Most of the US. Flextronics provides a Basic Life and ADD insurance benefit at no cost to you that is equal to 2 times your annual base earnings to a maximum of 3000000 combined Basic Life and Additional Life insurance.

Accidental Death Insurance The 4 Absolute Best Policies

Accidental Death Insurance The 4 Absolute Best Policies

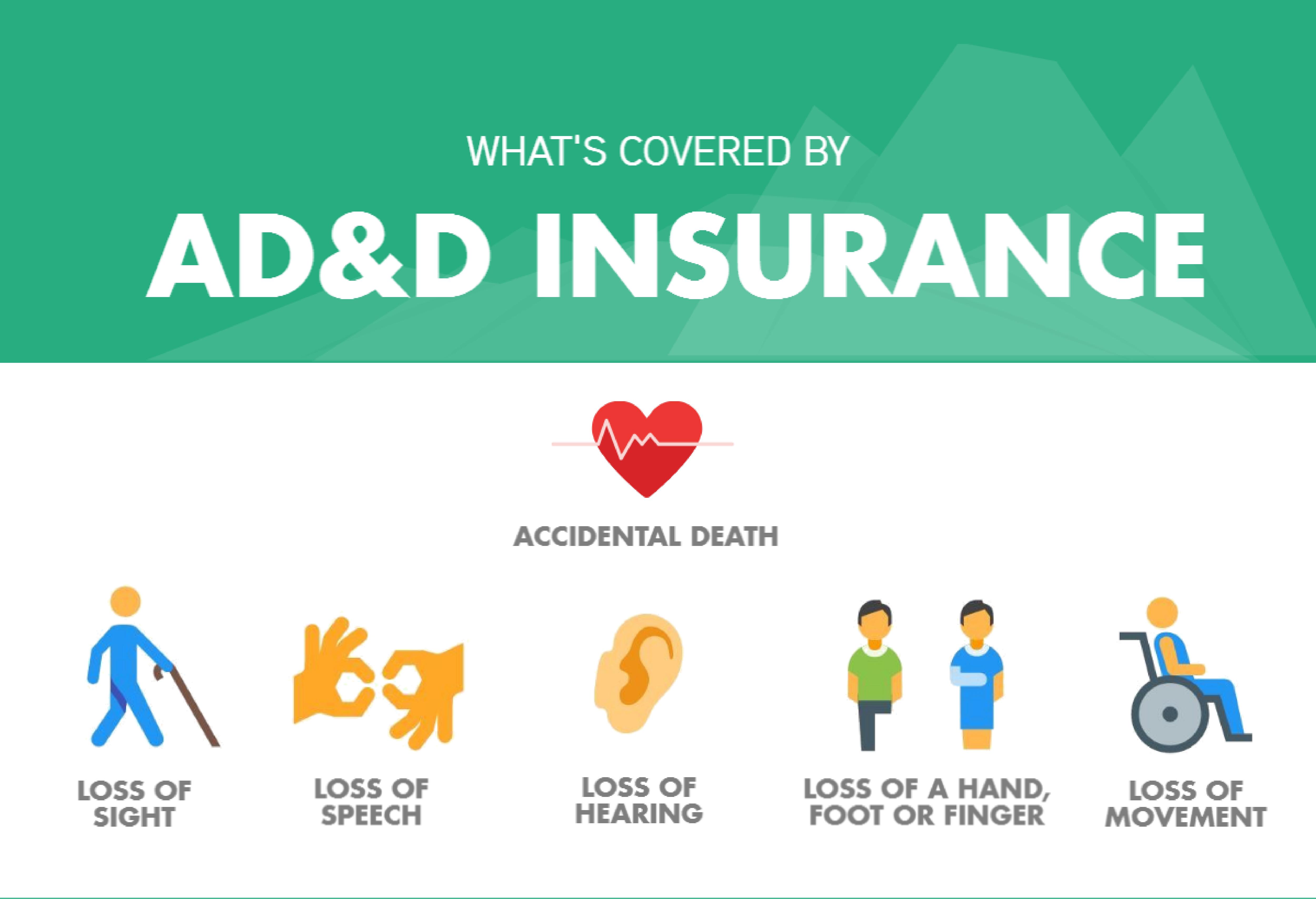

ADD insurance pays you or your beneficiaries a set amount of money if your death or dismemberment is the direct result of an accident.

Basic ad&d insurance. And if your employer offers ADD insurance you might be able to get a basic amount as a free benefit. Insure now and pay later with no additional charges or hidden cost. 15000 G reviews with 495 rating.

ADD is a limited form of insurance that covers you only in accidents. All of the following condi-tions must be met. Insure now and pay later with no additional charges or hidden cost.

You are covered for ADD Insurance on the date of the accident. The following eligibility applies. Download Reports from 10000 trusted sources with ReportLinker.

ADD is Insurance that pays an additional benefit if you are seriously injured or die due to a covered accident. Advertentie Unlimited access to Vehicle Insurance market reports on 180 countries. How much can I purchase.

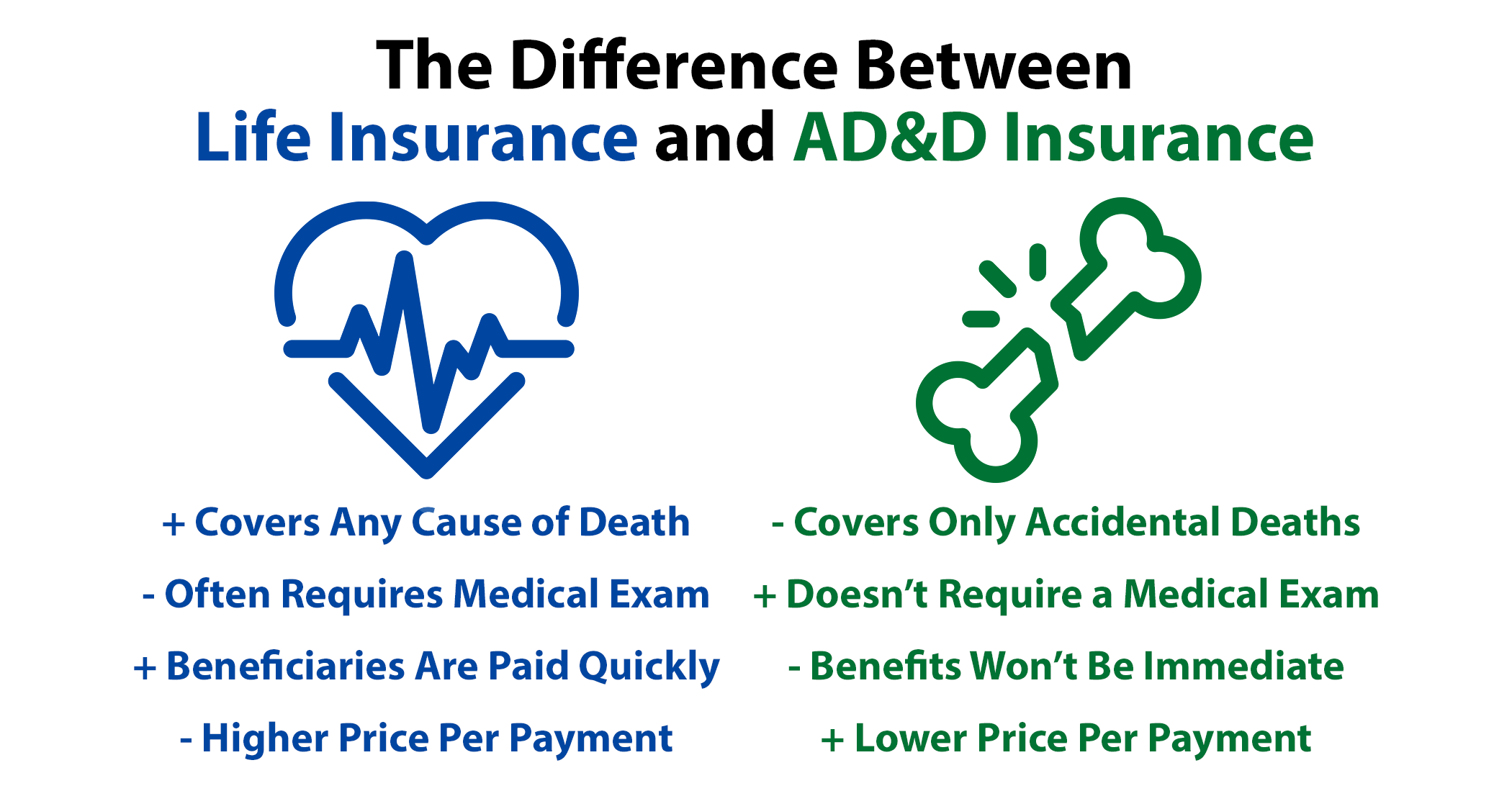

Basic and Supplemental Life Insurance pays a benefit if you die for any reason except those excluded in the certificate of insurance. When adding an ADD rider also known as a double indemnity rider to a life insurance policy the. However there are coverage restrictions that make accidental death and dismemberment insurance far less useful.

Additional Life ADD and Dependents Life insurance for you and your family. Basic life insurance pays a beneficiary if death of the insured person occurs by any reason except suicide in the first two years. What is ADD insurance.

Accidental Death Dismemberment ADD Insurance ReliaStar Life pays this benefit for covered losses due to a covered accident. Basic Life and ADD Insurance for you. The World Bank Group offers basic Accidental Death and Dismemberment Insurance ADD to staff on regular open term and executive director ED appointments at HQ and country offices COs.

It pays the beneficiary if death occurs by accident or it pays the insured person if they lose a limb. Understanding Accidental Death and Dismemberment ADD Insurance Accidental Death. In general ADD insurance premiums are tied to the amount of coverage you purchase.

Basic Life and ADD Insurance are the names often used when offering supplemental insurance to employees. ADD Insurance is meant to protect your family if you are killed in a non-work-related accident or survive an accident but lose a limb or suffer another loss such as your sight or hearing. Download Reports from 10000 trusted sources with ReportLinker.

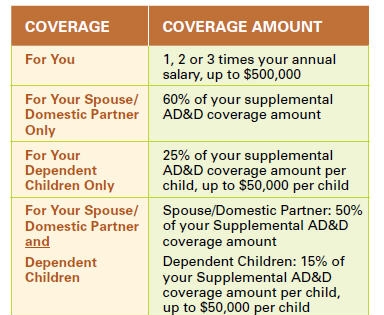

Most ADD policies pay a percentage for the loss of a limb partial or permanent paralysis or. You can purchase Supplemental Life and ADD Insurance each in increments of 5000 up to. Advertentie We help you choose the best insurance for you.

Basic Life refers to life insurance that would pay the death benefit to the beneficiary if death occurred by any reason except suicide in the first two years. Basic ADD Insurance will not pay benefits for death or dismemberment resulting directly or indirectly from. Intentionally self-inflicted injury or any such attempt while sane or insane.

The cause of the loss is not excluded. The loss occurs within 365 days of the date of the accident. What does ADD Insurance Cover.

ADDD stands for Accidental Death and Dismemberment. Basic Accidental Death and Dismemberment ADD Insurance Citi provides Basic ADD insurance through MetLife at no cost to you if your benefits eligible pay is less than 200000. ADD Insurance is designed to pay benefits in addition to other types of insurance coverage.

Advertentie We help you choose the best insurance for you. ADD stands for Accidental Death and Dismemberment insurance. Commission or attempt to commit a felony or an assault.

ADD pays a benefit if you are dismembered or die as a result of an accidental injury. 15000 G reviews with 495 rating. Advertentie Unlimited access to Vehicle Insurance market reports on 180 countries.

Accidental Death And Dismemberment Insurance The Florida Bar Member Benefits Insurance Retirement Programs

Accidental Death And Dismemberment Insurance The Florida Bar Member Benefits Insurance Retirement Programs

What Is Accidental Death And Dismemberment Coverage Quotacy

What Is Accidental Death And Dismemberment Coverage Quotacy

Family Horizons Credit Union Ad D Insurance

What Is Ad D Insurance Youtube

What Is Ad D Insurance Youtube

Is Group Accidental Death Dismemberment Ad D Worth It Glg America

What Is Ad D Group Insurance Online Ca

What To Know About Ad D Insurance Forbes Advisor

What To Know About Ad D Insurance Forbes Advisor

Accidental Death Dismemberment Ad D Insurance

Accidental Death Dismemberment Ad D Insurance

Should You Have Accidental Death And Dismemberment Insurance Haydel Biel Associates

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

Supplemental Life And Ad D Coverage Expanded For 2019 Hub

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

5 Star Life Basic Life And Ad D Voluntary Group Term Life Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.