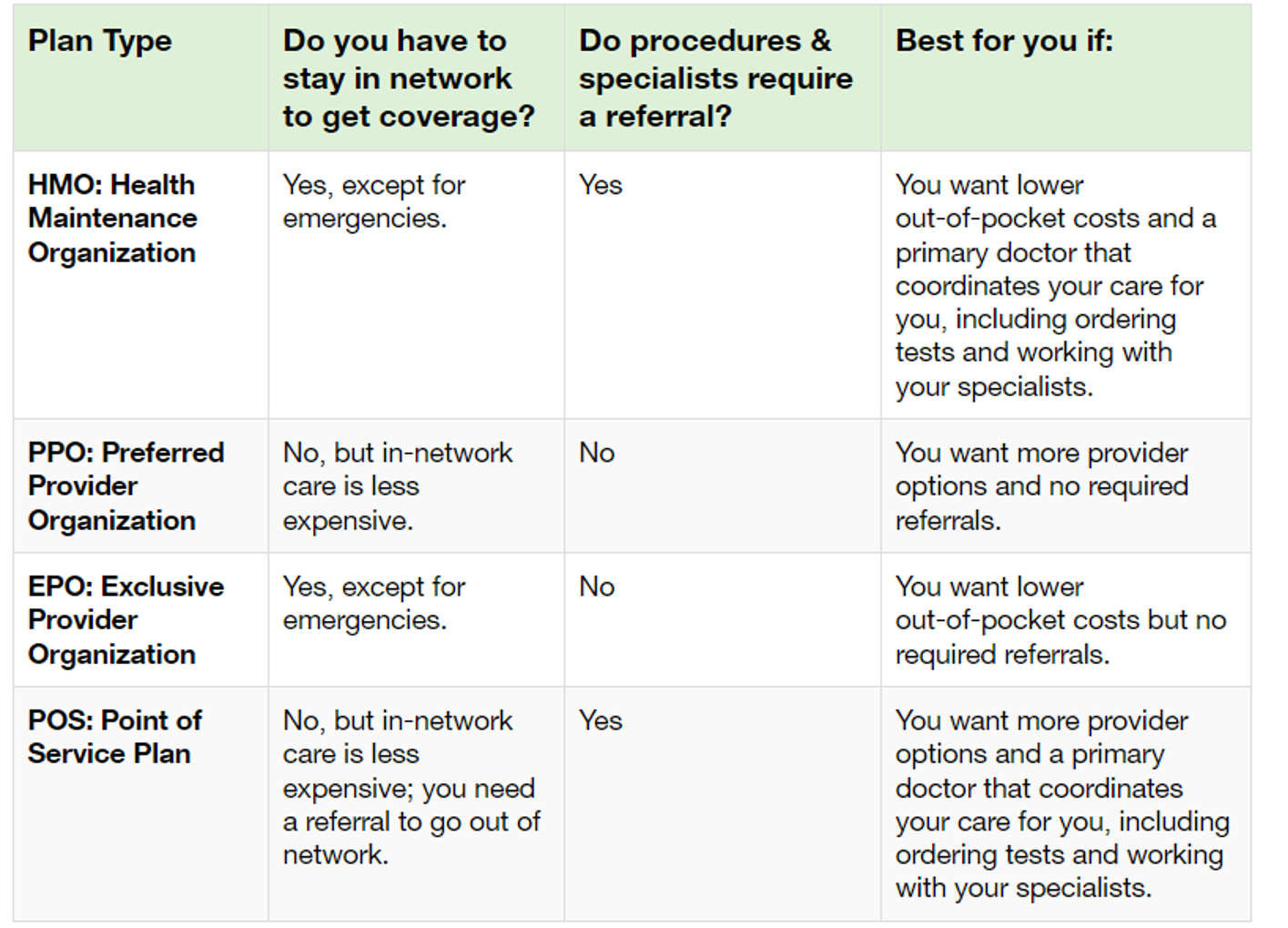

Difference between EPO and PPO. PPO or Preferred Provider Organization health plans are generally more flexible than EPO Exclusive Provider Organization plans and have higher premiums. An EPO or exclusive provider organization is a bit like a hybrid of an HMO and a PPO.

EPO health plans are often more affordable than PPO plans if you choose a doctor or specialist in your local network. The one exception is emergencies which are often covered even if they are out of your network. The EPO is now an important term since roughly half the State for certain carriers will have only have EPOs available to them depending on the carrier.

An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA. You will pay the full cost of items such as prescription drugs and office visits until the plans deductible amount is met. Although this feature can be a big help it can also be a wash financially by the time you pay all of your premiums for the year.

What is Difference between PPO and EPO. Both EPO and PPO have different features and it is necessary to keep in mind various factors such as cost options as well as your own needs before finally choosing a plan. Im on an union and the insurance kicks in after 90 days.

Lower out-of-pocket maximum. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy Safety How YouTube works Test new features Press Copyright Contact us Creators. The reason behind the price disparity between different.

Here well explain some of the basics starting with PPO HMO and EPO plans. Of het nu een HMO een ACO een EPO of een PPO is de eerste vraag is welke providers zich in het netwerk bevinden en hoe ze zich verhouden tot de providers die u nodig heeft op de locaties en bij de faciliteiten die u wilt gebruiken. You can self-refer to an in-network provider when a medical need arises.

You must identify your own needs before going with. For most services youll have to meet a higher deductible before the HSA Plan pays its share of the cost of services than you would in the EPO or PPO Plans. This comparison explains how.

And the other question is as follows. Lets understand the difference between the PPO and EPO before shopping the Covered California plans. PPO vs EPO.

First of all its important to note that coverage across different companies does not differ. There are many types of insurance created around the world to treat and ensure that people get medical treatments at a reasonable price. A Bronze plan in one company implies the same coverage as a bronze plan in another and so on and so forth.

However if you choose to get care out of your plans network your medical care may not be covered. The high-deductible health plan HDHP is frequently among the health insurance choices offered by companies these days. The main downside of a.

A health plans network is the set of healthcare providers. The PPO typically has a lower maximum out-of-pocket cost than an HDHP. EPOs generally offer a little more flexibility than an HMO and are generally a bit less pricey than a PPO.

However an EPO generally wont. Costs are kept low because providers charge a fee that has been negotiated with your EPO plan ahead of time. Which is better Medicare or Medicaid.

This video breaks it down removes t. HMO vs EPO vs PPO Obamacare Networks Explained. Adam Cataldo May 28 2014.

Is my job provide insurance better than any of latter.