On the other hand with a self-funded plan the employer pays claims costs only as they are incurred. Like self-funded insurance employers agree to a set pot of money upfront from which all claims are paid.

Employee Medical Benefits Self Funded Vs Fully Insured Brown Brown Of Connecticut Inc

Employee Medical Benefits Self Funded Vs Fully Insured Brown Brown Of Connecticut Inc

What is a Self-Funded Health Plan.

Self funded plans. Full control of the plan design Plan designs that will provide cost savings. The employer reaps the savings in the years with average to below average claims. If you get insurance through your or your parents work or schoolincluding if you are a government employeeyou may have a self-funded plan.

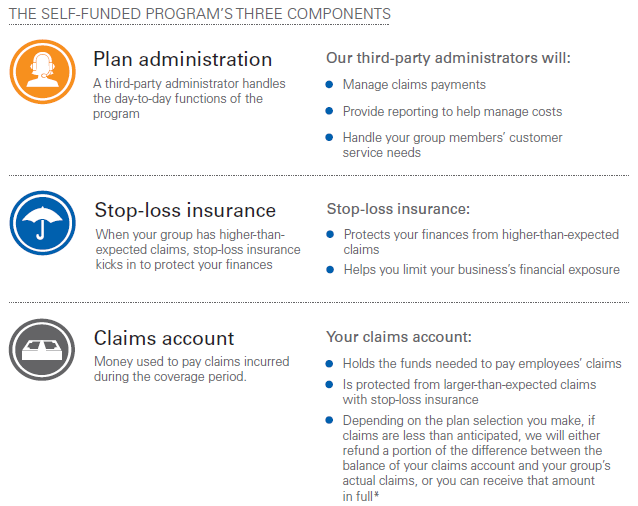

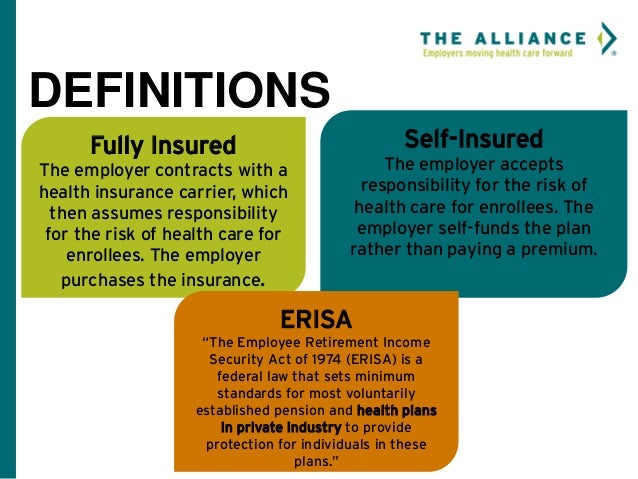

What is a self-funded plan. Its also known as a self-insured health plan or self insurance. The insurance company manages the payments but the employer is the one who pays the claims.

With a traditional self-funded plan employers of all sizes gain the flexibility to customize and adjust benefit plans as organizational needs change. Soumettez votre projet en ligne. In these plans your employer or school uses their own funds to cover your health expenses instead of paying premiums to an.

That means the employer pays health claims based on the healthcare thats used. Self-funded health plans are giving smaller businesses hope that they can provide excellent benefits without breaking the bank. The premium covers administration costs.

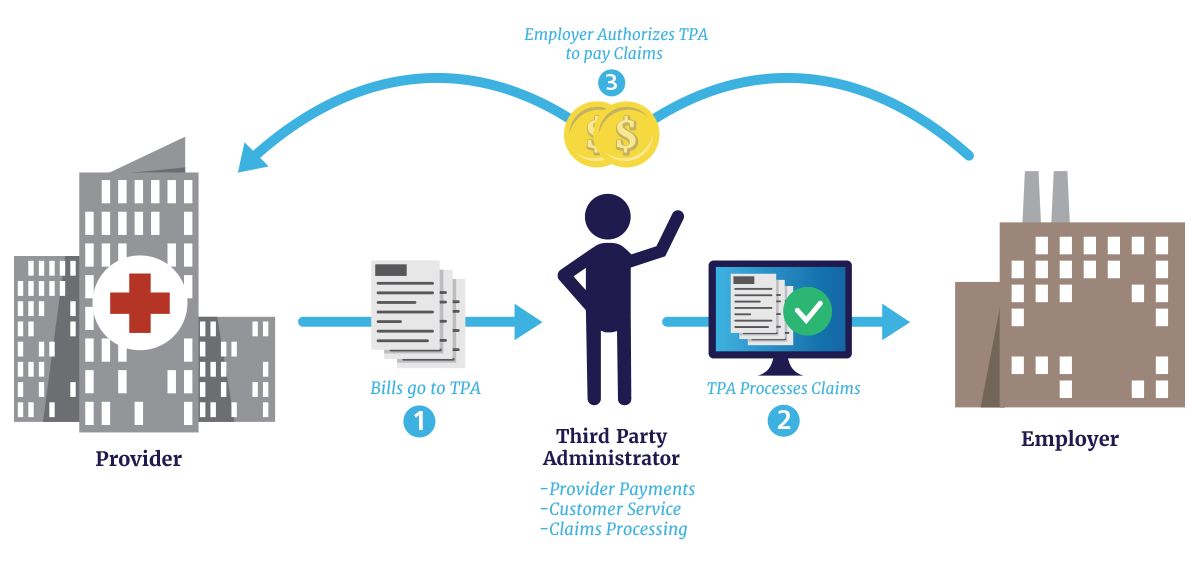

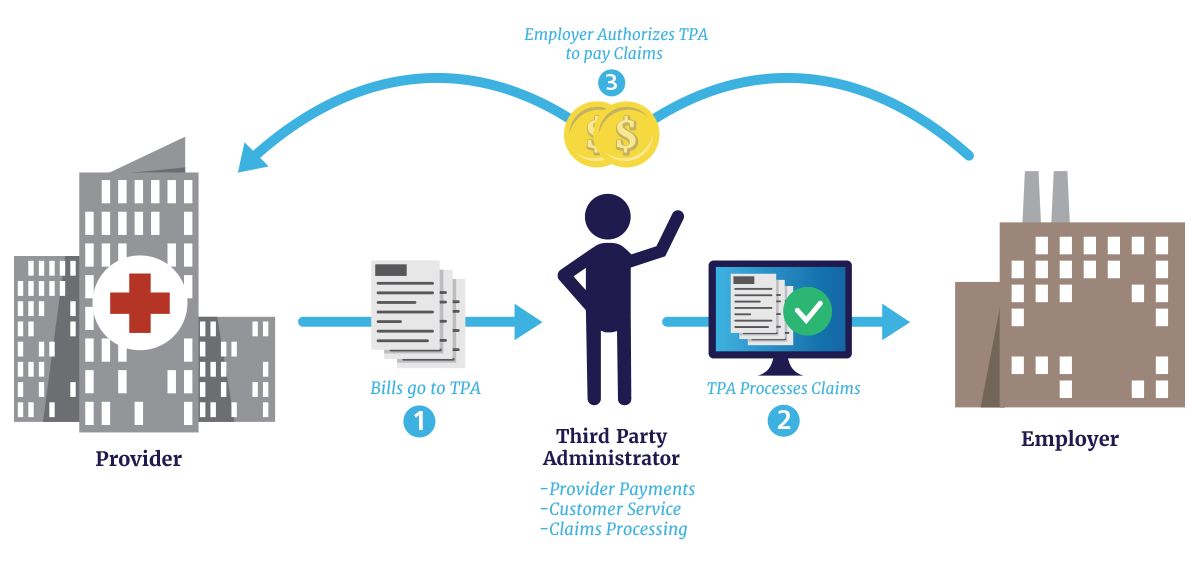

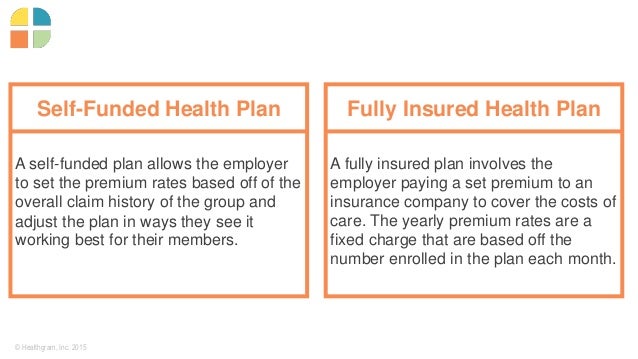

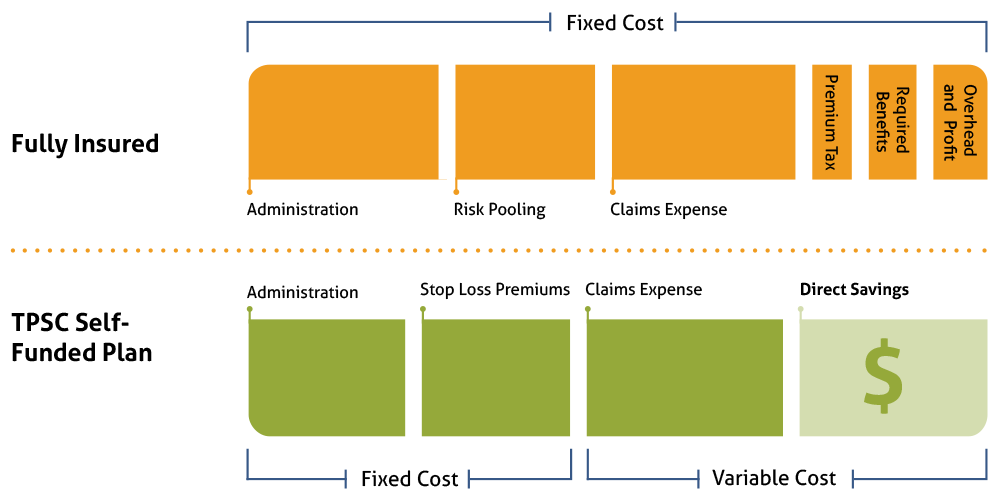

In a traditional fully insured plan employers pay one set premium to a traditional insurance carrier. This in turn improves cash flow and overall ease of administration by centralizing services through a TPA and only paying for actual claims not projected costs. Annonce Leader du Financement Participatif au Service de lAgriculture et lAlimentation.

With a self-insured self-funded health plan also known as a section 105 plan employers run their own health plan as opposed to purchasing a fully-insured plan from an insurance carrier. Self-funded health plans are filling the gap. Self-funded plans allow the group to save on costs that may be associated with a Fully Insured Dental Plan.

In keeping with the order and to protect our employees and our community we have shifted many of our employees to work-from-home. A Self Funded or Self-Insured plan is one in which the employer assumes the financial risk for providing health care benefits to its employees. However self-insuring exposes the company to much larger risk in the event.

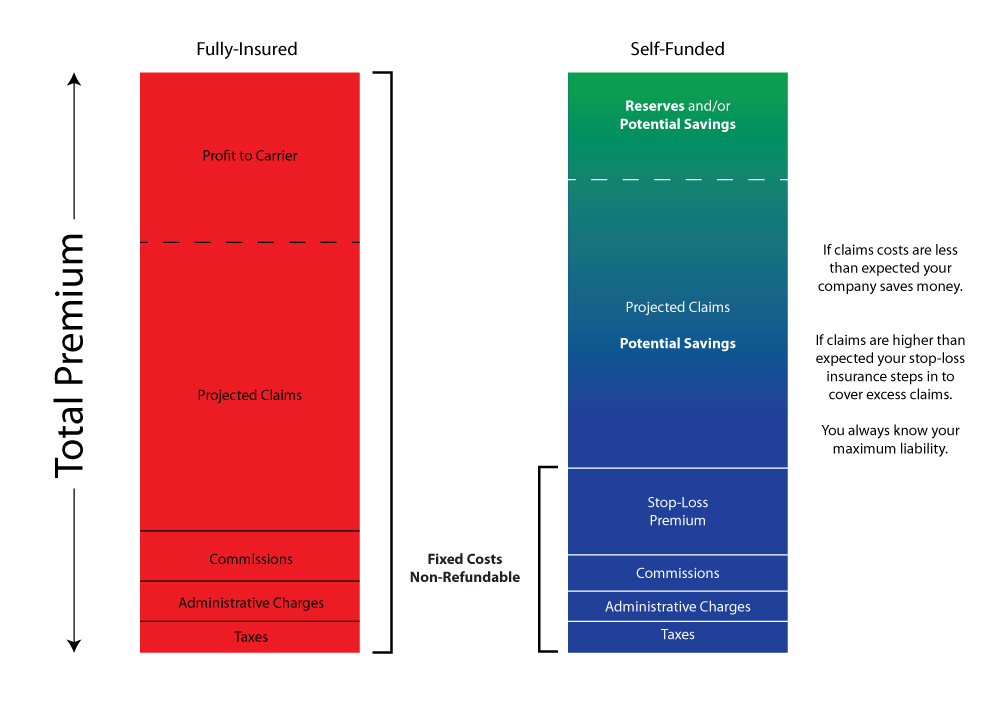

Une équipe dexperts à votre écoute. Employers opt to self-insure because it allows them to save money if claims are at or below the expected level. To put it in.

However self-funding exposes the company to greater risk if. Level-funded insurance plans are a form of self-funded insurance. Self-funded plans offer most companies a way to save money on their benefits plans while providing healthcare and customer service to employees that is just as good or better than they would receive in a traditional fully insured plan.

CDCs guidance on what to do if you are sick. The more your company spends on benefits the less they have to share with employees in terms of pay and other benefits. Self-insurance is also called a self-funded plan.

This is a good thing for employees too. This is a type of plan in which an employer takes on most or all of the cost of benefit claims. Cost savings and benefits from a self-funded include.

With a self-funded self-insured health plan employers operate their own health plan as opposed to purchasing a fully-insured plan from an insurance carrier. Une équipe dexperts à votre écoute. However many carriers that offer level-funded insurance plans inflate administration costs by up to 40 and ask their customers to split 50 of their unused funds with the carrier.

Annonce Leader du Financement Participatif au Service de lAgriculture et lAlimentation. CDCs guidance on COVID-19 prevention. Employers choose to self-insure because it can allow them to save significantly on premiums.

In practical terms Self-Insured employers pay for claims out-of-pocket as they are presented instead of paying a pre-determined premium to an insurance carrier for a Fully Insured plan. A self-funded plan is a health plan that is sponsored by an employer rather than an insurance company. Self-funded plans do not work like other health insurance plans.

Is considered an essential business under Ohios stay-at-home order. With this model it does not matter how many claims an employer does or does not incur the same monthly cost must be paid to the insurer. Soumettez votre projet en ligne.

What Are Self Funded Health Plans Aka Self Insured Benefit Plans

What Are Self Funded Health Plans Aka Self Insured Benefit Plans

What Is Self Funded Insurance Your Self Funding Faqs Answered

What Is Self Funded Insurance Your Self Funding Faqs Answered

Exploring Self Funded Healthcare Insurance Plans Obamacare Help For Small Businesses Inc Com

Exploring Self Funded Healthcare Insurance Plans Obamacare Help For Small Businesses Inc Com

Self Funded Vs Fully Insured Health Plans Youtube

Self Funded Vs Fully Insured Health Plans Youtube

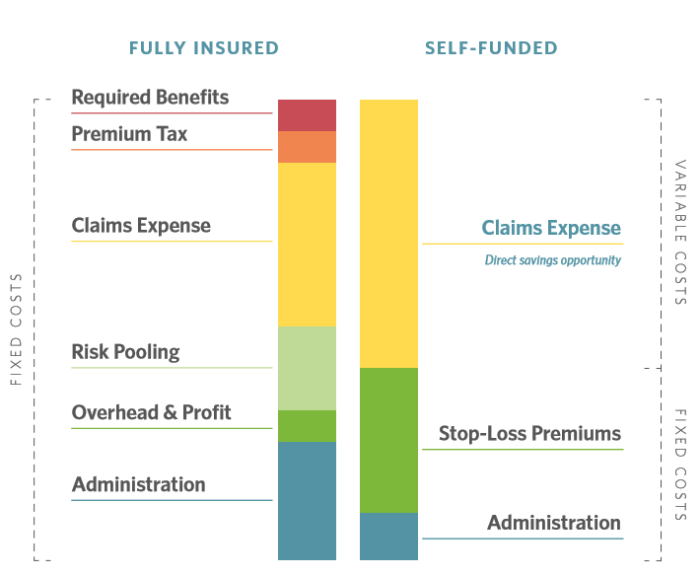

Self Funded Vs Fully Insured Health Plans Infographic Medcost

Self Funded Vs Fully Insured Health Plans Infographic Medcost

Self Funded Health Insurance Plans Are A Money Saving Alternative For Small Groups Georgia Health Insurance Inc

Self Funded Health Insurance Plans Are A Money Saving Alternative For Small Groups Georgia Health Insurance Inc

What The Fund All About Fully Partially And Self Funded Health Plans Filice Insurance Services Llc

What The Fund All About Fully Partially And Self Funded Health Plans Filice Insurance Services Llc

Understanding The Basics Of Self Funded Health Plans

Understanding The Basics Of Self Funded Health Plans

Self Funded Plans Fringe Benefit Plans Inc

Self Funded Plans Fringe Benefit Plans Inc

Terms To Know In Self Funded Health Plans Medcost

Terms To Know In Self Funded Health Plans Medcost

Self Funded Health Plans Fully Insured Vs Self Insured Prodigy

Self Funded Health Plans Fully Insured Vs Self Insured Prodigy

Fully Insured Vs Self Funded Shenandoah Valley Group

Fully Insured Vs Self Funded Shenandoah Valley Group

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.