Plans are insured and offered through separate Blue Cross and Blue Shield companies. You consent to being contacted by a BlueCross BlueShield of South Carolina licensed insurance agent regarding their products and services.

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Blue Cross Blue Shield Medicare Supplement Plans Boomer Benefits

Following the lead of Anthem Innovative F launched last year Blue Shield now has a Medigap Plan F Extra with additional benefits that are not covered by traditional Plan F.

Bcbs supplemental insurance plan f. Plan G covers everything that Plan F covers except the Medicare Part B deductible. Then your Plan F supplement pays your deductible and the other 20. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits.

A BCBS Plan F covers. Plan F is a plan thats included in Medicare supplement insurance Medigap. This is where a Medigap Plan F from Blue Cross Blue Shield steps in.

Medicare Supplement Insurance Plans are identified by the letters A B C D F G K L M and N. Each plan covers a different set of costs. When you are in the hospital there is.

Medicare Part B first pays 80. One Plan that Covers Everything. It also covers physician services speech and physical therapy durable medical equipment diagnostic tests supplemental Medicare coverage for skilled nursing.

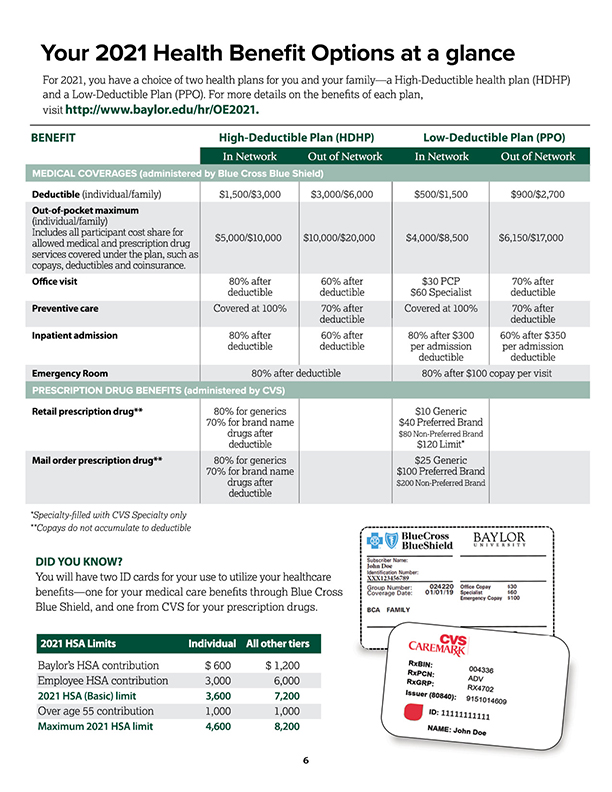

These plans offer coverage in addition to your Blue Cross and Blue Shield of Texas BCBSTX health plan like. BCBS Medicare Supplement Plan F Plan F is one of the most popular Medicare Supplement insurance coverage options that is sold through Blue Cross Blue Shield. This is our most comprehensive Medicare supplement plan.

Youll pay a fixed amount each month and youll pay nothing for services covered by Original Medicare when you go to any doctor or hospital that accepts Original Medicare. Supplemental health plans can help keep you and your family protected while at home or overseas. This Medigap plan will help you pay your portion of the costs of your Medicare Part A and Medicare Part B benefits.

Medicare Parts A and B cover a lot of ordinary medical expenses but there are some things they dont cover. Plans as low as 35month with nationwide doctor choice. Plan F covers that for you.

They are sometimes called Medigap plans. Your Part A Hospital Care Co-Insurance and Costs. They can help pay some of the remaining costs like your copays deductibles and coinsurance.

This means you will have nothing out-of-pocket for any covered hospital or outpatient services. Aside from a monthly premium youll only need to. Medicare Supplement plans do just that.

Essentially the beneficiary pays their premium and nothing else. It covers literally all the gaps in Medicare Parts A and B. This includes excess charges of Medicare-approved amounts.

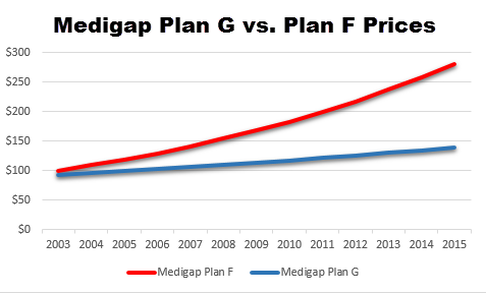

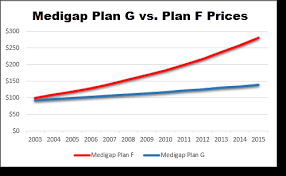

Medicare Supplement Plans with EXCLUSIVE EXTRAS. Plan F covers the beneficiarys portion of the cost. This plan offers robust coverage and is less expensive than Plan F.

Some doctors charge a 15 excess charge beyond what Medicare pays. Plan F is the most comprehensive Medigap plan on the market. Enrollment in these plans depends on the plans contract renewal with Medicare.

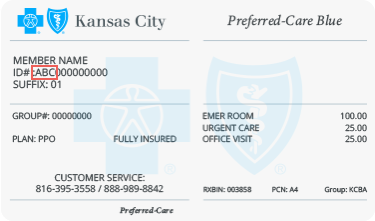

Blue Cross Medicare Supplement Plan F includes supplemental Medicare coverage for medical services covered in Part B including outpatient and medical services in or out of the hospital. BlueCross BlueShield of South Carolina offers BlueCare and Blue Select Medicare Supplement plans. If youre new to Medicare in 2020 and would like a very inclusive Medigap plan.

Plan F coverage also includes your other doctor visits for illnesses and injuries. Youll also get access to the Medicare Supplement Well-Being Program which includes. With Plan F you are covered for a wide array of benefits including.

If you are shopping for a Medicare Supplement Plan F Regence BlueCross BlueShield is one option. Plan F also pays the 20 for a long list of other Part B services. BlueCross Medicare Supplement plans offer.

Blue Shield of California is now offering Medicare Supplement Medigap Plan F Extra with hearing and vision benefits. Out of all of the Medicare supplement plans. Because its a Medicare supplement plan youll be able to see any doctor nationwide who accepts Original Medicare.

BCBS Medicare Supplement Plan G. It can help pay for expenses that arent covered under original Medicare. Thats because it is the most comprehensive of all the available Medigap plans.

In addition any beneficiary on Plan F will experience no out-of-pocket expenses during hospital or doctor visits. Blue Cross Blue Shield Medigap Plan F. You can sign up for these plans at any time.

You may be eligible for a discount if you and another individual residing in your household are both enrolled in a Blue Cross and Blue Shield of Illinois Medicare Supplement Insurance Plan effective on or after May 1 2019. If you are shopping for a Medicare Supplement Plan F Highmark Blue Cross Blue Shield is one option. Plan F has been the most popular supplement plan.

Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization andor Part D plan sponsor with a Medicare contract. The panel above briefly outlines the coverage. Plan F is the most comprehensive Medigap plan on the market.

Supplemental Health Insurance Plans. The panel above briefly outlines the coverage.

:max_bytes(150000):strip_icc()/cigna-logo-wallpaper-e1474921230453-fa540a75903245a18ff0e794e1e1f7ec.jpg)