Your employer will have a type of life insurance chart that may offer you a 50000 or 100000 policy at no cost. Here are three main advantages of getting group life insurance through your employer.

Is Life Insurance Through Work Enough Especially Today Llis

Is Life Insurance Through Work Enough Especially Today Llis

Many employers offer basic life insurance to their employees as part of their benefits package.

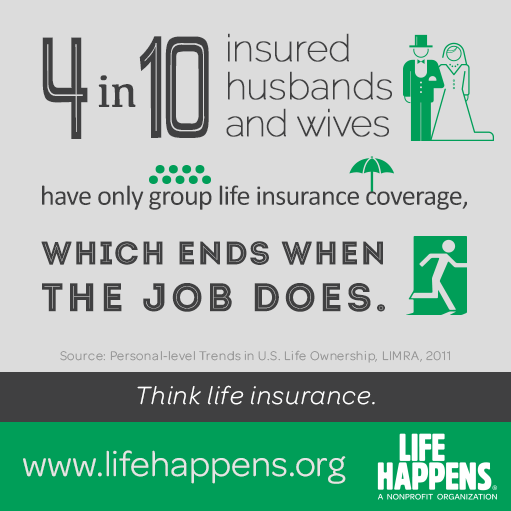

Life insurance through employer. In fact more than 100 million Americans have at least some life insurance coverage through an employer-sponsored group life plan. At this price point. This represents an opportunity for employers to offer life.

A new survey from LIMRA the research engine for the life insurance. Life insurance is an employee benefit frequently offered by employers. But that will be totally inadequate if you have a young family and actually need something closer to 500000 or more.

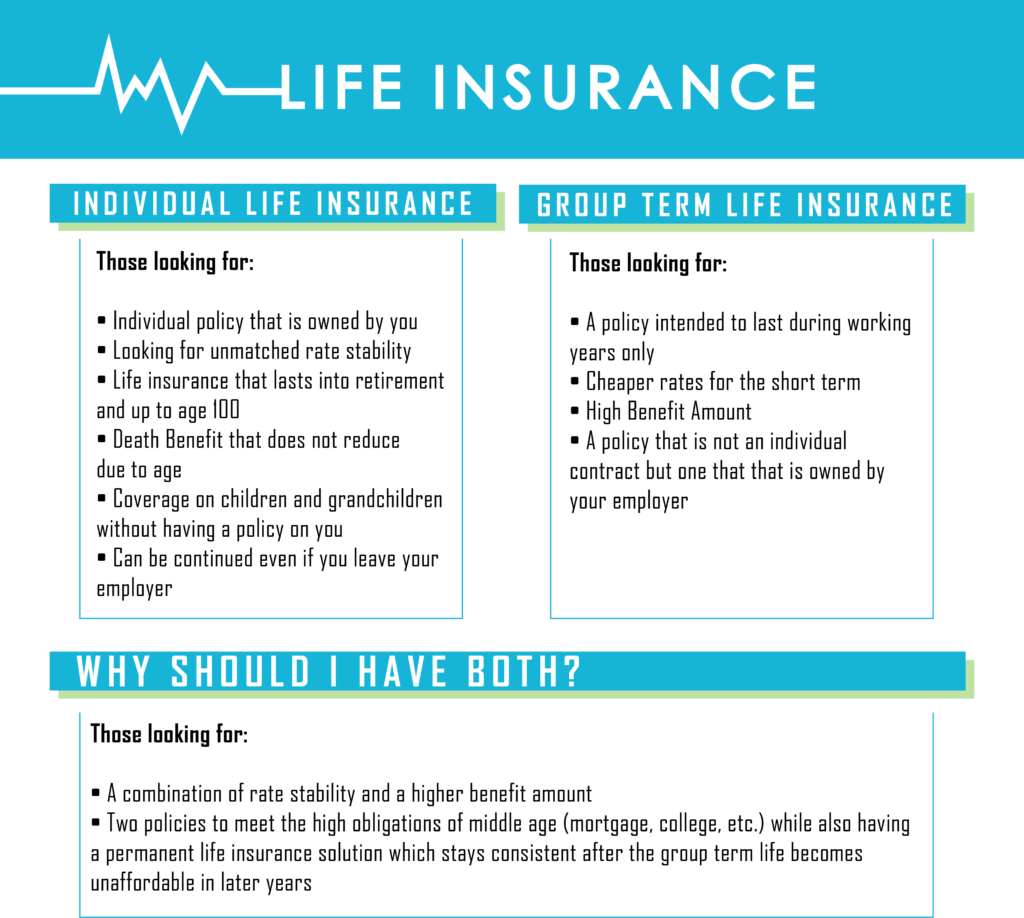

That said most employer-sponsored life insurance plans are term life policies meaning youre covered for a. All Cigna products and services are provided exclusively by or through operating subsidiaries of Cigna Corporation including Life Insurance Company of North America and Cigna Life Insurance Company of New York New York NY and Connecticut General Life Insurance Company. Much like it sounds employment life insurance also called group life insurance is a benefit offered through your employer that pays out a certain amount to a named beneficiary if you are to pass away while employed at the company.

Its a popular employer-provided perk that is lulling workers into a false sense of security. As with other life insurance policies group life insurance is designed to cover the financial risks to your family should you pass away. This type of life insurance policy is usually for a pre-determined set amountsuch as 10000 or a years salaryand is offered at a very low cost or even free.

Life insurance is an insurance policy that provides in exchange for monthly quarterly or annual premium payments a lump sum of money to the designated beneficiary of an employee who dies. Costs tend to be lower for many people because with group plans the cost per individual goes down as the plan enlarges. Much like health insurance employer-provided group life insurance.

As the name suggests its offered to a large group in this case employees of the same company rather than an individual. Group life insurance is a type of life insurance offered by employers usually through large insurance companies like MetLife Principal or Liberty Mutual. Employers can provide employees with up to 50000 of tax-free group term life insurance coverage.

The Lowdown on Employer-Issued Life Insurance. Group life insurance is one of the most commonly offered benefits in an employer-sponsored benefits package. Basic life insurance through work is often automatic and free but the amount of coverage could be much less than what you may actually needleaving you underinsured.

Employers arent required by the law to provide life insurance to their. According to IRS Code Section 79 the cost of any coverage over 50000 that is paid for by an. It will most likely be cheaper to go through your employer as life insurance rates for diabetics can be costly especially if a severe case.

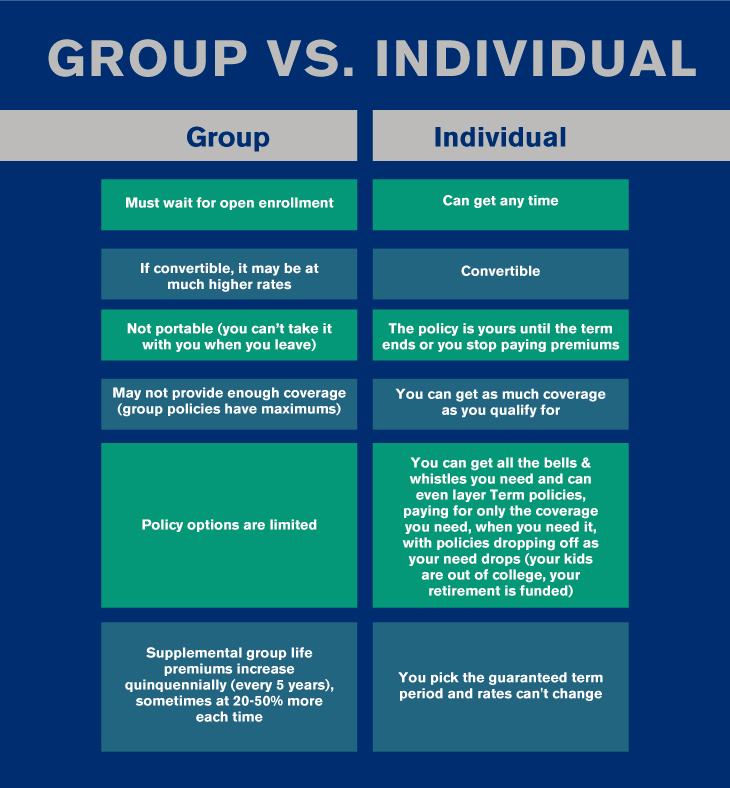

For example most employer life insurance policies fall far short of the amount of coverage that you actually need. Situations When You May Consider Purchasing Life Insurance Through A Third-Party Provider. Life Insurance Through Work vs Private Insurance.

Getting coverage through work can be relatively easy. There are two types of group life coverage. Lets say your employee benefits include a.

Determining Adequateness of Life Insurance Through Work. The paperwork is often part of your hiring documents. Employers insurance plans tend to be paid for or subsidized by the company giving you life insurance at a low cost or even free.

While basic employer-provided life insurance is usually low-cost or free and you may be able to buy additional coverage at low rates your policys face value still may not be high enough. The exact amount paid out differs from employer to employer but it is usually around or. For many employers benefits can be up to 30 of the cost of an employee.

Which Is the Best Value. Basic life insurance if offered is generally provided at no cost. Fifty-seven percent of life insurance policyholders obtain it exclusively through their workplace.

In other words if your employer is spending 100000 on your salary for example they might be spending an extra 30000 per year on your benefits. The amount may be fixed as in everyone receives the same benefit. You may even have the option to buy additional coverage at low rates.

Many companies also offer the option to purchase a. What Is Employment Life Insurance. Basic coverage through work is usually free for the employee making it an easy way.

![]() Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Do I Need Life Insurance If I M Covered Through Work Policyadvisor

Is My Life Insurance Policy From Work Enough Laptrinhx News

Is My Life Insurance Policy From Work Enough Laptrinhx News

Is My Life Insurance Through Work Enough Coverage Colorado Life Quotes Term Life Insurance Colorado Insurance Broker

Is My Life Insurance Through Work Enough Coverage Colorado Life Quotes Term Life Insurance Colorado Insurance Broker

3 Myths About Life Insurance Through Work That Will Make You Rethink Your Coverage Life Insurance Insurance Myths

3 Myths About Life Insurance Through Work That Will Make You Rethink Your Coverage Life Insurance Insurance Myths

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security

Life Insurance Through Work Benefits Does It Provide A False Sense Of Security

Is Life Insurance Through Work Enough Savvy Daily

Is Life Insurance Through Work Enough Savvy Daily

What S The Difference Between Life Insurance Through Work Vs Private Insurance Control Cost Coverage And Duration Of Coverage Plus A Free Calculator To

What S The Difference Between Life Insurance Through Work Vs Private Insurance Control Cost Coverage And Duration Of Coverage Plus A Free Calculator To

Legal General America On Twitter Group Insurance Through An Employer May Not Be Enough Figure Out How To Get Started Today Learn More Here Https T Co Ehtixcar6j Liam19 Lifeinsurance Https T Co Uudnexvzhn

Legal General America On Twitter Group Insurance Through An Employer May Not Be Enough Figure Out How To Get Started Today Learn More Here Https T Co Ehtixcar6j Liam19 Lifeinsurance Https T Co Uudnexvzhn

Life Insurance Through Work It S Likely Not Enough Jessi Fearon

Life Insurance Through Work It S Likely Not Enough Jessi Fearon

Personal Life Insurance Explained Https Www Insurechance Com

Personal Life Insurance Explained Https Www Insurechance Com

Life Insurance Through Employer Cigna

Life Insurance Through Employer Cigna

Is Your Employer Provided Life Insurance Coverage Enough Blog Phil Klein Insurance Group

Is Your Employer Provided Life Insurance Coverage Enough Blog Phil Klein Insurance Group

Is It Enough To Have Life Insurance Through Work Good Financial Cents Life Insurance Facts Life Insurance Marketing Life Insurance Sales

Is It Enough To Have Life Insurance Through Work Good Financial Cents Life Insurance Facts Life Insurance Marketing Life Insurance Sales

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.