Medigap Plan G is a Medicare supplement insurance plan. Once the individual has paid the first 185.

Medicare Supplement Plan G 2020 Updates Coverage And Deductible Youtube

Medicare Supplement Plan G 2020 Updates Coverage And Deductible Youtube

There are a variety of Medigap plans and while any one of them will add an additional expense to your retirement budget they can be well worth it for the.

Is medicare plan g worth it. There is only one difference between the Plan F and Plan G. Medigap Plan G is quickly becoming one of the more common options when it comes to Medigap plans. Each Medicare Supplement picks up the coverage gaps of Medicare a little differently.

With a Plan G all youre on the hook for is that Medicare Part B deductible which is only 203 in 2021. Yes Plan G does offer a stable rate plan that comes with immediate cost savings with the only difference being the 203 Medicare part B deductible. Medicare Supplement Plan G.

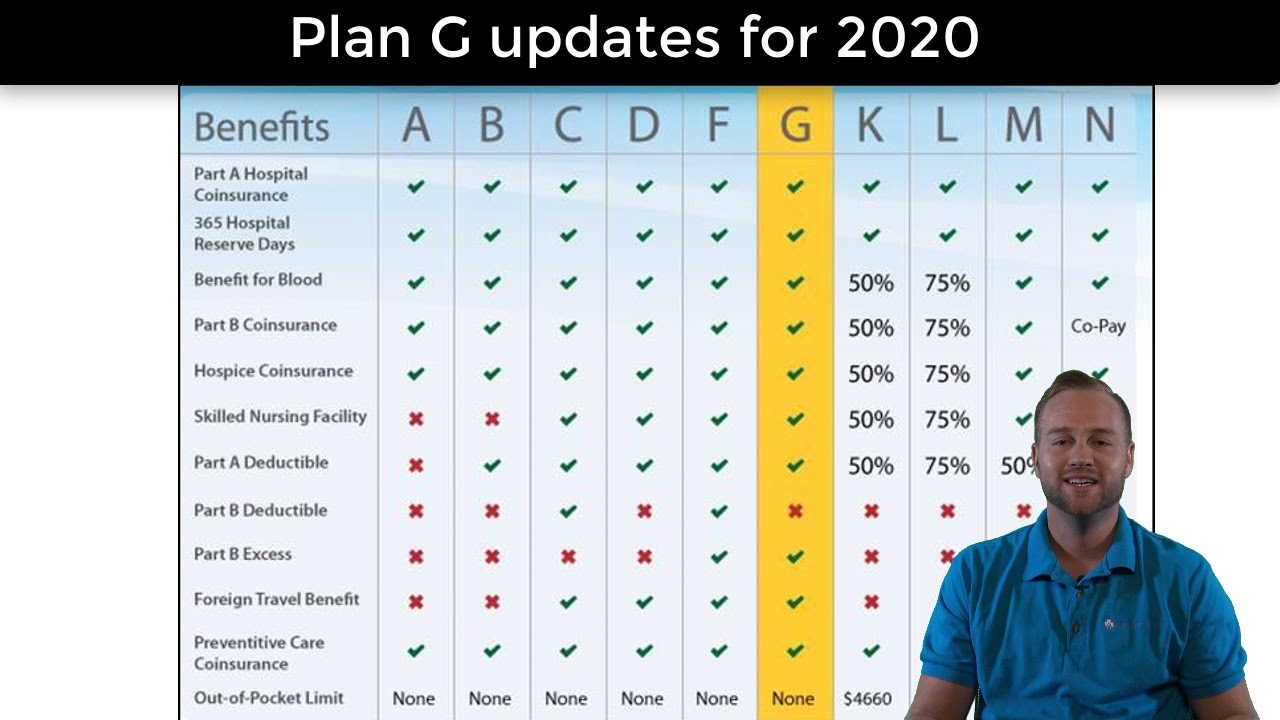

It covers eight of the nine benefits. LinkedIn with Background Education. With the recent announcement of the looming end to Plan F in 2020 many beneficiaries are looking at Medigap Plan G as a comprehensive coverage alternative.

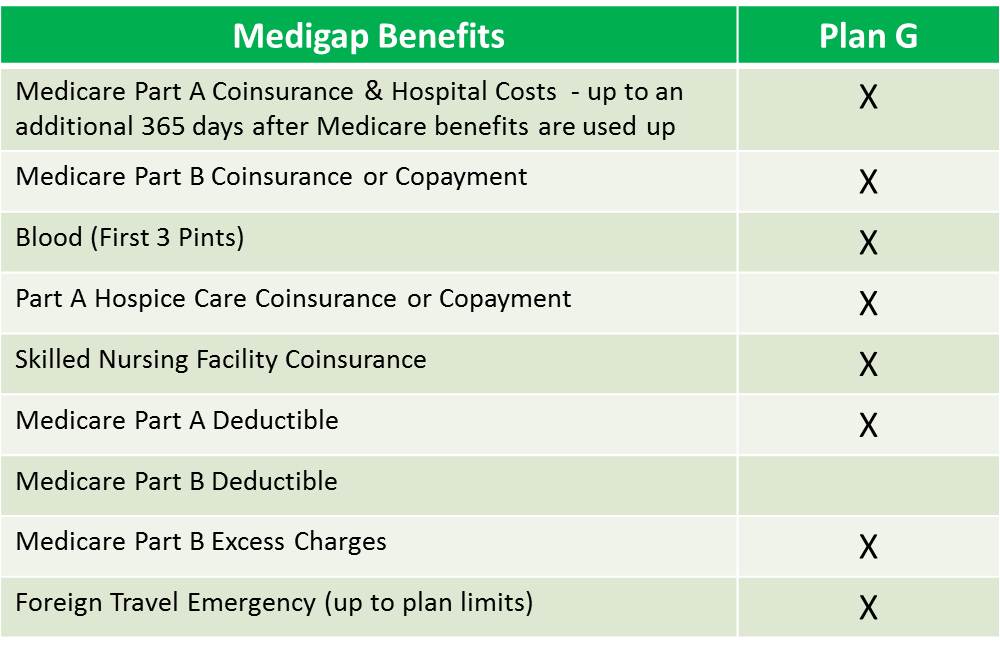

A Medicare Advantage plan may help you lower health costs not covered by Medicare but there are definite tradeoffs compared to classic MedicareMedigap. Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used. This means it cover inpatient hospital stays and care and outpatient medical services.

This deductible is currently 2021 203year. Plan F is the only plan that offers more However more coverage generally means higher premiums. Plan G covers everything that Original Medicare Medicare Parts A and B covers.

Your Original Medicare coverage will initially pay for any medical care you need. Plan G offers generous coverage compared to most other Medicare Supplement plans. Medicare supplement Plan G also known as Medigap Plan G is now the most comprehensive Medicare supplement plan health insurance companies offer.

The individual is responsible for the Part B deductible which is 185 in 2019. Good news that deductible is only 203 in 2021. All other coverage gaps left behind by Medicare are paid by Plan G.

Medigap Plan G Company Ratings When youre researching Medigap plans you probably find yourself interested in what companies offer this plan. Plan G has historically been much more stable than Plan F and is one reason Plan F will disappear in the future. To help you determine which coverage you do and dont need.

Medicare Plan G value review. And often Plan G is among the best deals financially. Medicare Supplement Plan G like Plan F offers generous benefits including.

Medicare Plan G can help give you greater cost certainty and protection from high out-of-pocket costs. It covers a variety of expenses that arent covered by Medicare parts A and B such as. Plan G is one notch down from that.

It may be able to save you money as well but you will have to examine your own expenses and needs first and then compare prices on that plan to determine if it is a cost-effective way to go. Plan G is a better a value even for those that believe that they are limiting their out-of-pocket costs by enrolling in the Plan F because it has no deductibles or co-pays for any Medicare-approved healthcare. With Medigap plans you dont have to worry about 4 5 or even 6000 deductibles.

If a company is going to sell Medicare Supplement plans it has to be one or more of the plans listed on this chart. Medicare Plan G provides tremendous value as one of the more affordable Medigap plans offering among the most comprehensive coverage. We rate the value of Medicare Plan G as an A How popular is Medicare Plan G.

The plan can help reduce your out-of-pocket costs. Medicare supplement plan G doesnt cover only one benefit of Medigap that is Medicare Part B deductible 185 for 2019. Plan G in particular covers all the gaps in Medicare with the one exception of the Medicare Part B deductible.

Plan F which typically has higher premiums than Plan G is currently the most popular plan chosen by nearly 60 of Medicare recipients. Now Plan Ga new option for new Medicare enrollees beginning January 1 2020offers the closest available coverage to what was Plan F. What you can expect if you have Plan G.

With a Plan G you have full coverage after the Medicare Part B deductible. Medicare Supplement Plan G is going to save a lot of seniors money on their healthcare. You will only pay the annual Medicare Part B deductible.

If you have Medicare supplement plan G you can expect to be covered in almost all of the out-of-pocket expenses from Original Medicare. Then Plan G will kick in and pay the rest of the bill once your annual deductible is met. Does the G plan offer a stable rate year after year.

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medigap Benefits Medicare Supplement Plan G Love Photos Cool Photos Medicare Supplement Plans

Medigap Benefits Medicare Supplement Plan G Love Photos Cool Photos Medicare Supplement Plans

Medigap Plans F G N Going Away Medicare Plan Saver

Medigap Plans F G N Going Away Medicare Plan Saver

Medicare Plan G Review Medicare Nationwide

Medicare Plan G Review Medicare Nationwide

Medicare Supplement Plan G The Better Value Plan

Medicare Supplement Plan G The Better Value Plan

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medigap Plan G Medicare Supplement Plan G 65medicare Org

Medicare Plan F And G Which Is Best In 2020 Senior Healthcare Direct

Medicare Plan F And G Which Is Best In 2020 Senior Healthcare Direct

Medigap Plan G An Alternative To Medicare Supplement Plan F Medicare Supplement Experts Since 1981 Securecare65

Medigap Plan G An Alternative To Medicare Supplement Plan F Medicare Supplement Experts Since 1981 Securecare65

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Supplement Plan G Medigap Plan G Freemedsuppquotes

Medicare Plan G What You Need To Know Ensurem

Medicare Plan G What You Need To Know Ensurem

Medigap Plan G Tupelo Ms Bobby Brock Insurance

Medigap Plan G Tupelo Ms Bobby Brock Insurance

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.