The new California subsidy was implemented in 2020. Federal 1095A subsidy statement is reported to form 8962 Premium Tax Credit and then moves on to the 1040 income tax return.

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

The web address for the Covered California Account Login is.

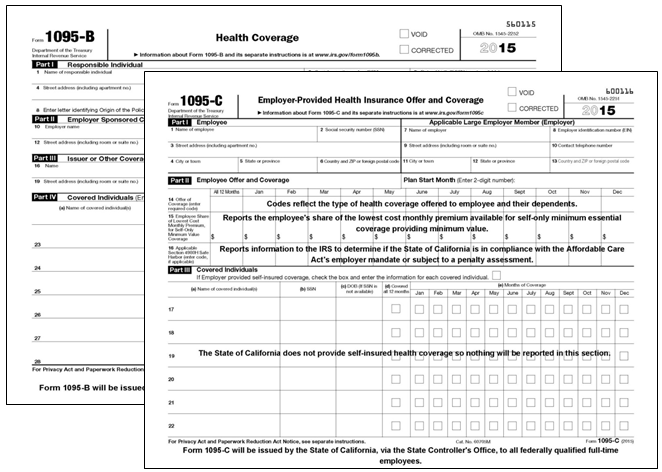

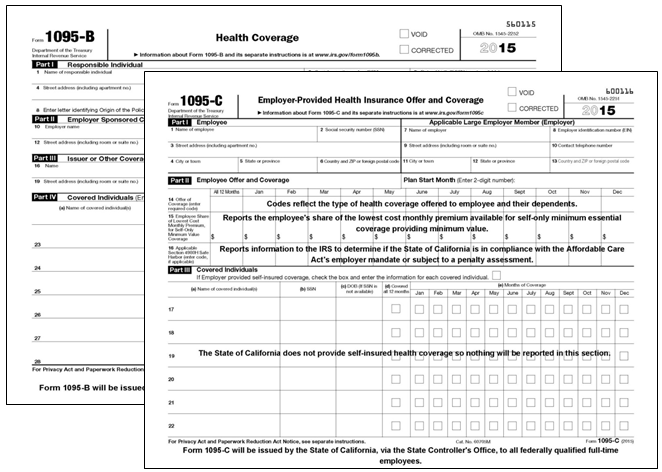

How to get covered california 1095 a. Form 1095-C Individuals who enroll in health insurance through their employers will receive this form. The 1095A is a tax document that lets the IRS know how much Covered Ca tax subsidy you were eligible for and how much tax subsidy you received. Without it you can not properly complete IRS Form 8962 which is now required of all tax filers.

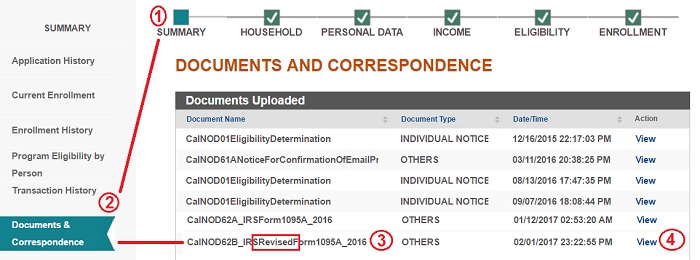

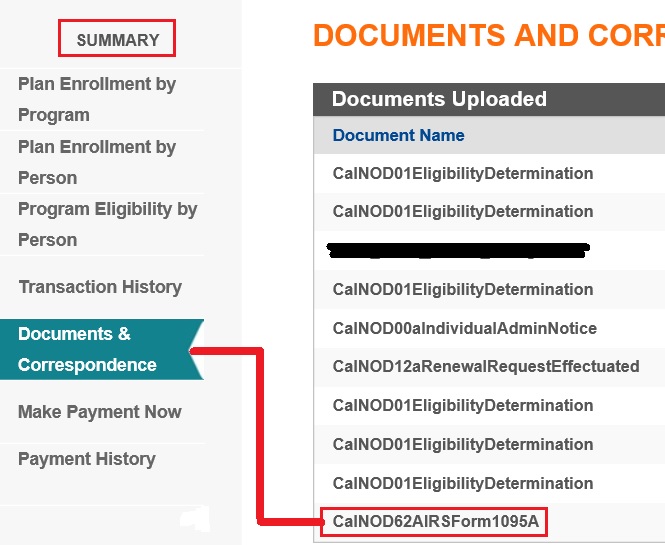

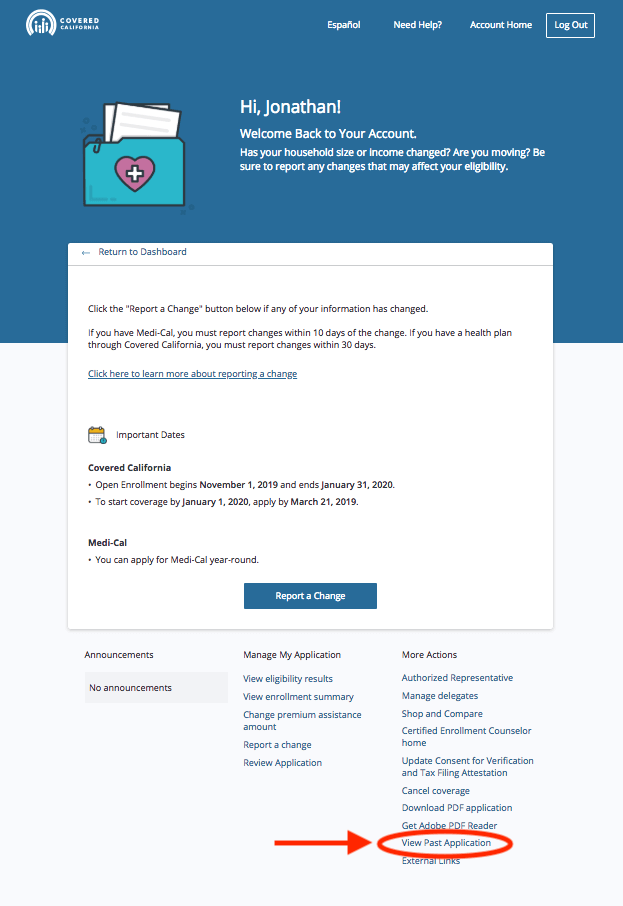

You will have to login to your Covered California online account. You will find the 1095-A form in your Documents and Correspondence folder. Look for the list of links in the bottom-center of the page.

Its the only place where you can get financial help when you buy health insurance from well-known companies. Per the Internal Revenue Code Section 6055 the California Department of Health Care Services DHCS began issuing Internal Revenue Service IRS Form 1095-B to all Medi-Cal beneficiaries annually starting in January 2016. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download the 1095-A document as PDF.

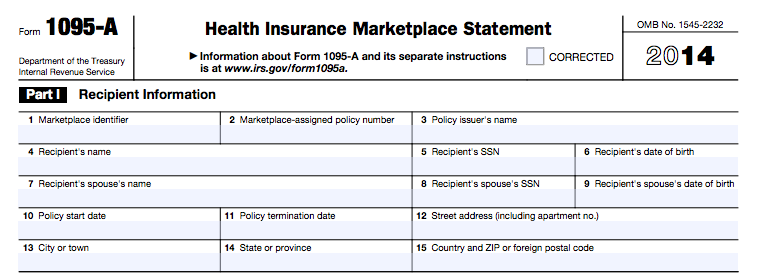

After logging in youll be on the Consumer Home Screen. Form 1095-A Individuals who enroll in health insurance through Covered California or the Federal Marketplace will get this form. You will need your Form 1095-A when you prepare your federal income tax return.

Your Form 1095-A shows the amount the Internal Revenue Service IRS paid to your insurance company to lower the cost of your health coverage. Set up a secure user name and password. You were enrolled in employer health coverage through Covered California for Small Business CCSB.

Login to your Covered California online account. Care Covered subsidized or unsubsidized plan. You were enrolled in the Medi-Cal program.

Use the California Franchise Tax Board forms finder to view this form. They also send a copy to the IRS. Covered CA members will receive their 1095-A Forms either by postal mail or by a secure message on their Covered CA online account depending on how they indicated on their application how they would like to be contacted by Covered CA.

Visit Covered California to create an account clicking the link at the bottom of the grey box. The California Form FTB 3895 California Health Insurance Marketplace Statement. You can also find more information by visiting the Internal Revenue Service IRS website.

The 1095-A form will be mailed by Covered California to individuals enrolled in an LA. Keep in mind that sometimes an IRS Form 1095-A or Form FTB 3895 might look incorrect. Covered CA sends out IRS 1095-A Forms by January 31 st each year.

Follow the simple 3 steps above and you can receive your 1095 today. California FTB 3895 subsidy statement flows into form 3849 and then on to the CA 540 tax return. Our Service Center staff will investigate your case within 60 days of receiving your dispute and send corrected tax forms if necessary.

Covered California will send IRS Form 1095-A Health Insurance Marketplace Statement to all enrolled members. How do I get my 1095 A from Kaiser. These forms are used when you file your federal and state tax returns to.

Some reasons why you may not receive an IRS Form 1095-A or Form FTB 3895. Form 1095-B does not require completion or submission to DHCS. You were enrolled in a minimum coverage plan also known as catastrophic plan.

During tax season Covered California sends two forms to members. If you dont have a login and password call 800-300-1506. You dont need to do anything.

How do I get my 1095-A Form. If you notice a mistake on your tax forms please complete the Request to Correct or Dispute Tax Forms. How do I get a 1095.

Find the link called View Past Application in the bottom right-hand column and click on it. To get there click on the Summary checkbox on the home screen and next click the Documents and Correspondence link select and download CalNOD62A_IRSForm1095A_2016. The federal IRS Form 1095-A Health Insurance Marketplace Statement.

Errors on your forms. How to find your 1095-A on Covered California Step 1. Complete the rest of the page.

Click on Eligibility Results. Covered California will mail the IRS Form 1095-A to all consumers who got insurance through Covered California in 2014. If you have any questions regarding your Form 1095-A please contact Covered California at 800 300-1506.

It is used to fill out IRS Form 8962 Premium Tax Credit as part of your federal tax return. You may find the form in your Secure Mailbox iffy or more reliably on your Documents and Correspondence page. Form 1095-B Individuals who enroll in health insurance through Medi-Cal Medicare and other insurance companies or coverage providers will receive this form.

The amount paid was based on the most recent household size and income information you provided to Covered California. On the User Information Page select Yes you have an existing case to link to this new account and enter access code. Click Case Summary in the upper left.

Covered California is a free service from the state of California that connects Californians with brand-name health insurance under the Patient Protection and Affordable Care Act. The Form 1095-A has the information you or your tax preparer will need to file your tax returns.

Covered California Issues Revised 1095 As Without Being Asked

Covered California Issues Revised 1095 As Without Being Asked

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

Covered California Form 1095 A Fill Out And Sign Printable Pdf Template Signnow

Irs Form 1095 A Health For California Insurance Center

Irs Form 1095 A Health For California Insurance Center

1095 A Tax Credits Subsidies For Form 8962 Attaches To 1040 Covered Ca

Where Is The Covered California 1095 A

Where Is The Covered California 1095 A

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Covered California Sends 1095 A Reminder Notices Health For California Insurance Center

Fillable Online Irs Form 1095 A Talking Points Covered California Fax Email Print Pdffiller

Fillable Online Irs Form 1095 A Talking Points Covered California Fax Email Print Pdffiller

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Where Is The Money Going Covered California Sends Wrong Tax Info To 100 000 Customers Ca News

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca And Your Taxes What Is Form 1095 A Clark Irish Insurance

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

Covered Ca Subsidy Over 65 If Not Eligible For Medicare

How To Find Your 1095 A On Covered California Rockridge Health Benefits

How To Find Your 1095 A On Covered California Rockridge Health Benefits

Annual Health Care Coverage Statements

Annual Health Care Coverage Statements

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

Didn T Get A 1095 A Or Ecn You Can File Taxes Without Them

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.