Im also not sure why its a moot point - According to my calculations if the non-network deductible applied I would be able to make an additional 1450 contribution for 06. PPO plans include out-of-network benefits.

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

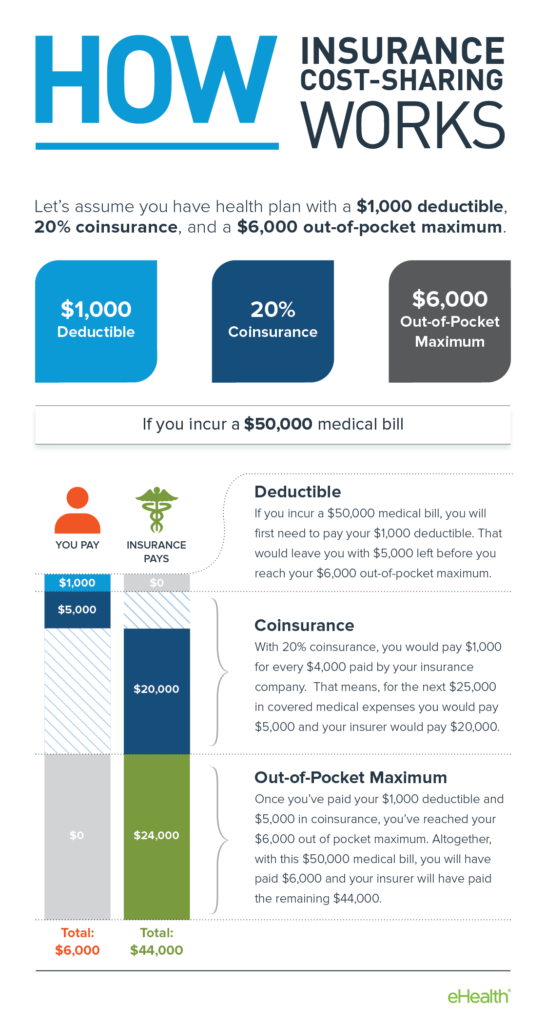

If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500.

In network deductible. In-Network Out-of-Network In-Network Out-of-Network In-Network Out-of-Network Deductible Individual 2000 4000 850 3000 400 1550 Family 40001 8000 2550 9000 1200 4650 Out-of-Pocket Maximum Individual 4000 includes deductible 12000 includes deductible 2850 includes deductible 9000 includes deductible 2400 includes deductible. 39 While net debt obligations are typically deductible when the equity value purchase price derived from the enterprise value is determined the working capital. HMO plans dont include out-of-network benefits.

If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. Additionally out-of-network service costs may not count toward your annual deductible. A deductible is the amount you pay for most eligible medical services or medications before your health plan begins to share in the cost of covered services.

DTTL also referred to as Deloitte Global does not provide services to clients. Depending on how your plan works what you pay in copays may count toward meeting your deductible. DTTL and each of its member firms are legally separate and independent entities.

Insured individuals usually pay less when using an in-network provider because those networks provide services at lower cost to the insurance companies with which they have contracts. In network refers to providers or health care facilities that are part of a health plans network of providers with which it has negotiated a discount. That means if you go to a provider for non-emergency care who doesnt take your plan you pay all costs.

But you usually pay more of the cost. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited a UK private company limited by guarantee DTTL its network of member firms and their related entities. The lesser of 4000 or 5450 4000.

Annual In-Network Deductible for Individual Coverage. In-network and out-of-network deductibles. After that you share the cost with your plan by paying coinsurance.

The providers contract with the insurer requires the insurer to accept the. These are separate deductibles for health services you receive from providers inside or outside of your insurance companys network. So youll pay more out of pocket to use an out-of-network provider.

Many translated example sentences containing in Network deductible Spanish-English dictionary and search engine for Spanish translations. A deductible is the amount you pay for health care services before your health insurance begins to pay. For example your plan may pay 80 percent and you pay 20 percent if you go to an in-network doctor.

When out-of-network the usual coinsurance rates that apply in-network may not apply out-of-network. In this case money paid for out-of-network care gets credited toward the out-of-network deductible but doesnt count toward the in-network deductible unless its an emergency situation. Out-of-network providers cost more to use which means deductibles are higher than any in-network deductible.

The lesser of 8000 or 5450 5450. They help pay for care you get from providers who dont take your plan. When out-of-network any remaining cost above this amount 100 in this case may have to be fully covered by the person receiving care.

You may have two separate health insurance deductibles one for in-network care and another larger one for out-of-network care.