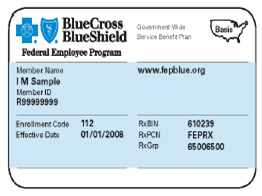

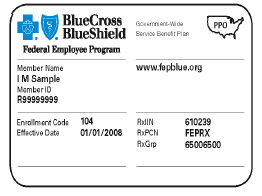

This program should not be confused with HMSAs Federal Employees Health Benefits FEHB program coverage code 87. The FEP membership cards are identified by coverage codes 104 105 and 106 for the Standard Option and 111 112 and 113 for the Basic.

Federal Employee Program Fep Member Id Cards Get Makeover

Federal Employee Program Fep Member Id Cards Get Makeover

4 You must be the contract holder or spouse 18 or older on an FEP Blue Focus plan to earn this reward.

Bcbs fep basic plan. Standard Option Coverage for. 2021 Blue Cross and Blue Shield Service Benefit Plan Brochure - Standard and Basic Options. Self Only Self Plus One or Self and Family Plan Type.

Skilled nursing facility admission. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan. The out-of-pocket maximum is 5500 for Self Only contracts and 11000 for Self Plus One and Self and Family contracts.

15 rows 1 Under Basic Option you pay 30 of our allowance for agents drugs andor supplies you receive. New choices include the FEP Blue Focus plan that costs less than other FEP plans. Standard Option Basic Option and FEP Blue Focus.

You will be going to a new website operated on behalf of the Blue Cross and Blue Shield Service Benefit Plan by a third party. Blue Cross and Blue Shield Service Benefit Plan Brochures. This Plan is underwritten by participating Blue Cross and Blue Shield Plans Local Plans that.

Radiology MRI CT scans PET scans. 100 per day for ground ambulance. This is a summary of the features of the Blue Cross and Blue Shield Service Benefit Plan.

Blue Cross and Blue Shield Service Benefit Plan - FEP Blue Standard and FEP Blue Basic Options. The Federal Employee Program FEP is a nationwide Federal Employees Health Benefits program administered through local Blue Cross and Blue Shield Association plans. 150 per day for air or sea ambulance.

Dental and vision plan premiums lowered for 2019. These medical services may require prior approval. Below are links to the interactive versions of the brochures.

Washington Today the Blue Cross and Blue Shield BCBS Government-wide Service Benefit Plan also known as the Federal. Blue Cross and Blue Shield Service Benefit Plan - FEP Blue Standard and FEP Blue Basic Options. Before making a final decision please read the Plans Federal brochures Standard Option and Basic Option.

Thanks for being a member. PPO 1 of 7 The Summary of Benefits and Coverage SBC document will help you choose a health plan. Were proud to continue being your partner in health.

The protection of your privacy will be governed by the privacy policy of that site. The Disputed Claims Process. Standard and Basic Options Click on a link below to view the corresponding brochure content.

Blue Cross and Blue Shield Federal Employee Program FEP Keeps Medical Premiums Stable While Expanding Plan Offerings for 2019. 2021 Blue Cross and Blue Shield Service Benefit Plan Brochure - FEP Blue Focus. Standard Option Basic Option FEP Blue Focus.

This Plan is underwritten by participating Blue Cross and Blue Shield Plans Local Plans that. A trusted provider for 60 years Weve been committed to providing quality healthcare coverage to federal employees retirees and their families since 1960. Under contract CS 1039 with the United States Office of Personnel Management as authorized by the Federal Employees Health Benefits law.

Inpatient residential treatment center admission. Blue Cross and Blue Shield Service Benefit Plan. Coronavirus Update FEP will waive early medication refill limits on 30-day prescription maintenance medications.

The SBC shows you how you and the plan would share the cost for covered health care services. Filing a Claim for Covered Services. Other services including but not limited to.

The Blue Cross and Blue Shield Service Benefit Plan is the number one choice of federal retirees in the Federal Employees Health Benefits Program. Each member of a Basic Option plan who has Medicare Part A and Part B can get reimbursed up to 800 per year for paying their Medicare Part B premiums. 125 copayment for emergency room care.

35 copayment for urgent care. Three plan options to meet your healthcare needs. Blue Cross and Blue Shield Service Benefit Plan Brochure - 2020.

2020 Blue Cross and Blue Shield Service Benefit Plan Brochure - FEP Blue Focus. You pay all charges for care in settings other than the emergency room. Summary of Benefits for the Blue Cross and Blue Shield Service Benefit Plan.

Coordinating Benefits With Medicare and Other Coverage. For both Basic and Standard Option Self Plus One and Self and Family enrollments once an individual on the contract reaches the Self Only out-of-pocket maximum. 125 copayment for emergency room care.

Under our contract CS 1039 with the United States Office of Personnel Management as authorized by the Federal Employees Health Benefits law. All benefits are subject to the definitions limitations and exclusions set forth in the Federal brochures. Before making a final decision please read the Plans Federal brochures Standard Option and Basic Option.

Definitions of Terms We Use in This Brochure. The Blue Cross and Blue Shield Service Benefit Plan has a variety of pharmacy programs to meet your prescription needs. If you do not obtain prior approval there may be a reduction or denial of your benefit.