Lets take a look at what Plan F covers. Plan F covers the Part A deductible in full no matter how many times you may be admitted for inpatient care in same year.

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

It also covers physician services speech and physical therapy durable medical equipment diagnostic tests supplemental Medicare coverage for skilled nursing facility care home health care approved services and hospice care.

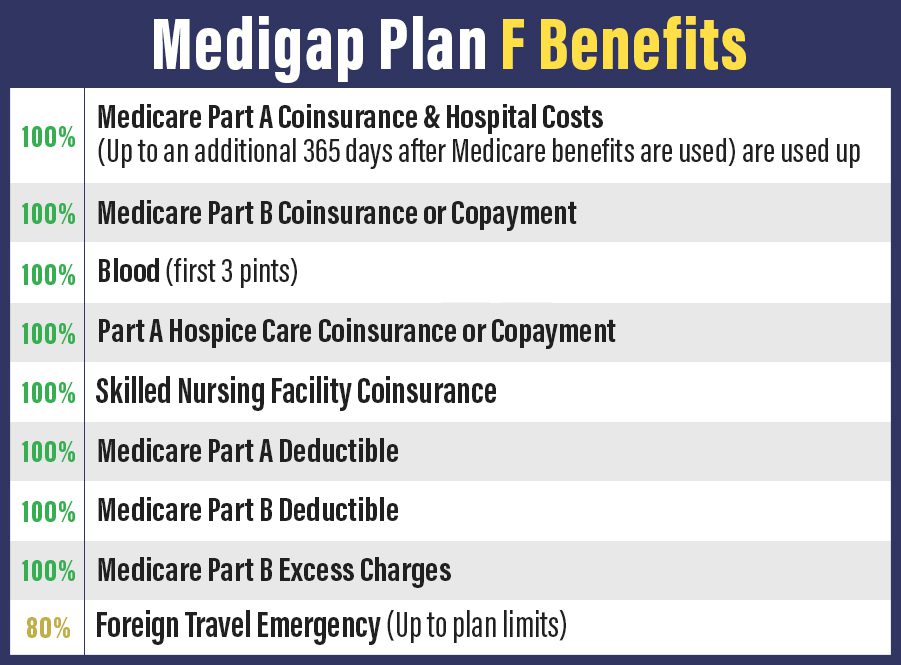

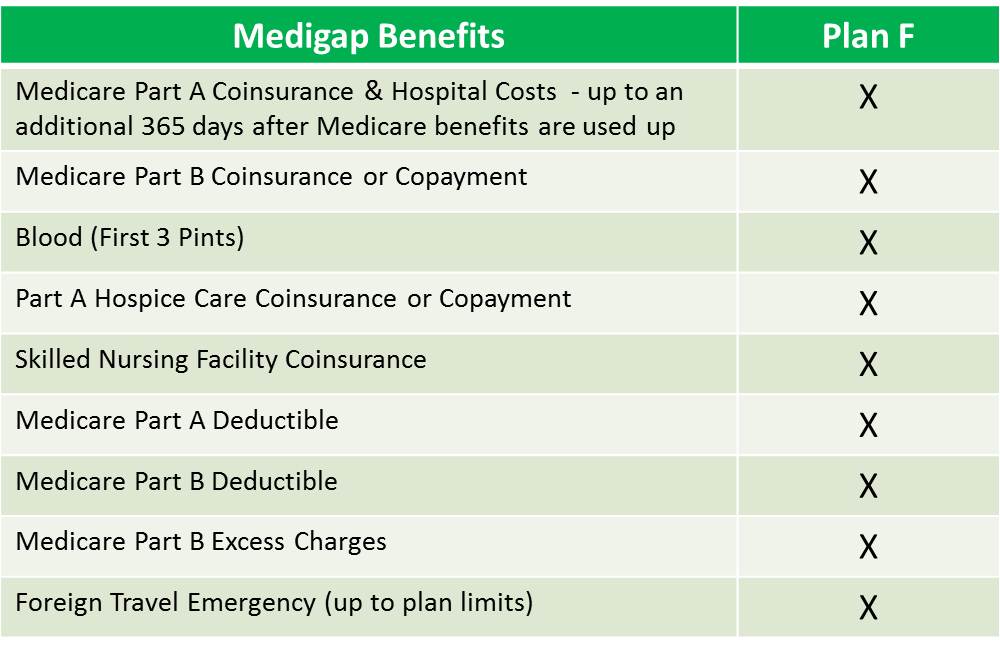

What does plan f cover on medicare. Plan F covers the 20 of Medicare-approved hospital expenses not covered under Part A. Its the most extensive of all plans offered but be warned its going away. These can include deductibles copayments and coinsurance.

Medicare Part B beneficiaries have to pay a deductible of 203 per year in 2021 before Part B benefits kick in. Plans E H I and J are no longer sold. In other words a Plan F Medicare Supplement covers all of the gaps in Original Medicare and adds coverage when you travel.

In cases where service costs exceed 250 this plan covers. High-deductible Medigap Plan F provides coverage for. When compared against other plans Plan F offers extensive coverage for out-of-pocket medical costs.

Plan F also covers the cost of hospice care adding to coverage that Medicare Part A provides. Part A hospice care copayments and coinsurance. Medicare Plan F is a supplementary insurance policy also known as Medigap.

Even though Medicare Supplement Plan F provides the most comprehensive basic benefits for Original Medicares out-of-pocket costs it would generally not cover acupuncture. Medicare Plan F covers many of the cost gaps in Medicare Part A and Part B. If you receive a medical treatment that Medicare does not.

Part A deductible coinsurance and any hospital costs. Medicare Supplement Plan F only covers services that are covered by original Medicare parts A and B. If you have been shopping for a Medicare Supplement also known as Medigap insurance plan you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs.

Part A hospital deductible and coinsurance Hospital costs up to an additional 365 days after Medicare benefits are exhausted Part A Hospice care coinsurance or copayment. This means that Medicare Supplement Plans C and F will no longer be available to new Medicare enrollees. In terms of benefits the high deductible Plan F option offers the exact same coverage as the standard Plan F version once you meet the deductible.

Medigap Plan F is the most comprehensive Medicare Supplement plan. In fact Medigap Plan F is the only Medigap policy that provides coverage for all nine basic benefit areas. This post has been updated for 2021.

People who have Original Medicare otherwise. These can include deductibles copayments and. Plan F also helps you with nursing care costs.

As mentioned Medicare Supplement Plan F offers the broadest coverage of all of the standardized Medigap plan offerings Plans A-N. The plan works alongside Original Medicare to cover out-of-pocket costs. Medicare Supplement Plan F may eventually leave the market starting in 2020 but not for everyone.

Medicare Supplement Plan F has also been the 1 seller with Baby Boomers for many years. As of January 1 2020 people new to Medicare cant buy plans that cover the Medicare Part B deductible. Many people refer to Plan F as Medicare Part F or Medigap Part F.

Plan F also covers other costs such as. Medicare Supplement Plan F covers the Part B deductible in full. Plan F will over the coinsurance on this end-of-life care helping with an essential service that many seniors need at some point and minimizing the cost of care for themselves and for their families.

Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or co-payment First three pints of blood. Part B deductible coinsurance and copayments. Medigap Plan F may cover.

Also referred to as Medicare Supplement Plan F it covers both Medicare deductibles and all copays and coinsurance leaving you with nothing out-of-pocket. Blue Cross Medicare Supplement Plan F includes supplemental Medicare coverage for medical services covered in Part B including outpatient and medical services in or out of the hospital. Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment.

Part A coinsurance and hospital costs for an extra 365 days beyond what Medicare covers. The correct name is plain old Plan F.

Medigap Plan F Tupelo Ms Bobby Brock Insurance

Medigap Plan F Tupelo Ms Bobby Brock Insurance

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan F The Most Common And Comprehensive Plan

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Supplement Plan G Medicare Part G An Illustrated Guide To Medicare Part G

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Vs Plan G Vs Plan N Medicare Nationwide

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

What Is Medicare Supplement Plan F Gomedigap

What Is Medicare Supplement Plan F Gomedigap

Comparing Medicare Supplement Plan F G Medicarehaven Com

Comparing Medicare Supplement Plan F G Medicarehaven Com

What Does Plan F Cover Medicare Plan F Coverage

What Does Plan F Cover Medicare Plan F Coverage

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Supplement Plan F 7 Essential Facts You Must Know Clear Medicare Solutions

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.