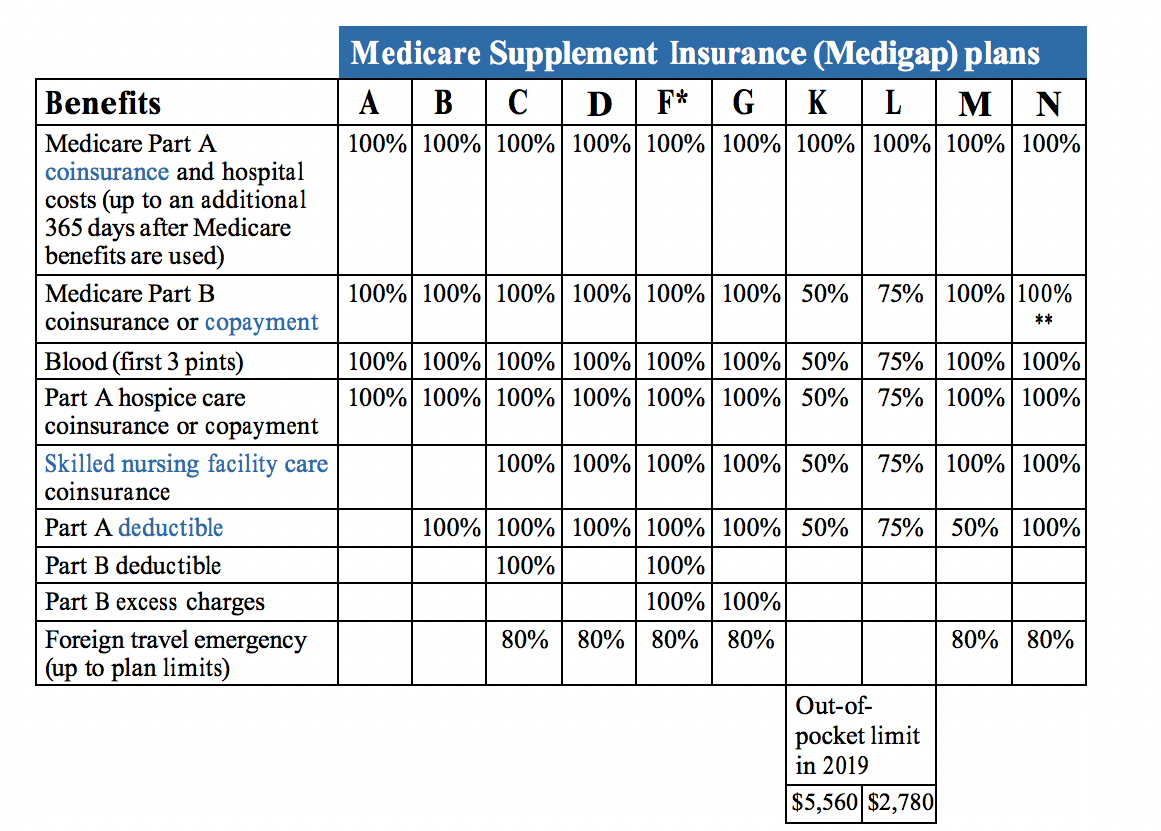

Because Medicare supplemental coverage consists of 10 standardized plans and high deductible Plan F is easy to compare supplements online and get rates from several companies. With this option you must pay for Medicare-covered costs coinsurance copayments and deductibles up to the deductible amount of 2340 in 2020 2370 in 2021 before your policy pays anything.

Plan F Vs Plan G Medicare Hero

Plan F Vs Plan G Medicare Hero

Plan F coverage also includes your other doctor visits for illnesses and injuries.

Plan f prices. This amount can go up each year. F3 includes consumption only no publishshare. Subsequent pricing for tenant-based apps applies to any tenant in your organization.

Keep in mind that the high-deductible Plan F option doesnt vary from the standard Plan F when it comes to basic benefits. Then your Plan F supplement pays your deductible and the other 20. Great if you use less data or lots of Wi-Fi.

In addition to the basic Plan F there is a high deductible version of Plan F available. 658 per day x 60 Original Medicare covers up to 90 days in a hospital per benefit period and offers an additional 60 days of coverage with a high coinsurance. Plan F also has a high-deductible option.

These 60 reserve days can be used only once during your lifetime but do not have to be applied towards the same hospital stay. Plan F includes a high deductible option where 2000 is required before benefits are paid. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1 2020.

This is a variation on the standard Plan F that requires beneficiaries to pay all out-of-pocket expenses up to the deductible which is 2370 in 2021. While monthly premiums for this option may be lower you must pay a deductible before Plan F begins paying for benefits. Some doctors charge a 15 excess charge beyond what Medicare pays.

1 Subsequent pricing for user-based apps applies only to the individual licensed for the first app. A person must reach the deductible before the plan. After meeting the deductible the plan begins to pay for Medicare-covered costs.

The High Deductible Plan F has a deductible of 2340 but because you have to pay more out-of-pocket the premiums for this plan tend to. Office Home Business 2019. This includes durable medical.

Once the annual deductible is met the plan pays 100 of covered services for the rest of the year. Medicare Supplement Plan F may eventually leave the market starting in 2020 but not for everyone. Plans F and G also offer a high-deductible plan in some states.

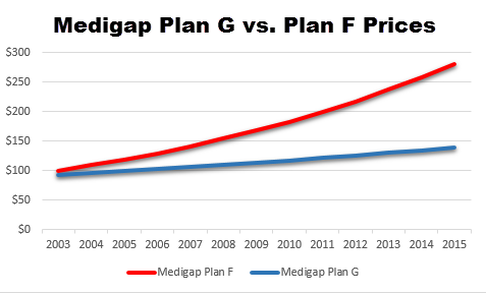

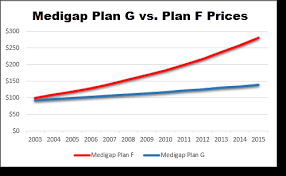

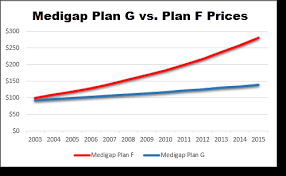

Nationally monthly premiums for Plan G average about 150 compared with Plan Fs 186 according to Aon. F3 plans include 2GB OneDrive storage per user. Pay annually Continue with monthly plan.

Medicare Part B first pays 80. High-deductible policies have lower premiums but if. Some legacy Office 365 plans that are no longer in market as of August 2015 may also not have access to Sway.

Simply Unlimited for 3. Save with an annual subscription. Or buy at 599month.

Sway is not currently available for Government Community Cloud GCC customers and customers in certain geographies at this time. Plan F high deductible 2786. Plan F covers that for you.

Taxes govt fees. 17 ea 10 GB 17 dollars each plus 10 dollars per gigabyte. For example if Person A is licensed for the first app subsequent pricing wouldnt apply to Person B.

With Plan F you need to pay just 20 of the healthcare expenses when out of the country. If you choose this option you have to pay a deductible of 2240 for 2018 before the plan pays anything. Plan F also pays the 20 for a long list of other Part B services.

30 ea 30 dollars each. Medicare Supplement Plan F covers up to 80 of the health care expenses incurred abroad. Plan F is often compared with Plan G and Plan N.

It should be noted that Original Medicare does not offer coverage for these costs. If you have been shopping for a Medicare Supplement also known as Medigap insurance plan you may already know that Medicare Supplement Plan F may cover a lot of your Medicare Part A and Part B out-of-pocket costs. Most afforable plan if you use a lot of data.

1 Plans F and G offer high-deductible plans that each have an annual deductible of 2370 in 2021. In 2021 this has a deductible of 2370. Switch to an annual subscription and enjoy the full power of Microsoft 365 for less than paying monthly.

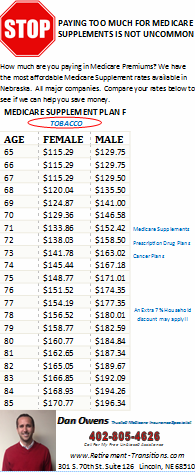

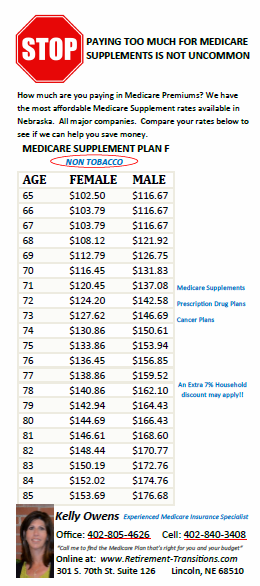

Lincoln Nebraska Medicare Supplement Prices Plan F Retirement Transitions

Lincoln Nebraska Medicare Supplement Prices Plan F Retirement Transitions

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Plan F Or Plan G Medigap Plans F G 65medicare Org

Plan F Or Plan G Medigap Plans F G 65medicare Org

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Medigap Plan F Medicare Supplement Plan F Medicarefaq

Humana Medicare Supplement Plans Cost Coverage Review

Humana Medicare Supplement Plans Cost Coverage Review

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan Blog Health Exchange Agency

Medicare Supplement Plan Blog Health Exchange Agency

Is Plan F Worth The Price Ensurem Life Optimized

Is Plan F Worth The Price Ensurem Life Optimized

Comparing Medigap Plans Senior65

Comparing Medigap Plans Senior65

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Medigap Plan F Hd For Florida Seniors Medigap Seminars

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Best Medicare Supplement Plan F Rates Benefits Medigap Plan F Comparison

Lincoln Nebraska Medicare Supplement Prices Plan F Retirement Transitions

Lincoln Nebraska Medicare Supplement Prices Plan F Retirement Transitions

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.