Plan F gets all the attention and many agents promote that plan exclusively. So what does Plan G cover.

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medigap Plan G Tupelo Ms Bobby Brock Insurance

However in many cases Plan G is the better value.

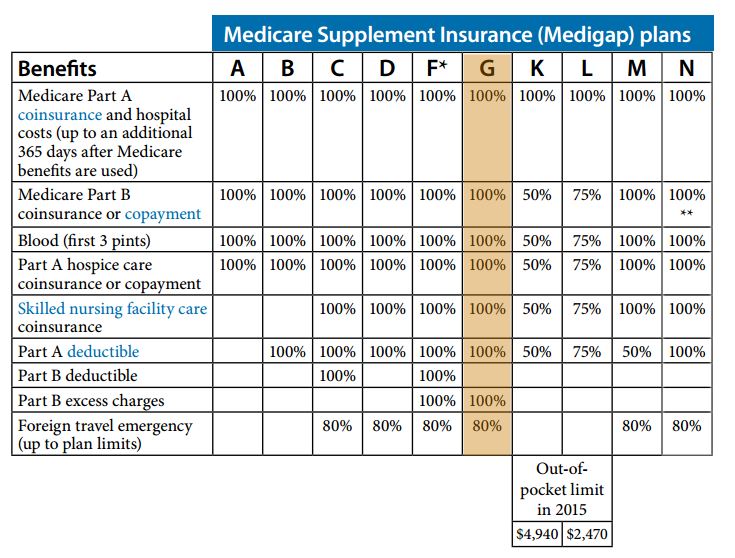

What is a medigap plan g. The only difference between these two plans is the coverage of the Medicare Part B deductible which is 185year for 2019. The plans are named by letter ranging from A to N. With a Medicare Advantage plan one can usually only see a provider who is on the approved list of doctors for the HMO or PPO.

Medicare Supplement Plan G also called Medigap Plan G is a supplemental policy that has become more common since it was first made available a few years ago. Medigap policies supplement original Medicare benefits and plans must follow standardized Medicare rules. 4 Zeilen Medigap Plan G is a Medicare supplement insurance plan.

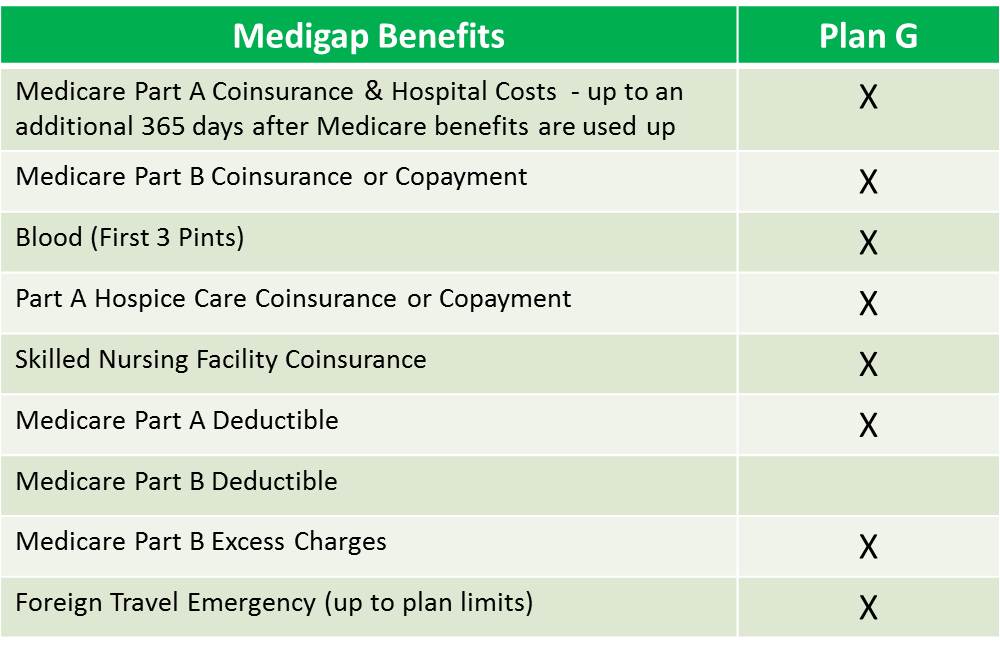

Medigap Plan G is known for providing the greatest value of the available options to beneficiaries. The only gap in Medicare coverage not filled by Plan G is Part Bs deductible 203 in 2020. Medigap plans are sold by private insurance companies and they help fill in all of the gaps that original Medicare leaves behind hence the name Medigap.

Plan G is private medicare insurance that supplements Original Medicare. 164month EXAMPLE 3 SOUTHERN CA. In most states Plan G generally runs about 20-25 more per month than Plan N More about Plan G prices.

Medigap Plan G Premiums vs. Depending upon the condition of your health it might be a better idea to sign up for Plan N even though there is a copay and may be 15 in excess charges associated with it. When you have a Medicare Supplement Plan G you pay the monthly premium and the only out-of-pocket expense you have is Medicares Part B annual deductible 18300 for 2018.

Medigap also called Medicare Supplement is an insurance policy that helps to supplement Original Medicare Part A and B by helping to cover the gaps in Original Medicare. EXAMPLE 2 PANHANDLE FL. Ask for a rate-shopping comparison guide.

To have a Medicare Plan G policy a. Contact insurance companies recommended. Medicare is a health insurance program offered by the federal government for people age 65.

It covers a variety of expenses that. Consider your current monthly insurance costs how much. Medigap usually has a monthly premium and you may also have to pay copays coinsurance and deductibles.

Use Medicaregovs tool to find and compare Medigap policies. Medigap Plan N Premiums. Medigap Plan G is popular because like Plan F it sets a fixed amount for out-of-pocket expenses.

Thankfully Medicare Supplement Plans also known as Medigap help fill in the gaps. Contact your State Health Insurance Assistance Program SHIP. How the Medicare Supplement Plan G works is that it pays all the holes or gaps in Medicare Parts A and B except for one which is the Medicare Part B annual deductible.

Medicare Supplement Plan G in particular offers the broadest coverage for new Medicare beneficiaries. Plan G is one of 10 major Medicare supplement plans currently offered to new Medicare enrollees. Yet when choosing supplemental Medicare coverage youll want to know ahead of time if Plan G is right for you.

Also called Medigap Plan G FREEDOM 1. With a Medicare Supplement Plan G also called Medigap Plan G one can see any doctor that accepts Medicare. Medicare Part B excess charges foreign travel and skilled nursing care coverage which gives beneficiaries the most expansive coverage anywhere.

Were here with all the information you need to know about what Plan G covers the costs associated with this plan. Once thats paid your only health services expense will be monthly insurance premiums. Original Medicare is the default option when you enroll in Medicare and is.

The Plan G rates shown below are for a 65-year old non-smoking female and they are the lowest current rates in that respective area every insurance company charges different prices. EXAMPLE 1 ALL OF NC. Plan G is one of the most popular Medigap plans because it offers the most coverage including.

And thanks to the phasing out of the popular Medigap Plan F in 2020 Plan G is now the plan of choice for many. Medigap Plan G is one of the most common and comprehensive Medicare Supplement plans. Some people call Medicare supplement plans Medigap because they fill in the gaps that exist in Medicare.

Medicare Supplement Plan G like other Medigap plans A. Before we start looking at Plan G specifically lets take a broad look at Medigap plans and why you should purchase one of these plans. Medigap Plan G Rates start at 85month.

Is Medigap Plan G right for you. Medicare Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used Medicare Part B coinsurance or copayment Blood first 3 pints Part A hospice care coinsurance or copayment Skilled nursing facility care coinsurance Part A.

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

The Best Medicare Supplement Plan F Vs Plan G Vs Plan N Askmedicaremike Com

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medigap Plan G

Medicare Supplement Plan G Medigap Plan G

Medigap Benefits Medicare Supplement Plan G Love Photos Cool Photos Medicare Supplement Plans

Medigap Benefits Medicare Supplement Plan G Love Photos Cool Photos Medicare Supplement Plans

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Supplement Plan G The Better Value Plan How To Plan Medicare Supplement Plans Medicare Supplement

Medicare Supplement Plan G The Better Value Plan How To Plan Medicare Supplement Plans Medicare Supplement

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Medigap Planners Medigap Plan G Or Medigap Plan N Compare Rates And Benefits Medigap Planners

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G An Alternative To Medicare Supplement Plan F Medicare Supplement Experts Since 1981 Securecare65

Medigap Plan G An Alternative To Medicare Supplement Plan F Medicare Supplement Experts Since 1981 Securecare65

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.