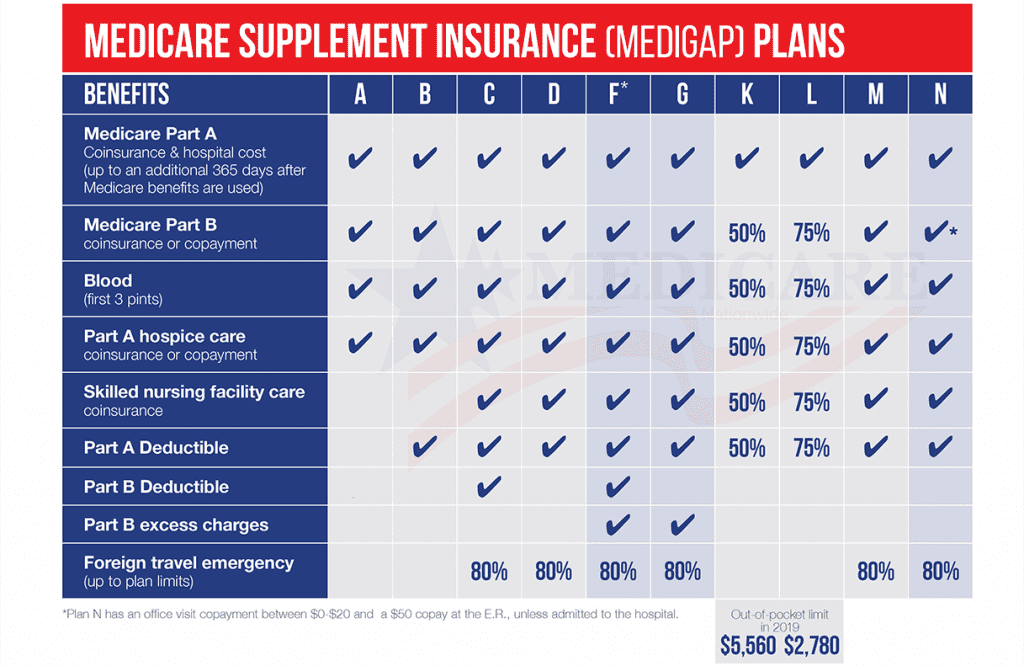

8 Zeilen The only benefit Plan F offers that Plan G doesnt is coverage for the Medicare Part B. Plan F benefits include coverage for all copays deductibles and coinsurance.

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

Plan G does not cover the Part B deductible the Part B deductible for 2018 is 183.

What is the difference between medicare supplement f and g. If you select the high deductible plans you have to pay the first 2000 deductible in 2010 in MediGap-covered costs before the MediGap policy pays anything. If you first became eligible for Medicare on or after January 1 2020 you cannot enroll in Medicare Plan F. Plan G will offer a high deductible option beginning January 1 2020.

Medicare Supplement Plans F and J also have a high deductible option. In exchange for you paying the Part B deductible youre going to get a big difference in premium savings. The ONLY difference between Plan G and Plan F is under Medicare supplement Plan G the Medicare Part B deductible is not covered.

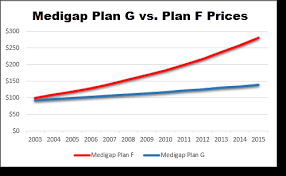

This part is easy to answer because there is only one benefit difference between Medigap plan G and F. In other words Plan F will cost you 500 or more in annual premiums than Plan G. Both plans require you to first have Original Medicare but the enrollment guidelines for Plan F changed at the beginning of 2020.

The Part B deductible is a one time deductible you must play each year when you see the doctor for non-preventive visits. Medigap Plan G offers all of the same benefits as Plan F except for the Part B deductible. See the chart below to get a visual of my explanation.

When you compare the lower premium benefit of Plan G you can save 500 or more. Lets Look at an Example. What is the difference between Medicare Supplement Plans F G.

Medigap or Medicare supplement insurance can help to pay for things that original Medicare doesnt. Plan G does not pay the Part B deductible like Plan F. Medigap Plan N covers the same benefits as Plan F except the Part B deductible and Part B excess charges.

Plan F covers the Medicare Part B deductible and Plan G doesnt. Medicare supplement Plan G is very similar to Plan F. Another big difference between Medicare Plan F and Plan G is who is eligible to enroll.

There are two big differences between Medicare Plan F and Plan G. The only difference when you compare Medicare Supplements Plan F and Plan G is that deductible. Medigap has several different plans that you can choose from including Plan F and Plan G.

With a Plan G she would pay about 120. 8 Zeilen Medicare Supplement Plan G is almost identical to Plan F except for the Part B deductible. After the deductible is met Plan G benefits are exactly the same as Plan F.

The only difference between Plan F Plan G is the Part B deductible which will be 198 in 2020. In 2021 the Part B deductible is 203. For example a 70 year old woman in a big city pays 200 a month for her Medicare Supplement Plan F.

Medicare Supplement Plans F and G are identical with the exception of one thing. The difference between Plan F and Plan G is the annual Part B deductible. Jack has Plan G in addition to Medicare.

The better option depends on the monthly premium difference between Plan G and Plan F in your area. The trade is youre going to get a significantly lower premium with Plan G. First Plan G has lower premiums than Plan F.

Medicare Supplement Plan N. Example if the Plan F premium in your area is 140 but the Plan G premium is 100 you end up spending 480 more over a 12-month period in premiums with Plan F just to have the Part B. This means that you will have to pay 183 annually before Plan G begins to cover anything.

Otherwise they function just the same. Medicare Supplement Plan G. In Washington a Plan Fs premium is 2568 and the Plan G1896 a difference of 672.

There is one important feature that Medicare Supplements Plan F and G have over all the other Medigap plans. Second you will pay a 203 Part B deductible in 2021. The Medicare Part B deductible is an annual deductible.

We dont recommend the high deductible plans. This means the most you can pay out of pocket under Plan G is 203 for the year. The annual premium on Plan G is usually lower which is typically a l ot less than what the cost of the part B deductible is.

What is the difference between Plan F and G. Most striking is one company in North Carolina that offers a Plan F with an annual premium of 3556. 9 Zeilen Plan G coverage is similar to that of Plan F but does not cover the Medicare Part B.

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Medicare Plan F Vs Plan G Vs Plan N Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Anthem Medicare Supplement Plans Boomer Benefits

Medicare Supplement Comparison Chart Compare Medigap Plans

Medicare Supplement Comparison Chart Compare Medigap Plans

Medicare Supplement Plans Seniorquote Insurance Services

Medicare Supplement Plans Seniorquote Insurance Services

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Plan F Vs Plan G Comparison By Gomedigap Medicare Supplement Medicare Supplement Plans Medicare

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Which Is Better Plan F Or Plan G Medicare Supplement Youtube

Which Is Better Plan F Or Plan G Medicare Supplement Youtube

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.