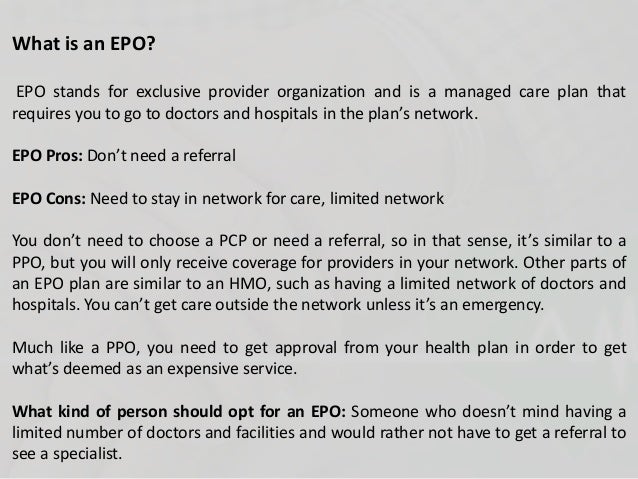

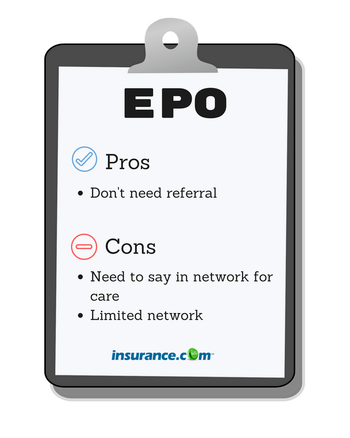

Your insurance will not cover any costs you get from going to someone outside of that network. Like an HMO your care is covered only if you see a provider in the plans network unless its an emergency as defined by the plan.

Which Health Insurance Plan Is Best Hmo Ppo Hdhp Pos Epo

Which Health Insurance Plan Is Best Hmo Ppo Hdhp Pos Epo

The network of providers of an EPO are generally larger than with a Health Maintenance Organization HMO.

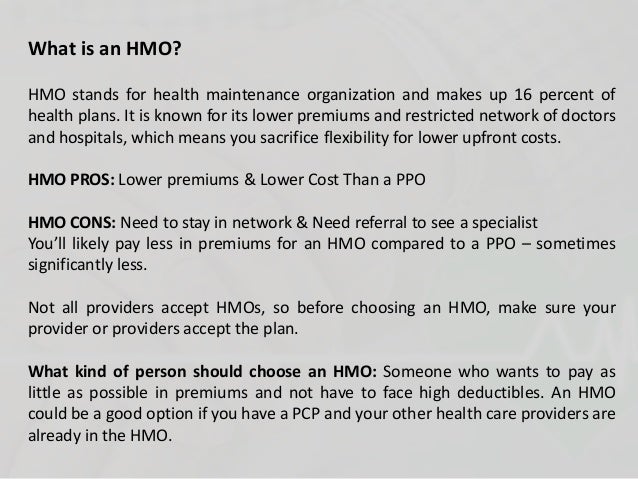

What is an epo insurance plan. These plans are among the most affordable options with generally low monthly rates. An Exclusive Provider Organization EPO plan is a health insurance plan that only provides coverage for medical care within a specific provider network. In California health insurance plan options primarily include Health Maintenance Organization HMO and Preferred Provider Organization PPO.

Under an EPO plan the insurer will only provide cost sharing when you use a health care provider that is inside your network. EPO health insurance plans typically cost you less than Health Maintenance Organization HMO and Preferred Provider Organization PPO plans with lower rates for care. EPO stands for Exclusive Provider Organization plan.

They will bear the costs of outside services. Comparison shopping is a great way to evaluate the private insurance plans in Part C Medicare Advantage Medicare Supplement and the. Coverage is not provided for out-of-network service costs unless they are related to a medical emergency.

An Exclusive Provider Organization EPO is a managed care plan where services are covered only if you go to doctors specialists and hospitals in the plans network. As a member of an EPO you can use the doctors and hospitals within the EPO network but cannot go outside the network for care. There is also a third option Exclusive Provider Organization EPO which is growing in popularity in California.

Thats partly because an EPO. EPO insurance plans offer a very limited number of providers who offer large discounts on their rates. EPO customers benefit from having quality medical care ready and waiting for them at an agreed cost sharing range.

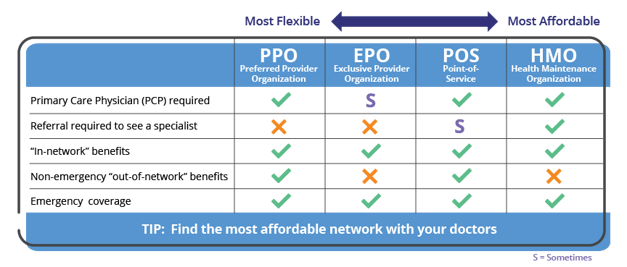

Exclusive Provider Organization EPO combines elements of PPOs and HMOs. 7 Like HMOs many POS plans require you to have a PCP referral for all care whether its in or out-of-network. The downside of this type of plan is that any provider outside of the EPO network isnt covered by your insurance.

What is an EPO plan. An EPO is a hybrid between an HMO and PPO plan An exclusive provider organization or EPO is a health insurance plan that only allows you to get health care services from doctors hospitals and other care providers who are within your network. The only exception to this rule is in the case of an emergency.

An Exclusive Provider Organization plan EPO is similar to an HMO plan in that it has a limited doctor network and no out-of-network coverage but it is similar to a PPO plan in that you dont have to designate a primary care physician upon applying and you dont need a referral to see a specialist. An Exclusive Provider Organization EPO is a type of health plan that offers a local network of doctors and hospitals for you to choose from. What is an EPO plan.

If its not an emergency and you see an out-of-network provider you will have to pay the full cost out of your pocket. EPO or Exclusive Provider Organization describes the network of healthcare providers doctors hospitals imaging services that the health insurance plan is contracted to work with and is willing to compensate for your care. What Is an EPO Insurance Plan.

Many plans contain co-pays before the deductible co-pays are your friend BEFORE the deductible. There are no out-of-network benefits. EPO Health InsuranceWhat It Is and How It Works Point of Service POS POS plans resemble HMOs but are less restrictive in that youre allowed under certain circumstances to get care out-of-network as you would with a PPO.

EPO rates are typically lower than other types of insurance such as PPO plans. An EPO can have lower monthly premiums but require you to pay a higher deductible when you need health care. Most EPOs dont require.

An EPO is a type of health insurance plan that offers a local network of doctors specialists and hospitals in your area for you to choose from. The expense may or may not count towards the out-of-pocket maximum in the plan. An EPO is usually more budget-friendly than a PPO plan.

An EPO Exclusive Provider Organization insurance plan is a network of individual medical care providers or groups of medical care providers who have entered into written agreements with an insurer to provide health insurance to subscribersBasically an EPO is a much smaller PPO. If you get sick somewhere outside of your network you could have to pay 100 percent of the bill.

Exclusive Provider Organization Epo Insurance 101 Medicaid Info Org

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

What Are The Differences Between Hmo Ppo And Epo Health Plans New Youtube

Which Health Insurance Plan Is Best Hmo Ppo Hdhp Pos Epo

Which Health Insurance Plan Is Best Hmo Ppo Hdhp Pos Epo

What Is An Epo Health Insurance Plan

What Is An Epo Health Insurance Plan

Frequently Asked Questions About Health Net Health Net

Frequently Asked Questions About Health Net Health Net

Difference Between An Hmo Vs Ppo Xcelhr

Difference Between An Hmo Vs Ppo Xcelhr

Epo Health Insurance Plan What You Need To Know My Calchoice

Epo Health Insurance Plan What You Need To Know My Calchoice

Know Your Options Individual Health Insurance In Tennessee

Know Your Options Individual Health Insurance In Tennessee

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Hmo Vs Epo Vs Ppo Explained Medicoverage Com

Epo Vs Ppo Difference And Comparison Diffen

Epo Vs Ppo Difference And Comparison Diffen

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Hmo Vs Ppo Vs Other Plans What S The Difference Insurance Com

Pin On Obama Care Health Insurance

Pin On Obama Care Health Insurance

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

What Type Of Health Plan Works Best For Me Choosing The Right Plan Independence Blue Cross

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.