You have through August 15 2021 to enroll in or change 2021 health. A key difference here though is that you can also withdraw the money tax-free as long as you use it to pay for qualified medical expenses.

5 Things To Know About Health Savings Accounts Thinkhealth

New lower costs on Marketplace coverage available now.

Health insurance savings plan. The HSA plan is similar but must be used only for qualifying medical expenses. One benefit of an HSA is that the money you deposit into the account is not taxed. A part of the premium is used for the insurance which covers an individual just as a medical insurance does.

Many of us buy health insurance just to save tax under section 80 D. You must be enrolled in a high deductible health plan HDHP. Health savings plan HSA offers you health insurance.

Nevada Health Link Announces Health Insurance Savings Through the American Rescue Plan Act April 16 2021 By Abbi Whitaker Leave a Comment Nevada Health Link the online health insurance marketplace operated by the state agency the Silver State Health Insurance Exchange Exchange is offering even bigger coverage savings to eligible. Contributions to HSAs generally arent subject to. Employees invest in a tax-free medical savings account while employed by a Minnesota public employer including a city state county school district or governmental subdivisions.

If more than one family member is covered no family member will receive benefits other than preventive benefits until the family deductible is met. Not just anyone can open an HSA. Remember dont just choose the plan that is the cheapest find the one that works best for you and your family.

A health savings account or HSA lets you put aside money for medical expenses while taking a tax deduction for the contributions you make to the account. If youve been enrolled in a traditional health insurance plan it might feel like a big difference but it can save you thousands each year. Health Savings Account HSA A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses.

With a FSA plan you can save money tax-free for health insurance deductibles and other health-related expenses. The Savings Plan is a high deductible plan and has individual deductibles and family deductibles. You may choose to apply the funds in these plans to insurance deductibles and enjoy the benefits of lower insurance premiums with a high-deductible plan.

Just as the name implies a health savings account HSA is a financial account designed to help you save for qualified health care expenses. In a nutshell a health savings account lets you contribute money on a pre-tax basis and your money gets the chance to grow tax-free until you use it for qualified healthcare expenses. The Health Insurance Plans provide financial support for health related emergencies It helps meet various health insurance needs be it based on the life stage of.

While you can use HSA money to pay for a variety of medical and dental services and procedures you generally cant use it to pay premiums for health insurance. The lowdown on HSAs. Prescription benefits are included with Savings Plan coverage.

And not just any HDHP is HSA. You not your employer or insurance company own and control the money in your HSA. A health insurance plan helps you save tax upto 75000.

For people who are not aware of health savings account should first get an idea of what a health savings account is. You get to deduct contributions to an HSA just like you would contributions to a 401 k or IRA. Health savings accounts HSAs are like personal savings accounts but the money in them is used to pay for health care expenses.

You must also get a health insurance plan for your parents spouse and kids to ensure. 4 Zeilen What is a Health Savings Plan. The Health Care Savings Plan HCSP administered by Minnesota State Retirement System MSRS is an employer-sponsored program authorized by Minnesota State Statute 35298.

Get yourself a health insurance plan that helps you during critical times and helps in saving finances in the long run. By using untaxed dollars in a Health Savings Account HSA to pay for deductibles copayments coinsurance and some other expenses you may be able to lower your overall health care costs. This account is premium based.

It is a savings account that is designated for medical requirements of the individual. A Health Savings Account HSA can help people with high-deductible health insurance plans cover their out-of-pocket costs. However there is a lot more beyond saving taxes.

An HSA is an account that you can deposit money into for the express purpose of saving for medical expenses. Switching from traditional health insurance to a health sharing plan is always an option. You will pay the full allowed.

There are some exceptions however. You may be eligible for more savings and lower costs on Marketplace health insurance due to the American Rescue Plan Act of 2021 even if you werent before. Health insurance premiums after these new savings will go down.

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

Hsa Compatible High Deductible Health Plans Www Westernhealth Com

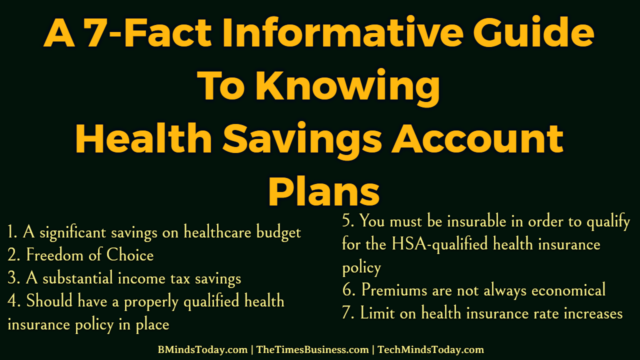

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

A 7 Fact Informative Guide To Knowing Health Savings Account Plans

How Do Hsa Plans Work Is A Health Savings Account Health Plan Right For You New Hampshire Health Insurance Blog

How Do Hsa Plans Work Is A Health Savings Account Health Plan Right For You New Hampshire Health Insurance Blog

Health Savings Accounts Allied Insurance Advisors Llc

Health Savings Accounts Allied Insurance Advisors Llc

The Pros And Cons Of A Health Savings Account Hsa

The Pros And Cons Of A Health Savings Account Hsa

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Flexible Spending Accounts Fsa Vs Health Savings Accounts Hsa

Health Savings Account Hsa Plans California

Health Savings Account Hsa Plans California

To Find The Right Insurance Plan You Ll Need To Know The Terminology And Figure Out Your Ne Health Savings Account Health Insurance Plans Best Health Insurance

To Find The Right Insurance Plan You Ll Need To Know The Terminology And Figure Out Your Ne Health Savings Account Health Insurance Plans Best Health Insurance

The Power Of The Health Savings Account Hsa Mark J Kohler

The Power Of The Health Savings Account Hsa Mark J Kohler

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.