Does Insurance Cover ER or Urgent Care Visit. How much you pay for the visit depends on your health insurance plan.

In fact the federal Emergency Medical Treatment and Labor Act EMTALA is designed to guarantee a persons right to receive emergency treatment regardless of if they can pay or not source.

Emergency room only insurance. For example if you get into a medical emergency and your medical costs total thousands of dollars. Monthly plan premiums tend to be lower but youll generally need to pay for all health-care costs out of pocket until you reach the plans annual deductible which is usually at least a couple thousand dollars. Emergency Room Insurance Coverage Emergency room insurance coverage comes with a lot of caveats.

The answer is Yes you can. Typically an emergency room visit which costs more than 150 depending on the patients condition is part of a health insurance coverage. The patient is probably unconscious and they cannot wait for the condition to deteriorate because they dont have the insurance details.

Most health plans may require you to pay something out-of-pocket for an emergency room visit. Truth be told emergency room bills can be very high sometimes and without insurance it becomes close to impossible to settle them. When you or a member of your family needs emergency medical care a lack of health insurance can mean the difference between life and death.

Emergency room costs can vary greatly depending on what type of medical care you need. People are left stranded when the mail comes in with their emergency bill reading close to 20000. Catastrophic plans are designed to protect you in a worst-case scenario.

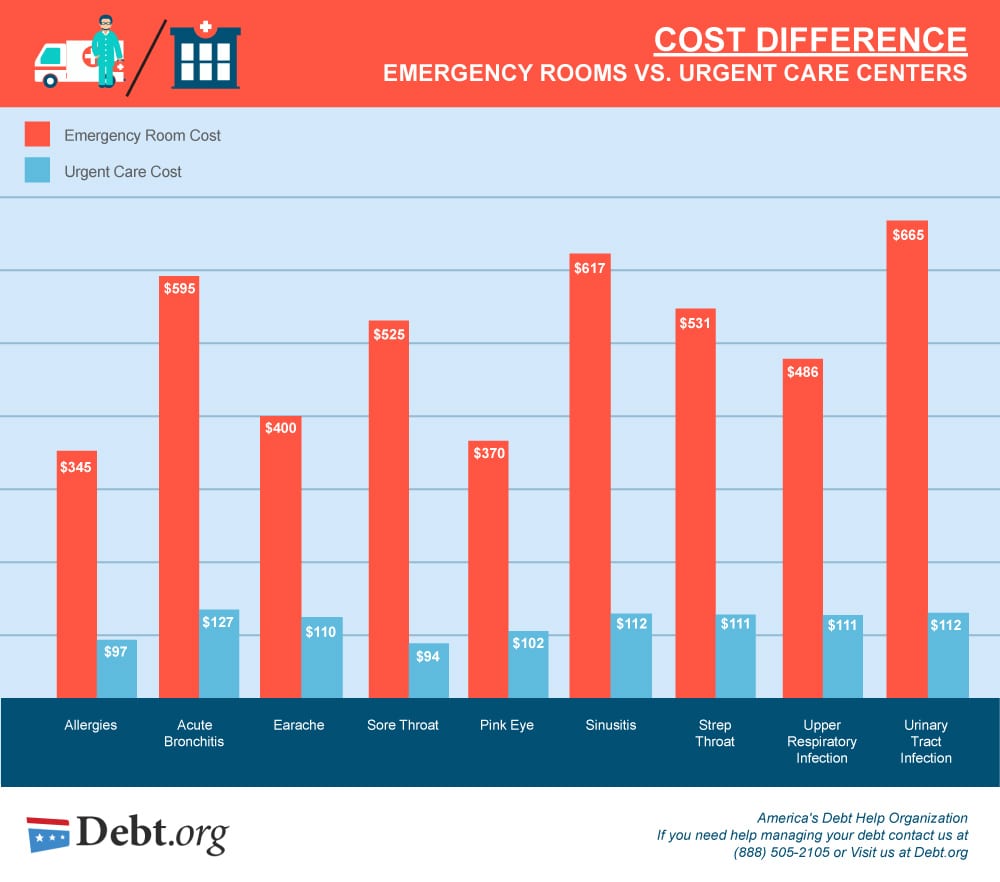

Under the Affordable Care Act Obamacare health insurance plans are required to cover emergency services. According to Consumer Health Ratings the average cost of emergency room visits in 2019 was around 1700. High emergency room costs are one significant reason to get health insurance and safeguard your finances.

The fixed coverage plans will ONLY pay the fixed amount listed in the schedule of benefits for ALL charges incurred in the Emergency Room. You could use catastrophic health insurance for. You may wind up with a hefty hospital bill if you visit an emergency room without insurance but they must care for you in an emergency.

Health insurance already covers emergency room care so you dont need extra insurance. Can you visit a freestanding emergency room with no insurance. Catastrophic health insurance is a type of insurance plan that provides coverage for emergency medical situations only.

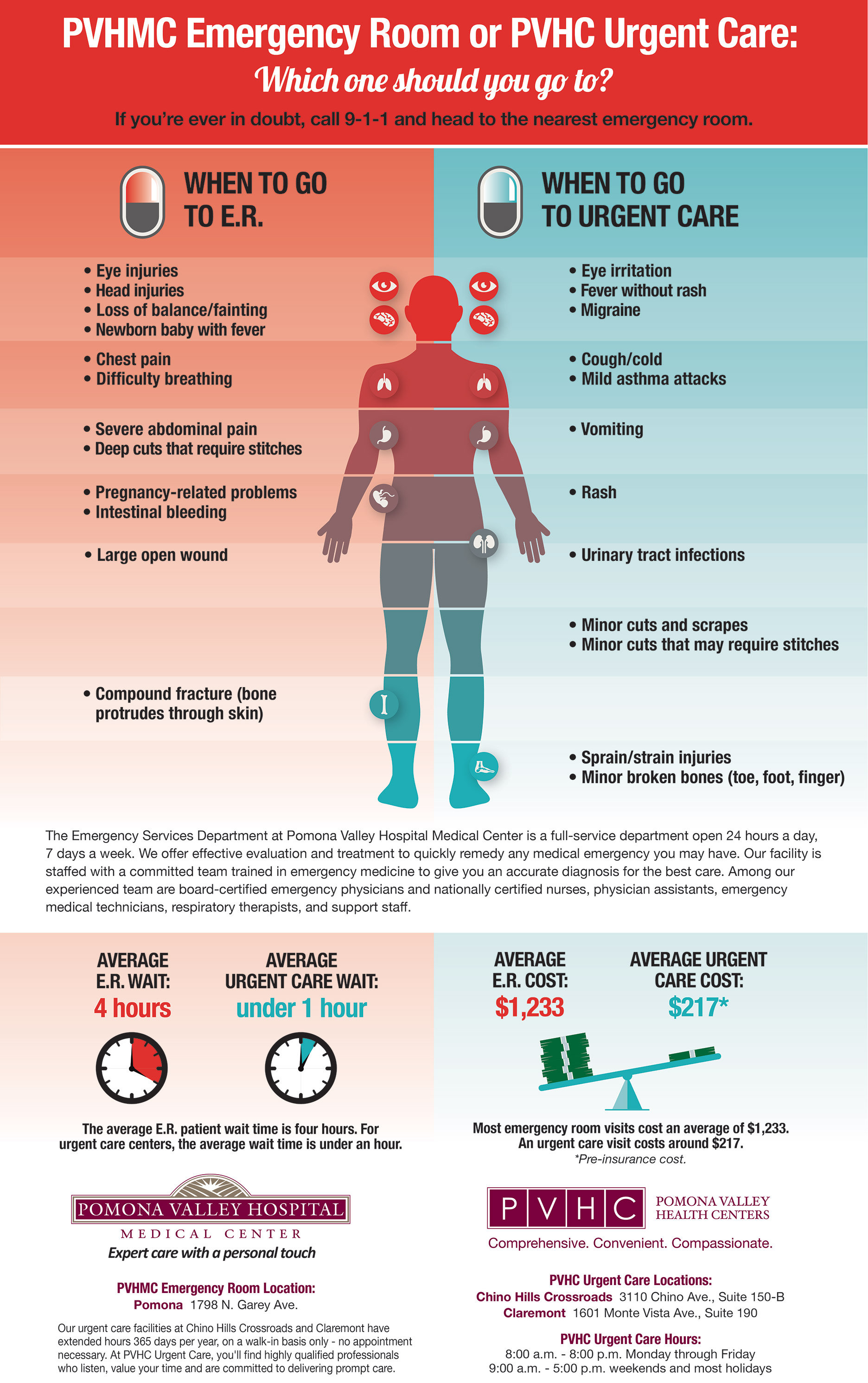

Typical health insurance companies must be notified of an emergency room stay within 48 hours and its likely you will be responsible for a high deductible or copay before your provider pays out for any emergency room insurance coverage. However you must check out the insurance plan if its from Cigna Aetna Blue Cross Blue Shield or United Health Care which we accept in our facility. As a general rule urgent care will cost less than emergency room visits.

It basically says that if you need emergency medicine you must be treated at any emergency room to the best of the staffs ability until youre in stable condition. Emergency rooms are typically designed to respond to life-threatening illnesses and injuries that require immediate attention. Thats a lot of money.

Also regardless of whether you have health insurance emergency departments must treat you if its an emergency. Also studies show that emergency room costs have steadily increased since 2013 and are likely to continue climbing. They also cannot charge you higher copays or coinsurance for going to an out-of-network emergency room.

The emergency room will administer treatment immediately since they cannot delay screening or treatment in order to ask about the payment procedure or insurance status. But before giving you the cost of an ER visit with an insurance plan lets get to know the cost of emergency room visit without insurance. Thanks to recent changes in American healthcare laws obtaining insurance and getting emergency care is easier than ever.

For example the VisitorSecure plan with a 5000000 policy maximum will only pay up to 37500 per injuryillness for the use of a hospital Emergency Room and ALL EXPENSES INCURRED THEREIN.

Emergency Room Vs Urgent Care Differences Costs Options

Emergency Room Vs Urgent Care Differences Costs Options

Cost Comparison Er Vs Urgent Care Naught Naught Insurance

Cost Comparison Er Vs Urgent Care Naught Naught Insurance

How Much Does An Urgent Care Visit Cost Ehealth

How Much Does An Urgent Care Visit Cost Ehealth

Can I Visit A Freestanding Emergency Room With No Insurance

Can I Visit A Freestanding Emergency Room With No Insurance

Guide To Navigating An Urgent Care Visit Without Insurance

Guide To Navigating An Urgent Care Visit Without Insurance

Usa Visitors Difference Between Urgent Care Vs The Emergency Room

Usa Visitors Difference Between Urgent Care Vs The Emergency Room

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

Emergency Room Visit Coverage In Visitors Insurance For Fixed Coverage Plans

Emergency Room Or Pvhc Urgent Care Which One Should You Go To Pomona Valley Health Centers

Emergency Room Or Pvhc Urgent Care Which One Should You Go To Pomona Valley Health Centers

Urgent Care Vs Emergency Room What S The Difference Gohealth Urgent Care

Urgent Care Vs Emergency Room What S The Difference Gohealth Urgent Care

Emergency Room Health Insurance Coverage Keep Yourself Protected

Emergency Room Health Insurance Coverage Keep Yourself Protected

Emergency Room Process Stock Vector Illustration Of Care 14659597

Emergency Room Process Stock Vector Illustration Of Care 14659597

Northern Utah Emergency Room Er Vs Urgent Care Ogden Clinic

Northern Utah Emergency Room Er Vs Urgent Care Ogden Clinic

What To Expect In The Emergency Department Mount Sinai Hospital Toronto

What To Expect In The Emergency Department Mount Sinai Hospital Toronto

/average-cost-of-an-er-visit-059cd1b1df38413f94f3ba420c8c24b5.png)

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.