Typically with HDHPs employees must meet their deductible before the carrier will pay for any services other than preventative care. A copay is a fixed amount you pay for a health care service usually when you receive the service.

What Is Coinsurance Ramseysolutions Com

What Is Coinsurance Ramseysolutions Com

Its not based on a percentage of the charge so it might be higher or lower than what a coinsurance would be usually lower.

What does copay after deductible mean. After you pay your annual deductible your insurance starts paying its portion of the cost of covered care you receive for the rest of the year. After deductible might mean you only do the copay after its met. Copays and deductibles are both features of most insurance plans.

You pay 20 of 100 or 20. If you end up getting admitted to the hospital the insurance company waives the ER copay. When your insurance plan specifies there is no charge after your deductible this means the insurance company will pay the remainder of costs after you pay the entire deductible amount.

I get Copay after deductible -- you must pay for the service fully out of pocket until your deductible is met after which you must only pay the copay amount and the insurance pays for the rest. I would expect the former to cost more if its copay ONLY less of its in addition to. From copays to out-of-pocket maximums no two plans are the same.

A deductible is an amount that must be paid for covered healthcare services before insurance begins paying. Your copayment for a doctor visit is 20. Deductibles coinsurance and copays are all examples of cost sharing.

100 views Answer requested by. Coinsurance is an additional cost that some health care plans require policy holders to pay after the deductible is met. Copayment A fixed amount 20 for example you pay for a covered health care service after youve paid your deductible.

Lets say your health insurance plans allowed amount for an office visit is 100 and your coinsurance is 20. 100 coinsurance essentially means the same thing. The phrase 40 Coinsurance after deductible means that you may be responsible for 40 of the approved part of the bill plus the delta between what they bill and what they cover.

Coinsurance What is coinsurance. Updated December 05 2016 -- For Administrators and Employees. It means you are going to pay 25 for whatever procedure is done then you are going to pay 100 of the cost until your total medical expenditures reach your annual deductible.

Joes health plan has a combined deductible of 3000. Copay with deductible might mean you pay the copay before and after you meet the deductible. Insurance companies often set limits to how much they will pay however.

After your total medical expenditures reach the deductible amount you are going to pay 20 of the cost above that deductible amount. Coinsurance is often 10 30 or 20 percent. You may still have to pay some form of cost-sharing even after a deductible is met.

Depending on the service the health care provider and your insurance your portion of the cost of care covered by the plan after youve met your deductible may be a copayment or coinsurance amount. The insurance company pays the rest. This means that if you have an HDHP with a 3000.

Your plan determines what your copay is for different types of services and when you have one. Coinsurance is a portion of the medical cost you pay after your deductible has been met. In this article we will focus on charges after the deductible.

If your plan includes copays you pay the copay flat fee at the time of service at the pharmacy or doctors office for example. Copays for High Deductible Health Plans HDHPs work a little different from other types of plans. This doesnt mean your prescriptions will be free though.

A copay after deductible is a flat fee you pay for medical service as part of a cost-sharing relationship in which you and your health insurance provider must pay for your medical expenses. You may have a copay before youve finished paying toward your deductible. Lets say your health insurance plans allowable cost for a doctors office visit is 100.

Pertaining to health insurance what does Copay with deductible mean in contrast to Copay after deductible. A copay is a fixed amount that you pay regardless of the allowed charge for a service. Coinsurance is the portion of your medical bill that you are responsible to pay before or after a deductible is met.

If youve paid your deductible. Usually once this single deductible is met your prescriptions will be covered at your plans designated amount. Improve this question.

Coinsurance is a way. The percentage of costs of a covered health care service you pay 20 for example after youve paid your deductible. Depending on how your plan works what you pay in copays may count toward meeting your deductible.

The amount can vary by the type of service. The portion you pay is based on a percentage and not a dollar amount or fixed price. When you pay coinsurance you split a certain cost with the insurance company at a ratio determined by the terms of your insurance plan.

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

Copay With Deductible Vs Copay After Deductible Medical Sciences Stack Exchange

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

Understanding Cost Sharing Deductibles Coinsurance And Copays Healthtn Com

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

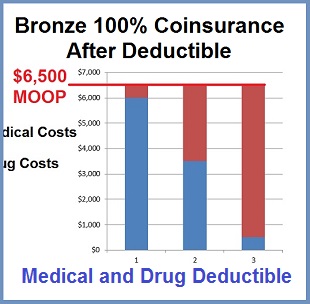

Bronze 60 100 Coinsurance After The Deductible Confusion

Bronze 60 100 Coinsurance After The Deductible Confusion

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

Copay Vs Deductible How Does Insurance Work Aeroflow Healthcare

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Am I Buying 5 Health Plan Terms To Know Premera Blue Cross

What Is An Out Of Pocket Maximum Bluecrossmn

What Is An Out Of Pocket Maximum Bluecrossmn

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Definitions And Meanings Of Health Care And Health Insurance Terms

Small Business How Does Coinsurance Work Ehealth

Small Business How Does Coinsurance Work Ehealth

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.