Consider Medicare Supplement Plan G and Plan N. However while Plan G usually has higher premiums it could save you money in the long run.

Medicare Plan F Vs Plan J Comparison Costs And Coverage

Medicare Plan F Vs Plan J Comparison Costs And Coverage

Medicare Supplement Plan J Medigap Plan J was discontinued in 2010.

Medicare plan j vs plan g. Medicare Part A Hospital Deductible The 2010 deductible is 1100. Shop 2021 Medicare plans. While Plan F allots for coverage of 80 of costs Plan J provides 100 coverage.

Once the annual deductible is met the plan pays 100 of covered services for the rest of the year. Skilled Nursing Facility SNF Coinsurance 13750 a day for days 21-100 in a Skilled Nursing Facility in 2010 Medicare Part B Yearly Deductible The 2010 deductible is 155 Medicare Part B Excess Charges. Get advice from our licensed insurance agents at no cost or obligation to enroll.

Original Medicare refers to Medicare Part A and Medicare Part B and they cover your inpatient and outpatient services. The standard Medicare Supplement Plan G with a low deductible rather than the High Deductible Plan G is usually be the better choice for most people choosing Plan G in my opinion. Medicare Supplement Plan J or more popularly known as Medigap Plan J was one of the most popular plans until it was discontinued on June 1 2010.

Subtract the monthly premium for Plan G. Annons Protect the best years ahead. Medicare Part A deductible 1484 in 2021.

The standard Plan G has a higher monthly premium than the high deductible plan but has a substantially lower yearly deductible and a greater convenience of use. MMA added Medicare Part D a prescription drug plan to the list of available policies creating many similarities between Part D and Plan J. Since Plan G typically has a more expensive premium it actually may save you money in the long run.

Plan J had one other benefit that was later deemed to be unnecessary by Medicare. In 2021 the high deductible version of Plan G has a 2370 deductible before the plan will start coverage. At-home recovery care up to 1600 a year.

In fact the law no longer allows you to get some of the coverage. For example Plan F and Plan J cover. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1 2020.

Anyone who already had the plan can keep it and receive its benefits. Heres a good way to see if switching to G is a wise financial move. Plan G is almost identical to F except the Part B deductible is not covered.

Shop 2021 Medicare plans. Medicare Supplement Plan G is one of those options. Get advice from our licensed insurance agents at no cost or obligation to enroll.

However Plan G does not cover the Medicare Part B deductible which is 14850 in 2021. Learn more about Medigap Plan J coverage costs and. All enrollees in an expired plan including Plan J are able to keep their plan with no loss of benefits.

If you can find a Plan G option that only costs 203 more per year or less than your current Plan J you could save money in the long run by switching to Plan G provided you dont need the extra foreign emergency care coverage. If you do decide to comparison shop and want to maintain the level of coverage you have with Plan J there are other options out there for you. Thats because The Medicare Modernization Act was passed and sales of Medigap Plan J was stopped.

That said we always recommend comparison shopping. It had a benefit which included about 1600 worth of At Home Recovery care. The reason G costs more is because it provides more coverage.

With your Plan J you will get the basic coverage categories like Part A coinsurance and hospital costs for an additional 365 days after your original Medicare coverage has expired. Take your current monthly premium for Plan J. Medigap Plan J.

If you have a Plan J still then you have the most coverage that you can buy. The reason why this plan is no longer being offered is because of the Medicare. If I have a Plan J what should I do.

Medicare Part B excess charges Plan J and Plan F each provide coverage for foreign travel emergency care as well. Annons Protect the best years ahead. 1 Plans F and G offer high-deductible plans that each have an annual deductible of 2370 in 2021.

First of all you do not have to do anything. Replacing Medicare Supplement Plan J with Plan F or G can result in hundreds of dollars in annual savings. Medicare Supplement Insurance Plan J coverage also provides two additional benefits that are not found in Plan F.

Premiums for each plan can vary by the carrier that offers it but Plan G is typically more expensive than Plan N because it offers a higher level of coverage. As long as Medicare pays first Plan F and Plan J will cover the rest of the costs leaving you to pay nothing out-of-pocket. Due to these similarities sales of Plan J stopped as.

However you may save enough in your premium to cover the deductible. Plan G is usually more expensive than Plan N.

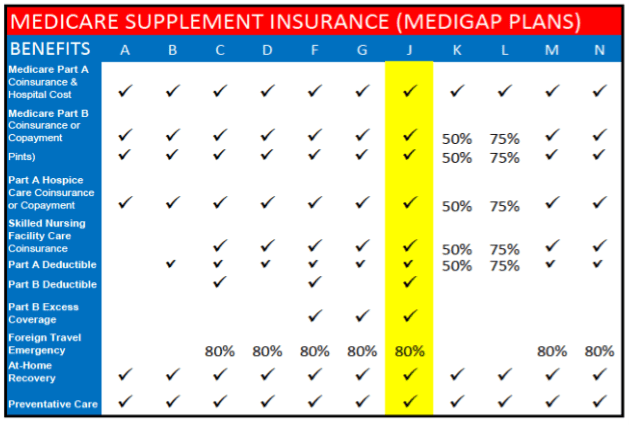

Comparison Chart Of All 10 Medicare Supplement Plans Policies

Comparison Chart Of All 10 Medicare Supplement Plans Policies

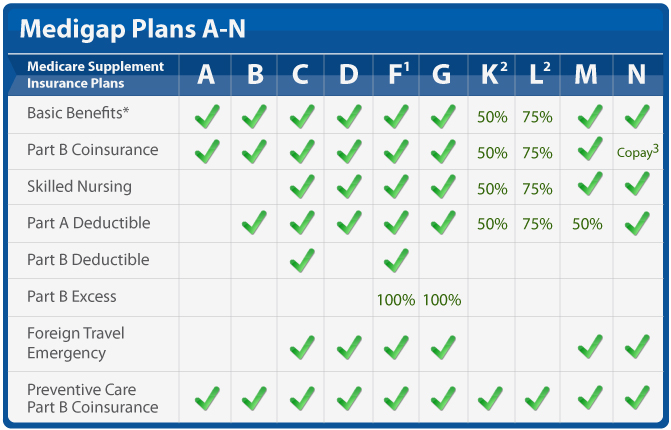

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Medicare Supplement Plan J Vs Plan F What Is The Difference Gomedigap

Medicare Supplement Plan J Vs Plan F What Is The Difference Gomedigap

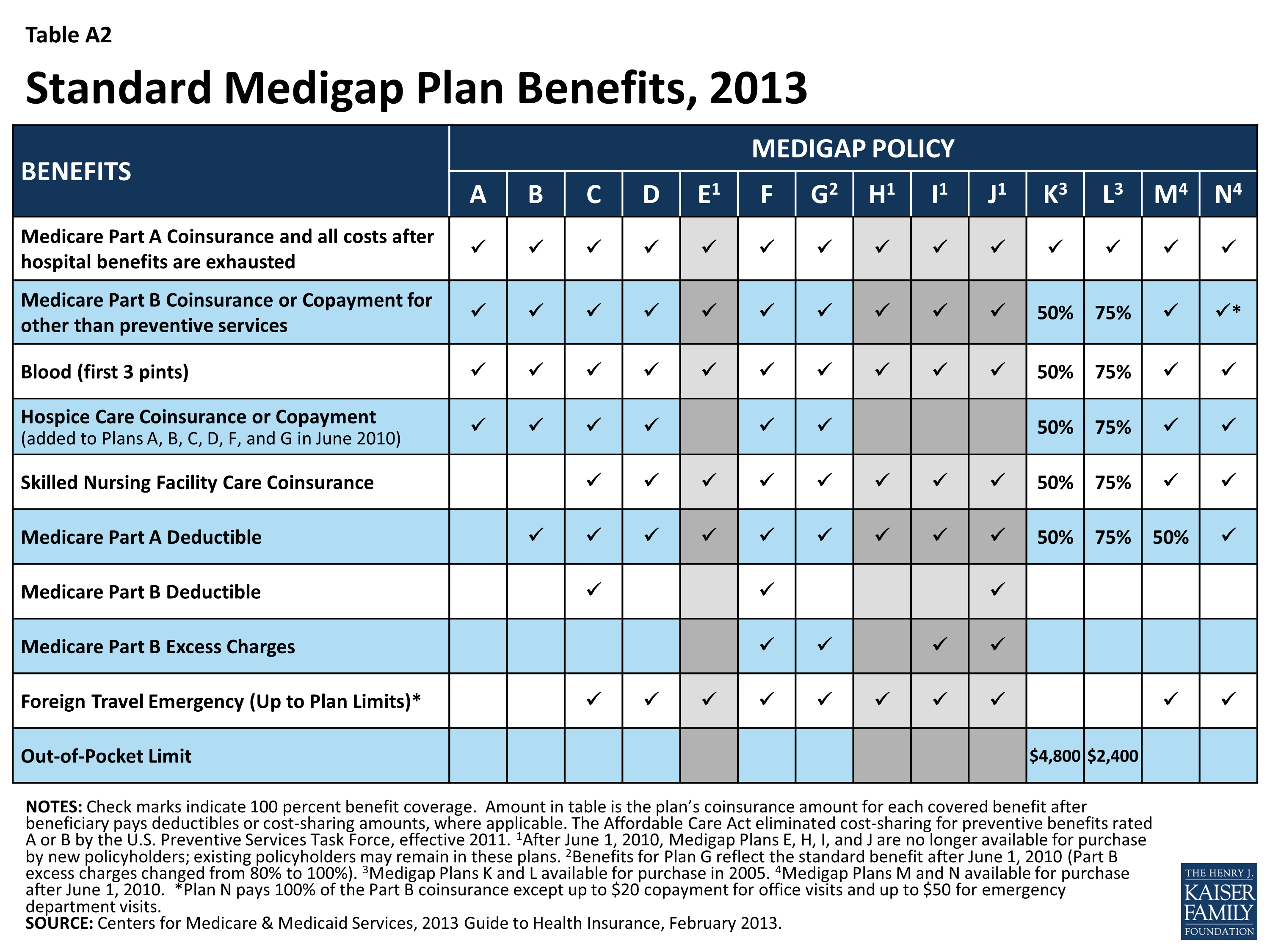

Medigap Reform Setting The Context For Understanding Recent Proposals Appendices Kff

Medigap Reform Setting The Context For Understanding Recent Proposals Appendices Kff

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan J Review Pricing Reviews Star Ratings

Medicare Supplement Plan J Review Pricing Reviews Star Ratings

Cost Of Supplemental Health Insurance For Seniors

Cost Of Supplemental Health Insurance For Seniors

Plan G Medicare Shunyata Healing Center

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Should I Buy Medicare F Or G Off 55 Rescuelab Com Pk

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

Medicare Supplement Insurance Plan J Medigap Plan J Costs Benefits

What Is A Medsup Plan Medicare Supplement Basics Amba Association Member Benefits Advisors

Choosing Between Medigap Plan G And Plan N 65medicare Org

Choosing Between Medigap Plan G And Plan N 65medicare Org

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.