Obamacare requires insurers to cover emergency services at the same price whether a hospital is in or out of network Even if your insurance covers it an emergency room visit. Insurance plans cant require higher copaymentsor coinsuranceif you get emergency care out-of-networkand they cannot require prior approval either.

/cdn.vox-cdn.com/uploads/chorus_asset/file/9688285/erfees_cover_alt.jpg) An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

An Er Visit A 12 000 Bill And A Health Insurer That Wouldn T Pay Vox

You can use your health insurance to pay for your visit to the emergency room.

Emergency room insurance coverage. PPO health insurance firms do use emergency room bikers that can be added onto the plan however the optional advantage is often difficult to situate on the applications. In an emergency you should get care from the closest hospital that can help you. Your insurance company cant charge you more for getting emergency room services at an out-of-network hospital.

With Value ER you will have protection 24 hours a day seven days a week. Insurance companies have denied coverage to patients who went to an emergency room for non-urgent procedures like a cough sore throat or sprained ankle. An emergency is usually a situation that is life-threatening or could result in the loss of a limb without immediate.

One damaged bone and that 5000 deductible is maxed out. The amount of the co-pay varies by plan. But Anthem has caused controversy with new rules in six states Georgia Indiana Missouri Ohio New Hampshire and Kentucky that shift the cost of ER visits to the patient if a review of the claim determines that the situation was not an emergency after all.

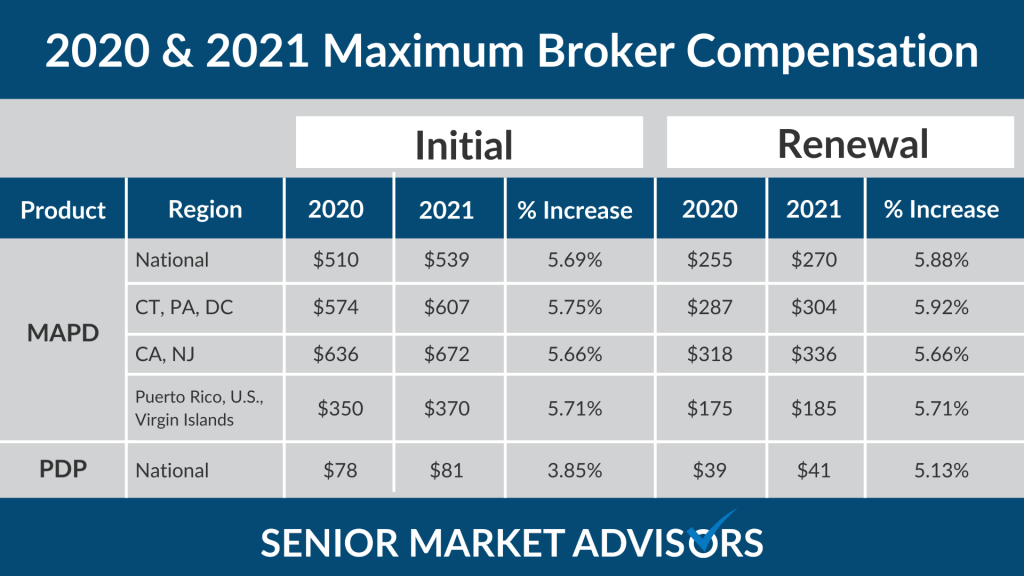

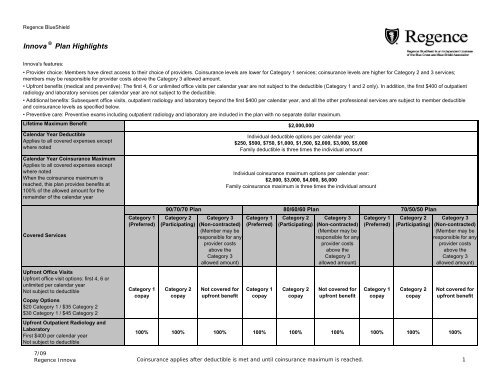

ER plans that cover accidental bodily injuries is the first category. The fixed coverage plans will ONLY pay the fixed amount listed in the schedule of benefits for ALL charges incurred in the Emergency Room. A large percent of PPO plans meet deductibles from emergency room costs.

If they can afford to offset the bill all at once then well and good most emergency rooms accept cash payment. Emergency room insurance supplements fall into two main categories. When they visit an emergency room for any medical service they are required to pay all the charges in cash.

The second form of ER plan is a Critical Illness Insurance plan that covers emergency room related expenses for sickness and disease such as life threatening cancer heart attacks and stroke. Benefits up to 100000 per Hospital Emergency Room visit up to 2 times per year - per family. In some states the access fee is waived if youre admitted to the emergency room.

After an auto accident hospitals ambulances or doctors offices may not require immediate payment. Features of this plan include. If you are admitted the deductible usually is waived.

This low cost emergency room insurance policy will give you the peace of mind that comes from knowing you are prepared in case of an emergency. Just as with regular office visits your health insurance plan will require a co-pay for emergency care. Emergency Room Insurance Coverage Supplements Health Insurance Short Term Health Insurance Personal accident insurance strategy products are a form of damage insurance strategy that can be used with any licensed doctor e.

If you could have received treatment at an urgent care center or walk-in clinic this may not be covered by insurance and you would have to pay for your treatment out of your own pocket. Plan benefits provided through Vera vary by state but all emergency room visits apply to your deductible the amount you pay before your health insurance kicks in and coinsurance with an additional 250 access fee. For example the VisitorSecure plan with a 5000000 policy maximum will only pay up to 37500 per injuryillness for the use of a hospital Emergency Room and ALL EXPENSES INCURRED THEREIN.

Im having an emergency. There are people in America with good jobs and stable sources of incomes but have no medical insurances. R clinic or urgent proper care facility in the United States and while traveling abroad for up to two months.

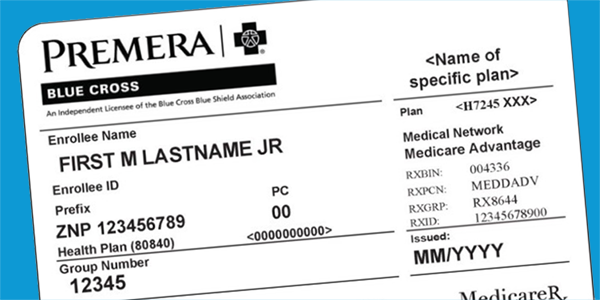

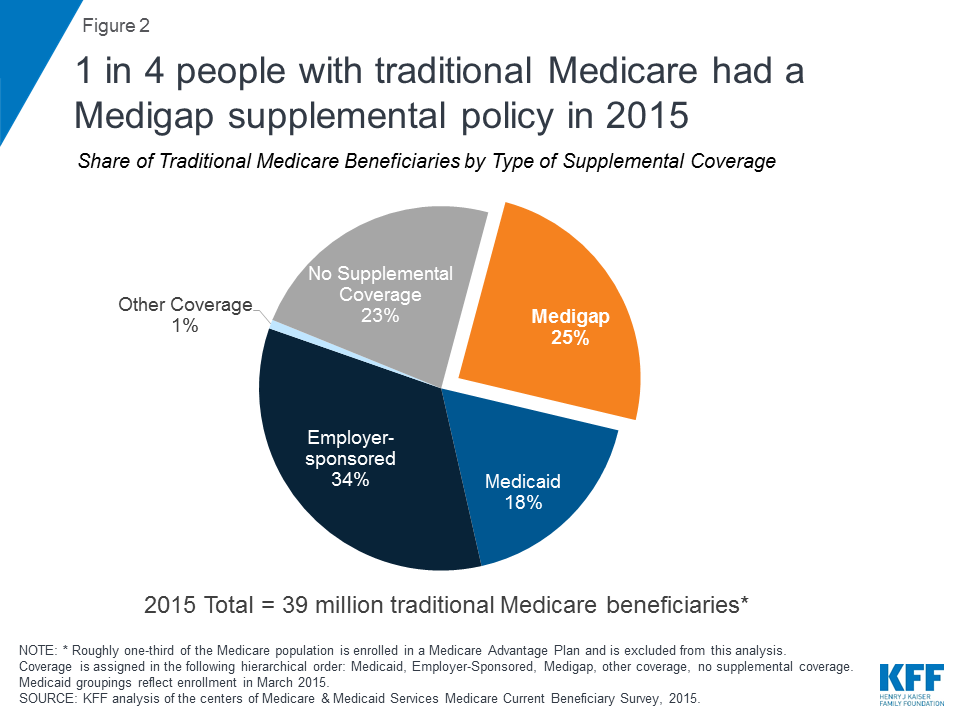

For the most part insurers pay for those trips to the emergency room. Blue Cross Blue Shield of Michigan defines being admitted as having an inpatient hospital stay that lasts more than 24 hours. Out-of-network emergency care is covered under allinsurance plans sold after March 23rd 2010 as part of Ten Essential Benefitsunder the Affordable Care Act.

That hospital will treat you regardless of whether you have insurance. However you will still be responsible for covering the deductible or co-pay associated with your policy.