And prior to 2021 you could earn up to 400 of the federal poverty level to qualify for subsidies also known as the subsidy cliff. See Stay Off the ACA Premium Subsidy Cliff.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

So based on 2020 poverty thresholds if you had claimed upfront health subsidies but went on to earn more than 51040 as a single earner or 104800 for a.

Aca subsidy income limits 2020. This means that more people may be eligible for reduced premiums or premium subsidies. For example in 2020 people with income between 250 and 300 of the Federal Poverty Level were expected to pay between 829 and 978 of their income toward a second lowest-cost Silver plan in their area. Extra subsidies for all customers between 100-400 of the Federal Poverty Level FPL All customers.

You can qualify for a premium tax credit if your individual income falls between 12880 and 51520 or 100 and 400 of the FPL. For 2021 coverage before the American Rescue Plan removed the upper income limit for subsidy eligibility it was 51040 for a single person and 104800 for a family of four. After earning an income of 100400 or higher for a family of four 83120 for a family of three 65840 for a married couple with no kids and 48560 for single individuals you will no longer receive government health care subsidies.

The ACA uses the term modified adjusted gross income MAGI to describe the way income would be calculated for premium subsidy eligibility and thats accurate terminologythe calculation is a modification of adjusted gross income. The new law changed it to a sliding scale between 4 and 6 of income in 2021 and 2022. What is the Maximum Income for Obamacare for 2020 - 2021.

Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. Cost Share Reduction Tier 1 limit. 978 of your income.

For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. But the concept of MAGI already existed for other tax-related purposes and is calculated differently which. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

9 rows Lowest eligible income 100 FPL. The basic math is 4X the Federal Poverty Level FPL as determined by the government. Here are the limits for 2020 plans for individuals and families.

Fortunately the HealthCaregov exchange figures it all out for you. Before the American Rescue Plan ARP was enacted eliminating the income cap for subsidy eligibility in 2021 and 2022 subsidies were available in the continental US for a single person with an income of up to 51040. Your actual subsidy could be much greater or much smaller depending on your income the number of people in your family your age and whether you smoke or not.

You may be eligible for a health insurance subsidy in 2020 if your total household income falls within certain limits. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy. 00978 50000 4890.

9500 - 4890 4610. The income cutoffs are tied to the Federal Poverty Level and are adjusted each year. 23 In March 2021 the federal government enacted the American Rescue Plan Act which expanded the eligibility requirements for subsidies.

So for instance a 21-year-old with an income of 19320 who was eligible for a subsidy of about 3500 under the Affordable Care Act would get 4300 under the new plan assuming the cost of his. Each year the ACA sets new limits for out-of-pocket maximums and deductibles. Income Limits for 2020 Health Insurance Subsidy The 2020 income figures are in the chart below.

These amounts are just below and just above the upper threshold for subsidy eligibility so the 51000 income will allow the person to receive a premium subsidy while the 52000 income will not note that the 2020 poverty guidelines are used to determine premium tax credit eligibility for 2021 coverage. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. For 2020 your out-of-pocket maximum can be no more than 8150 for an individual plan and 16300 for a family plan before marketplace subsidies.

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Subsidy Calculator Are You Eligible For A Subsidy Ehealth

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

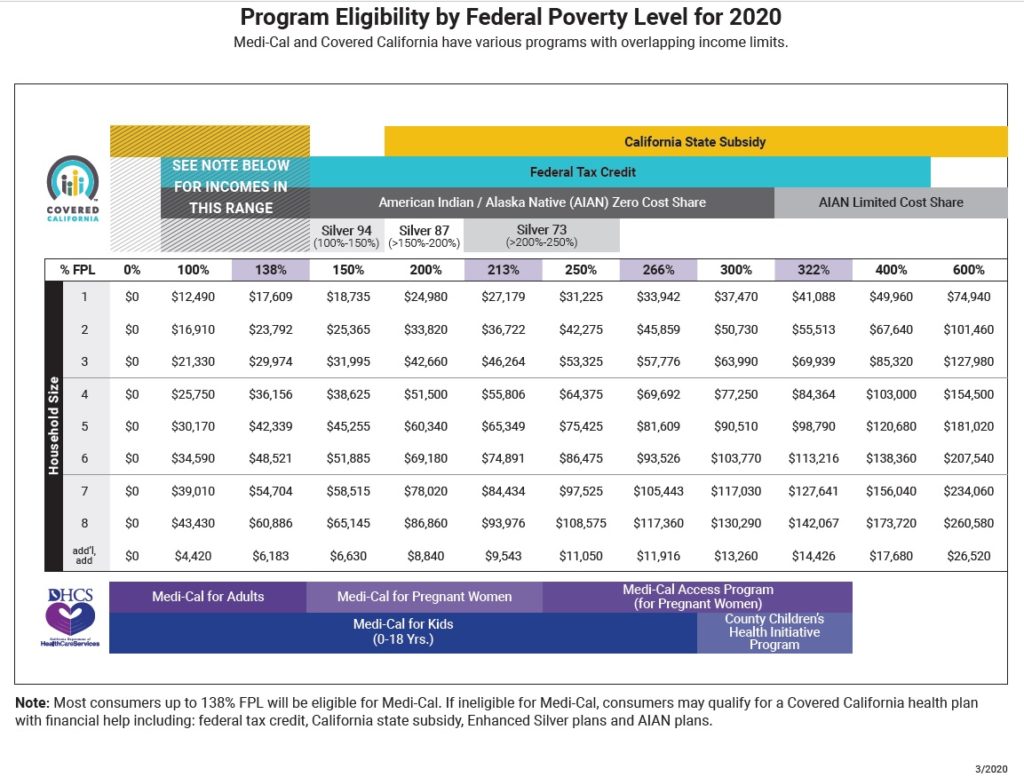

Revised 2020 Covered California Income Eligibility Chart

Revised 2020 Covered California Income Eligibility Chart

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Income Based Costs Nevada Health Link Official Website Nevada Health Link

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Aptc Income 2021 Tax Form 1040 Trout Insurance Services

Aptc Income 2021 Tax Form 1040 Trout Insurance Services

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

2020 2021 Federal Poverty Levels Fpl For Affordable Care Act Aca Florida Health Agency

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.