5 feet 5 inches. According to Bariatric Surgery Source one common source of financing is a secured medical loan.

Does Anthem Insurance Cover Weight Loss Surgery

Does Anthem Insurance Cover Weight Loss Surgery

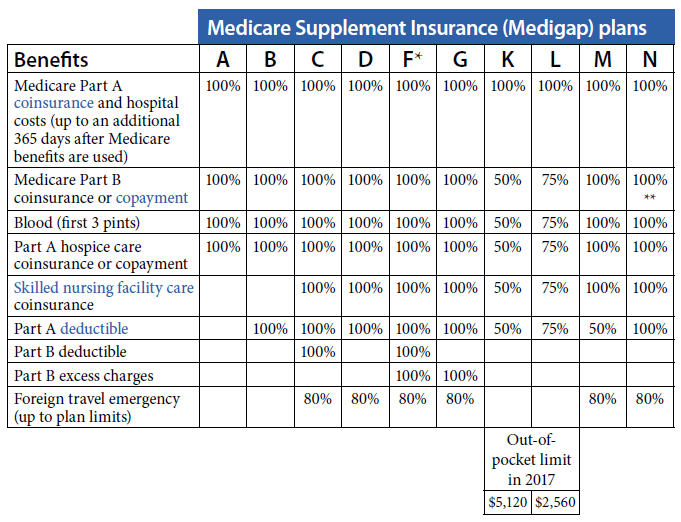

The procedures excluded from coverage under a BCBS Illinois plan are.

Does anthem blue cross cover gastric sleeve. Laparoscopic gastric plication laparoscopic greater curvature plication LGCP. Some large insurance companies have started covering gastric sleeves. Will BCBS pay for weight loss surgery.

However this procedure is considered experimental and is not covered. Gastric Sleeve Patients. How to pay for bariatric surgery without insurance.

Band fills are covered if you had a gastric band using your insurance but not for cash pay. The average cost of a gastric sleeve surgery is 14900 but it can vary widely from state to state. Open Gastric Bypass Surgery.

Procedures Excluded from Coverage. You will want to see if they will cover Lap Band Surgery Gastric Bypass Surgery and Gastric Sleeve Surgery. While you can review your insurance policy package to see what weight control or bariatric management expenses are covered or excluded you may find it easier to simply give us a call at or fill out our free no obligation FREE LAP-BAND Insurance Verification Form so that our LAP-BAND Insurance Coordinator can verify your Anthem Blue Cross or any other Anthem.

A gastric restrictive bariatric procedure which is performed alone or in combination with adjustable gastric banding where the stomachs volume is reduced by dissecting the greater omentum and short gastric vessels and the greater curvature is invaginated using multiple rows of non-absorbable sutures. The gastric balloon is not yet covered by insurance and we do not offer it for a number of reasons. What insurance pays for gastric sleeve.

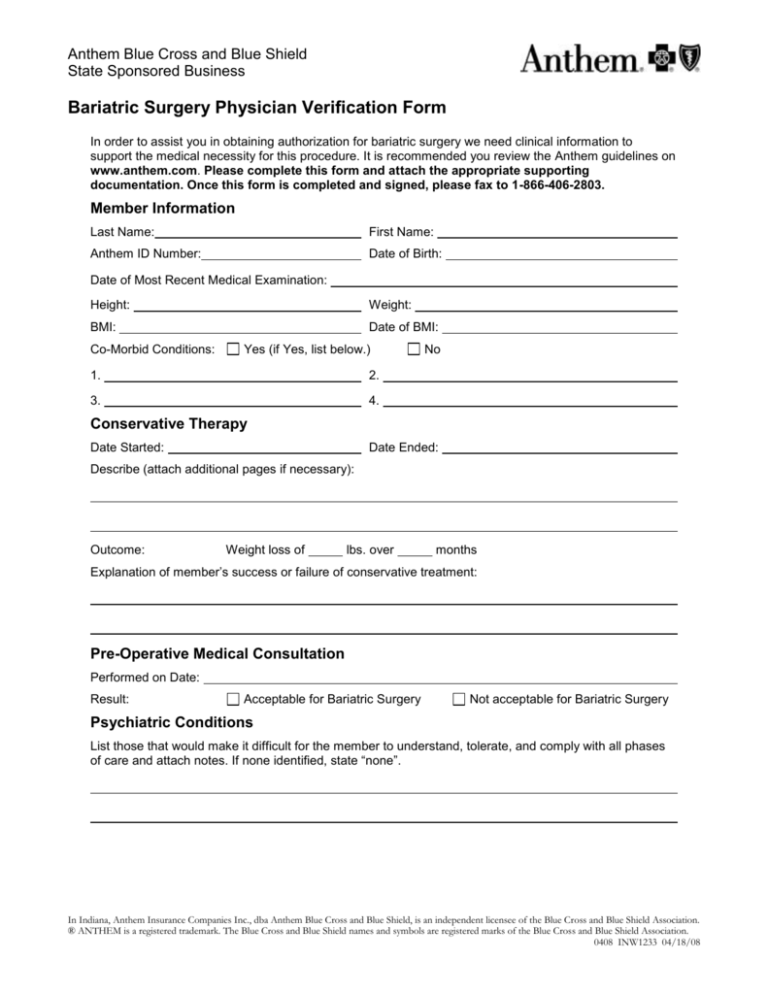

This page explains the coverage requirements plan types and covered procedures as well as how to appeal a. The following surgeries are covered. Yes Anthem Blue Cross and Blue Shield of California will cover your Gastric Sleeve Surgery as long as your insurance plans requirements for bariatric surgery are met.

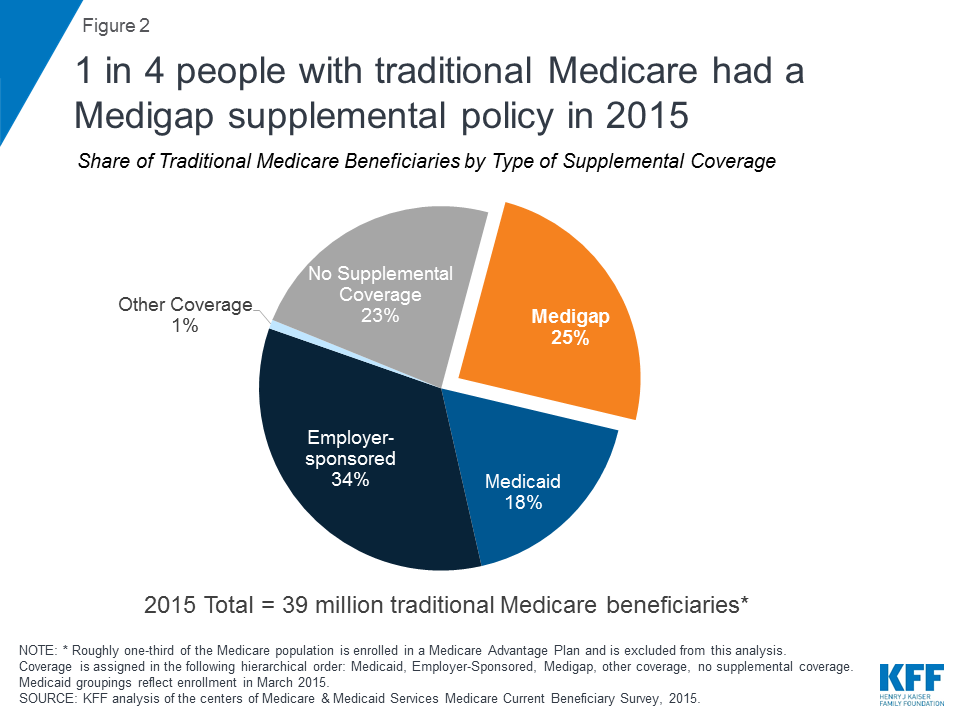

Since 2010 many insurance companies cover the costs of gastric sleeve surgery as a primary weight loss method so make sure you check with your insurer. Major proven bariatric surgical procedures such as the gastric sleeve and the gastric bypass are typically covered if the policy covers bariatric surgery in general. Anthem BCBS may cover weight loss surgery as long as.

Anthem will cover your LAP-BAND Surgery as long as you meet your insurance plans requirements for bariatric surgery. Blue Cross Blue Shield of Kansas covers 4 weight loss procedures including the Gastric Sleeve Gastric Bypass and Duodenal Switch assuming your policy includes bariatric surgery. I was wondering if anyone has a list of insurance companies that cover the gastric sleeve surgery.

If so what hoops did you have to go through for insurance to cover it. The weight loss procedures that Blue Cross covers include. Check If your Insurance Company Covers Bariatric Surgery.

Aetna Anthem Blue Cross Blue Shield Cigna and United Healthcare all cover the majority of or parts of gastric sleeve surgeries for patients that meet the eligibility criteria. How do people afford bariatric surgery. Aetna Anthem Blue Cross Blue Shield Cigna and United Healthcare all cover the majority of or parts of gastric sleeve surgeries for patients that meet the eligibility criteria.

Lap Adjustable Gastric Bands. Gastric Bypass Using A Roux-En-Y Anastamosis. A panniculectomy is a surgical procedure that removes this excess skin and fatty tissue for a slimmer stomach.

While Blue Cross does cover most of the weight loss procedures there are a few that they do not. I currently have medical insurance with Blue Cross Blue Shield did anyone that has had the gastric sleeve surgery have this same insurance. Aetna Anthem Blue Cross Blue Shield Cigna and United Healthcare all cover the majority of or parts of gastric sleeve surgeries for patients that meet the eligibility criteria.

Gastric Banding Realize Band or Lap Band Gastric Sleeves. Biliopancreatic Bypass with Duodenal Switch. Your first call to your insurance carrier is to collect information about your policy.

All these procedures are considered medically necessary and covered by insurance. Ive heard of some insurance companies will cover it and some will not. If you have questions about your plans coverage when it comes to a Gastric Sleeve procedure or other bariatric surgeries West Medical offers a FREE Insurance Coverage Hotline to determine the coverage rate of your plan.

Procedures Blue Cross Does Not Cover. What Are The Kinds Of Bariatric Surgeries Anthem BCBS Covers. Will Anthem BCBS Cover.

Gastric Banding a procedure we no longer offer Procedures considered experimental like the Mini Bypass will not be covered. The duodenal switch while less popular may also be covered by the policy.