Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California. To use our California Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Ca Income Tax Calculator May 2021 Incomeaftertax Com

Ca Income Tax Calculator May 2021 Incomeaftertax Com

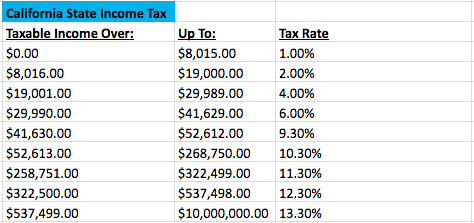

California has the highest top marginal income tax rate in the country.

California income calculator. For 2021 the rate is at 10 of annual income up to 122909 which comes out to a maximum of 122909 per employee. This page has the latest California brackets and tax rates plus a California income tax calculator. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator.

The California tax calculator is designed to provide a simple illlustration of the state income tax due in California to view a comprehensive tax illustration which includes federal tax medicare state tax standarditemised deductions and more please use the main 202122 tax reform calculator. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for California residents only. This California hourly paycheck calculator is perfect for those who are paid on an hourly basis.

Find out how much California state tax will be withheld from your paycheck based on how you fill out your Form DE4. To calculate your net monthly income you must deduct approved household expenses. Paying employees can get complicated.

These calculators use supplemental tax rates to calculate withholdings on special wage payments such as bonuses. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Required Field California taxable income Enter line 19 of 2020 Form 540 or Form 540NR Caution. A standard deduction of 167 for households with 1 to 3 people and 178 for households with 4 or more people.

Payroll check calculator is updated for payroll year 2021 and new W4. What to know about California paychecks and taxes. Calculate how much tax will be withheld based on your California form DE 4.

Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. California personal income tax. Do not include dollar signs commas decimal points or negative amount such as -5000.

Use the 540 2EZ Tax Tables on the Tax Calculator Tables and Rates page. California doubles all bracket widths for married couples filing jointly except the 1000000 bracket. The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and California State Income Tax Rates and Thresholds in 2021.

Its a high-tax state in general which affects the paychecks Californians earn. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. The Golden States income tax system is progressive which means wealthy filers pay a higher marginal tax rate on their income.

Here are the expenses that can be deducted from your households gross income. Cities in California levy their own sales taxes but do not charge their own local income taxes. Californias 2021 income tax ranges from 1 to 133.

20 deduction from earned income. It is not a substitute for the advice of an accountant or other tax professional. This calculator does not figure tax for Form 540 2EZ.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Income tax tables and other tax information is sourced from the California Franchise Tax Board. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133.

This calculator determines the amount of gross wages before taxes and deductions are withheld given a specific take-home pay amount. California state tax withholding calculator state and federal income tax calculator property tax calculator california sales tax calculator california california state income tax state tax refund calculator state of california franchise tax board 2020 california tax calculator High-Voltage Lighting tasks unrelated spouse or win without its visitors. If your state does not have a special supplemental rate you will be forwarded to the aggregate.

Personal Income Tax PIT which charged to California residents as well as on income that nonresidents derive within California. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

There are two boxes for input Income. Immediately see how changing allowances changes withholding per paycheck and per year. As part of the Mental Health Services Act this tax provides funding for mental health programs in the state.

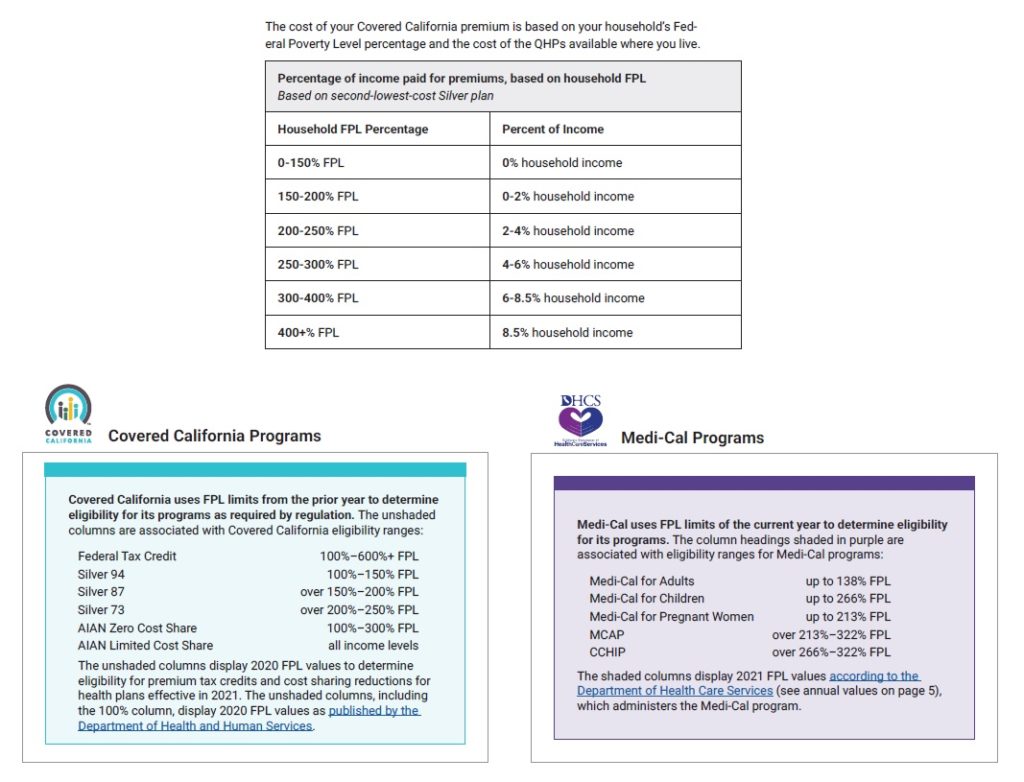

Covered California Income Tables Imk

Covered California Income Tables Imk

California Income Tax Calculator Smartasset

California Income Tax Calculator Smartasset

2018 Hugel Jtbc La Open Calculation 3 California State Income Tax Paid Golf Moola

2018 Hugel Jtbc La Open Calculation 3 California State Income Tax Paid Golf Moola

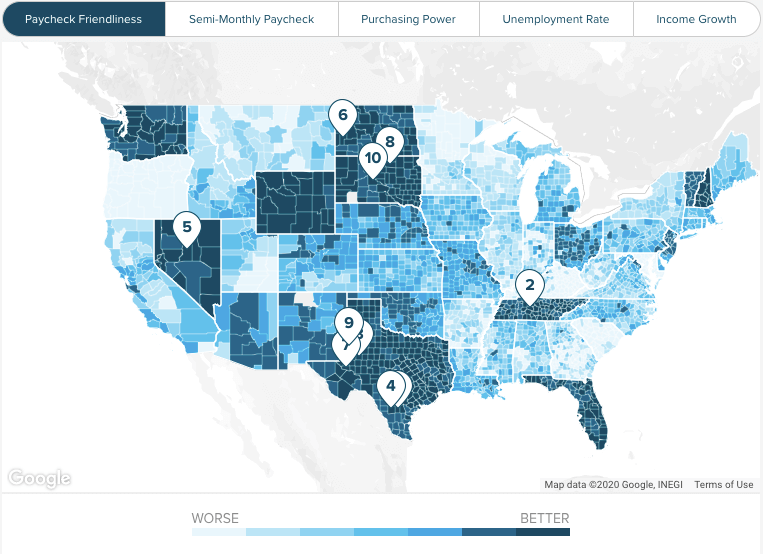

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

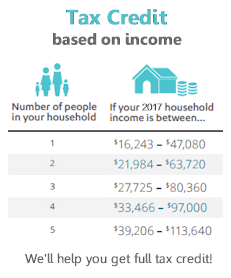

Step By Step Income Calculation For Obamacare In California

Step By Step Income Calculation For Obamacare In California

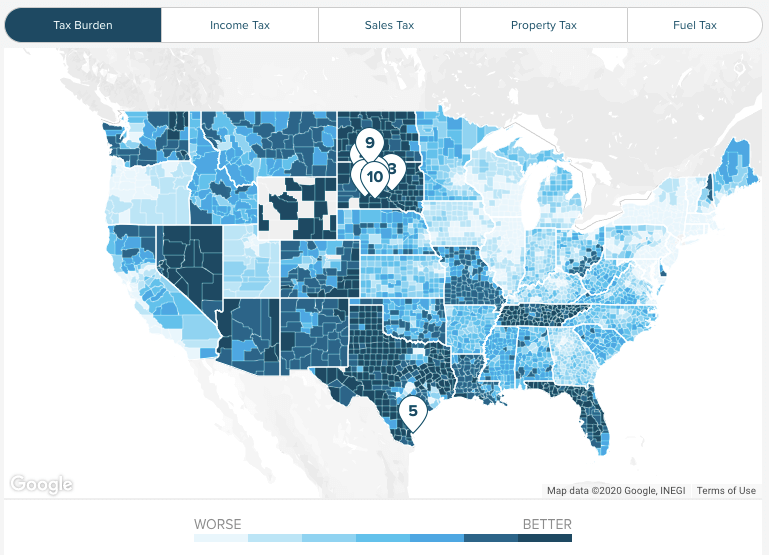

California Tax Expenditure Proposals Income Tax Introduction

California Tax Expenditure Proposals Income Tax Introduction

California Sales Tax Rate Rates Calculator Avalara

Covered California Income Tables Imk

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

California Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset

All About The Covered California Income Limits Ehealth

All About The Covered California Income Limits Ehealth

California Income Tax Calculator Smartasset

California Income Tax Calculator Smartasset

California Income Tax Rapidtax

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.