Click Save at the bottom and then Open. It comes from the Marketplace and shows both you and the IRS what you paid out-of-pocket for your insurance premiums.

/ScreenShot2021-02-11at12.24.19PM-2c611375f2b44f57b6181bc158b48119.png) About Form 1095 A Health Insurance Marketplace Statement Definition

About Form 1095 A Health Insurance Marketplace Statement Definition

For instructions and the latest information.

2019 1095 a. Keep for your records. You can download Form 8962 directly from the IRS website at IRSgov. If you are expecting to receive a Form 1095-A you should wait to file your income tax return until you receive that form.

Name of employee f. All forms are printable and downloadable. If a 1095-A the kind the marketplace sends was never sent out to.

However it is not necessary to wait for Forms 1095-B or 1095-C in order to file. Internet Explorer users. Just about anyone who enrolled in a health insurance plan through the government Marketplace will need to have a copy of the form before they file their taxes.

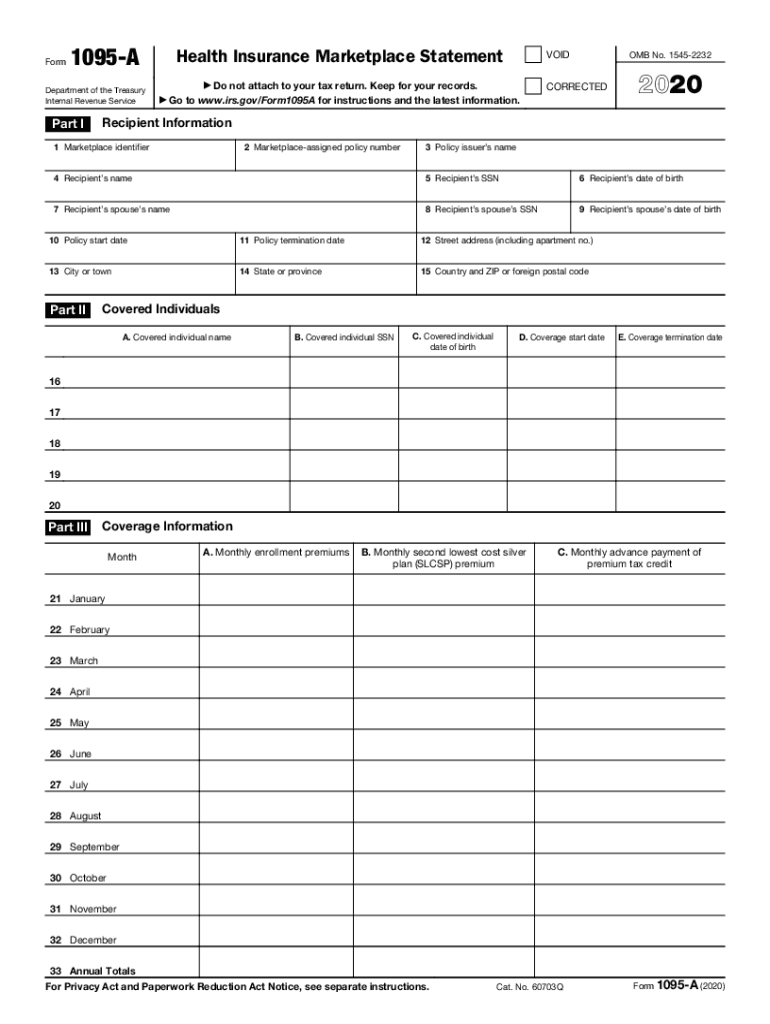

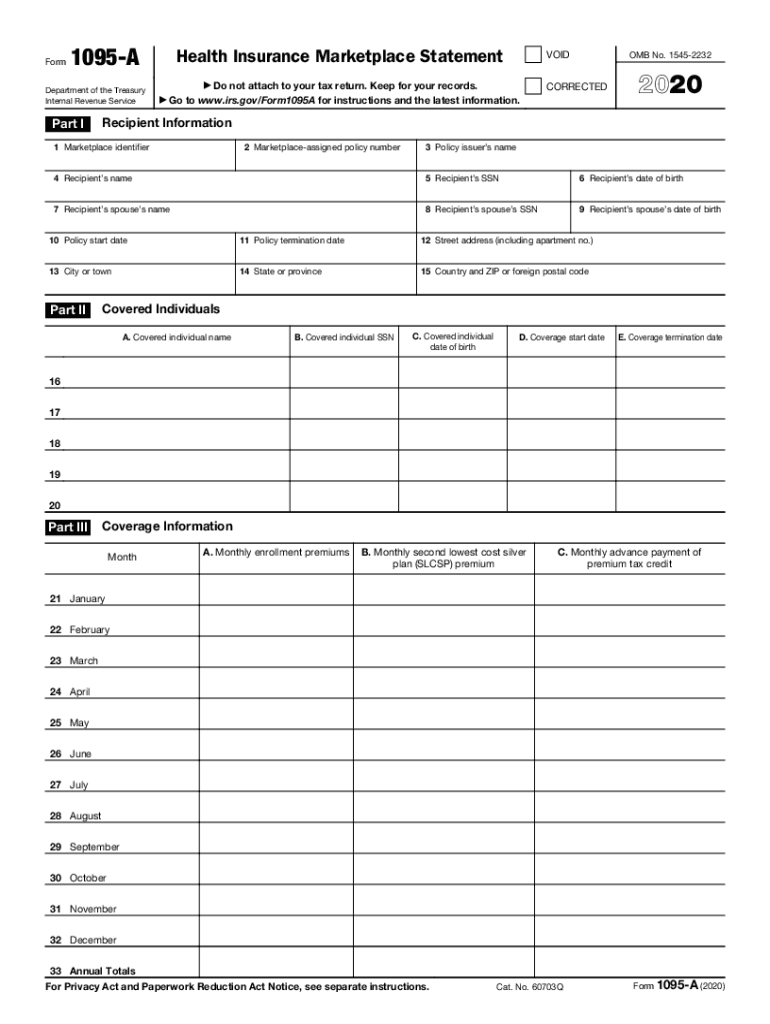

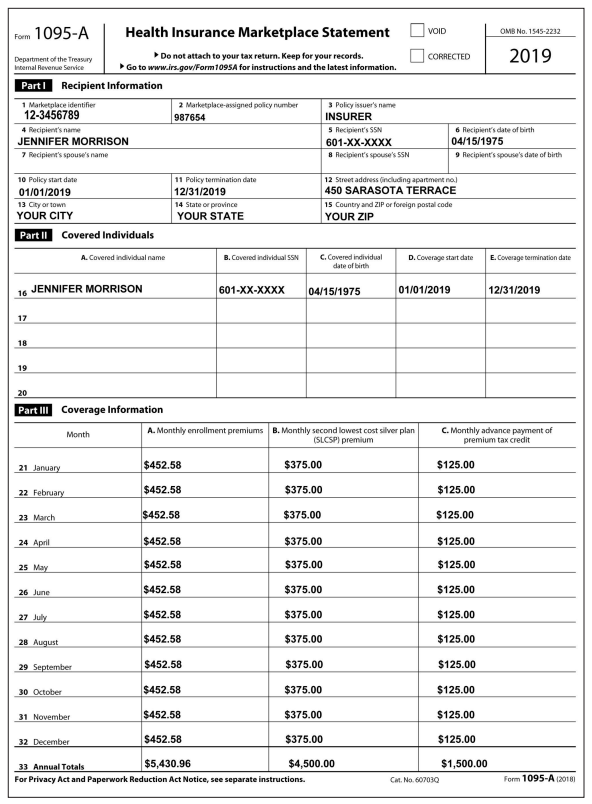

Look for Form 1095-A. You received this Form 1095-A because you or a family member enrolled in health insurance coverage through the Health Insurance Marketplace. Form 1095-A is a prepopulated tax form like a W-2 that the Federally-facilitated Marketplace FFM sends to consumers.

Under Your Existing Applications select your 2020 application not your 2021 application. Form 1095-A also is furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit. Under Your Existing Applications select your 2019 application not your 2020 application.

Part I Employee. Instructions for Form 1095-A Health Insurance Marketplace Statement 2018 Form 1095-A. Form 1095a for 2019 return You are not required to enter either the 1095-B or 1095-C into TurboTax - you just put them in your tax files.

Department of the Treasury Internal Revenue Service. Select Tax Forms from the menu on the left. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace.

This form is for income earned in tax year 2020 with tax returns due in April 2021. It comes from the Marketplace not the IRS. If you or anyone in your household had a 2019 Marketplace plan youll get Form 1095-A Health Insurance Marketplace Statement in the mail by early February.

Check Form 1095-A for accuracy. How to find your 1095-A online Log in to your HealthCaregov account. We will update this page with a new version of the form for 2022 as soon as it is made available by the Federal government.

Health Insurance Marketplace Statement 2017 Inst 1095-A. Form 1095-A is used to report certain information to the IRS about individuals who enroll in a qualified health plan through the Health Insurance Marketplace. Under Your Forms 1095-A for Tax Filing click Down-load PDF and follow these steps based on your browser.

Form 1095-A is the Health Insurance Marketplace statement. Instructions for Form 1095-A Health Insurance Marketplace Statement. Do not attach to your tax return.

When the pop-up appears select Open With and then OK. Your Form 1095-A to show that you or someone in your household had health insurance in 2019. If this error occurred in the Review then you must have unintentionally checked something that made TurboTax think that you had insurance from the Marketplace under the auspices of the Affordable Care Act.

Form 1095-A is used to report certain information to the IRS about individuals who enroll in a. This Form 1095-A provides information you need to complete Form 8962 Premium Tax Credit PTC. Information about Form 1095-A Health Insurance Marketplace Statement including recent updates related forms and instructions on how to file.

Form 1095-A is also furnished to individuals to allow them to take the premium tax credit to reconcile the credit on their returns with advance payments of the premium tax credit advance credit payments and to file an. How to find your 1095-A online. More about the Federal Form 1095-A.

Download all 1095-As shown on the screen. It may also be available online in your HealthCaregov account. Form 1095-A will not be generated for Marketplace consumers who were enrolled in catastrophic plans.

If you want to see if you qualify for a premium tax credit youll need the information on your Form 1095-A to complete the IRS Premium Tax Credit Form 8962. We last updated Federal Form 1095-A in January 2021 from the Federal Internal Revenue Service. Log into your HealthCaregov account.

You must file a federal tax return for 2019 even if you usually dont file or your income is below the level requiring you to. You should get your 1095-A form by mail no later than mid-February. Employer-Provided Health Insurance Offer and Coverage.

Do I need my 1095 to file taxes 2019. It may be available in your HealthCaregov account as soon as mid-January Once you have it follow the steps below. A copy is sent to you and the IRS.

Select Tax Forms from the menu on the left. Irst name middle initial last. Once completed you can sign your fillable form or send for signing.

Fill Online Printable Fillable Blank Form 1095-A Health Insurance Marketplace Statement 2019 Form Use Fill to complete blank online IRS pdf forms for free. The downloaded PDF will appear at the bottom of the screen. Health Insurance Marketplace Statement 2018 Inst 1095-A.

Https Info Nystateofhealth Ny Gov Sites Default Files Tax 20credits 2c 20form 201095a 2c 201095b 20webinar 20slides 0 Pdf

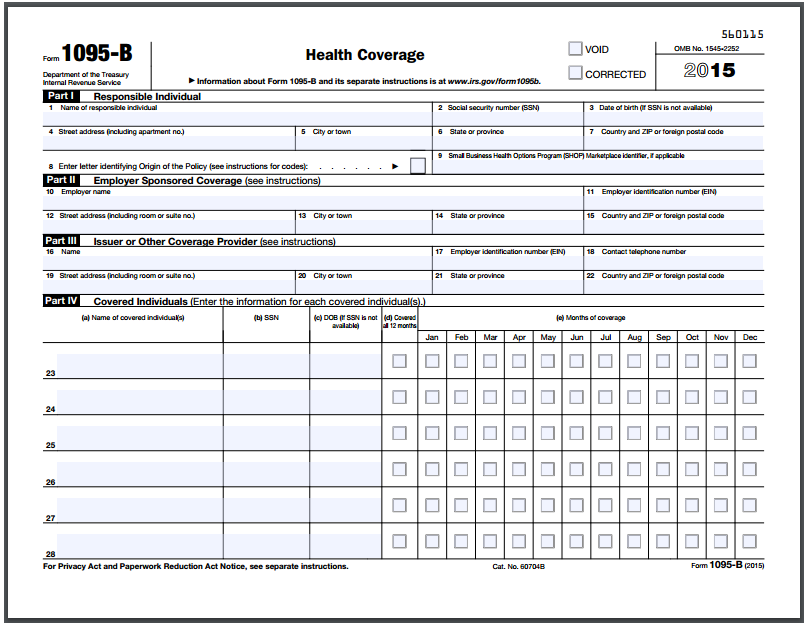

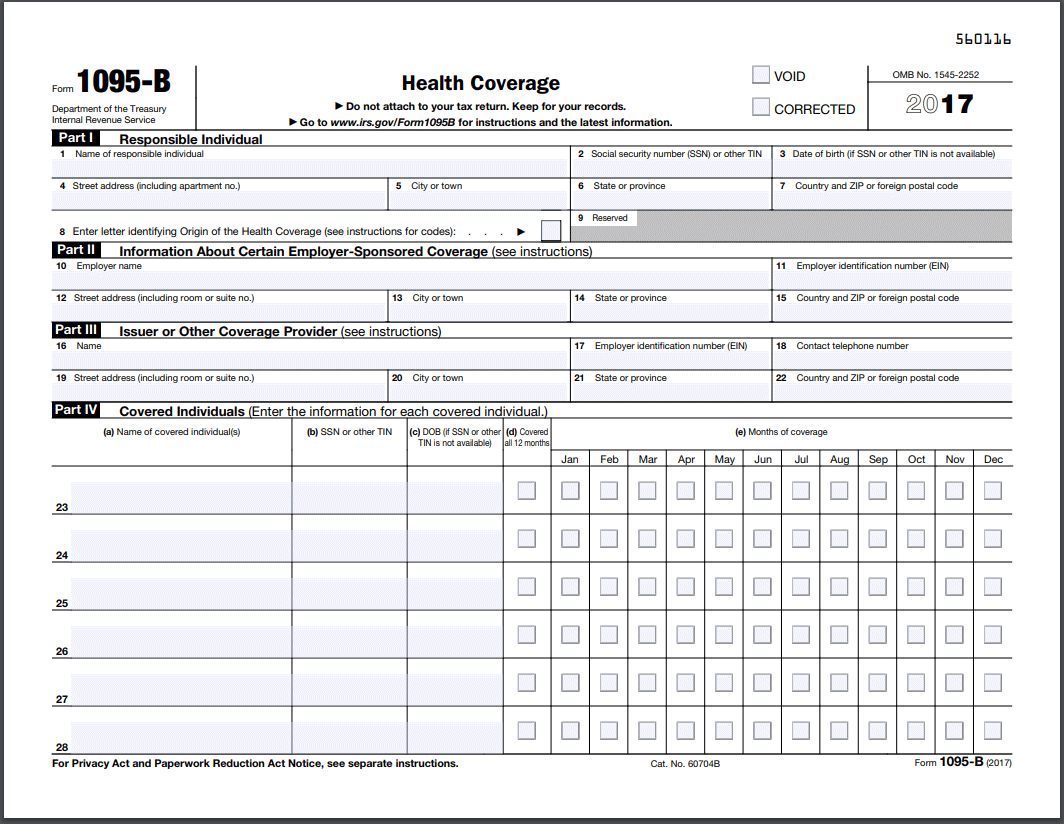

Form 1095 A 1095 B 1095 C And Instructions

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement 2020 Templateroller

Irs Form 1095 A Download Printable Pdf Or Fill Online Health Insurance Marketplace Statement 2020 Templateroller

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

2020 Form Irs 1095 A Fill Online Printable Fillable Blank Pdffiller

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

14 How Do Jennifer S Educator Expenses Affect Her Chegg Com

Breakdown Form 1095 A Liberty Tax Service

Breakdown Form 1095 A Liberty Tax Service

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

2020 Taxes What To Do With Form 1095 A Health Insurance Marketplace Statement Healthcare Gov

Obamacare Tax Forms In The Time Of Coronavirus Don T Mess With Taxes

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

2015 1095 Tax Form 1095 A 1095 B And 1095 C Tax Filing Obamacare Net

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

What To Do If Your Obamacare 1095 A Column B Is Zero Poorer Than You

1095 A 1095 B And 1095 C What Are They And What Do I Do With Them Healthcare Counts

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.