Estimating your expected household income for 2021. The types of assistance offered under the Affordable Care Act are.

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

Are You On The Edge Of The Aca Subsidy Cliff Ehealth Insurance

And although there is normally an income cap of 400 of the poverty level discussed in more detail below that does not apply in 2021 or 2022.

Obamacare income levels for subsidies. The types of assistance offered under the Affordable Care Act are. Before the American Rescue Plan you could put as much as 983 of your income toward insurance without qualifying for subsidies. With the new subsidies and the limits the Covid-19 relief bill placed on health care costs many are also paying much less for Obamacare plans than they have in the past.

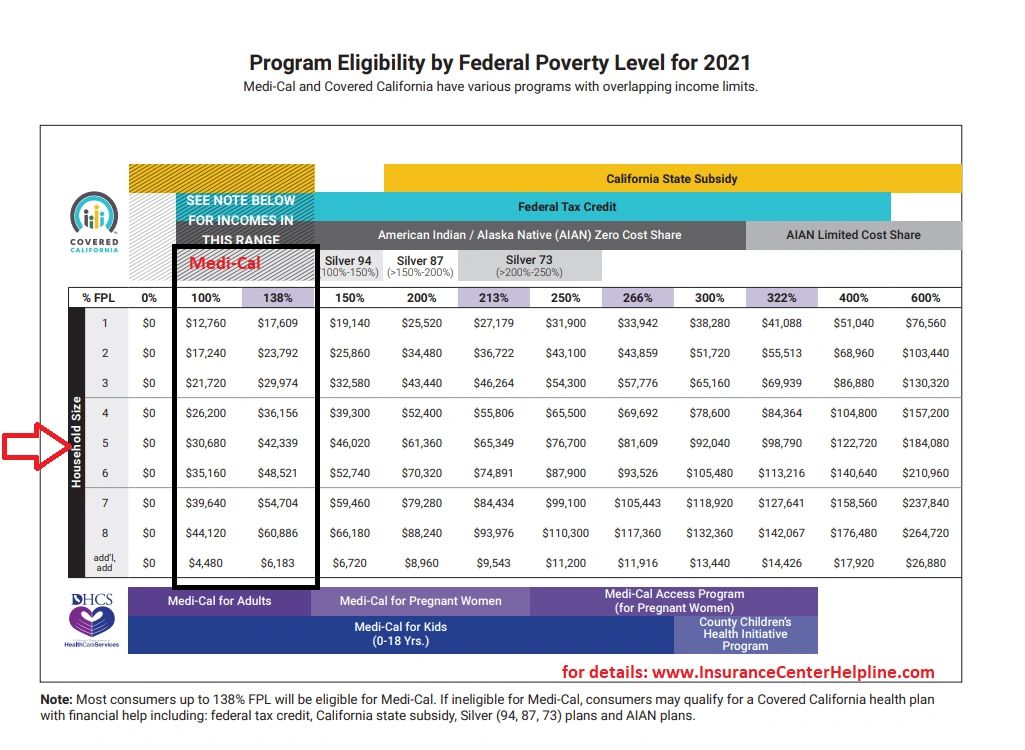

ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. The minimum income for ObamaCare is 100 of the federal poverty level. 9 rows With the recent passage of the ARPA there is now NO INCOME LIMIT for ACA tax.

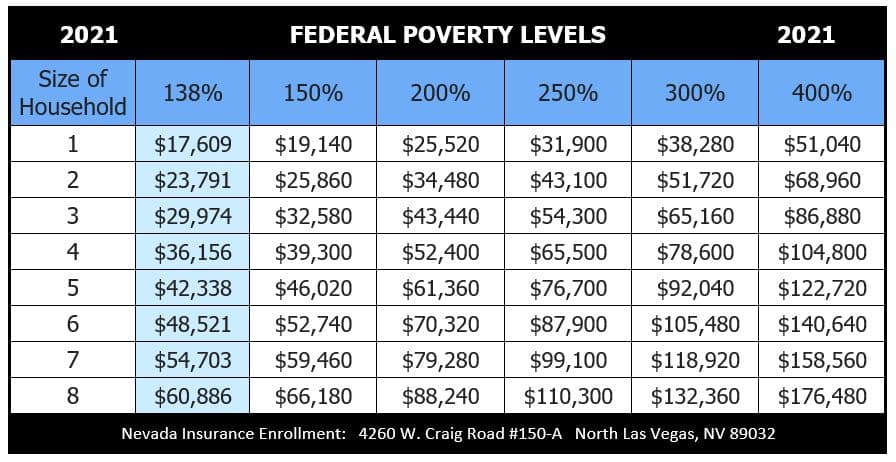

For 2021 those making between 12760-51040 as an individual or 26200-104800 as a family of 4 qualify. You can check the federal poverty level guidelines each year to figure out what the minimum income level is. But do not include Supplemental Security Income SSI.

CSR subsidies lower your coinsurance and lower copays deductibles and maximum out-of-pocket costs you will pay in a policy period. For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. Income under 25100 to be exact for a family of four two adults two children 20780 for a family of three and 12140 for an individual are considered poverty levels in the United States.

The subsidies are designed to ensure nobody puts more than 85 of their income toward health insurance. Before the stimulus bill passed Obamacare subsidies were available only to. If your MAGI goes above 400 FPL even by 1 you lose all the subsidy.

Instead of an income cap the new rules allow for premium subsidies if the cost of the benchmark plan would otherwise exceed 85 of their ACA-specific modified adjusted gross income. Savings are based on your income estimate for the year you want coverage not last years Use our income calculator to make your best estimate. Obamacare Subsidy Eligibility Obamacare offers subsidies also known as tax credits that work on a sliding scale.

The dollar amount of this changes every year but for 2020 it is 12490 for an individual and 25750 for a family of four. For 2020 coverage those making between 12490-49960 as an individual or 25750-103000 as a family of 4 qualify for ObamaCare. The Maximum Income You qualify for the premium subsidy only if your modified adjusted gross income MAGI is at 400 FPL or below.

For 2021 that is 12760-51040 for an individual and 26200- 104800 for a family of four. On the lower end subsidies are available in most states if your income is at least 139 of the poverty level with Medicaid available below that. You can probably start with your households adjusted gross income and update it for expected changes.

NBC News spoke to 16. Most people are eligible for subsidies when they earn 400 or less of the federal poverty level. The calculator spits out 0 subsidies which is a glitch implying such applicants pay 0 to next to nothing for annual health care premiums.

If you meet these criteria youll be eligible for a subsidy on a sliding scale based on your income. ObamaCare Cost Assistance To get assistance under the Affordable Care Act you must earn between 100 400 of the poverty level. To qualify for a subsidy your household income must be between 100 and 400 of the FPL.

Please note that in states that expanded Medicaid those making under 138. And prior to. But you must also not have access to Medicaid or qualified employer-based health coverage.

8 rows Prior to 2021 you were expected to chip in anywhere from 2 to 983 of your income. For income-based subsidy eligibility a household must have an income of at least 100 of the federal poverty level 139 percent of the federal poverty level in states that have expanded Medicaid. Cost Sharing Reduction CSR subsidiesreduce your out-of-pocket expenses on silver plans purchased through the health insurance marketplace for those with incomes between 100 250 of the poverty level.

See Stay Off the ACA Premium Subsidy Cliff. Also those earning more than 400 of the federal poverty level -- about 51000 for an individual and 104800 for a family of four in 2021 --. Select your income range.

They limit the amount you pay in monthly premiums to a percentage of your annual income.

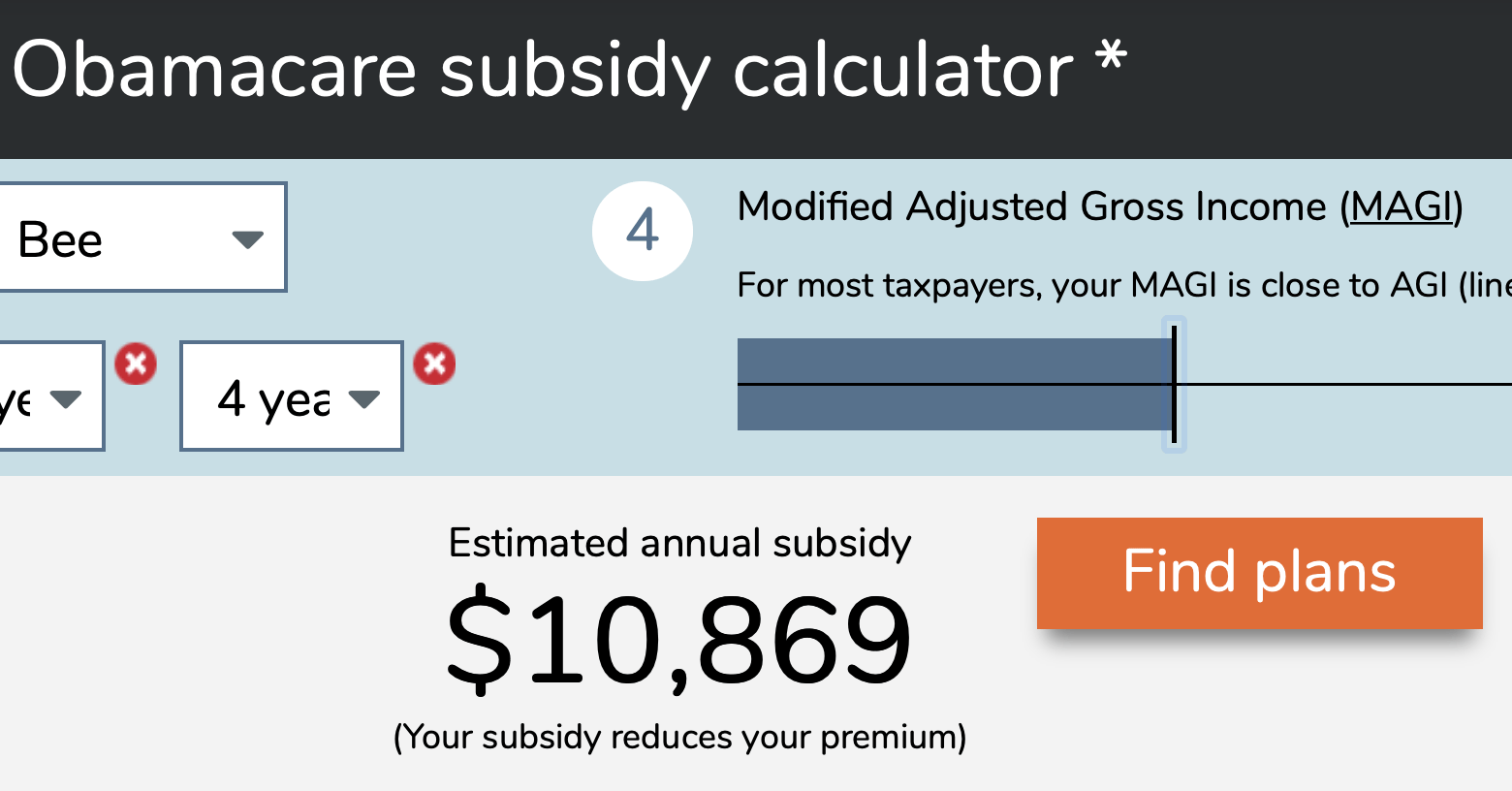

2021 Obamacare Subsidy Calculator Healthinsurance Org

2021 Obamacare Subsidy Calculator Healthinsurance Org

2015 Aca Obamacare Income Qualification Chart My Money Blog

2015 Aca Obamacare Income Qualification Chart My Money Blog

Health Insurance Marketplace Calculator Kff

Health Insurance Marketplace Calculator Kff

2021 Health Insurance Federal Poverty Level Chart

2021 Health Insurance Federal Poverty Level Chart

What Is The Maximum Income For Obamacare Subsidies In Year 2021

What Is The Maximum Income For Obamacare Subsidies In Year 2021

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How The Affordable Care Act Is About To Become More Expensive Mygovcost Government Cost Calculator

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Obamacare Income Limits 2018 Income Calculations Obamacare Quotes

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

How Your Obamacare Insurance Subsidy Is Calculated An Advanced Lesson

Subsidy Amounts By Income Limits For The Affordable Care Act

Subsidy Amounts By Income Limits For The Affordable Care Act

Are You Eligible For A Subsidy

Are You Eligible For A Subsidy

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

Don T Fall Off The Affordable Care Act Subsidy Cliffs Root Of Good

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.