What Is a Health Savings Account HSA. Instead they are a remarkable insurance alternative that offer savings of up to 50 of monthly healthcare costs.

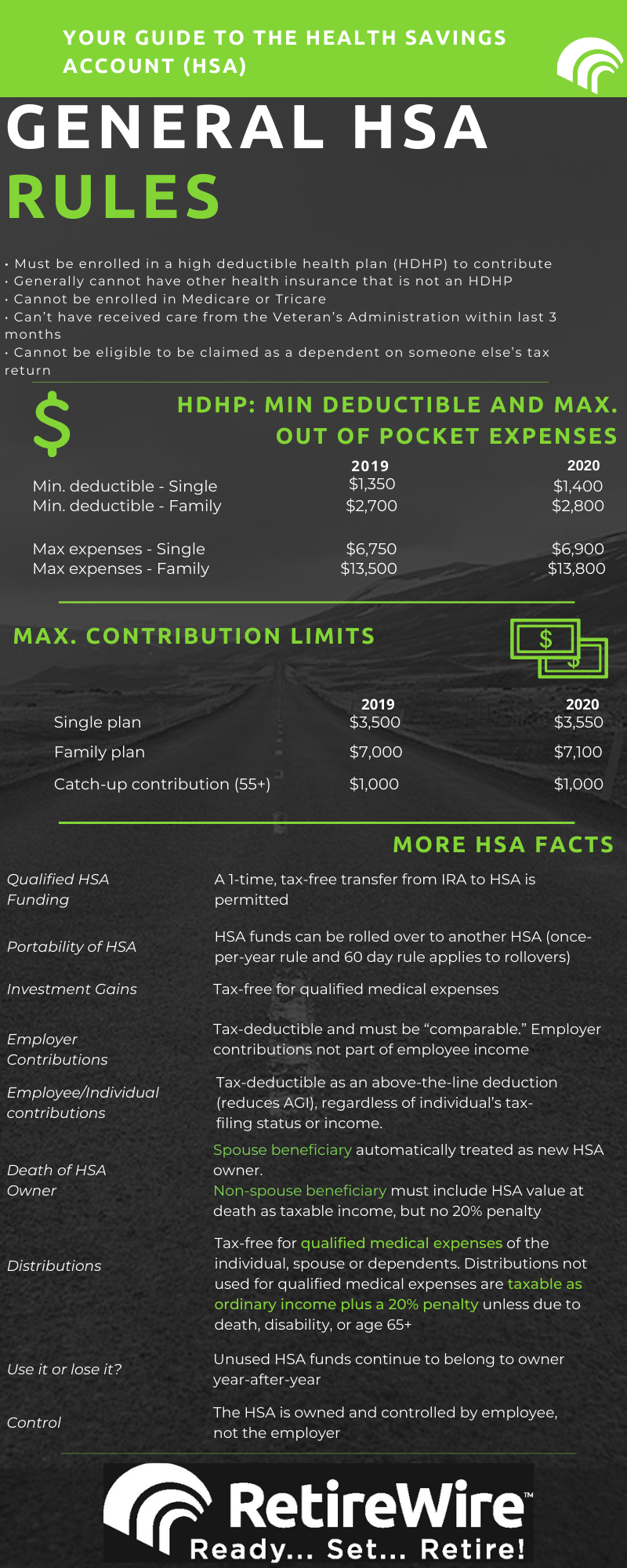

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

How Does An Hsa Work The 2020 Hsa Rules Strategy Retirewire

It seems that an HSA would be most appealing to an individual or family that has relatively modest medical care expenses can afford a high-deductible medical plan and could take advantage of the substantial tax benefits of a health savings account.

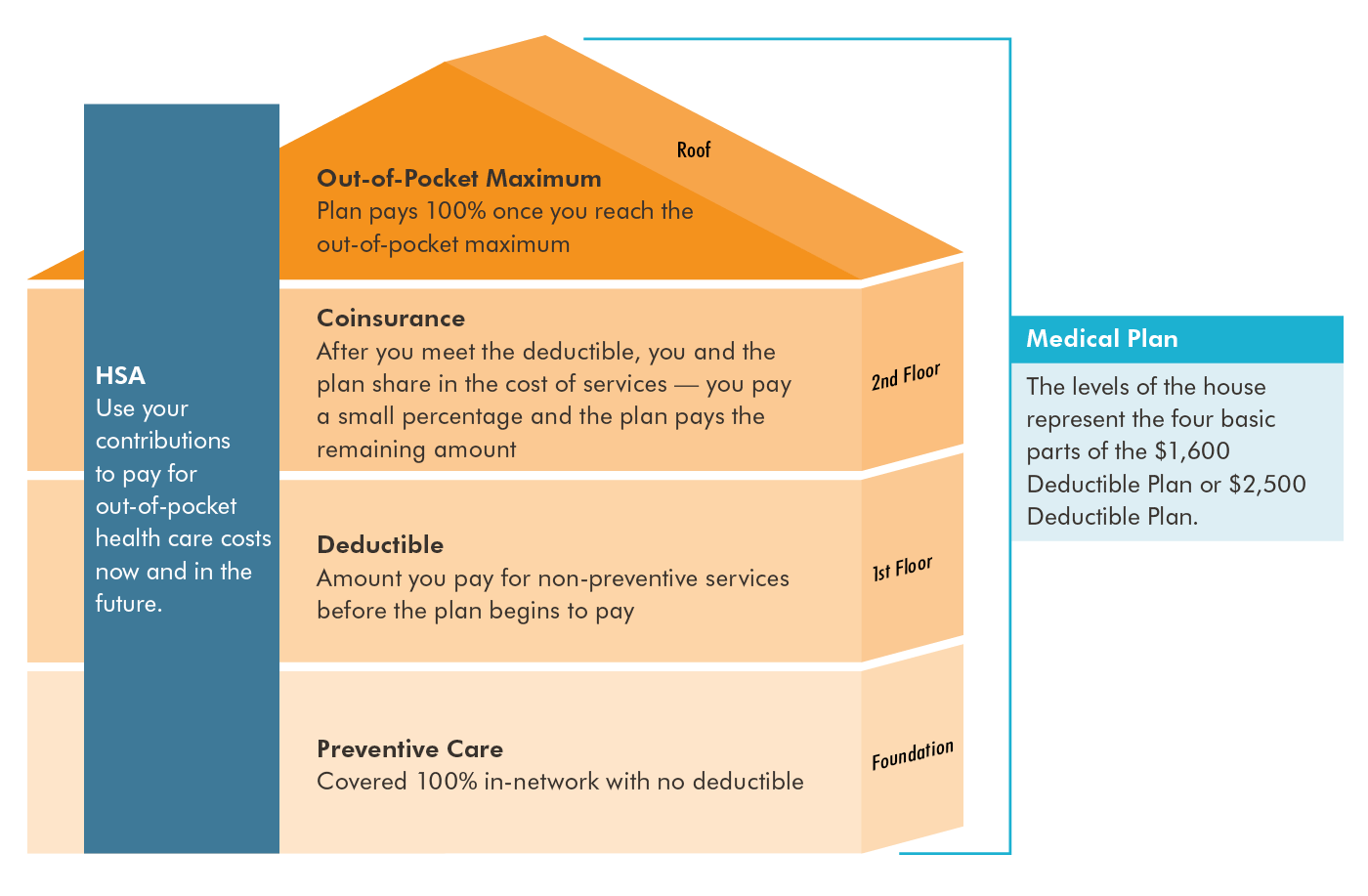

Hsa medical plan. While you can use the funds in an HSA at any time to pay for qualified medical expenses you may contribute to an HSA only if you have a High Deductible Health Plan HDHP generally a health plan including a Marketplace plan that only covers preventive services before the deductible. You must be enrolled in a high deductible health plan HDHP. Those Deductible and medical expenses for you and your family.

If you enroll in an HDHP you may pay a lower monthly premium but have a higher deductible meaning you pay for more of your health care items and services before the insurance plan pays. If you cover yourself and one or more family members you must pay the entire family. Health Savings Account Any previously allocated funds remain yours and can be spent on qualified medical expenses.

The Health Savings Account HSA Plan combines a high-deductible. HSAs and high-deductible health plans were created as a way to help control health care costs. The lowdown on HSAs.

In 2016 3365 of the 4058 plans 83 on the federal exchange had deductibles greater than 1300. To be eligible to open an HSA you must have a special type of health insurance called a high-deductible plan. A CDHP is a high-deductible health plan HDHP with a health savings account HSA.

The health plan passes through a portion of the health plan premium as a deposit to the HSA. Contributions If your plan is HSA eligible you can contribute the singlefamily amount for that year. Youre allowed to contribute to one only if.

Start with health care cost sharing Hundreds of thousands of Americans are already signed up for. However you arent allowed to make new contributions to your HSA when youre not enrolled in a HDHP. A health savings account also known as an HSA is a tax-exempt savings account that when paired with a qualified high-deductible health plan QHDHP can be used to pay for certain medical expenses.

A Health Savings Account HSA is a tax-advantaged account created for or by individuals covered under high-deductible health plans HDHPs to save for. Also known as Health Care Sharing Ministries HCSMs or medical cost sharing these plans are not actually insurance. Many employers offer such plans as well as HSAs to.

One benefit of an HSA is that the money you deposit into the account is not taxed. Funds deposited are not taxed nor are withdrawals for qualified expenses. Eligibility for an HSA.

At the same time a tool that could soften the blowthe Health Savings Account HSA which allows people to pay many of their health care costs with tax-deductible dollarsis not available to most Americans with high-deductible plans. Health Savings Account HSA Health Savings Accounts HSAs are available to members who enroll in a high deductible health plan HDHP are enrolled in Medicare or another health plan and are not claimed as a dependent on someone elses Federal tax return. What is a Health Savings Account HSA.

For plan year 2019 the minimum deductible is 1350. Not just anyone can open an HSA. You must be enrolled in this High Deductible Health Plan HDHP You are not covered under any other health plan that is not a HSA qualified HDHP separate vision.

If you combine your HDHP with an HSA you can pay that deductible plus other qualified medical expenses using money you set aside in your tax-free HSA. Or you may save this money in Your HSA account to use for medical expenses at a later date. If you leave a HDHP while you have an HSA you can still spend the funds or use them to reimburse yourself for qualified medical expenses until you empty the account.

CDHPs offer lower premiums a higher medical deductible and a higher medical out-of-pocket limit than most traditional health plans. It is important for each employee to compare an HSA to other medical plan options. 9 rijen HSA Medical Plan.

What is a consumer-directed health plan CDHP. A health savings account or HSA plan is a tax-advantaged account you use to save for health expenses. And not just any HDHP is HSA qualified.

Why were health savings accounts created. A Health Savings Account HSA can help people with high-deductible health insurance plans cover their out-of-pocket costs. Just as the name implies a health savings account HSA is a financial account designed to help you save for qualified health care expenses.

Contributions to HSAs generally arent subject to federal income tax and. To qualify for an HSA you must have a high deductible health plan with a deductible over 1400 for an individual or 2800 for a family.

Choosing The Right Medical Plan Human Resources Purdue University

Choosing The Right Medical Plan Human Resources Purdue University

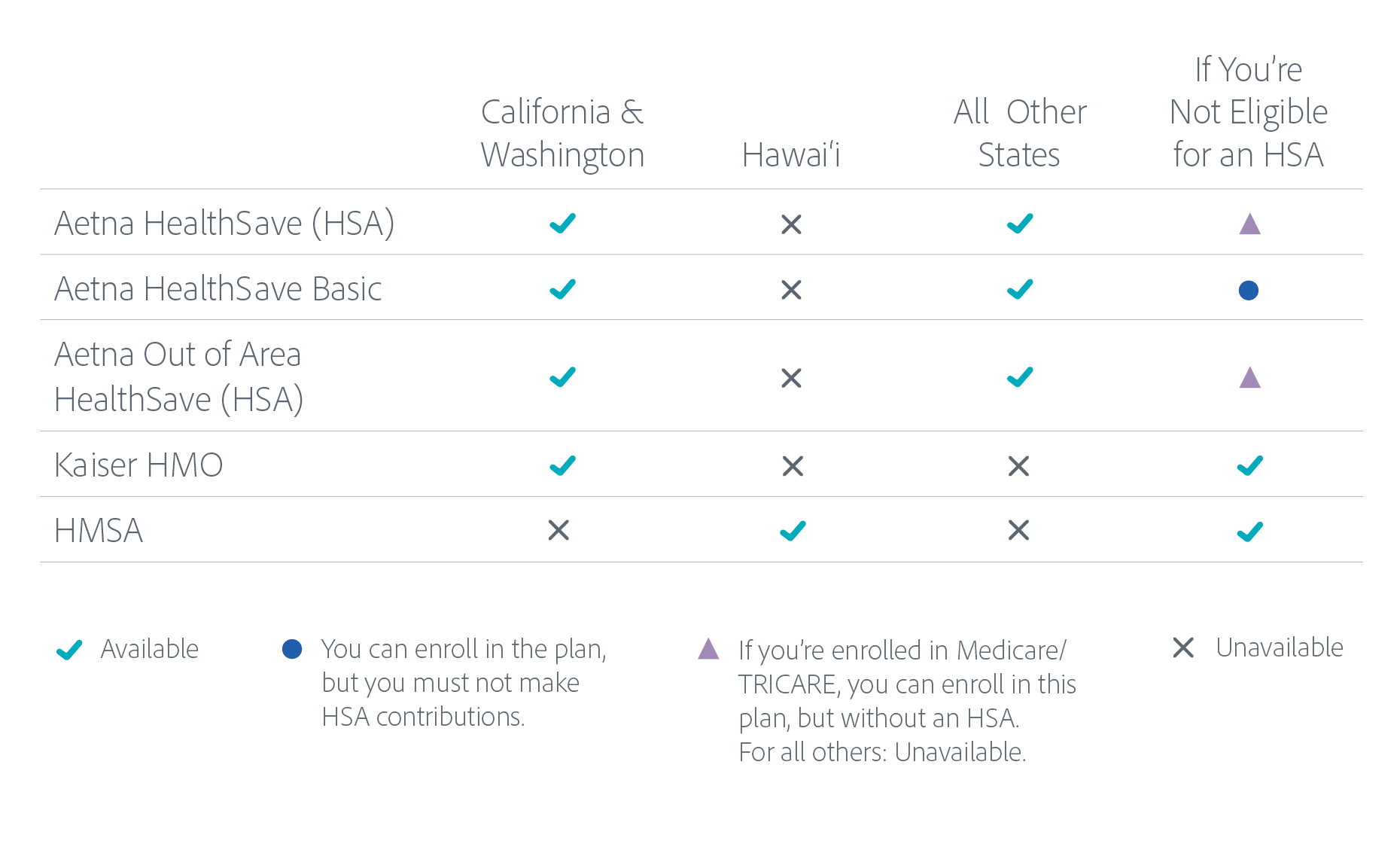

Choosing A Medical Plan Adobe Benefits

Choosing A Medical Plan Adobe Benefits

Hsa Vs Ppo Motivhealth Insurance Company

Hsa Vs Ppo Motivhealth Insurance Company

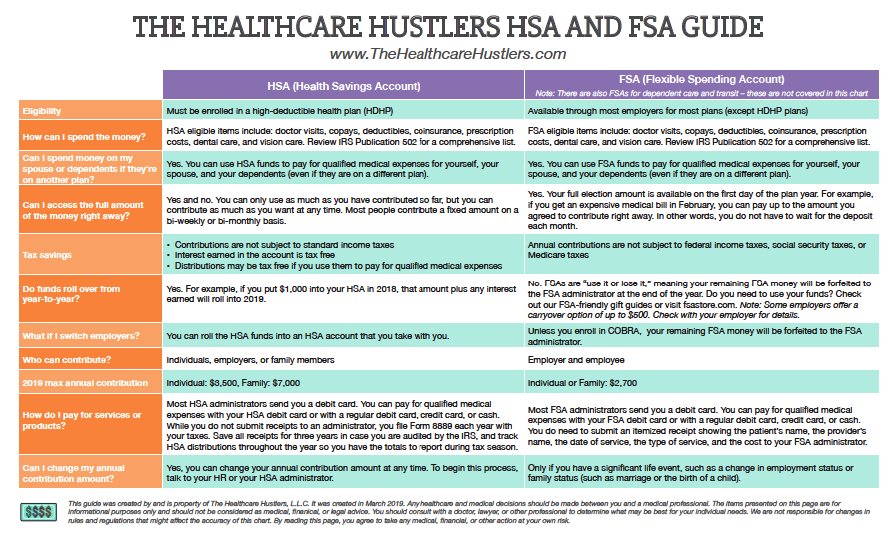

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Hsa Vs Fsa What Is The Difference The Healthcare Hustlers

Retirement Health Savings Account And Medicare

Retirement Health Savings Account And Medicare

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Health Savings Account Habits Fidelity

Health Savings Account Habits Fidelity

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

Best Hsa Health Insurance Plans In California Hsa Insurance Plans Ca

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.