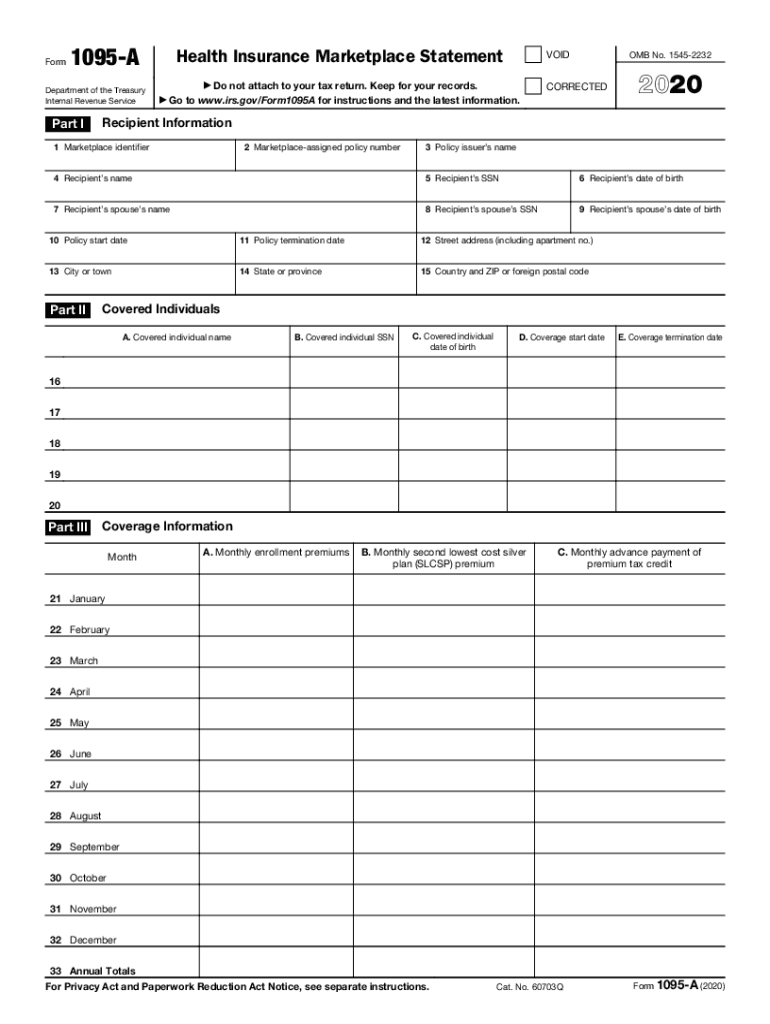

Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. Use your 1095-A to file Form 8962 with your tax return.

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

However Pay Centers are no longer required to provide 1095-B forms unless you request one.

Where to get 1095 a. Under Your Existing Applications select your 2020 application not your 2021 application. Click here if you purchased your plan via healthcaregov. You can also download your 1095-A through your Healthcaregov account.

Youll get forms from anyone who provided you coverage by early February. Pay Centers must provide your 1095-B form. It also is available in your online account.

People generally receive only one version though some may get both a 1095-B and a 1095. Theres only one place where you can get a copy of your 1095 tax form. Store this form with your important tax information.

IF YOU ARE TRYING TO DO THIS FROM YOUR SMART PHONE OR IPAD PLEASE STOP. How to find your 1095-A online Log in to your HealthCaregov account. The downloaded PDF will appear at the bottom of the screen.

Youll get 1095-A forms from every provider who you had a Health Insurance Marketplace plan with. Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser. You can also contact the Marketplace Call Center if you find any errors on your 1095A.

Note you may have received IRS letter 12C where the IRS is looking for Form 1095-A. If you get healthcare from your employer contact your companys benefits department. Look for your form in early February.

Look for Form 1095-A If anyone in your household had Marketplace coverage in 2017 you can expect to get a Form 1095-A Health Insurance Marketplace Statement in the mail by mid-February. Other states that use healthcaregov will find their 1095-A at wwwhealthcaregov. Line-By-Line Instructions for 1095-A Form.

Select Tax Forms from the menu on the left. If there are errors contact. 1095-A comes from the federal government Federal Exchange Marketplace or state-based Exchange Marketplace.

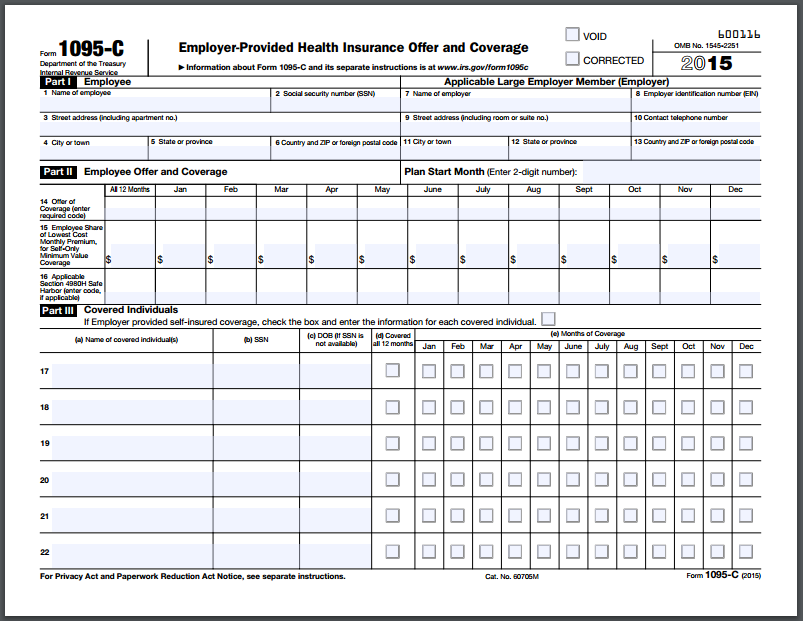

Pay Centers are required to provide 1095-C forms. If you had more than one type of health insurance throughout the year then follow this rule of thumb. It comes from the Marketplace not the IRS.

You may call your Health Insurance Marketplace to avail a. If you dont have your 1095A form you can view it online. Under Your Existing Applications select your 2019 application not your 2020 application.

You can get all your MA Form 1095-As going back all years. This page was compiled over the years in a response to peoples questions with 1095-A forms. The Pay Centers will provide the forms to the Service member Retiree or Annuitant between January 1 and March 2 2020.

Your 1095-A should be available in your HealthCaregov account. 1095-C forms are generated by the Service Pay Centers. 1095-B comes from your insurance company.

The information below remains important. If anyone in your household had Marketplace health coverage in 2020 you should have already received Form 1095-A Health Insurance Marketplace Statement. The information on Form 1095-A is used to determine the amount of taxes you will owe or the refund you receive based on the tax credit you may have taken in advance to lower the cost of your health insurance plan.

Internet Explorer users. If you receive health coverage for yourself or your family through the Health Insurance Marketplace you will receive a Form 1095-A from your insurer after the year ends. Download all 1095-As shown on the screen.

You should see this form in the mail by mid-February. The Form 1095-A only reports medical coverage not catastrophic coverage or. If you didnt get the form online or by mail contact the Marketplace Call Center How to use Form 1095-A.

Download all 1095-As shown on the screen. Log into your healthcare account and follow these steps. The form 1095-A is used to report health insurance purchased through Healthcargov or your states Health Insurance agency The form 1095-A is mailed to taxpayers on January 31 of the year.

Youll receive a 1095-A Health Insurance Marketplace Statement. If your form is accurate youll use it to reconcile your premium tax credit. Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an.

This form will be mailed by Jan. When the pop-up appears select Open With and then OK. 1095-C comes from your employer.

Contact them directly ONLY your insurer will have access to it and can provide you with a copy. Click Save at the bottom and then Open. Select Tax Forms from the menu on the left.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png)