How cost-sharing reductions work. While Obamacare subsidies in the form of tax credits apply to any level of plan cost-sharing subsidies only apply to the Silver level.

2018 Cost Sharing Reduction Subsidies Csr

2018 Cost Sharing Reduction Subsidies Csr

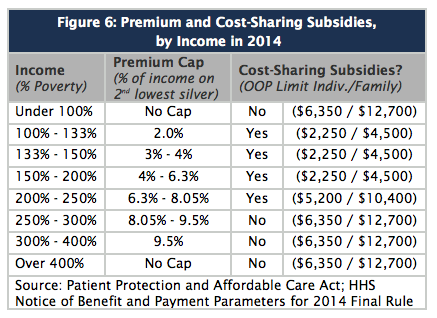

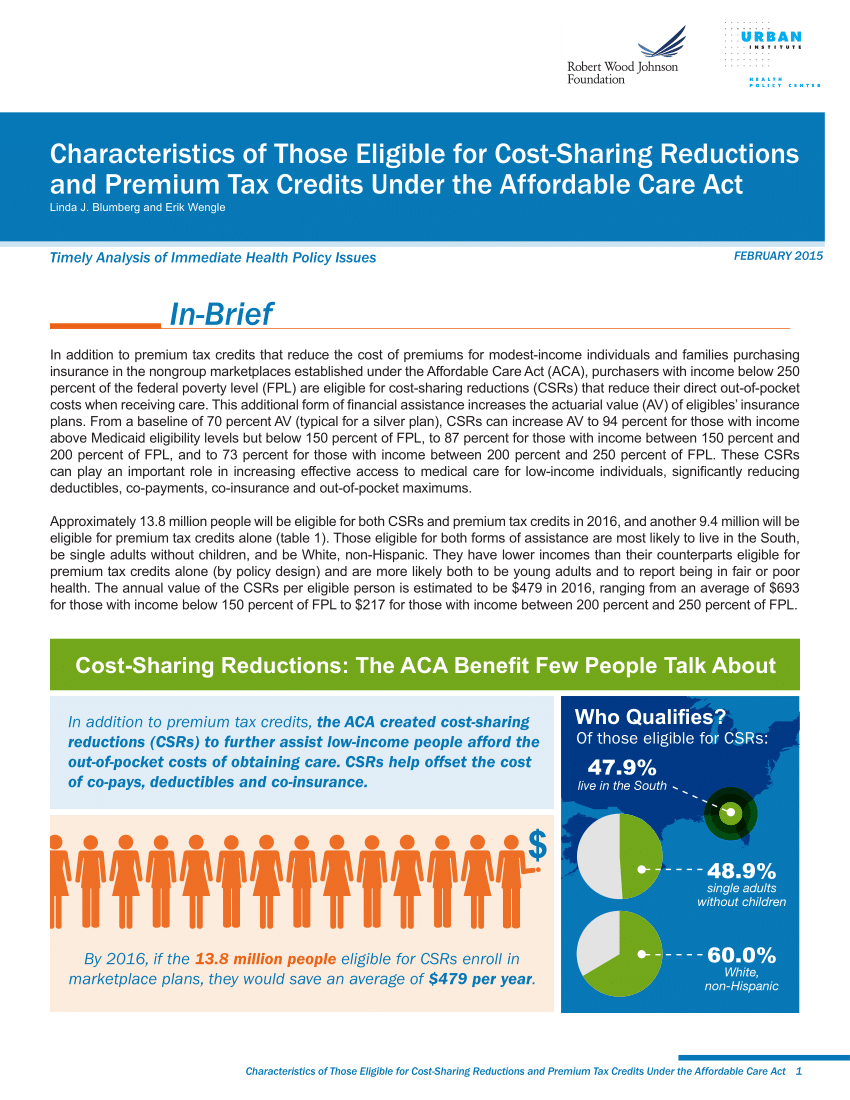

The subsidy known as a cost-sharing reduction lowers the out-of-pocket limit and increases the generosity of coverage for eligible individuals depending on income.

How do you qualify for cost sharing reductions. Be ineligible for Medicaid or Childrens Health Insurance Program CHIP be a US. More than 48 percent of Covered Californias 14 million consumers benefit from these reductions. Youll find out exactly how much youll save only after you apply and shop for Silver plans in the Health Insurance.

To qualify for Cost Sharing Reduction Subsidies you must. For example instead of paying a 45 doctor visit cost sharing may lower your doctor visit copayment down to 5. Individuals and families with incomes up to 250 percent of the poverty line are eligible for cost-sharing reductions if they are eligible for a premium tax credit and purchase a silver plan through the Health Insurance Marketplace in their state.

Lack affordable coverage through an employer. When you fill out a Marketplace. A premium tax credit and cost-sharing reductions.

If you qualify you must enroll in a plan in the Silver category to get the extra savings. Individuals may qualify for financial help with premiums and out-of-pocket costs for coverage purchased through a health insurance marketplace. Shop on the Health Insurance Marketplace or your states Marketplace Make between 100 250 FPL Obtain a Silver plan CSR subsidies are only offered on Silver plans.

To qualify for lower costs at the doctors office your income must be below 250 of the federal poverty level and you must choose a Silver plan. People with lower incomes receive the most assistance. American Indians and Alaska Natives can also qualify to get these cost-sharing reductions when they enroll in a Bronze or Gold plan.

Do you qualify for cost-sharing reductions. Applicants can find out if they qualify for a cost-sharing reduction when they first apply. If you make under 250 of the Federal Poverty Level under 64505 for a family of four you may qualify for cost sharing reduction CSR.

In the Health Insurance Marketplace cost-sharing reductions are often called extra savings. Not funding cost-sharing reductions. The less you make the more cost sharing will save you at the point of.

Cost-sharing reductions allow individuals making less than 30000 a year to pay less for services such as copays and deductibles. In some cases deductibles can be as low as 75 for an individual. Cost Sharing Reduction CSR A discount that lowers the amount you have to pay for deductibles copayments and coinsurance.

Individuals and families with income between 100 and 250 percent of the federal poverty level may also qualify for help paying out-of-pocket costs for services covered by their plan. Full premium subsidies strongest level of cost-sharing reductions. Citizen or proof of legal residency file taxes jointly if married.

How are the cost-sharing reductions provided. To be eligible for the premium tax credit the individual must meet all of the following criteria. This means better benefits for you at the same monthly premium.

If it does fall in the range the amount youll save on out-of-pocket costs depends on your specific income estimate. Financial help is available in two forms. To be eligible for a Cost Sharing Reduction you must.

Be within 100-250 of the Federal Poverty Level. Cost-sharing reductions are available to people who buy their own health insurance through the exchange choose a silver plan and have an income between 100 and 250 of the federal poverty level the lower limit is 139 in states that have expanded Medicaid since Medicaid is available to people with income below that level. But eligibility for robust cost-sharing reductions will depend on the marketplace being able to disregard income over 133 of the poverty level for people who are receiving unemployment compensation and that wont be available until the summer in most states.

Cost Sharing Reduction Cuts 5 Questions Answered In Response To Trump S Executive Order

Cost Sharing Reduction Cuts 5 Questions Answered In Response To Trump S Executive Order

Qualify For Cost Sharing Reductions Enroll Virginia

Qualify For Cost Sharing Reductions Enroll Virginia

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

How Will The Affordable Care Act S Cost Sharing Reductions Affect Consumers Out Of Pocket Costs In 2016 Commonwealth Fund

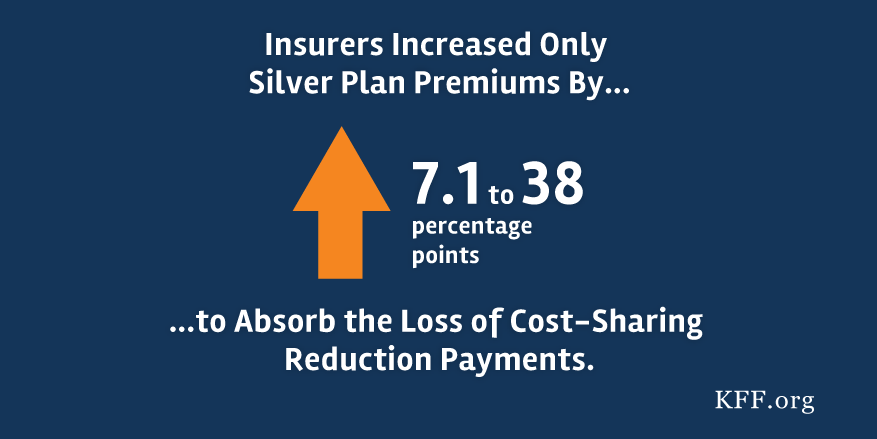

How The Loss Of Cost Sharing Subsidy Payments Is Affecting 2018 Premiums Kff

How The Loss Of Cost Sharing Subsidy Payments Is Affecting 2018 Premiums Kff

Characteristics Of Individuals Eligible For Cost Sharing Reductions And Download Table

Characteristics Of Individuals Eligible For Cost Sharing Reductions And Download Table

What Are Cost Sharing Reductions And Why Do They Matter Healthcare Counts

How Do Cost Sharing Reduction Csr Subsidies Affect Your State Healthcare Town Hall

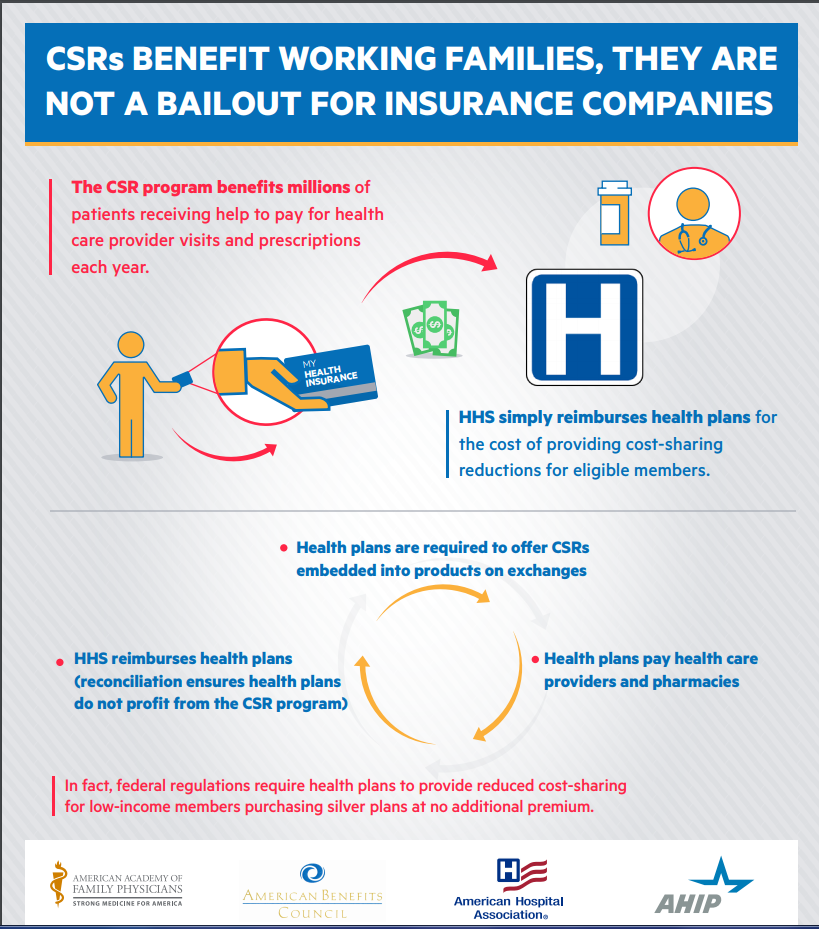

Payers Providers Highlight The Pros Of Cost Sharing Reductions

Payers Providers Highlight The Pros Of Cost Sharing Reductions

What Are Cost Sharing Reductions And Why Do They Matter Healthcare Counts

What Are Cost Sharing Reductions And Why Do They Matter Healthcare Counts

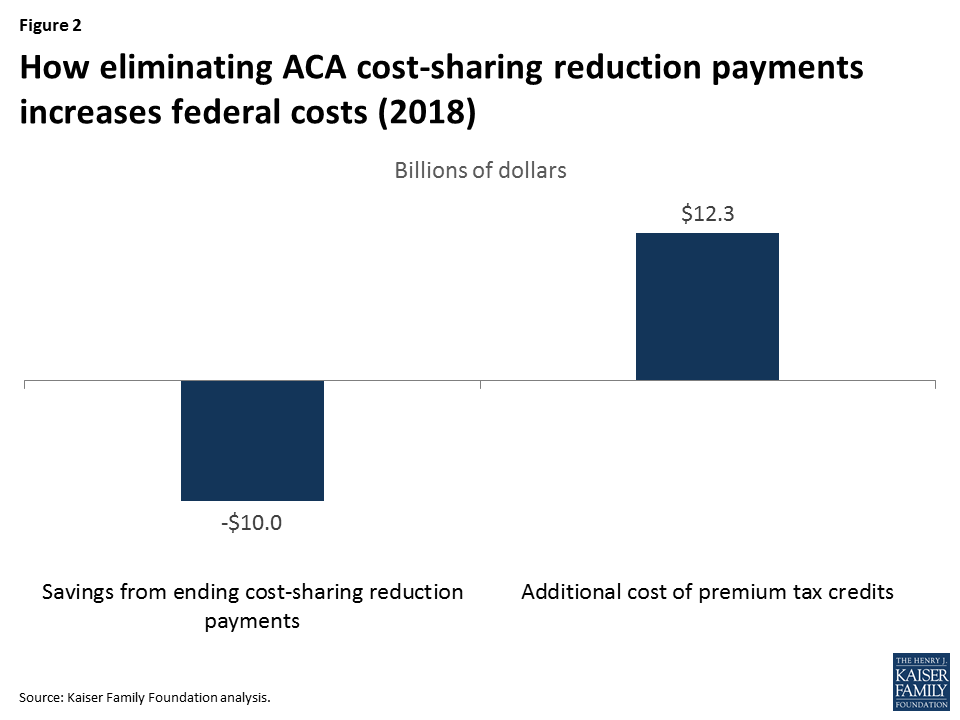

The Effects Of Ending The Affordable Care Act S Cost Sharing Reduction Payments Kff

The Effects Of Ending The Affordable Care Act S Cost Sharing Reduction Payments Kff

Characteristics Of Individuals Eligible For Cost Sharing Reductions And Download Table

Characteristics Of Individuals Eligible For Cost Sharing Reductions And Download Table

What It Means For You The Administration S Cost Sharing Reduction Funding Cuts By Lori Lodes Get America Covered Medium

What It Means For You The Administration S Cost Sharing Reduction Funding Cuts By Lori Lodes Get America Covered Medium

Cost Sharing Reductions Subsidy Wikipedia

Cost Sharing Reductions Subsidy Wikipedia

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.