Where To File Form 1099 Misc In California. File Form 1099 Misc California.

California 1099 State Reporting Rules E File Ca 1099 Forms

California 1099 State Reporting Rules E File Ca 1099 Forms

Where To File Form 1099 Misc In California.

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

Where to file 1099 misc in california. FRANCHISE TAX BOARD PO BOX 942840 SACRAMENTO CA 94240-6090. Mail paper returns to. File Form 1099 Misc California.

How To File 1099 Misc Forms In California. Department of the Treasury Internal Revenue Service Center Ogden UT 84201. Where To File Form 1099 Misc.

How To File Tax Form 1099 Misc. For paper filed returns the due date is February 28 2021. If youre in California you mail Copy A to the Department of the Treasury Internal Revenue Service Center Kansas City MO 64999.

This income will be included in your federal adjusted gross income which you report to California. Where you send Copy A depends on where you are. What Is A 1099 Misc Tax Form.

How To File 1099 Misc Forms In California. California Connecticut District of Columbia Louisiana Maryland Pennsylvania Rhode Island West Virginia. 21 Posts Related to Where To Mail Form 1099 Misc In California.

When you paper file 1099 MISC it must be sent to the IRS on or before the deadline. Department of the Treasury Internal Revenue Service Center Ogden UT 84201. The IRS Recommends Filers to E-File Form 1099-MISC for quick processing.

Box 942840 Sacramento CA 94240-6090. If filing 250 or more returns you must file electronically using Secure Web Internet File Transfer SWIFT. You may receive a 1099-MISC if you received at least 600 for.

File Form 1099 Misc California. The 1099-MISC mailing addresses are given below. Based on the principal business or residence.

California State Tax Forms By Mail. February 28 2021 for paper. File Tax Form 1099 Misc.

In this case we e-File your forms with CFSF status and the IRS will forward your forms to the state via the CFSFP. When filing state copies of forms 1099 with California department of revenue the agency contact information is. For 2020 the due date is.

How To File A 1099 Misc. Franchise Tax Board PO Box 942840 Sacramento CA 94240-6090. The California Franchise Tax Board recommends that businesses use the IRS Combined FederalState Filing Program to fulfill their state 1099 filing requirements.

Check the 1099 online reporting requirements for California and e-file in minutes. Franchise Tax Board PO. Order 1099 Forms From Irs By Mail.

Yes the State of California supports the Combined Federal and State Filing Program 1099 is applicable this year JMP-PC. Choose the correct mailing address and send it to the IRS. Where To File 1099 Misc Form.

Irsgov Form 1099 Misc. How Do I File My 1099 Misc. Where To Mail Form 1099 Misc.

You may file up to 249 paper returns with the FTB. If you have an exception that requires you to report something different for federal and state purposes such as a different dollar amount file separate returns with IRS and us. With the CFSFP any federal e-File you submit through Tax1099 our platform will automatically flag your forms based on the states participation in the program.

Where To Mail Pa Form 1099 Misc. If they file 250 or more returns they must file electronically. This clause differs according to each state and state-specific filing requirements.

21 posts related to Where To File Form 1099 Misc In California. 1099 Misc What Tax Form To File. Im attaching the article about the combined program again for your reference.

You may request an extension to file electronically by submitting FTB Form 6274A. IRS will forward the information to us whether you are located in or out of the State of California except 1099-NEC must be submitted via paper or electronically to FTB. Where do I mail the forms.

Mail the forms to. How Do I File My 1099 Misc Tax Form. We accept the IRS extended due date of March 31 for electronically-filed Forms 1099 1098 and W-2G.

24 posts related to Where To File Form 1099 Misc In California. While we encourage payers to file electronically they may file up to 249 paper returns. Report the amount indicated on the form as income when you file your federal return.

Where To Mail 1099 Misc Forms. January 10 2019 by Mathilde Émond. Where To Mail Form 1099 Misc In Florida.

1099 Misc What Tax Form To File. Hansgreenholt January 9 2019 Templates No Comments. Once youve submitted your form 1099 to the IRS theyll be the one to submit it to your state.

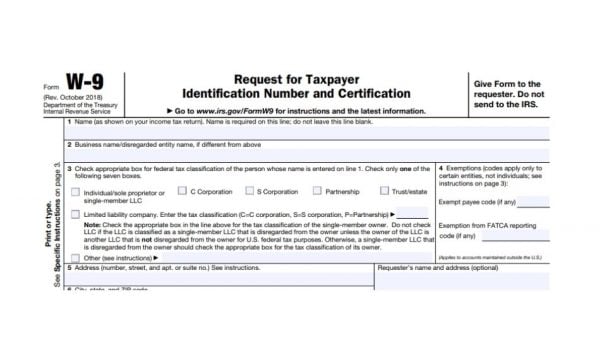

1099 Misc Tax Form Kit. E-file Form 1099-NEC MISC INT DIV directly to the California State agency with TaxBandits. You are required to file and mail Copy 1 of Form 1099-MISC to the state tax department according to the state from which you are generating income or the one from which you are operating your business or have your business situated.

Where To File Form 1099 Misc In California. California Connecticut District of Columbia Louisiana Maryland Pennsylvania Rhode Island West Virginia. March 31 2021 for electronic submissions.

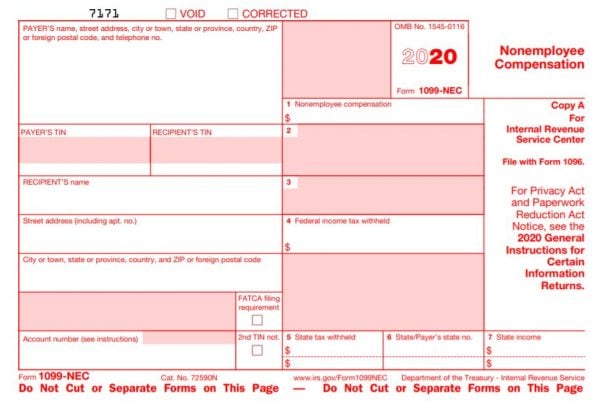

California requires 1099-MISC filing. When is the due date to file. A paper or electronic copy of the form 1099-NEC must be filed with FTB directly even if you filed it with the IRS.

3 Tips For Payroll Tax Filing Form 1099 Misc Novato Ca Patch

3 Tips For Payroll Tax Filing Form 1099 Misc Novato Ca Patch

Where To File Form 1099 Misc In California Vincegray2014

Where To File Form 1099 Misc In California Vincegray2014

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png) How To Report And Pay Taxes On 1099 Nec Income

How To Report And Pay Taxes On 1099 Nec Income

1099 Nec And 1099 Misc Changes And Requirements For Property Management

1099 Nec And 1099 Misc Changes And Requirements For Property Management

Where To Mail Form 1099 Misc In California Vincegray2014

Where To Mail Form 1099 Misc In California Vincegray2014

Where To File 1099 Misc Form Vincegray2014

Where To File 1099 Misc Form Vincegray2014

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

1099 Misc Instructions And How To File Square

1099 Misc Instructions And How To File Square

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg) Form 1099 Misc Miscellaneous Income Definition

Form 1099 Misc Miscellaneous Income Definition

There S A New Tax Form With Some Changes For Freelancers Gig Workers

There S A New Tax Form With Some Changes For Freelancers Gig Workers

File Form 1099 Misc Online Vincegray2014

File Form 1099 Misc Online Vincegray2014

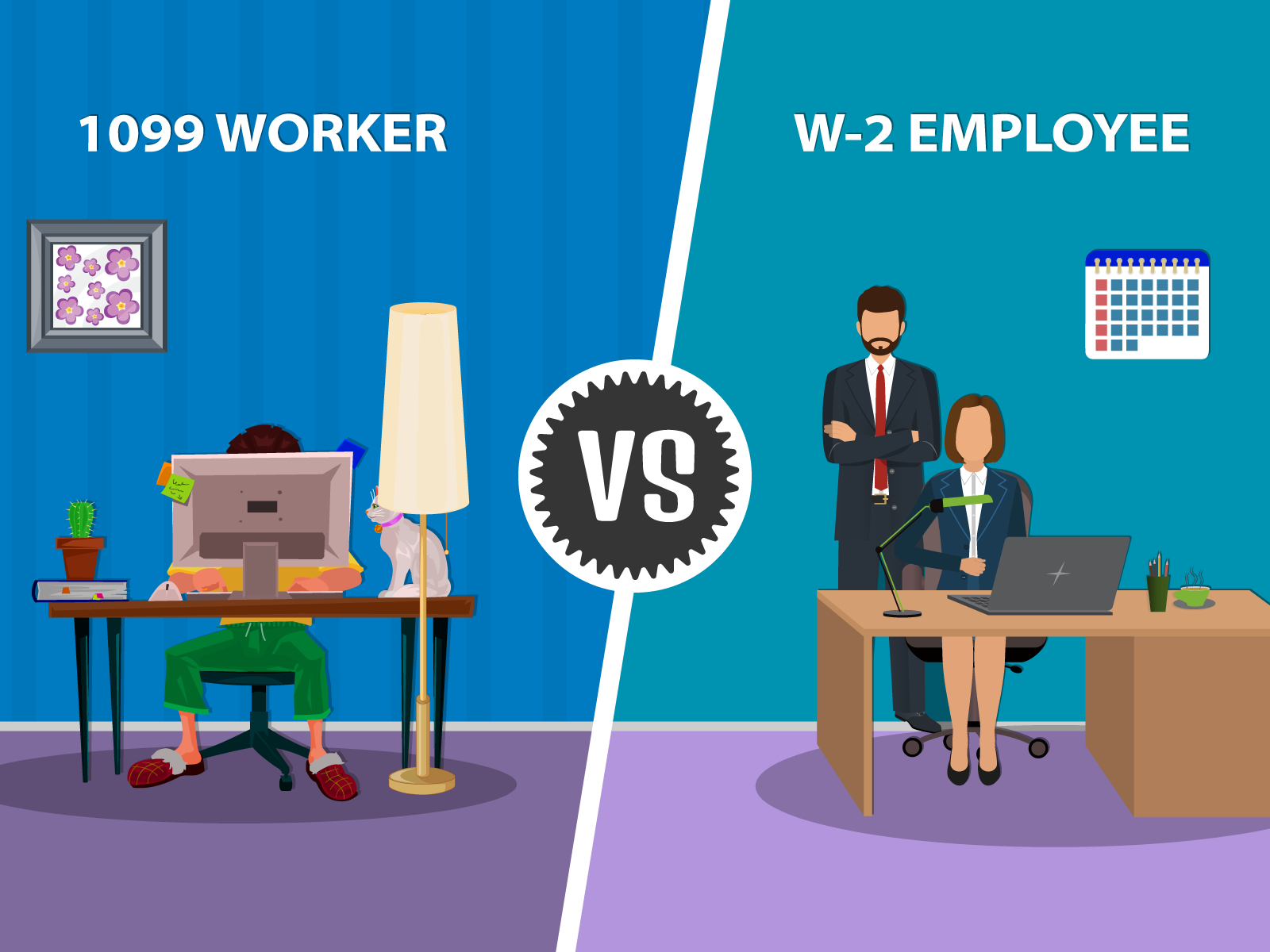

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

1099 Workers Vs W 2 Employees In California A Legal Guide 2021

:max_bytes(150000):strip_icc()/MiscellaneousIncome-dff90d4dcb754dd1a08e153167070669.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.