Grandfathered plans are not required to. Grandfathered Health Plan An individual health insurance policy purchased on or before March 23 2010.

What Is A Grandfathered Health Insurance Plan

These plans are referred to as grandfathered Recently the three agencies charged with administering the Act HHS DOL and Treasury have issued clarification as to what exactly a grandfathered plan is and the various changes made by health.

What is a grandfathered health plan. You can longer purchase grandfathered plans but you are individuals are able to keep them as long as they would like. If an insurance company decides to stop offering a grandfathered plan it must provide notice 90 days before the plan ends and offer other. Health plans are free to increase the number and type of benefits offered make changes to comply with state or federal regulations voluntarily adopt other consumer protections of the ACA and make modest adjustments in benefits cost-sharing and premiums.

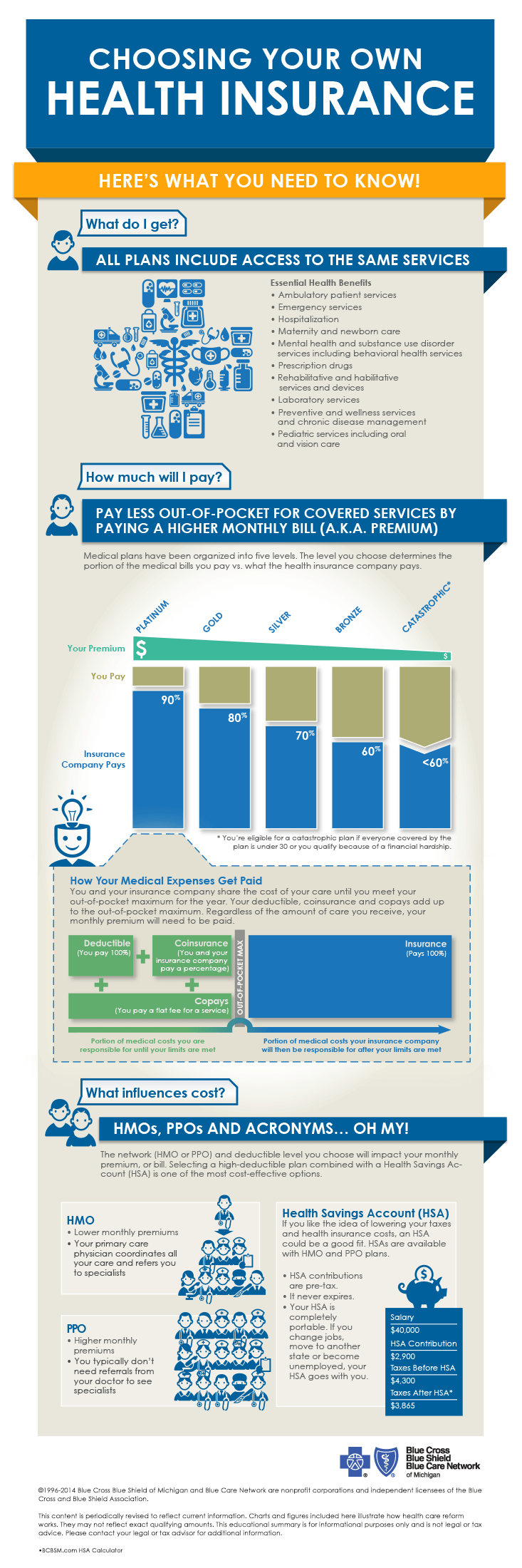

What is a grandfathered health plan. What are the benefits to an employer of having a grandfathered health plan. The Affordable Care Act requires health policies to cover more services.

The final rule reaffirmed that grandfathered status applies separately with respect to each benefit package. Under recently issued interim federal regulations a plan must have continuously covered someone since March 23 2010 in order to be grandfathered. If a plan is grandfathered they will be exempt from some but not all of the new rules under PPACA.

If so you have what is known as a grandfathered health insurance plan 1 Grandfathered plans may be job-based obtained through your employer or individual obtained in the private market. But health plans lose grandfathered status if they make any of the following changes. Grandfathered plans are health insurance plans that were already in effect as of March 23 2010 when the Affordable Care Act was signed into law.

A grandfathered status plan might not include certain benefits or consumer protections that non-grandfathered plans are required to include. Generally grandfathered plans do not have to comply with most of the new provisions under the insurance market reform rules including the requirement to offer preventive health without cost sharing. These plans have a grandfathered status and dont have to follow ObamaCares rules and regulations or offer the same benefits rights and protections as new plans.

Grandfathered health plans under the Affordable Care Act ACA are those existing without major changes to their provisions since March 23 2010 the date of the ACAs enactment. Do you have an individual health insurance policy that was initially purchased on or before March 23 2010the day the Affordable Care Act ACA was signed into law. It can also refer to individual plans that were purchased prior to this date.

This is because the status of the plan depends on the company not on the individual. Cant newly enroll people after March 23 2010 and have that new enrollment considered a grandfathered policy. Grandfathered plans are health plans that were in place before March 23 2010 when the Affordable Care Act was signed into law.

Grandmothered plans are individual and small-group health plans that took effect after the Affordable Care Act was signed into law in March 2010 but before the exchanges opened for business in October 2013 in some states grandmothered plans include plans that were issued as late as the end of 2013. Grandfathered plans are plans that were purchased before March 23 2010. What Grandfathered Means.

Cover preventive care for free cover essential health benefits guarantee a members right to appeal a coverage or claims decision comply with the ACAs rate review process for premium increases end yearly benefit caps on essential health benefits in the. Employees who are hired and join the health plan after March 2010 will still be covered by a grandfathered health plan. If the company has a grandfathered plan all new hires and their families will automatically be enrolled in that plan.

Grandfathered plans are group health plans or health insurance coverage that were in existence on March 23 2010 and have not undergone certain prohibited design changes since then. A grandfathered health plan is any health insurance plan that was put together before March 23 2010. They may not include some rights and protections provided under the.

But insurance companies can continue to offer the grandfathered plans to people who were enrolled before that date. Of grandfathered health plans to exclude children under age 26 who were eligible for other group health plan coverage and rules that provided a special enrollment period for children under age 26 who had been excluded from coverage. A grandfathered health insurance plan means that the plan does not have to follow the national healthcare reform guidelines implemented by our federal government as part of the Patient Protection and Affordable Care Act ACA in March 2010.

There are two types of grandfathered health insurance plans. A grandfathered plan is a health plan that was in existence on the date PPACA was passed March 23 2010. These plans werent sold through the Marketplace but by insurance companies agents or brokers.