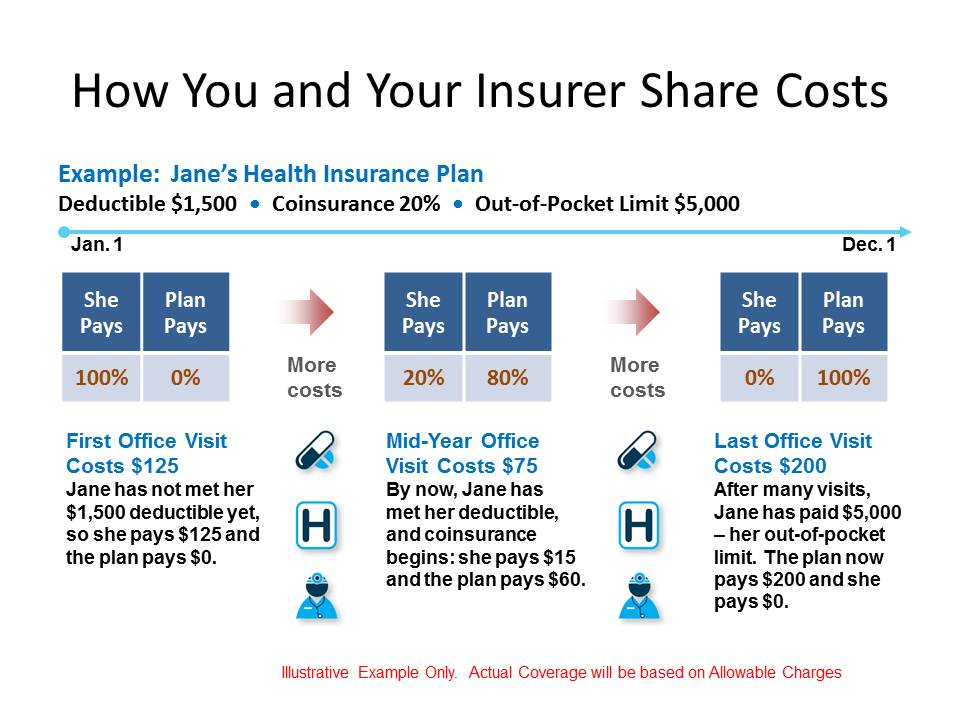

Your deductible is 1000 and your coinsurance responsibility is 20. It is similar to the copayment provision under health insurance.

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

Decoding Doctor S Office Deductibles Blue Cross And Blue Shield Of Illinois

It can be a fixed amount per the nature of the treatment of a fixed percentage.

What is coinsurance vs copay. Though they share similarities theyre ultimately different plans for your. Coinsurance is the other method used to calculate your share of medical expenses after paying your deductible each year. A percentage of covered benefits that the patient is responsible for paying.

Copays cover your portion of the. Difference Between Copay and Deductible. Difference Between Deductible and Out of Pocket Maximum 2.

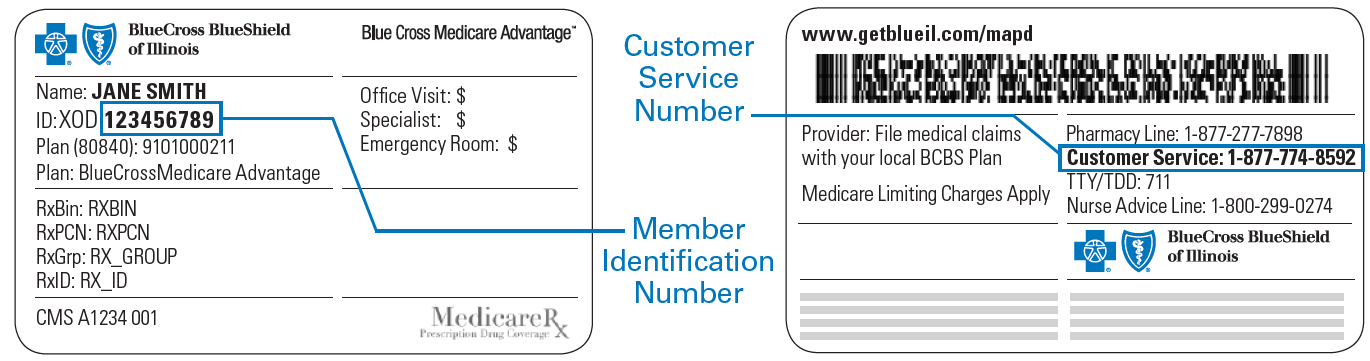

4 rijen Your copay amount is printed right on your health plan ID card. This amount is generally offered as a fixed percentage. Copay Coinsurance and copay as similar-sounding terms for your healthcare may be a little confusing.

Copay Now that we have fully rounded up the process of covering medical expenses from start to finish there is only one thing left to do understand the difference between copay and coinsurance. The amount A deductible is the fixed amount that you have to pay as a share of your medical bill upon which your policy comes into effect. We discuss in detail how coinsurance is a valuable insurance option to some than to others.

Coinsurance refers to the percentage of treatment costs that you have to bear after paying the deductibles. A copay is a type of insurance cost that is a set amount designated to be paid by the insured party whereas coinsurance is a percentage of health care costs covered by the insurer after the deductible is met. The remaining balance is covered by the persons insurance company.

In that case youd pay the 1000 for the deductible portion and youd also be on the hook for the remaining 20 with the health plan picking up the other 80. Both copays and coinsurance are forms of cost-sharing meaning you are splitting medical bills with your health insurance company. A flat amount that the patient pays a healthcare provider or pharmacy at every visit.

Coinsurance and copays both refer to the portion of medical expenses covered by the patient rather than by insurance. Difference between Copay and Co-insurance Copay is the fixed amount that you have to pay for your treatment. The definitions presented above make it all clearer.

What is the difference between coinsurance and copay. Coinsurance versus Copay comparison chart. The remaining percentage that you pay is called coinsurance.

Coinsurance works similarly to your copay. When comparing coinsurance and copay a copay seems to be the better option. In this case youd pay 1200 for the MRI on top of the 30 copay.

A copay short for copayment is a fixed amount a healthcare beneficiary pays for covered medical services. Youll continue to pay copays or coinsurance until youve reached the out-of-pocket maximum for your policy. This is because usually copays do not add to medical coverage deductibles or out-of-pocket maximums.

10-40 of the healthcare providers contracted rate with the insurer. Its a bit more complicated to. Thus coinsurance for an emergency room visit might be 38 and 25 for the given policies respectively.

The fact that both terms carry the same prefix may give you some initial idea. What are they and how do they differ. Copay is a set amount whereas coinsurance payments are charged as a percentage and varies depending on the cost of the procedure or costs of additional issues and complications.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/SIOLOW6MTM5OX3VJOTFGQUN6LE.jpg)