If you have an ITIN number or green card we can get you life insurance. No penalty for not having health insurance for 2019.

Serious Challenges And Potential Solutions For Immigrant Health During Covid 19 Health Affairs

Serious Challenges And Potential Solutions For Immigrant Health During Covid 19 Health Affairs

I believe if I wanted to file a W7 for to apply for an ITIN number I would need to file an.

Health insurance with itin number. Is there a reason why they need our social security numbers. Yes as long as the person is a lawful immigrant the individual can obtain health insurance through the marketplace. The Instructions for Form 8962 state.

You do however need an important document. For instance if you are an immigrant applying through the. The IRS requires that an insurance company obtain the SSN or ITIN of any policy owner who may receive an large.

Buying Health Insurance with a ITIN Number. Undocumented immigrants are excluded from all ACA benefits so they are not eligible to buy health insurance through the ACAs health care marketplace even at full cost. You must answer questions on the life insurance application about your age and health to qualify.

If a taxpayer has an ITIN instead of a SSN does health insurance coverage have to be reported under the Affordable Care Act. Additionally some counties offer other health care options for immigrants who. Immigrants who are not lawfully present can also buy private health insurance on their own outside of Covered California.

But I am wondering if I will be able to get health insurance for her. Because it can be difficult for illegal immigrants to find gainful employment due to a lack of a Social Security number you might not have the means to pay for health insurance out of pocket it can be extremely expensive. Forums Insurance Agents and Brokers Forum Getting Started Selling Insurance.

Find out if you qualify. Undocumented immigrants arent eligible to buy Marketplace health coverage or for premium tax credits and other savings on Marketplace plans. Before you can apply for health insurance it might help to understand how healthcare reform can work for you.

Your health insurance company is required to provide Form 1095-B PDF Health Coverage to you and to the Internal Revenue Service. Yes an ITIN Individual Taxpayer Identification Number issued by the US Department of Treasury Internal Revenue Service IRScan be used in place of the social security number SSN on any insurance application. Alien lawfully present in the United States.

That may affect the tax payers bottom line. My health insurance company has requested that I provide them with my social security number and the social security numbers of my spouse and children. An ITIN Individual Taxpayer Identification Number issued by the US Department of Treasury Internal Revenue Service IRS is most commonly used in place of the social security number SSN on any insurance application for an applicant without the SSN.

You can obtain an ITIN through the IRS. That document as we mentioned before is an Individual Taxpayer Identification Number ITIN. I filed my taxes for 2020 as a single person.

And while there are certainly more affordable options they often do little to alleviate the costs associated with medical care. At Immigrant Life Insurance we think all immigrants in the United States deserve life insurance protection. CAA services are by appointment only.

On 1222015 at 708 AM Chowdahead said. Yes you can get life insurance without a Social Security number. I am thinking I should apply for an ITIN number for her.

You will use information from the form to prepare your individual income tax return. However they may qualify for coverage through Medi-Cal up to age 19 or for pregnancy coverage. If they had health care through the marketplace healthcaregov and received a 1095-A then the 1095-A must be reconciled to see if the Fed paid to much or too little for the Premium Tax Credit.

The law requires SSNs to be reported on Form 1095-B. At Immigrant Life Insurance we have the knowledge experience and access to insurance companies that will issue policies to immigrants with an ITIN Individual Taxpayer Identification Number green card or social security card. Individuals who are eligible to file their taxes with an ITIN can establish that they are eligible for an exemption from the ACAs individual mandate which requires that people have health insurance.

That said you can get insurance through private insurance companies and there are a number of ways to go about it. The IRS requires that an insurance company obtain the SSN or ITIN of any policy owner who may receive an insurance benefit payment. Can I get life insurance without an ITIN.

The exemption would be on 8962 and be a Code C. Yes this will need to be reported under the Affordable Care Act. This includes the surname and first name date of birth of the card holder the first ten digits of the health insurance number a c ode number for the health insu rance company and the period of validity of the card.

According to the IRS ACA webinar today ITIN DO NOT need to have the ACA insurance etc. It looks like they are exempt based on interpretation of the law by the National Immigration Law Center. You may be able to use your Individual Taxpayer Identification Number ITIN to apply for health insurance in place of the SSN.

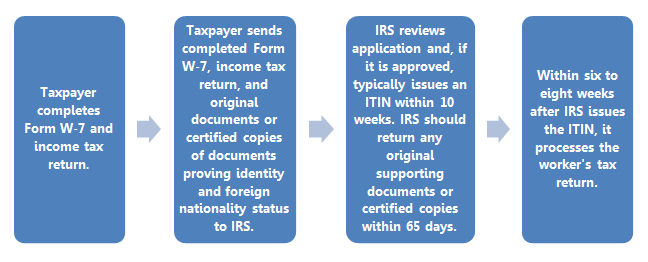

Immigrants who are not lawfully present do not qualify for a health plan through Covered California. It may be longer to get an ITIN for applications submitted between January 15 and April 15 due to the number of applications received by the IRS during this time period. Most insurance plans are focused more on your current residence than your SSN.

When can I meet with the CAA. Typical turnaround time to receive a response from the IRS for an ITIN is 3-4 weeks. Even if you dont have a social security number you can obtain life insurance.

Life Insurance Without Social Security Number Immigrants Get Covered

Life Insurance Without Social Security Number Immigrants Get Covered

Tax Id Number Itin Everything You Need To Know

Tax Id Number Itin Everything You Need To Know

International Health Insurance Individual Family Allianz Care

International Health Insurance Individual Family Allianz Care

What If I Don T Have Health Insurance H R Block

What If I Don T Have Health Insurance H R Block

Health Insurance For People Without A Social Security Number

Health Insurance For People Without A Social Security Number

Self Employed Health Insurance Deductions H R Block

Self Employed Health Insurance Deductions H R Block

Health Insurance For Children Without A Social Security Number My Family Life Insurance

Health Insurance For Children Without A Social Security Number My Family Life Insurance

Ultimate Guide To Selling International Health Insurance

Ultimate Guide To Selling International Health Insurance

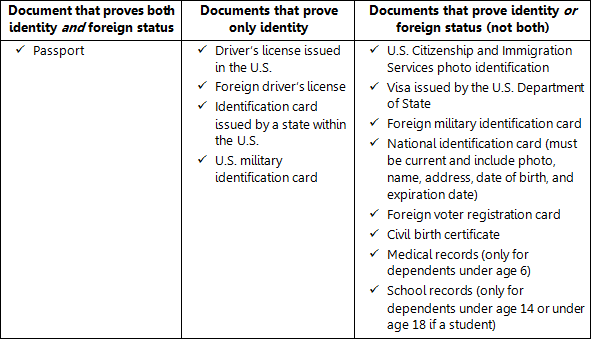

Individual Taxpayer Identification Number National Immigration Law Center

Individual Taxpayer Identification Number National Immigration Law Center

Applying For Health Insurance Without An Ssn Latorre Insurance

Applying For Health Insurance Without An Ssn Latorre Insurance

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

3 21 263 Irs Individual Taxpayer Identification Number Itin Real Time System Rts Internal Revenue Service

Individual Taxpayer Identification Number National Immigration Law Center

Individual Taxpayer Identification Number National Immigration Law Center

Https Www Uhc Com Content Dam Uhcdotcom En Healthreform Pdf Provisions Reformreporting6055 Aso Ssn Solicitation Pdf

Https Oregonlawhelp Org Resource Immigrants Taxes And The Affordable Care Act Download Cf36d246 B9b2 1f4c 047a 9b7ff078f164

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.