Model and deductible based on your enrollment record at time of inquiry. Tax-deductible contributions may be made to an organization whose tax-exempt status is subsequently reinstated and that is listed in this Tax Exempt Organization Search as being eligible to receive tax-deductible contributions.

How Do Health Insurance Deductibles Work

How Do Health Insurance Deductibles Work

You wont ever have to write a check or make a payment to your insurer.

How to find my deductible. Part B also comes with a deductible of 203 per year in 2021. The revocation posting date is different from the revocation date displayed on the results page. This interview will help you determine the amount of your standard deduction.

Visit IRSgov click the search icon at the top of the page and enter Get Transcript in the search box to. Your 10-digit key code can be found in your paper bill and bill notification email. Once the deductible is met cost-shares apply.

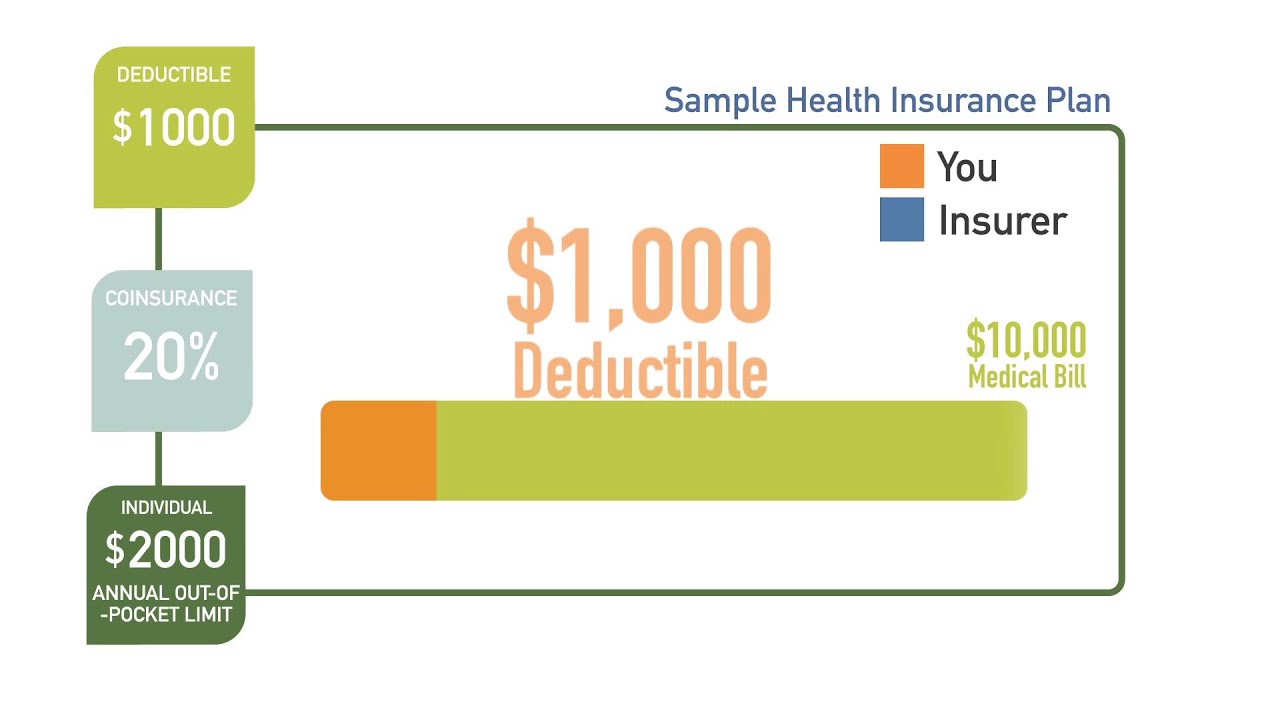

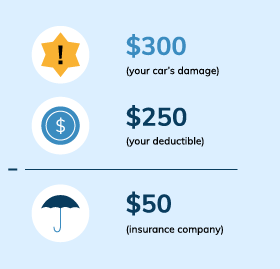

So if you have a claim approved for 5000 and your deductible is 250 your insurance company will issue you a check for 4750. Deductibles must be met before TRICARE benefits are payable. Claim Federal Tax Credits and Deductions.

Track your Medicare Claim Information Online. In most situations a deductible will apply but there are some circumstances in which the deductible may be waived. Once you pay your 203 which is likely to happen after your first or second doctor visit or procedure of the year Medicare pays 80 of the Medicare-approved amount.

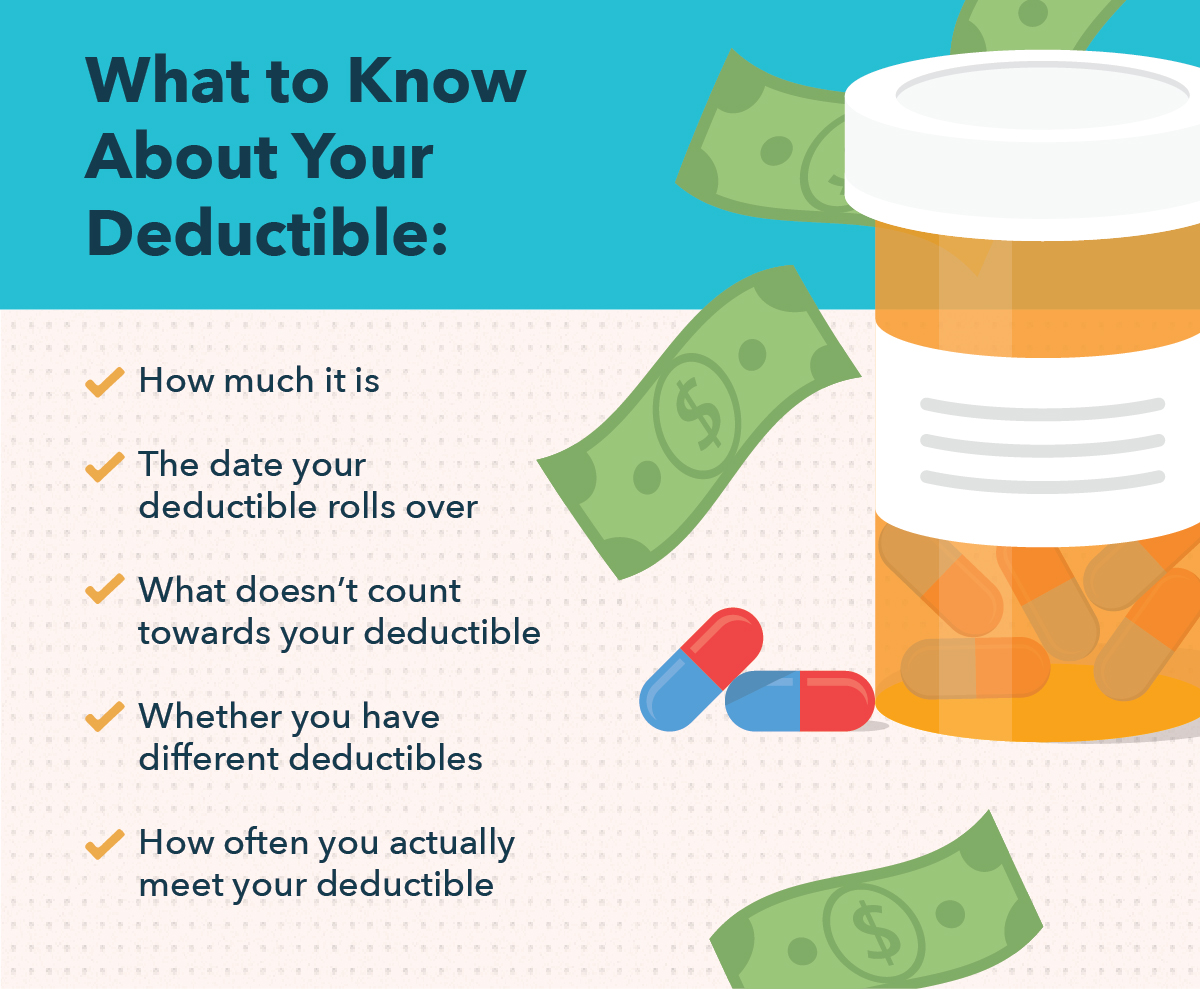

You may also be able to find your deductible amount on your proof of insurance card from the insurer. Annual deductibles apply to network and non-network providers for outpatient services only. Setting Up Your Online Account Can Be Extremely Helpful.

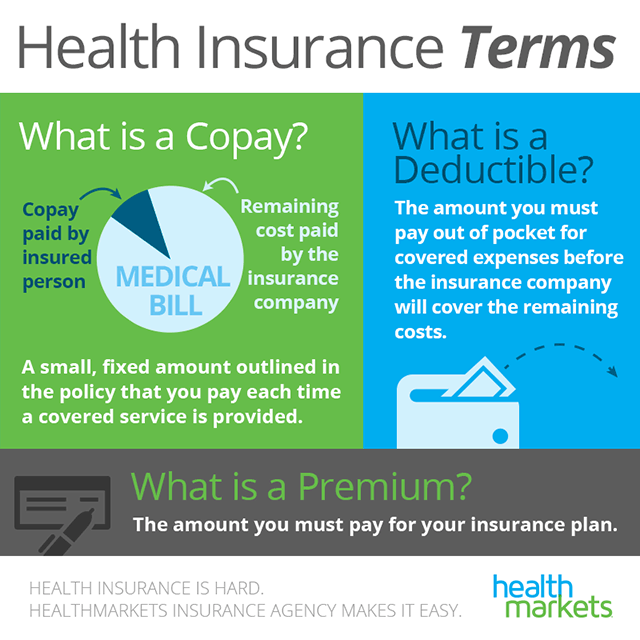

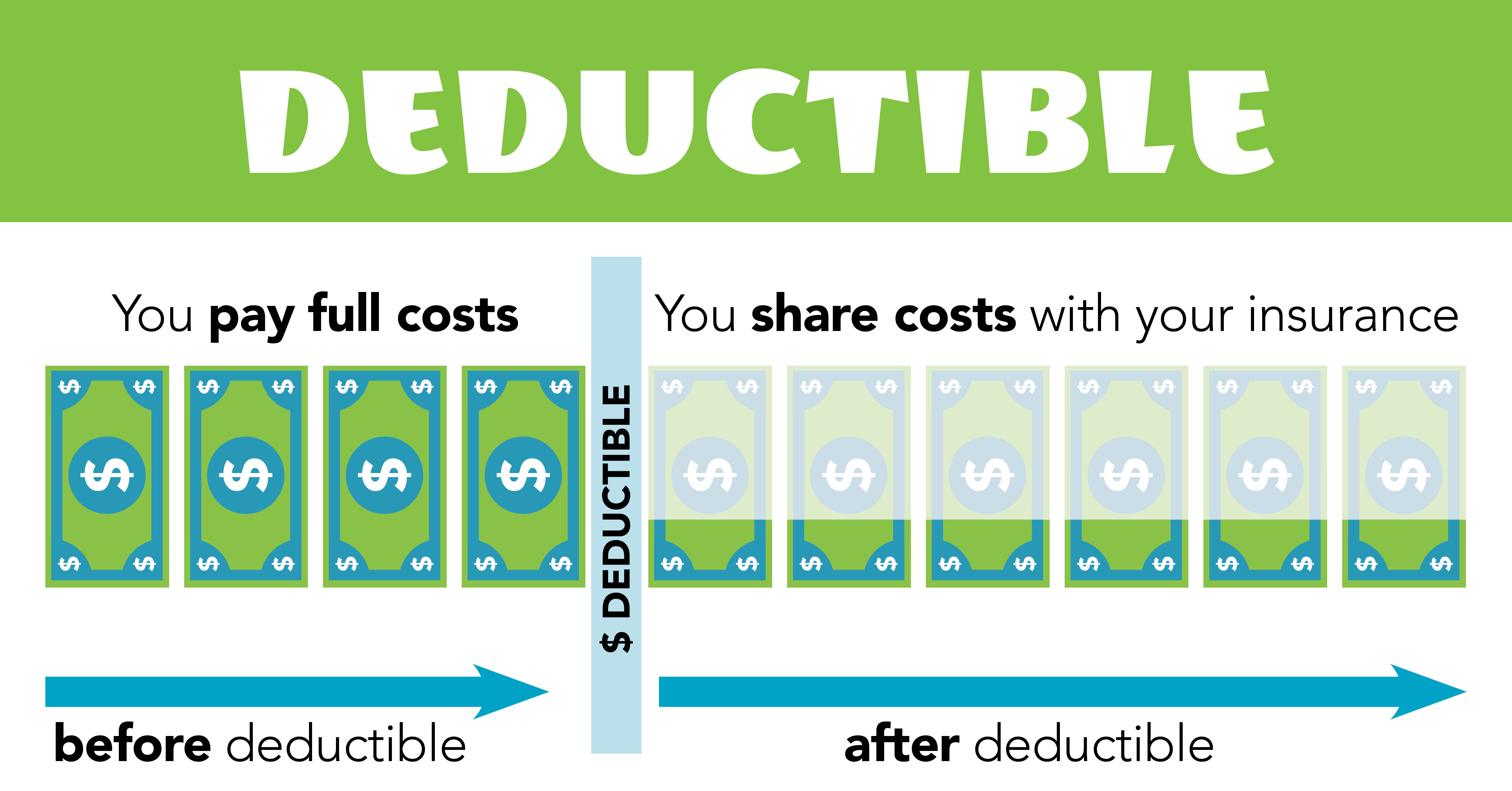

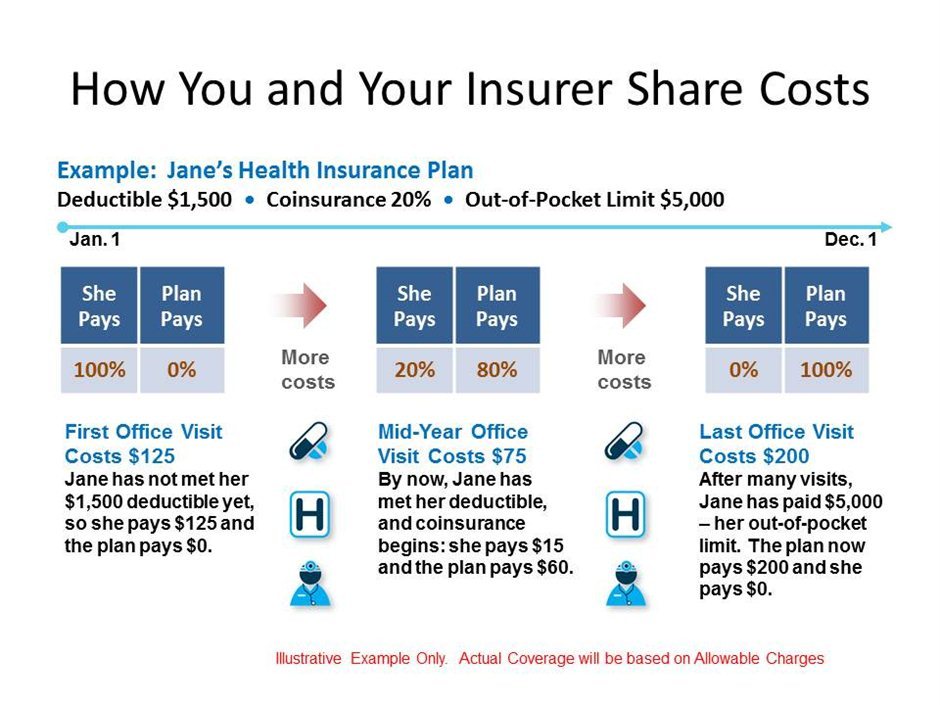

A deductible is the amount you pay for health care services before your health insurance begins to pay. Your deductible automatically resets to 0 at the beginning of your. Find credits and deductions for businesses.

Claim certain credits your tax return and you may be able to get a larger refund while others may give you a refund even if you dont owe any tax. When you dont have to pay your deductible. If you qualify your deductible will be lower and youll pay less each time you get care.

Available online on the web or download the ItsDeductible in the App Store for on-the-go donation tracking. Your insurance company will then start paying for your insurance-covered medical expenses. If all else fails you can call your insurance agent and ask him or her directly about what your current deductible is.

Set Your Deductible For the Lowest Amount You Can Afford. Claim deductions on your. Virtual Chat Is Often an Option.

Unlike Part A your deductible isnt tied to a benefit period or other complicated formulas. If your plans deductible is 1500 youll pay 100 percent of eligible health care expenses until the bills total 1500. Register as a contractor and receive and track income in a secure app with 2x more deals closed.

The amount of your deductible will be listed in your insurance policy documents. If Your Deductible Is Too High You Could Find Yourself Coming Up Short. If you have comprehensive coverage and make a claim to repair windshield glass damage then your deductible may be waived.

But you get these extra savings only if you enroll in Silver. If you used paid preparers to file your taxes they can also provide you with copies. Check with your insurance representative to verify what deductibles apply.

After that you share the cost with your plan by paying coinsurance. But if thats not your cup of teathen use your paper calendar to track the Medicare Part B Deductible. Please enter your mobile number below to access the deductible for your device.

Its a Good Idea To Know Your Personal Budget Restrictions. TRICARE Deductible Information. Then you can use this information to cross reference with the next tip.

Theyll simply subtract your deductible amount from your claims approved payout. TurboTax ItsDeductible makes it easy to track your charitable donations so you get the biggest tax deduction possible. Simply mark on the calendar the day you paid the Medicare provider and how much you paid.

There Are Many Ways to Locate Your Deductible Amounts. Network providers can collect at a minimum the copayment at the time of service. Information You May Need Your date of birth your spouses date of birth and filing status.

Basic income information including amounts and adjusted gross income. If you dont qualify for CSRs compare premiums and out-of-pocket costs of Silver and Gold prices to find your right plan. FMD is your deductible solution with a trusted name.

SEARCH BY MAKE MODEL. SEARCH BY PHONE NUMBER. Get the most from your charitable contributions anytime.

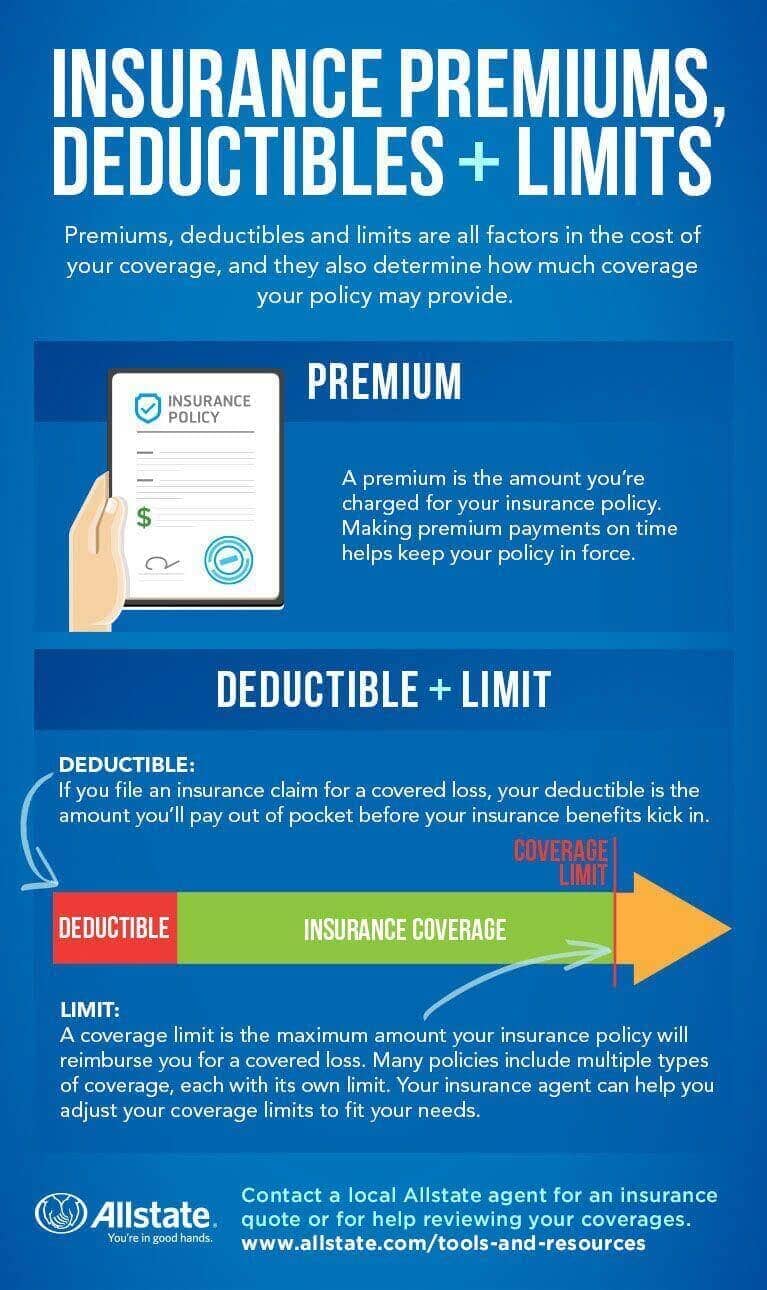

Insurance Premiums Deductibles And Limits Defined Allstate

Insurance Premiums Deductibles And Limits Defined Allstate

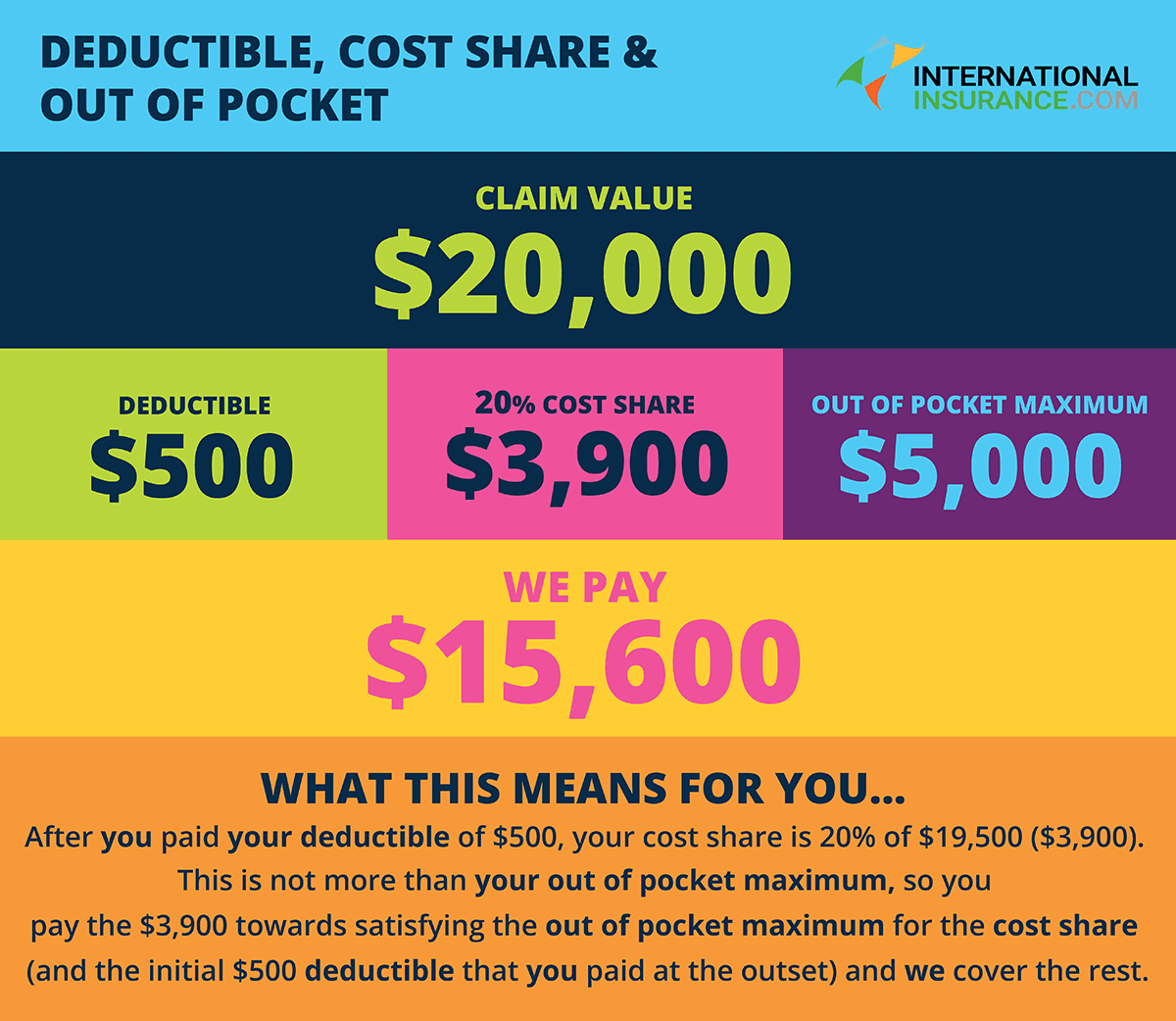

Deductibles Co Pay And Out Of Pocket Maximums

Deductibles Co Pay And Out Of Pocket Maximums

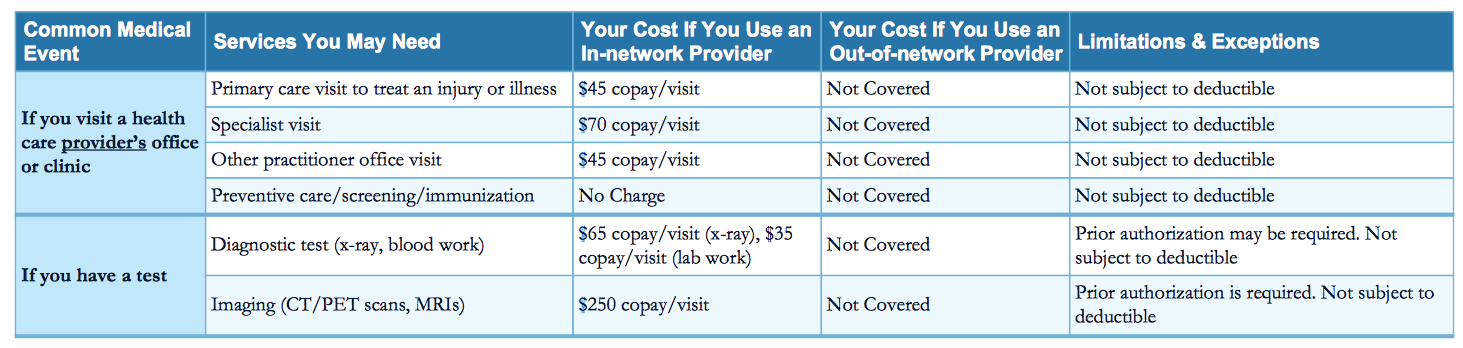

How Much Is My Doctor S Visit Going To Cost

How Much Is My Doctor S Visit Going To Cost

Health Insurance Deductible How Do Deductibles Work Mint

Health Insurance Deductible How Do Deductibles Work Mint

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

What Is A Deductible Learn More About Your Health Insurance Options Healthmarkets

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

Health Insurance Deductible How Do Deductibles Work Mint

Health Insurance Deductible How Do Deductibles Work Mint

What Is An Auto Insurance Deductible How Does It Work We Explain It

What Is An Auto Insurance Deductible How Does It Work We Explain It

How A Deductible Works For Health Insurance

How A Deductible Works For Health Insurance

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

True Family Embedded Deductibles Types Of Deductibles Bcbs Wny

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Understanding Deductibles Out Of Pocket Maximums Health Insurance

Deductible Maryland Health Connection

Deductible Maryland Health Connection

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Montana

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.