It will continue indefinitely unless you dont pay the premium. There are some circumstances where guaranteed renewable might not apply to your Medicare Supplement insurance plan.

Do You Have To Renew Your Medicare Supplement Every Year

Do You Have To Renew Your Medicare Supplement Every Year

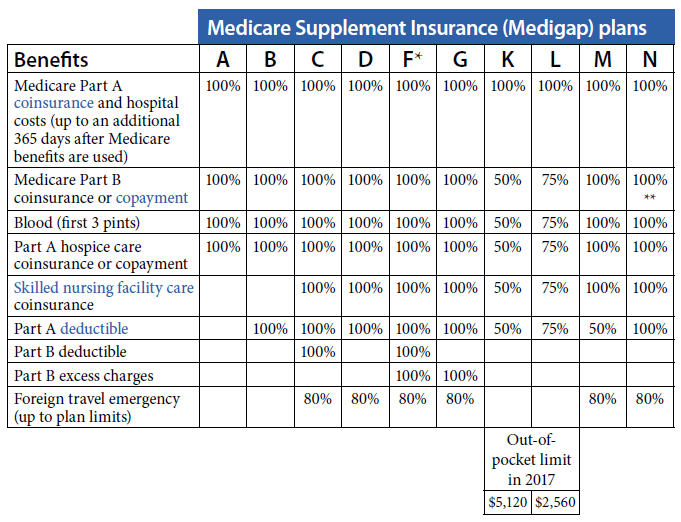

What Are Medicare Supplement Plans.

Do you have to renew your medicare supplement every year. You dont have to reenroll or inform the plan that youre staying. Your plan may not be renewed if you make false claims or commit fraud to your insurance company. Unless you take action to change it during the Annual Enrollment Period your current Medicare coverage will renew for the following year.

Typically benefits service providers pharmacies doctors hospitals medicines and cost-sharing change every year. Luckily Medicare Supplement plans are guaranteed renewable each year. Therefore the plan that works best for you this year wont necessarily be your best deal next year.

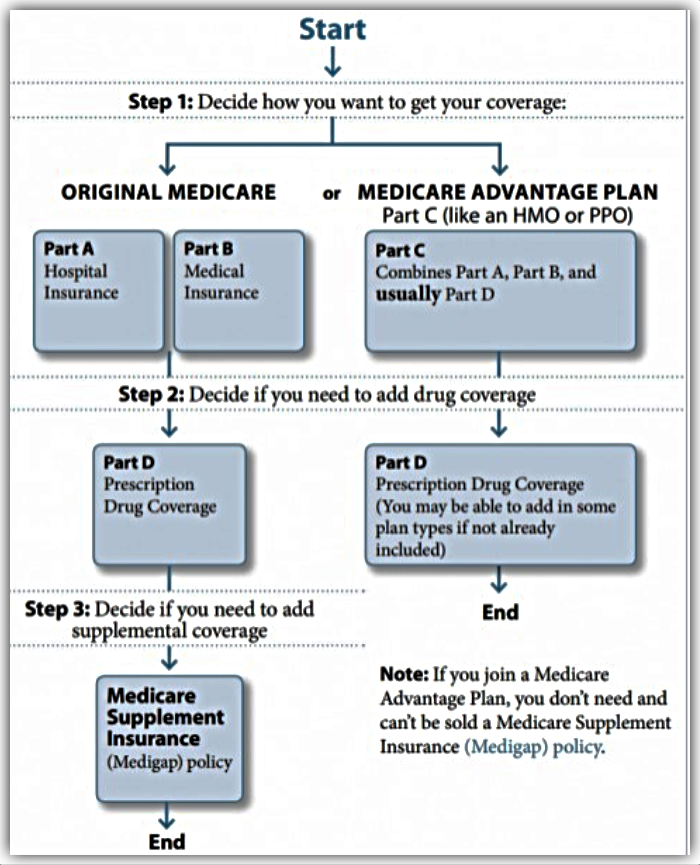

This is true whether you are in Original Medicare a Medicare Advantage plan or a Medicare Prescription Drug Plan. You will be automatically re-enrolled in your Medicare Advantage plan annually unless the company that provides your plan stops offering it. You may want to review your coverage annually with a licensed insurance agent.

Medicare Supplement insurance plans renew automatically when you make your premium payment. But be aware that all Part D plans can change their costs and coverage every calendar year. In most cases you will not have to re-apply for or renew your Medicare coverage each year.

One of the most convenient aspects of Medicare is that plans typically renew automatically. With a few exceptions Medicare coverage automatically renews at the end of each year. Just as you can enroll at any time of the year as long as you have Part B you also can change Medicare Supplement plans at any time.

This is true for Medicare Part A and Part B and Medicare Supplement Insurance policies. However if you are enrolled in a Medicare Advantage plan or stand-alone Part D prescription drug plan there could be a few exceptions when your coverage will. They have the benefit of being guaranteed renewable.

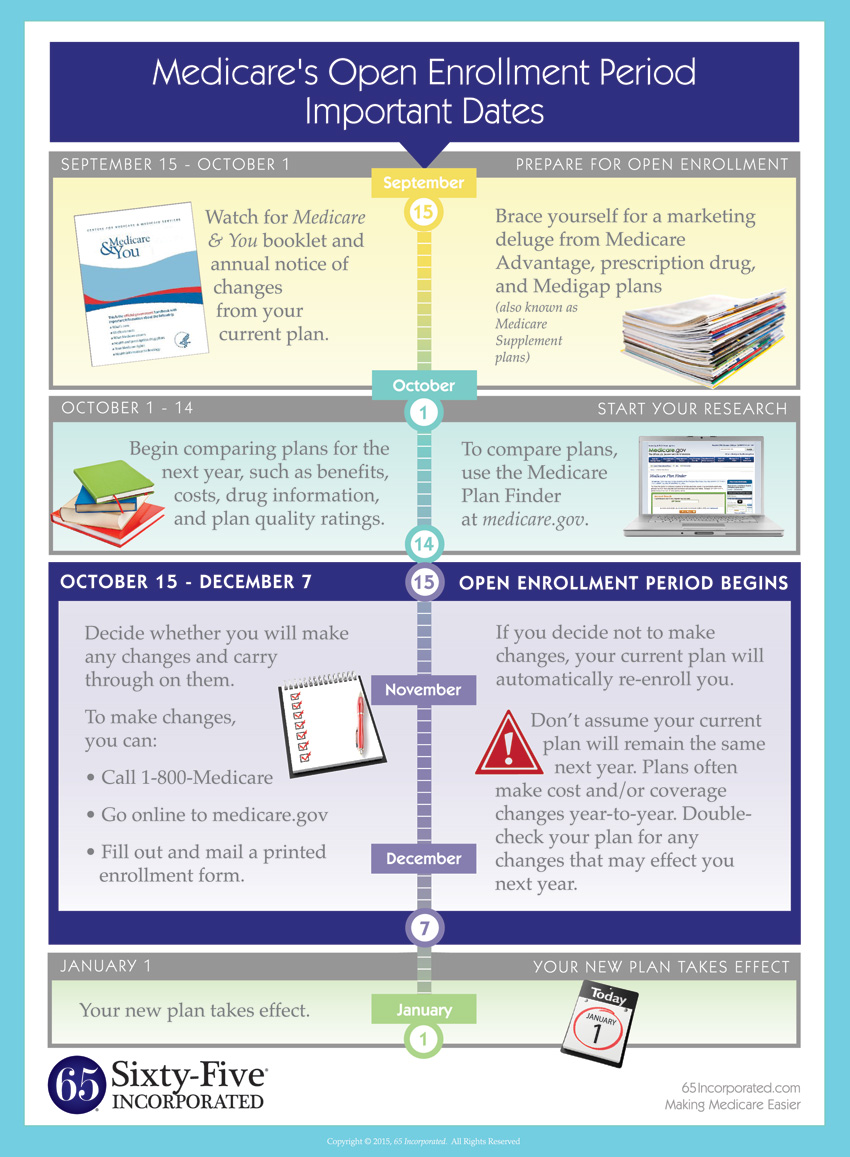

Then youll get a chance to buy a different one during the annual Open Enrollment Period from October 15 to December 7. In most cases you dont have to renew your Medicare coverage but its always a good idea to review your coverage every year to make sure it still fits your needs. If a plan decides it will no longer contract with Medicare your plan will not renew.

In general once youre enrolled in Medicare you dont need to take action to renew your coverage every year. But again if its not during your Medigap Open Enrollment Period or if you dont have a guaranteed issue right you must pass the providers medical underwriting process to qualify in most states. Well go over what exactly this means as well as many other details regarding these plans.

All Medicare Supplement plans are guaranteed renewable for life as long as you are paying your premium either monthly quarterly semi-annually or annually. In most cases you dont need to renew your Medicare Coverage Plan but its better to review the plan every year. So its in your own interests to carefully consider your options.

Automatic renewal helps ensure that you will have continuing coverage. If you are enrolled in Medicare you might not need to do anything for a renewal of your Medicare coverage. Those plans however will likely change in some way from year to year.

But what you need to know is that for Medicare Supplements there is no annual enrollment required. There are key dates. This is true whether you are in Original Medicare a Medicare Advantage plan or a Medicare prescription drug plan.

Medicare Advantage and Part D plans will renew if the same plan exists the following year. As long as you continue to pay any necessary premiums your Medicare coverage should automatically renew every year with a. You do not have to do anything annually to renew them and there is no annual open enrollment period for Medicare Supplement plans.

Your renewal date for your Medicare Supplement could be any time of the year. Lets say you turned 65 in April so your Medicare Supplement became effective that. Whether youre new to Medicare Supplement plans or just want to know the details going into a new year of coverage well go over everything.

In many cases your Medicare coverage will automatically renew each year. There may be some situations however in which your Medicare coverage will not renew.