First Health functions as a wrap network to help lower out-of-pocket costs for emergency services in the 49 states outside of Wisconsin. OhioHealthy HDHPHSA Medical Plan Summary of Benefits This document is a summary of benefits and services available through the Plan.

Spotlight Series A Health Savings Account Rundown Lumity

Spotlight Series A Health Savings Account Rundown Lumity

HSA funds are available as you contribute them while all Medical FSA funds are available on Day 1 of the plan year.

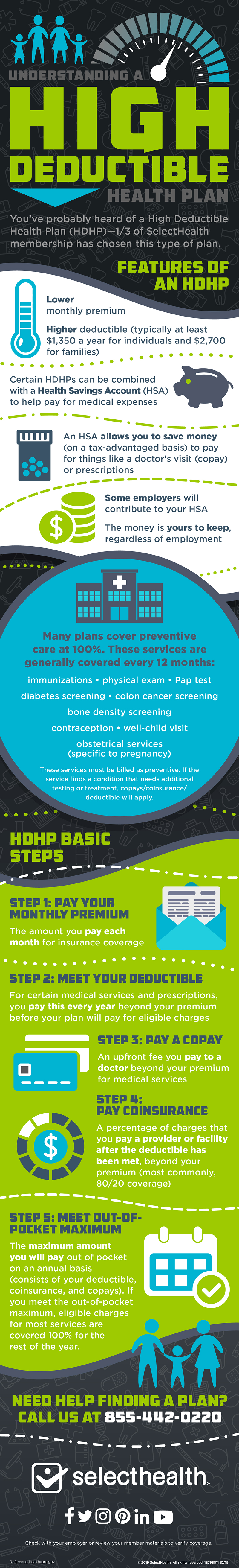

Hdhp hsa plan. If you combine your HDHP with an HSA you can pay that deductible plus other qualified medical expenses using money you set aside in your tax-free HSA. Since HDHP coverage makes you eligible to participate in a tax-favored Health Savings Account they have other special rules that set them apart from non-HDHP plans. Why choose the Colleges HDHPHSA.

Why an HDHP and HSA are better together. Please note that only medical mental healthsubstance abuse. An HSA allows HDHP plan participants to save pre-tax dollars to pay for qualified medical expenses.

An HDHP usually has a higher annual deductible than a typical health plan and its minimum deductible varies by year. For 2019 the IRS defines a high deductible health plan as any plan with a deductible of at least 1350 for an individual or 2700 for a family. For those 55 or older theres also an additional 1000 allowed as a catch.

Lower monthly medical dependent premiums Employer contributions for year 2021. HSA money can be used to cover the deductible or coinsurance amounts under your HDHP plan. An HSA works as an additional tax-advantaged savings vehicle similar to an IRA.

A high deductible plan HDHP can be combined with a health savings account HSA allowing you to pay for certain medical expenses with money free from federal taxes. When combined with a Health Reimbursement Arrangement HRA an HSA with an HDHP can be a powerful health benefit that sets you apart. For 2019 it is 1350 for.

An HDHP plan is typically about 10 cheaper than a traditional preferred provider organization PPO plan and is usually associated with a company funded tax-advantaged health savings account HSA that is meant to fund some of your medical expenses. If there are any differences between this summary and the rest of this Summary Plan Description SPD the provisions of the SPD documents will prevail for all benefits conditions limitations and exclusions. If you need more care youll save by using the tax-free money in your HSA to pay for it.

This year when I was completing my taxes with TurboTax 2020 I got to a question asking me. I also contribute to an HSA that we use to pay medical expenses. Although your HDHP might be a PPO HMO POS or EPO it will still.

In addition HSA dollars can be used to cover all expenses covered under a traditional medical flexible spending account plan hearing aids eyeglasses etc. So if you have an HDHP and dont need many health care items and services you may benefit from a lower monthly premium. Without the HDHP you cannot put money in the HSA.

High-Deductible Health Plan HDHP and Health Savings Account HSA Basics - YouTube. Our individual HDHPs include convenient access to Aspirus Health Plans Signature Network plus many health care professionals and hospitals in your area. This has been the case for years.

A High Deductible Health Plan HDHP is a health plan product that combines a Health Savings Account HSA or a Health Reimbursement Arrangement HRA traditional medical coverage and a tax-advantaged way to help save for future medical expenses while providing flexibility and. For context my wife is on my high deductible health plan Im the primary for our family. HSA options are available for both HMO and POS plans.

An HDHP is a specific type of health insurance HSA-qualified not just any plan with a really big deductible. To help balance the added out-of-pocket costs combining a health savings account HSA with an HDHP can generate tax savings for both employers and employees. FSCJ contribution 1500 Consortium contribution 500 Employee only 1000 Employee plus one 1500 Employee plus two HSA contributions arent taxed Qualified medical expenses are tax-free1.

Each year you andor your employer put money into the HSA tax-free up to 3250 for single plans and 6450 for family plans in 2013. As triple tax-advantaged accounts HSA contributions are tax-free earnings are tax-free and withdrawals for eligible expenses are tax-free. A high deductible health plan HDHP paired with a Health Savings Account HSA is growing in popularity because it allows employees to pay for medical expenses tax-free.

How To Explain High Deductible Plans

How To Explain High Deductible Plans

How An Hsa Works With A High Deductible Health Plan Youtube

How An Hsa Works With A High Deductible Health Plan Youtube

Dismissing High Deductible Hsa Plans Is A Costly Mistake Resource Planning Group

Getting To Know The Hdhp Hsa Human Resources

Getting To Know The Hdhp Hsa Human Resources

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Ppo Or Hdhp Making Health Insurance Choices Landsberg Bennett

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Is It Worth Having A Hdhp To Be Eligible For A Health Savings Account

Unpacking The Hdhp The Details Behind The High Deductible Health Plan

Unpacking The Hdhp The Details Behind The High Deductible Health Plan

The Pros And Cons Of High Deductible Health Plans Hdhps

The Pros And Cons Of High Deductible Health Plans Hdhps

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.