Plan F coverage also includes your other doctor visits for illnesses and injuries. Medicare Supplement Medigap plans may help with certain out-of-pocket health-care costs that Original Medicare doesnt pay for such as deductibles copayments and coinsurance.

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

These plans dont directly pay for medical care.

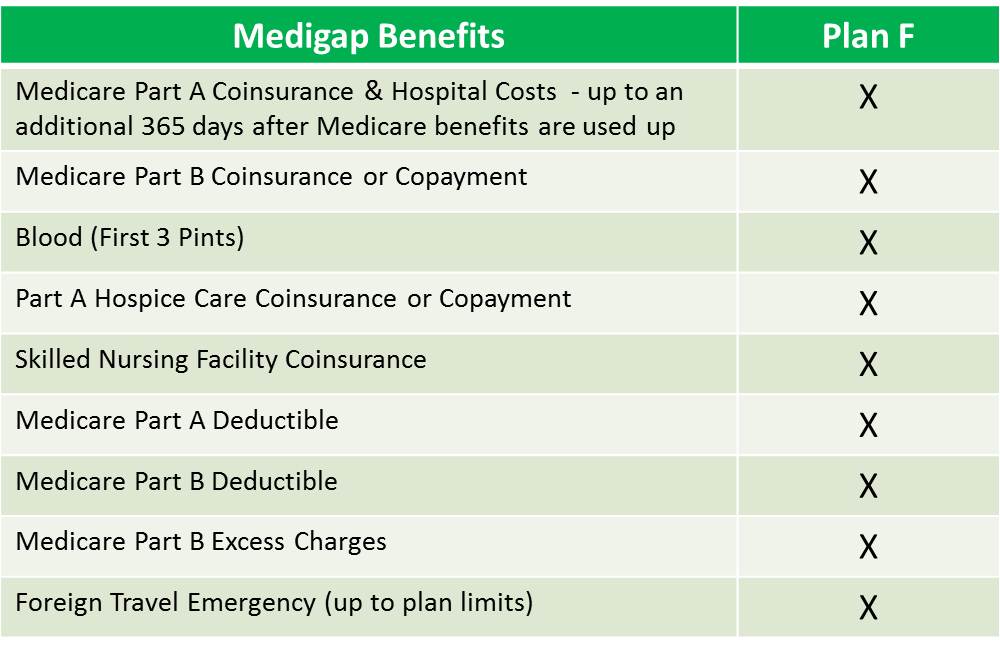

What is medicare supplement plan f. Currently Medicare Supplemental Plan F also known as Medigap Plan F has been the most popular of the supplemental plans because if its comprehensive coverage for parts that are not covered by Medicare alone. Then your Plan F supplement pays your deductible and the other 20. Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan.

The plan covers 100 of Part B. Plan F is one Medigap option. There are no claims paperwork to file and the policy virtually pays everything.

Like other Medicare supplement plans Plan F typically doesnt cover. The Medicare supplement insurance Plan F covers all the cost-sharing for Medicare Part A and B services. Medicare Plan F is the most comprehensive Medicare supplement plan.

Some doctors charge a 15 excess charge beyond what Medicare pays. In fact 55 of Medigap beneficiaries in 2017 were enrolled in Plan F. Recent Medigap Plan F changes wont impact all Medicare beneficiaries.

It is a supplemental policy that you can buy from a private insurance company. Medicare Supplement Plan F is popular with many of our clients because it offers the most comprehensive coverage out of all the Medigap plans available. Plan C is the other.

The reason why many people like Medicare Supplement Plan F is due to the fact that it is hassle-free. Medicare supplement insurance Medigap is a type of Medicare insurance policy that can help pay for some costs that original Medicare parts A and B doesnt cover. It pays Medicare costs for you in exchange for a monthly premium.

Medicare Supplement Plan F is generally regarded as the most comprehensive plan out of the 10 Medicare Supplement Medigap policies available in most states. Plan F will pay the following benefits costs are for 2020 and generally increase each year on January 1. Medicare Part B first pays 80.

Medicare Supplement Plan F or Part F is the most comprehensive supplemental insurance policy and covers 100 of the major gaps left by Medicare. The Innovative Plan F is Plan F with extra benefits. Plan F covers that for you.

Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service. Medigap Plan F is retiring for new-to-Medicare enrollees. Like many other Medigap policies Plan F also covers Part B copayments and the deductible.

Plan F will not be available for sale to Medicare beneficiaries who become eligible for Medicare after. The Medicare Part F policies are first-dollar coverage. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states.

What is Medicare Supplement Plan F. Instead you may want to consider Medigap Plan G which offers the next. It was developed to pay.

That means you could see a doctor with little to no money out of your own pocket. Dental care vision care including eyeglasses hearing aids long-term care private nursing. Medicare Supplement Plans also known as Medigap plans are insurance plans offered by private health insurance companies.

Plan F is a Medicare Supplement plan also known as a Medigap policy that is offered by private insurance companies. Lets do a brief review of what plan F covers. Rather they pay for out-of-pocket costs associated with Original Medicare insurance.

Thus you only pay the monthly premium and have no other out-of-pocket expense. Also referred to as Medigap Plan F it covers Medicare deductibles and all copays and coinsurance. However if you didnt become eligible for Medicare until January 1 st 2020 or later you cant apply for Plan F.

Those who have one of these plans are essentially grandfathered in and will be able to keep it. It is only available to Original Medicare beneficiaries who want the additional insurance coverage needed to help pay for their share of the costs. Medicare Supplement Plan F is also referred to as Medigap Plan F.

Of the 10 standardized plans that may be available in most states Medicare Supplement Plan F offers the most comprehensive coverage. Just as the rest of the parts F deals with drugs administrated in the clinic but has nothing to do with retail prescriptions. They will continue to have coverage for the Part B deductible which is 198 in 2020.

Medigap Plan F The Most Common And Comprehensive Plan

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Transamerica Medicare Supplement Plans For Baby Boomers

Transamerica Medicare Supplement Plans For Baby Boomers

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.