Some people may initially enroll in a Medicare Supplement plan and then decide to try a Medicare Advantage plan for the first time at age 68. The AEP runs from October 15 through December 7 of each year.

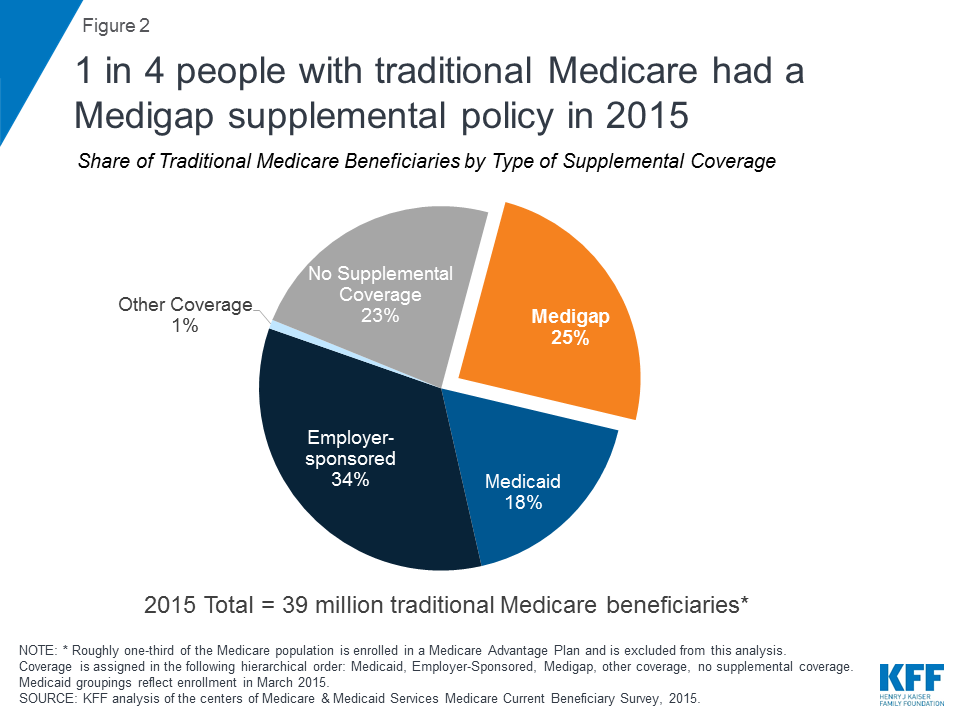

Medigap Enrollment And Consumer Protections Vary Across States Kff

Medigap Enrollment And Consumer Protections Vary Across States Kff

If you qualify for Medicare because of a disability your Initial Enrollment Period for a Medicare Advantage plan will consist of a 7-month period that begins three months before your 25th month of receiving disability benefits includes your 25th month of receiving benefits and continues for another three months after your 25th month of receiving benefits.

Trial period medicare advantage plan. Medicare Advantage trial rights work similarly to Medicare Supplement free look period rights but they have different qualifying criteria and a longer time frame associated with them. You can use the Medicare Advantage trial period to test out a Medicare Advantage plan. If you joined a Medicare Advantage plan when you were first eligible for Part A at age 65 you can switch to original Medicare at any time within the first 12 months in that plan.

If it is the first time in an Advantage plan they will have a 12 month Trial Right. The trial period gives you 1 year to see if Medicare Advantage is right for you. You can only use this option once so think it through.

During the first three months of your Medicare coverage you can drop your MA plan and return to original Medicare or switch to a different Medicare Advantage plan. In fact Medicare actually provides two 12-month Medicare Advantage plan trial periods allowing you to return to a Medicare Supplement policy with guaranteed issue rights no medical underwriting - and depending on where you live your state may provide additional guaranteed issue rights for joining a Medicare Supplement. During this 12-month window you have a SEP that allows you to disenroll from your first Medicare Advantage plan and go.

If you dont cancel your plan before that trial period you will lose the chance to exercise your trial rights and you may be subject to medical underwriting. The annual enrollment period and the Medicare Advantage open enrollment period. If youre new to Medicare youll get a grace period for testing out your new Advantage plan.

Trial Rights Can Be Used in One of These Two Situations. If they are dissatisfied they can disenroll from drop out of the plan anytime during that period prior to the one-year anniversary of the effective date. What you can do You can only enroll and disenroll in a Medicare Advantage plan during certain times of the year.

The Medicare Advantage Disenrollment Period MADP is when you can disenroll from a Medicare Advantage plan and return to Original Medicare. This is a one-time offer and its only for brand new enrollees. I have a severe or disabling condition and theres a Medicare Chronic Care Special Needs Plan SNP available that serves people with my condition.

In some cases if you are in your trial right period for a Medicare Advantage Part C plan which is up to 12 months after initial enrollment you also have guaranteed issue rights to purchase a private supplemental health insurance plan during this special enrollment period. There are two times to disenroll from a Medicare Advantage plan. Annual enrollment takes place in the fall from.

If during the first year your coverage needs to be changed or you decide that you want to return to Original Medicare and your previous Medicare Supplement coverage the 12-month trial period lets you do it. Youll have a guaranteed. During the Annual Election Period AEP Medicare Advantage-eligible individuals may enroll in or disenroll from a Medicare Advantage plan.

Under this Medicare Advantage Trial Right scenario you have a right to purchase any Medigap plan available from the company of your choice in your state. It is the one enrollment period that occurs each year. Keep in mind the 12-month trial period for your Medicare Advantage plan.

The Medicare trial period of 12 months allows people to determine whether an Advantage plan works for them while retaining access to Medigap policies. This period occurs every year from January 1 to February 14. They can rejoin Original Medicare and still have a guaranteed issue right to purchase a Medigap policy.

Your chance to drop your Medicare Advantage Plan lasts for 12 months after you join the Medicare Advantage Plan for the first time. Having this 12-month trial period allows you to try the benefits of a Medicare Advantage plan for which you may save money on monthly premium costs. Medicare beneficiaries have a 12-month period to try out a Medicare Advantage plan.

Essentially your clients have a 12-month period to test out a Medicare Advantage plan. If you enrolled in a private Medicare Advantage plan during your ICEP you have a trial period This trial period is a 12-month window.

Medicare Advantage Trial Right Your Get Out Of Jail Free Card Call Keith Murray At 1 888 228 6119

Medicare Advantage Trial Right Your Get Out Of Jail Free Card Call Keith Murray At 1 888 228 6119

How To Get Out Of A Medicare Advantage Plan

How To Get Out Of A Medicare Advantage Plan

Am I Stuck With My Medicare Advantage Plan

Am I Stuck With My Medicare Advantage Plan

Medicare Advantage Trial Rights Explained For Agents Ritter Insurance Marketing

Medicare Advantage Trial Rights Explained For Agents Ritter Insurance Marketing

Gmia Inc Medicare Plan J And Non Credible Pdp Coverage

Medicare Advantage Vs Medigap Medicare Supplement Boomer Benefit

Medicare Advantage Vs Medigap Medicare Supplement Boomer Benefit

Medigap Plan Medicare Advantage Trial Period Terri Yurek Insurance

Medigap Plan Medicare Advantage Trial Period Terri Yurek Insurance

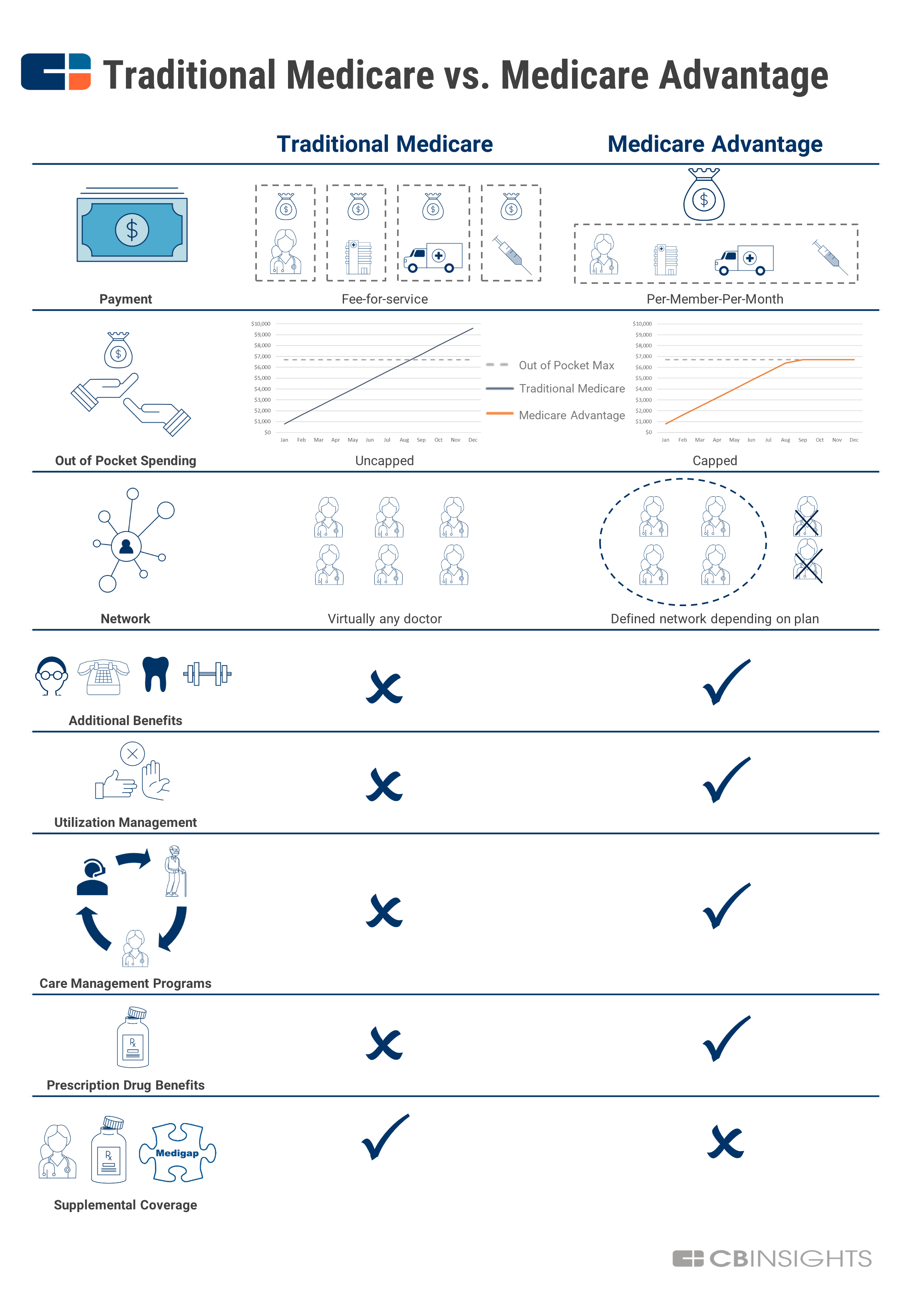

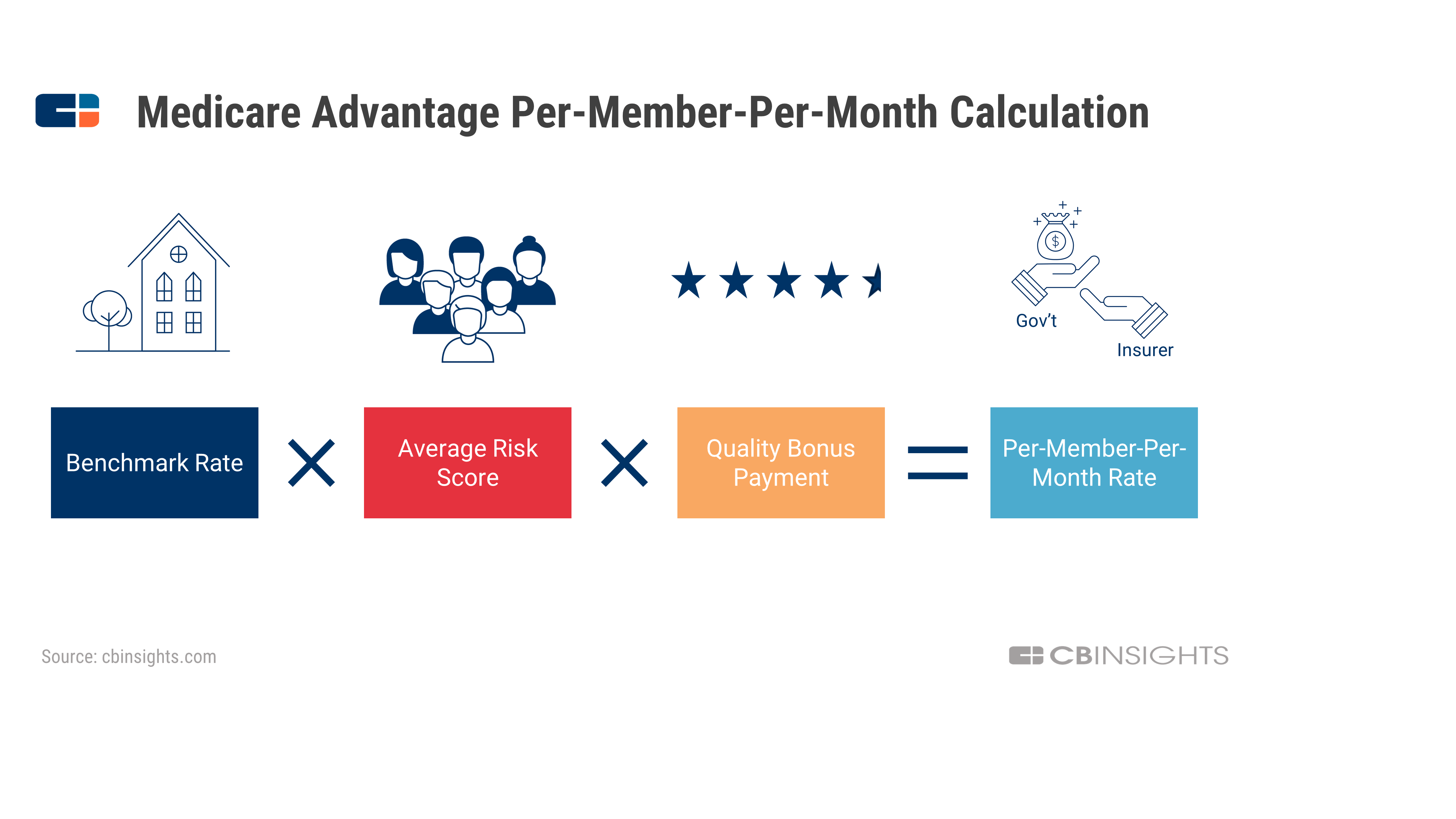

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

Understanding Medicare Advantage Plan Trial Period Youtube

Understanding Medicare Advantage Plan Trial Period Youtube

Guaranteed Acceptance Medi Gap Supplemental Plans Turn 65

Guaranteed Acceptance Medi Gap Supplemental Plans Turn 65

Medicare Advantage Trial Right Your Get Out Of Jail Free Card Call Keith Murray At 1 888 228 6119

Medicare Advantage Trial Right Your Get Out Of Jail Free Card Call Keith Murray At 1 888 228 6119

Medicare 101 What S The Difference Between Original Medicare And Medicare Advantage Health Enews

Medicare 101 What S The Difference Between Original Medicare And Medicare Advantage Health Enews

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

A Simple Guide To Medicare Advantage And Why It S Taking Off Now Cb Insights Research

.jpg?sfvrsn=35193292_4)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.