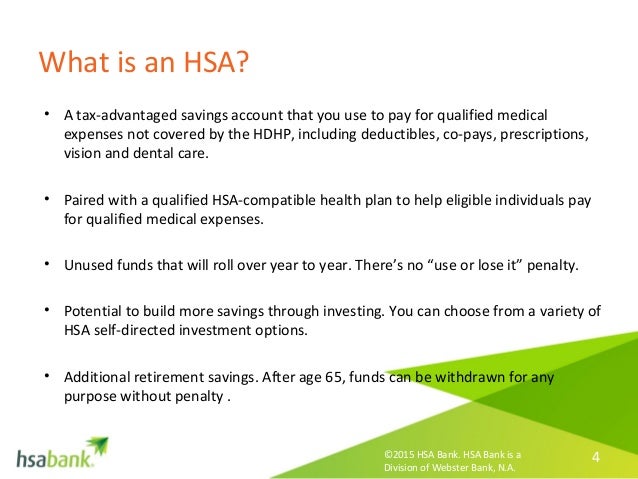

Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses. Since the HSA is governed by the federal government they get to decide which plans meet the mark.

A Health Savings Account HSA is a tax-advantaged account created for or by individuals covered under high-deductible health plans HDHPs.

What is hsa compatible. The rules that define HSA. Only medical expenses covered by the HDHP are taken into account in determining whether the HDHP deductible has been satisfied. You not your employer or insurance company own and control the money in your HSA.

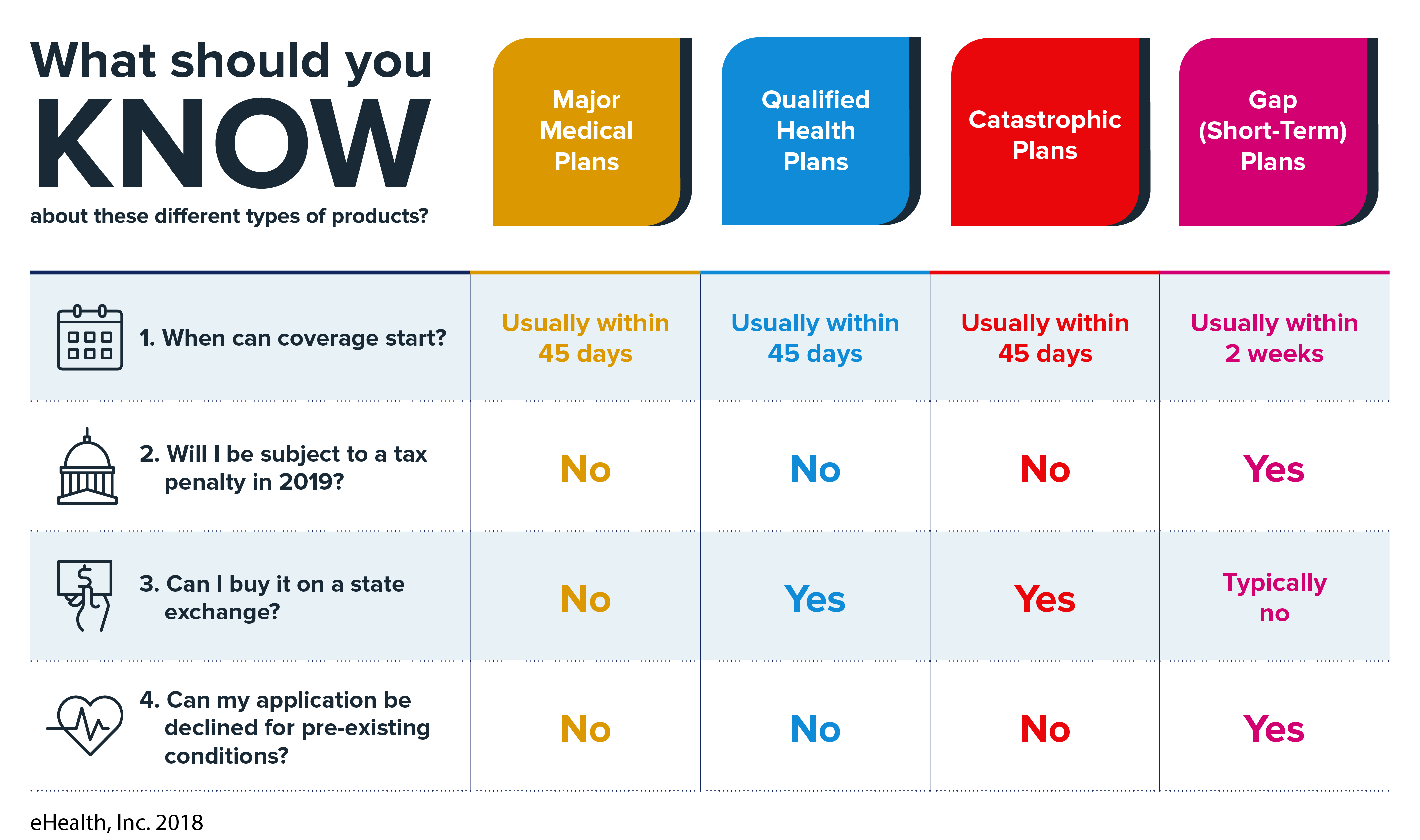

An HSA-compatible health plan is a health insurance plan that meets the guidelines set by the IRS regarding deductibles out-of-pocket expenses and acceptable coverage. Finding using HSA-eligible HDHPs. Eligible dependents include a spouse children under the age of 26 and children over age 26 who are tax dependents.

Employees are able to set-aside a designated amount to be used on dental and vision expenses. Criteria For Compatible Health Insurance Plans. Deposits to the HSA are tax-deductible and grow tax-free.

The Internal Revenue Service IRS has. Withdrawals are always tax-free if theyre used for qualifying medical expenses although they account can be used like a traditional IRA after age. 6050 for individuals and 12100 for the families.

But when combining these benefits its important to make sure they. Typically plans that are HSA compatible are clearly marked as such. These limits for 2021 are.

The most common HSA-compatible account is the Limited Purpose FSA or Limited Purpose HRA. Here are the two major requirements to qualify as HSA insurance. One benefit of an HSA is that the money you deposit into the account is not taxed.

These accounts were created in. If you are age 55 or older at the end of your tax year your contribution limit is increased by 1000. Therefore you need to look for high deductible plans that are HSA compatible.

Amounts are adjusted yearly for inflation. The health plan cannot provide benefits before the deductible is met except for preventive care services. A Limited Purpose FSA is typically designed to pay eligible dental and vision expenses.

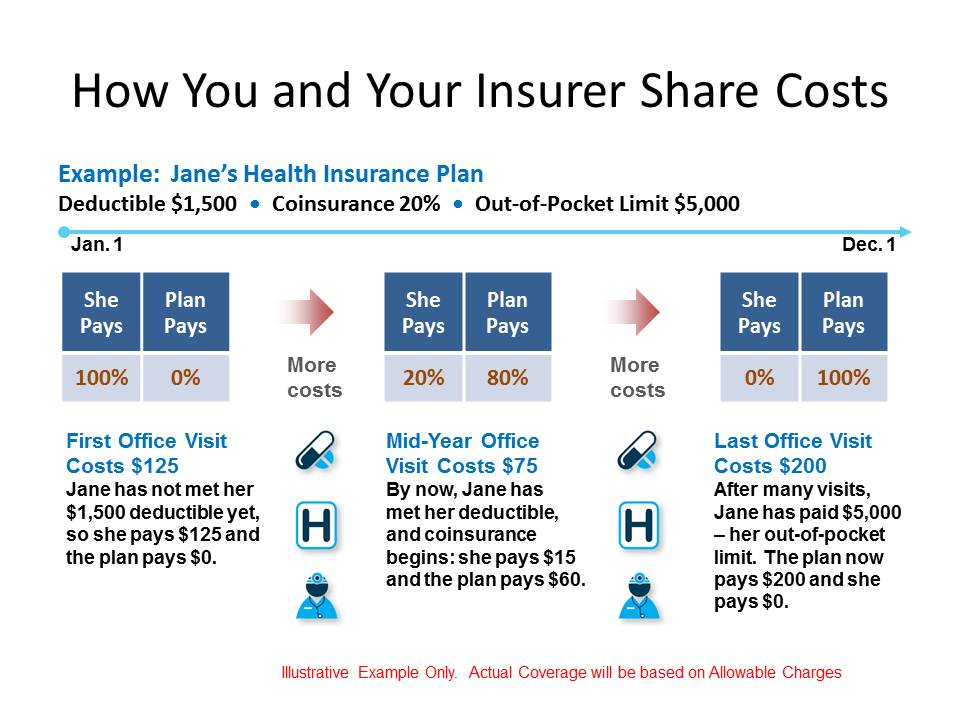

What makes an HDHP HSA-compatible. For an HDHP to be considered HSA-compatible it must meet minimum deductible and maximum out-of-pocket expense requirements for the applicable year as defined by the IRS subject to cost-of-living adjustments. A health plan is an HSA-compatible HDHP only if it satisfies both a minimum annual deductible amount and a maximum out-of-pocket expense amount.

If youre eligible for a health savings account commonly called an HSA taking advantage is a smart way to save money on your current and future medical expenses. A health savings account is a tax-advantaged savings account combined with a high-deductible health insurance policy to provide an investment and health coverage. You can carry over unused funds from year to year and the account is yours to keep even if you change jobs change health plans or retire.

So you may have to click on each plans actual summarybrochure to find out whether each is HSA eligible. 7200 for family HDHP coverage. 3600 for self-only HDHP coverage.

An HSA is designed to work with a qualifying high-deductible health plan HDHP. This is a great route and may save you money compared to continuing with your employer-provided option through COBRA. Health Savings Accounts let you pay out-of-pocket healthcare costs with pretax dollars but you must have a high-deductible health plan to qualify.

An HSA-Compatible FSA lets you pay for qualified out-of-pocket dental and vision care expenses on a pre-tax basis. The HSA can only be used with high deductible plans. Enrolling in new coverage provided it is an HSA compatible plan with no lapse will result in zero repercussions to your HSA eligibility.

Offering additional benefits like health savings accounts HSAs and voluntary benefit options like hospital indemnity insurance can help employees feel more financially protected. The sum of the annual out-of-pocket expenses required and the annual deductible should not exceed a certain threshold. There are yearly limits for deposits into an HSA.

Some Marketplaces can sort by HSA compatible High Deductible Health Plans but all insurers selling on the Marketplaces are required to include whether a plan is HSA eligible in the plans information. Your HSA-Compatible FSA covers qualified healthcare expenses for you and your eligible dependents. The advantage is that this combination delivers additional tax benefits.

What Does HSA Compatible Mean. The money you contribute to an HSA-Compatible FSA is not subject to payroll taxes so you end up paying less in taxes and taking home more of. The money goes in tax-free grows income tax-free and comes out income tax-free when you use it for qualified medical expenses.