A group life insurance policy is one of the ways in which life insurance can be distributed and are available through a corporate your employer and master trusts. An example of a group policy would be one thats been purchased by an employer or trustee of a superannuation fund with the employees or fund members being the life insured.

Group Term Life Insurance An Overview

Group Term Life Insurance An Overview

Or you can offer the same level of benefits to all.

What is a group life insurance policy. Before youre are eligible for group life insurance youll need the following. Our Group Life cover offers a great deal of flexibility and you can choose different levels of benefits for different types of employee. The basics of group life insurance The advantages of group life insurance.

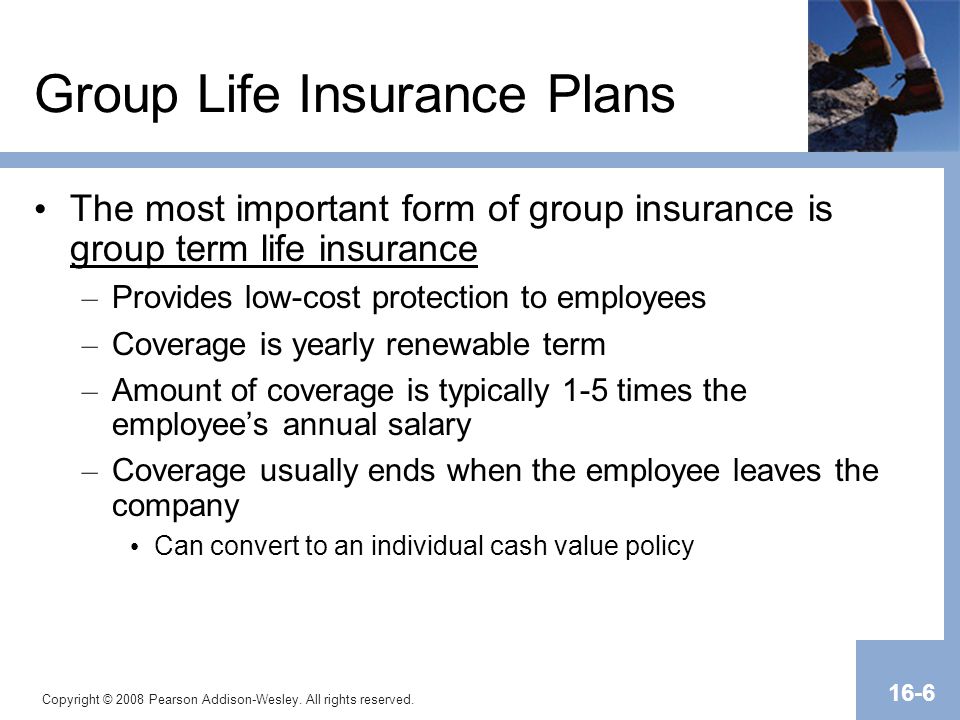

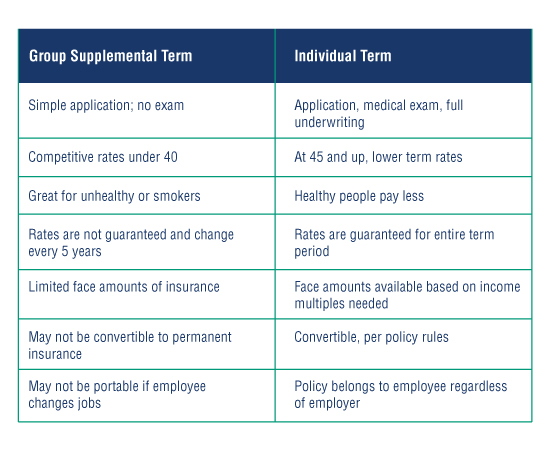

Buying more coverage at. Group life insurance policies are generally written as term insurance and offered to employees who meet eligibility requirements such as being a permanent employee or 30 days after hire. The most common form of group life insurance is group term life.

Typically an employer-sponsored group policy is term life insurance. Such as directors managers and staff. Group term life insurance is an employee benefit thats often provided for free by employers.

Group life insurance products offer benefits to a group of people. Group Insurance health plans provide coverage to a group of members usually comprised of company employees or members of an organization. In these cases the insurer agrees to offer the insurance without collecting detailed personal information on each persons current health status and previous health history.

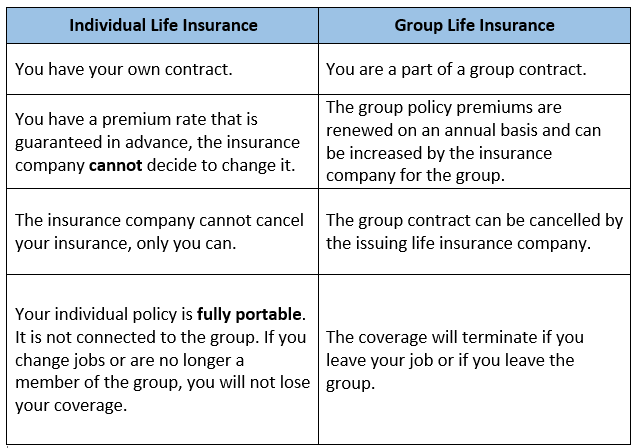

When the policy is up for renewal both the insurance company and the employer can determine whether to continue. Unlike an individual life insurance policy. The term group universal life policy refers to a form of universal life insurance offered to a group of people at a lower cost than what is typically offered to an individual.

Group life insurance coverage is limited. Typically with an employee life insurance policy the owner of the life insurance policy is the employer and the life insurance policy covers the employee. The insurance cover will be provided to a group of people under a single master life insurance policy.

Typically the policy owner is an employer or an entity such as a labor organization and the policy covers the employees or members of the group. Letter of appointment Certificate of registration or incorporation Form CO2 Form CO7 of the assured Means of Identification of two directors of the company A full schedule of staff or members under the scheme to take the. Group life insurance policies are established based on the risk factor of the group as a whole so higher risk members of the group are protected from being adversely singled out and either excluded or forced to pay more.

This is typically provided to the employees by the employer in the form of a 1-year annually renewable term insurance policy. Group life insurance is one type of life insurance where a single agreement or contract covers an entire group of people like the employees of a company. Employees may also have the option to buy additional coverage through payroll deductions.

Group policies are affordable and the cost of insurance is much lesser than for an individual policy. Group health members usually receive insurance at a. 4 Zeilen Group.

Group life insurance is a type of life insurance in which a single contract covers an entire group of people. Group life insurance involves a single contract covering a group of people typically an employer or large scale organisation. If you fear you wont qualify for competitively priced policies as an individual perhaps due to a pre-existing condition group life insurance through your work may be.

Group life insurance is often provided as part of a complete employee benefit package. Rates can also increase upon policy renewal. Group life insurance covers a group of people under a single contract often provided.

Its easy to qualify for coverage.

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Video Online Download

Group Life Insurance Who Is Issued A Certificate Of Insurance Mlshara

Group Life Insurance Who Is Issued A Certificate Of Insurance Mlshara

7 Important Facts To Consider About Group Life Insurance Policies Investment Professor Com

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Individual Life Insurance Vs Group Term Life Insurance Financial Benefit Services Employee Benefit Solutions

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Download

Is Group Life Insurance A Good Deal Llis

Is Group Life Insurance A Good Deal Llis

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Download

Chapter 16 Employee Benefits Group Life And Health Insurance Ppt Download

Don T Rely On Group Insurance Get An Individual Life Insurance Policy

Don T Rely On Group Insurance Get An Individual Life Insurance Policy

Group Life Insurance Who Is Issued A Certificate Of Insurance Mlshara

Group Life Insurance Who Is Issued A Certificate Of Insurance Mlshara

Know About Group Insurance Scheme Definition Features Benefits

Know About Group Insurance Scheme Definition Features Benefits

Group Life Insurance Vs Individual Life Insurance Policies

Group Life Insurance Vs Individual Life Insurance Policies

Business Life Insurance Find Group Coverage Today Trusted Choice

Business Life Insurance Find Group Coverage Today Trusted Choice

What Is Group Life Insurance Www Policy Com

What Is Group Life Insurance Www Policy Com

Group Life Insurance All You Need To Know Moneyvisual

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.